Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

June 02 2016 - 6:03AM

Edgar (US Regulatory)

|

|

|

|

|

Free Writing Prospectus

Relating to

the Preliminary Prospectus

Supplement dated June 1, 2016

To the Prospectus dated May 20, 2014

|

|

Filed pursuant to Rule 433

Registration Statement No. 333-196114

|

Reinsurance Group of America, Incorporated

$400,000,000 5.75% Fixed-To-Floating Rate Subordinated Debentures due 2056

Final Term Sheet

Dated

June 1, 2016

|

Issuer

|

Reinsurance Group of America, Incorporated

|

|

Security

|

SEC Registered 5.75% Fixed-To-Floating Rate Subordinated Debentures due 2056 (the “

Debentures

”)

|

|

Principal Amount

|

$400,000,000

|

|

Maturity Date

|

June 15, 2056

|

|

Settlement Date (T+5)*

|

June 8, 2016

|

|

Interest Rate During Fixed Rate Period

|

5.75%, from the issue date to but excluding June 15, 2026, or any earlier redemption date.

|

|

Interest Payment Dates During Fixed Rate Period

|

Payable quarterly in arrears on March 15, June 15, September 15 and December 15, commencing September 15, 2016, to and including, June 15, 2026, subject to Issuer’s option to defer interest payments.

|

|

Day Count Convention During Fixed Rate Period

|

30/360, unadjusted.

|

|

Interest Rate During Floating Rate Period

|

Sum of three-month LIBOR, reset quarterly, plus 4.04%, commencing on and including June 15, 2026, to the Maturity Date, unless redeemed or repaid earlier; provided that any such sum shall not be less than zero.

|

|

Interest Payment Dates During Floating Rate Period

|

Payable quarterly in arrears on March 15, June 15, September 15 and December 15, commencing September 15, 2026, to the Maturity Date, unless redeemed or repaid earlier, subject to Issuer’s option to defer

interest payments.

|

|

Day Count Convention During Floating Rate Period

|

Actual/360, adjusted.

|

|

Price to Public

|

$25 per Debenture/100% of principal amount.

|

|

Underwriting Discounts

|

$4,725,625, reflecting 14,650,000 Debentures to be sold to institutional investors, for which the underwriters receive an underwriting discount of $0.25 per Debenture, and 1,350,000 Debentures to be sold to retail investors, for which the

underwriters receive an underwriting discount of $0.7875 per Debenture

|

|

Proceeds to Issuer (after underwriting discount and before expenses)

|

$395,274,375

|

|

Optional Redemption

|

Redeemable in whole at any time or in part from time to time on or after June 15, 2026, at a redemption price equal to 100% of the principal amount of the Debentures being redeemed, plus accrued and unpaid interest to but excluding the

redemption date.

|

|

Redemption After the Occurrence of a Rating Agency Event

|

Redeemable in whole, but not in part, at any time prior to June 15, 2026 within 90 days of the occurrence of a rating agency event, at a redemption price equal to the greater of (i) 100% of the principal amount of the Debentures being

redeemed, or (ii) present value of the (a) outstanding principal (discounted from June 15, 2026 to but excluding the redemption date) and (b) remaining scheduled payments of interest that would have been payable from the

redemption date to and including, June 15, 2026 (discounted from their respective interest payment dates to but excluding, the redemption date) on the Debentures to be redeemed (not including any portion of such payments of interest accrued and

unpaid to but excluding the redemption date), at a discount rate equal to the Treasury Rate plus a spread of 50 basis points, in each case, plus accrued and unpaid interest to but excluding the redemption date.

|

|

Redemption After the Occurrence of a Tax Event or Regulatory Capital Event

|

Redeemable in whole, but not in part, at any time prior to June 15, 2026 within 90 days of the occurrence of a tax event or regulatory capital event, at a redemption price equal to 100% of the principal amount of the Debentures being

redeemed, plus accrued and unpaid interest to but excluding the redemption date.

|

|

Authorized Denominations

|

$25 and integral multiples of $25 in excess thereof.

|

|

Listing

|

The Issuer intends to apply to list the Debentures on the NYSE. If the application is approved, the Issuer expects trading on the NYSE to begin within 30 days of the initial issuance of the Debentures.

|

|

CUSIP / ISIN

|

759351 802 / US7593518027

|

|

Ratings (Moody’s / S&P)**

|

Baa2 / BBB (Stable/Stable)

|

|

Joint Book-Running Managers

|

J.P. Morgan Securities LLC

|

|

|

Merrill Lynch, Pierce, Fenner & Smith

|

|

|

Wells Fargo Securities, LLC

|

|

|

HSBC Securities (USA) Inc.

|

|

Co-Managers

|

Barclays Capital Inc.

|

|

|

KeyBanc Capital Markets Inc.

|

|

|

Mitsubishi UFJ Securities (USA), Inc.

|

|

(*)

|

It is expected that delivery of the notes will be made against payment therefor on or about June 8, 2016, which is the fifth business day following the date hereof (such settlement cycle being referred to as

“T+5”). Pursuant to Rule 15c6-1 under the Exchange Act, trades in the secondary market generally are required to settle in three business days unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish

to trade the notes on the date of pricing or the next succeeding business day will be required, by virtue of the fact that the notes initially will settle in T+5, to specify an alternative settlement cycle at the time of any such trade to prevent

failed settlement. Purchasers of the notes who wish to trade the notes on the date of pricing and the next succeeding business day should consult their own advisors.

|

|

(**)

|

An explanation of the significance of ratings may be obtained from the rating agencies. Generally, rating agencies base their ratings on such material and information, and such of their own investigations, studies and

assumptions, as they deem appropriate. The rating of the notes should be evaluated independently from similar ratings of other securities. A credit rating of a security is not a recommendation to buy, sell or hold securities and may be subject to

review, revision, suspension, reduction or withdrawal at any time by the assigning rating agency.

|

The Issuer has filed a registration

statement (including a prospectus, which consists of a preliminary prospectus supplement dated June 1, 2016 and an accompanying prospectus dated May 20, 2014) with the SEC for the offering to which this communication relates. Before you

invest, you should read the prospectus in that registration statement and other documents the Issuer has filed with the SEC for more complete information about the Issuer and this offering. You may get these documents for free by visiting EDGAR on

the SEC website at

www.sec.gov

. Alternatively, the Issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling: J.P. Morgan Securities LLC at

(212) 834-4533, Merrill Lynch, Pierce, Fenner & Smith Incorporated at (800) 294-1322, Wells Fargo Securities, LLC at (800) 645-3751, or HSBC Securities (USA) Inc. at (866) 811-8049.

ANY DISCLAIMERS OR OTHER NOTICES THAT MAY APPEAR BELOW ARE NOT APPLICABLE TO THIS COMMUNICATION AND SHOULD BE DISREGARDED. SUCH DISCLAIMERS OR OTHER

NOTICES WERE AUTOMATICALLY GENERATED AS A RESULT OF THIS COMMUNICATION BEING SENT VIA BLOOMBERG OR ANOTHER E-MAIL SYSTEM.

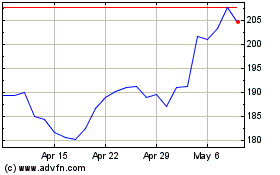

Reinsurance Group of Ame... (NYSE:RGA)

Historical Stock Chart

From Mar 2024 to Apr 2024

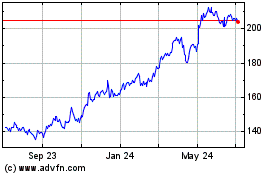

Reinsurance Group of Ame... (NYSE:RGA)

Historical Stock Chart

From Apr 2023 to Apr 2024