UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): November 19, 2015

REINSURANCE GROUP OF AMERICA, INCORPORATED

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

| Missouri |

|

1-11848 |

|

43-1627032 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification Number) |

16600 Swingley Ridge Road, Chesterfield, Missouri 63017

(Address of Principal Executive Office)

Registrant’s telephone number, including area code: (636) 736-7000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any

of the following provisions (see General Instruction A.2. below):

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain

Officers; Compensatory Arrangements of Certain Officers.

On November 23, 2015, the Board of Directors (the “Board”) of Reinsurance

Group of America, Incorporated (the “Company”) announced the appointment of Anna Manning as President effective December 1, 2015. A. Greig Woodring, current Company President and Chief Executive Officer, will relinquish the title of

President on such date. The Board also announced that Mr. Woodring is expected to retire and relinquish the title of Chief Executive Officer in late 2016, at which time the Board plans to appoint Ms. Manning as Chief Executive Officer. At

its meeting on December 15, 2015 the Board anticipates that it will elect Ms. Manning as a director of the Company, effective January 1, 2016.

Ms. Manning, 57, serves as a member of the Company’s Executive Council and is currently Senior Executive Vice President, Global Structured

Solutions. In that role, she has been responsible for the Company’s transactional businesses, including its Global Financial Solutions and Global Acquisitions units. From January 2011 through December 2014 she served as Executive Vice President

and Head of U.S. and Latin American Markets. In that position, she was responsible for all operations within the United States, South American and Latin American markets, including business development, pricing, underwriting, medical, claims and

operations. Until January 2011, Ms. Manning was Executive Vice President and Chief Operating Officer for RGA International Corporation. Prior to joining the Company in 2007, she was a senior consultant in the Toronto office of Towers

Perrin’s Tillinghast insurance consulting practice, where she provided consulting services to insurance companies in the areas of mergers and acquisitions, financial reporting, product development and value-added performance measurements.

Before joining Tillinghast, Ms. Manning was with Manulife Financial.

Manning Offer Letter

Pursuant to an offer letter between the Company and Ms. Manning (the “Offer Letter”), she will receive an annual base salary of $750,000 as

President, which will increase to $950,000 upon her appointment as Chief Executive Officer. She will continue to participate in the Company’s Annual Bonus Plan (“ABP”) and her target bonus shall remain equal to 100% of her base salary

as President, with potential payouts under this award ranging from zero to $1,500,000. New ABP goals will be established for her in her role as President. Upon appointment to the role of Chief Executive Officer, Ms. Manning’s ABP target

will increase to 130% of base salary. The terms and conditions of the current ABP were previously reported under “Compensation Discussion & Analysis – 2014 Compensation Actions and Results – Compensation Element #2 –

Annual Bonus Plan” in the Company’s proxy statement on Schedule 14A filed with the Securities and Exchange Commission on April 10, 2015 (the “Proxy Statement”).

The Offer Letter also provides that Ms. Manning will continue to participate in the Company’s long-term incentive program; however, effective with

the 2016 grant her target will be a fixed amount of $2,000,000, rather than a percentage of her base salary. Her 2016 grant will be allocated 75% to Performance Contingent Shares (“PCS”) and 25% to Stock Appreciation Rights

(“SARs”). Upon appointment to the role of Chief Executive Officer, Ms. Manning’s long-term incentive program target will be $3,245,000. The terms and conditions of prior PCS and SARs awards were previously reported under

“Compensation Discussion & Analysis – 2014 Compensation Actions and Results – Compensation Element #3 – Performance Contingent Shares” and “– Compensation Element #4 – Stock Appreciation Rights”

in the Proxy Statement. The Company’s future proxy statements will provide descriptions of any changes to the Company’s ABP, PCS and SARs awards. The foregoing description

1

of Ms. Manning’s compensation and equity grants provided in the Offer Letter does not purport to be complete and is qualified in its entirety by reference to the Offer Letter, which is

filed as Exhibit 10.1 to this Current Report on Form 8-K (this “Current Report”) and incorporated by reference herein.

Manning SAR Agreement

On November 19, 2015 the Board’s Compensation Committee (the “Committee”) approved an additional grant of SARs to Ms. Manning

valued at $3,000,000 that will fully vest (i.e., “cliff vest”) on November 30, 2020. The award is effective December 1, 2015 and will be made pursuant to a Stock Appreciation Right Award Agreement between the Company and

Ms. Manning (the “Manning SAR Agreement”). The foregoing description of the SAR award does not purport to be complete and is qualified in its entirety by reference to the form of Manning SAR Agreement, which is filed as Exhibit 10.2

to this Current Report and incorporated by reference herein.

Néemeh and Kinnaird Award Agreements

On November 19, 2015 the Committee also approved a grant of SARs for Alain Néemeh, Senior Executive Vice President – Global Life and Health

Markets, effective December 1, 2015. Mr. Néemeh’s grant is valued at $2,000,000 and also vests fully on November 30, 2020. The award will be made pursuant to a Stock Appreciation Right Award Agreement between the Company

and Mr. Néemeh (the “Néemeh SAR Agreement”). The foregoing description of the SAR award does not purport to be complete and is qualified in its entirety by reference to the form of Néemeh SAR Agreement, which is

filed as Exhibit 10.3 to this Current Report and incorporated by reference herein.

On November 19, 2015 the Committee also approved a grant of

Restricted Share Units (“RSUs”) for Donna Kinnaird, Senior Executive Vice President and Chief Operating Officer, effective December 1, 2015. Ms. Kinnaird’s grant is valued at $600,000 and fully vests on January 11,

2017. The award will be made pursuant to a Restricted Share Unit Agreement between the Company and Ms. Kinnaird (the “Kinnaird Agreement”). The foregoing description of the RSU award does not purport to be complete and is qualified in

its entirety by reference to the form of Kinnaird Agreement, which is filed as Exhibit 10.4 to this Current Report and incorporated by reference herein.

| Item 7.01 |

Regulation FD Disclosure. |

In a press release dated November 23, 2015, a copy of which is attached

to this Current Report as Exhibit 99.1, and the text of which is incorporated by reference herein, the Company announced the organizational changes described in the first paragraph of this Current Report.

The information in this Item 7.01 and the contents of Exhibit 99.1 will not be deemed to be “filed” for the purposes of Section 18 of the

Securities Exchange Act of 1934 (the “Exchange Act”), or otherwise subject to the liabilities of such section, nor will such information or exhibit be deemed incorporated by reference in any filing under the Securities Act of 1933 or the

Exchange Act, except as may be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

See Exhibit Index.

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REINSURANCE GROUP OF AMERICA, INCORPORATED |

|

|

|

|

|

| Date: November 24, 2015 |

|

|

|

|

|

By: |

|

/s/ Jack B. Lay |

|

|

|

|

|

|

|

|

Name: |

|

Jack B. Lay |

|

|

|

|

|

|

|

|

Title: |

|

Senior Executive Vice President and Chief Financial Officer |

3

EXHIBIT INDEX

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 10.1 |

|

Offer Letter, dated October 29, 2015, between the Company and Anna Manning. |

|

|

| 10.2 |

|

Form of Stock Appreciation Right Award Agreement, effective December 1, 2015, between the Company and Anna Manning. |

|

|

| 10.3 |

|

Form of Stock Appreciation Right Award Agreement, effective December 1, 2015, between the Company and Alain Néemeh. |

|

|

| 10.4 |

|

Form of Restricted Share Unit Agreement, effective December 1, 2015, between the Company and Donna Kinnaird. |

|

|

| 99.1 |

|

Company press release dated November 23, 2015. |

4

Exhibit 10.1

Reinsurance Group of America, Incorporated®

October 29, 2015

Anna Manning

Dear Anna:

On behalf of the Board of Directors and Greig

Woodring, I am delighted to offer you the position of Chief Executive Officer of RGA effective January 1, 2017. As a transitional step, our plan is for you to assume the role of President effective December 1, 2015, and begin a transition

into the role of CEO. You will continue with your current responsibilities until such time that you and Greig agree on a different structure. We are also very pleased to offer you a position on the Board of Directors to begin January 1, 2016,

contingent on a vote by the Board at its meeting in December. As CEO, you will transfer to St. Louis, Missouri over the course of your time as President.

Here are the details of your two-step offer.

|

|

|

| • Annual Salary: |

|

Effective 12/1/2015, your annual salary as a regular full-time employee will be USD $750,000. Delivery in USD and/or CAD is to be determined. Upon fully assuming the CEO role, your salary will be increased to USD $950,000. |

|

|

| • Annual Bonus Plan: |

|

You will continue to participate in RGA’s Annual Bonus Plan with a target bonus equal to 100% of your base pay, with an award range of zero to a maximum of two times your bonus target. Your target will be based on the new

salary effective January 2016, when new goals will be set for your role as President. Upon fully assuming the CEO role, your ABP target will increase to 130% of base salary. As you know, incentive payments are contingent upon Plan guidelines,

Company results and Board approval. |

|

|

| • Long-Term Incentive |

|

You will continue to participate in the LTI program, however, effective with the 2016 grant your target will be a fixed amount rather than a

percentage. Your 2016 target will be $2,000,000, with 75% allocated to the PCS program and 25% allocated to Stock Appreciation Rights. Upon fully assuming the CEO role, your LTI target will become $3,245,000.

Effective December 1, 2015, you will also receive a special long-term incentive grant

valued at $3,000,000, and fully vested in five years. The specific form of the grant will be confirmed at a special Board meeting on or about November 19, 2015. |

|

|

| • Benefits: |

|

Your benefits and PTO will remain intact until such time as the move to St. Louis occurs. |

This offer is contingent upon the successful completion and the results of a medical evaluation which will assess

your ability to fulfill the physical requirements of the CEO position. The evaluation will be conducted at Mayo Clinic in Rochester, Minnesota. It is scheduled for November 10-12. You will receive a call from a representative at Mayo Clinic on

Friday, October 30, to discuss next steps. The Board will only be informed of a pass or fail status by the responsible physician.

This letter is

designed to provide a summary of the offer we are verbally providing you. Due to the eventual relocation to the US, we will need to further elaborate on this offer with more details on the delivery of pay and the benefits that will be provided.

This offer is not intended to create any contractual rights or obligations concerning your employment. Either the employee or RGA has the right to terminate

employment at will, at any time, with or without cause. RGA reserves the right to modify or terminate any of its benefits and compensation plans, policies, programs, practices, etc., with or without notice.

Anna, congratulations! The Board of Directors undertook a thorough and time-consuming process to reach our decision to offer you this tremendous opportunity.

We are all fully confident you are the right person for this role and to lead RGA into the years ahead, and we are delighted to make this offer to you today.

Kind regards,

/s/ Cliff Eason

Cliff Eason

Chairman of the Board

Exhibit 10.2

REINSURANCE GROUP OF AMERICA, INCORPORATED

FLEXIBLE STOCK PLAN

STOCK APPRECIATION RIGHT AWARD AGREEMENT

Reinsurance Group of America, Incorporated, a Missouri corporation (the “Company”), and Anna Manning (the “Awardee”)

hereby agree as follows:

SECTION 1

GRANT OF STOCK APPRECIATION RIGHT

Pursuant to the Reinsurance Group of America, Incorporated Flexible Stock Plan, as amended (“Plan”) and pursuant to action of the

Committee charged with the Plan’s administration, the Company has granted to the Awardee, effective December 1, 2015 (“Effective Date”), subject to the terms, conditions and limitations stated in this agreement

(“Agreement”), the Plan and the Company’s Executive Compensation Recoupment Policy (as discussed in Section 8(c)), a Stock Appreciation Right (“SAR”), which is granted with respect to

[ ] shares (each, a “SAR Share”) of Common Stock.

SECTION 2

EXERCISE

PRICE PER SAR SHARE

The “Exercise Price Per SAR Share” shall be

$[ ] which is the Fair Market Value of one Share of Common Stock as of the Effective Date of this Agreement.

SECTION 3

EXERCISE

OF SAR

(a) Right to Exercise. This SAR is exercisable during its Term, but only after the Vesting Date (as defined below).

(b) Terms of Exercise. Upon proper exercise of any vested portion of the SAR, the Awardee or the individual or entity authorized

to exercise such SAR as provided herein shall be entitled to receive the excess of (i) the Fair Market Value of the specified number of SAR Shares as of the date of exercise (which shall be determined by multiplying the number of SAR Shares

being exercised by the Fair Market Value of one Share on the date of exercise) over (ii) an amount equal to the Exercise Price Per Share multiplied by the number of SAR Shares being exercised. Such excess, if any, shall be paid either

(x) in whole Shares, the number of which shall be determined using the Fair Market Value of one Share as of the date of exercise, disregarding any fractional shares or (y) in cash, with such method of payment to be determined by the

Committee in its sole discretion from time to time.

(c) Method of Exercise. The SAR may be exercised in whole or in part by the

Awardee or other individual authorized pursuant to the terms of this Agreement to exercise the SAR at any time or from time to time in accordance with procedures established by the Committee from time to time. As promptly as practicable after such

exercise of the SAR, but in

no event later than 30 days following the date of exercise of the SAR, the Company shall issue the number of Shares or pay the amount of cash, as applicable, determined pursuant to

Section 3(b) above to the Awardee or the individual or entity authorized to exercise such SAR as provided herein.

SECTION 4

CONDITIONS AND LIMITATIONS ON RIGHT TO EXERCISE SAR

(a) Vesting. Subject to paragraph (b) of this Section and subject to Sections 6 and 7, this SAR shall vest in its entirety on

November 30, 2020 (the “Vesting Date”). The SAR must be exercised if at all no later than ten (10) years from the Effective Date (the “Expiration Date”). The SAR may be exercised in full or in part after it

becomes fully vested. Upon a partial exercise of this SAR, the number of SAR Shares available for future exercise shall be reduced by the portion of the SAR so exercised.

(b) Exercise if No Longer an Employee.

(1) Termination. Except as provided in paragraphs (2) or (3) below, the SAR may be exercised only by the

Awardee while the Awardee is an Employee or within 30 days following termination of the Awardee’s status as an Employee. For purposes of this Agreement, “Employee” means:

(i) an officer or employee of the Company or one of its subsidiaries as defined in Section 424(f) of the Internal Revenue

Code of 1986, as amended (“Code”), or

(ii) an officer or employee of the Company’s parent as defined in

Section 424(e) of the Code, provided the Awardee is serving in such capacity at the request of the Company and the Committee approves the Awardee’s continued participation in the Plan.

Notwithstanding the foregoing, the Awardee may exercise the SAR following termination only to the extent the SAR was vested and had not been

exercised prior to termination and in no event may the SAR be exercised after the Expiration Date.

An approved leave of absence shall not

constitute a termination for purposes of this Section so long as the Awardee’s right to re-employment is guaranteed either by statute, local law, contract or pursuant to any Company policy. Where re-employment is not so guaranteed, termination

shall be deemed to occur on the first day after the end of such approved period of leave (but not after the Expiration Date).

(2) Disability or Death. Notwithstanding the Vesting Date set forth in Section 4(a) above, in the event of the

Awardee’s Disability or death while serving as an Employee that is prior to the Vesting Date, the SAR shall become immediately 100% vested, and the SAR may be exercised at any time within five (5) years following the earlier to occur of

death or Disability, but in no event later than the Expiration Date. In

2

the event of the Awardee’s Disability or death while serving as an Employee that is after the Vesting Date but prior to the Expiration Date, the SAR may be exercised at any time within five

(5) years following the earlier to occur of death or Disability, but in no event later than the Expiration Date. Should this Section 4(b)(2) become operative because the Awardee died while serving as an Employee, or should the Awardee die

after the Awardee’s Disability, then the SAR may be exercised by (i) a legatee or legatees of the Awardee under the Awardee’s last will; (ii) the Awardee’s personal representative(s) under the Awardee’s last will or, if

the Awardee died without a will, the executor of the Awardee’s probate estate; or (iii) the trustee(s) of the Awardee’s revocable living trust or of a trust indenture of which Awardee is a grantor or a beneficiary.

For purposes of this Agreement, “Disability” means disability as defined in any long-term disability plan maintained by the Company

or an Affiliate which covers the Awardee or, in the absence of any such plan, the physical or mental condition of the Awardee arising prior to the Vesting Date, which in the opinion of a qualified physician chosen by the Company prevents the Awardee

from continuing employment with the Company and its Affiliates.

(3) Retirement. In the event of the Awardee’s

Retirement after the Vesting Date but prior to the Expiration Date, the SAR shall remain exercisable as if the Awardee had continued his or her employment with the Company following such Retirement. In no event may any portion of this SAR be

exercised after the Expiration Date. Notwithstanding the Vesting Date set forth in Section 4(a) above, in the event of the Awardee’s Retirement prior to the Vesting Date, this Agreement will terminate and be of no further force or effect

and the SAR awarded to Awardee hereunder shall be forfeited, unless otherwise determined by the Committee in its sole discretion. In the event of the Awardee’s death following Retirement after the Vesting Date but prior to the Expiration Date,

the SAR may be exercised at any time within five (5) years following the Awardee’s death (but in no event later than the Expiration Date) by (i) a legatee or legatees of the Awardee under the Awardee’s last will; (ii) the

Awardee’s personal representative(s) under the Awardee’s last will or, if the Awardee died without a will, the executor of the Awardee’s probate estate; or (iii) the trustee(s) of the Awardee’s revocable living trust or of a

trust indenture of which Awardee is a grantor or a beneficiary.

For purposes of this Agreement, “Retirement” means termination

of the Awardee’s status as an Employee after the Awardee has attained a combination of age and years of service that equals at least sixty-five (65); provided that, the maximum number of years of service credited for purposes of this

calculation shall be ten (10).

(c) Dividend Equivalents. SARs shall not include dividend equivalent payments or dividend credit

rights.

3

SECTION 5

DELIVERY OF SHARES

The Company shall not be required to issue or deliver any certificates for SAR Shares, if applicable, upon the exercise of this SAR prior to

(a) the admission of such shares to listing on any stock exchange on which the Company’s Common Stock may then be listed, (b) the completion of any registration and/or qualification of such shares under any state or federal laws

(including without limitation the Securities Act of 1933) or rulings or regulations of any governmental regulatory body, which the Company shall determine to be necessary or advisable, or (c) if the Company so requests, the filing with the

Company by the Awardee or the purchaser acting pursuant to Section 4(b) of a representation in writing at the time of such exercise that it is his or her present intention to acquire the shares being purchased for investment and not for resale

or distribution.

SECTION 6

CHANGE OF CONTROL

Notwithstanding the Vesting Date set forth in Section 4(a), in the event of a Change of Control prior to the Vesting Date, the SAR shall

become immediately 100% vested (but in no event may the Awardee exercise any portion of the SAR after the Expiration Date).

SECTION 7

CANCELLATION

Notwithstanding anything herein to the contrary, this Agreement shall be cancelled and the SAR granted hereby shall be forfeited, without any

further action by the Committee, as a result of the Awardee’s Malfeasance. In the event of such cancellation, all rights of the Awardee hereunder shall terminate, irrespective of whether the SAR is otherwise vested, and the shares reserved for

use hereunder shall be available for future grant in accordance with the Plan. “Malfeasance” means (1) any conduct, act or omission that is contrary to the Awardee’s duties as an Employee or that is inimical or in any way

contrary to the best interests of the Company or any of its Affiliates, or (2) employment of the Awardee by or association of the Awardee with an organization that competes with the Company or any of its Affiliates.

SECTION 8

MISCELLANEOUS

(a)

Rights in Shares Prior to Issuance. Prior to issuance of certificates for Shares (if applicable), neither the Awardee nor his or her legatees, personal representatives, or distributees (i) shall be deemed to be a holder of any Shares

subject to this SAR or (ii) have any voting rights with respect to any such Shares.

(b) Non-assignability. This SAR shall not

be transferable by the Awardee otherwise than by will or by the laws of descent and distribution; provided that, the Awardee may transfer the SAR during his or her lifetime to a revocable living trust of which the Awardee is grantor, or to another

form of trust indenture of which Awardee is a grantor or a beneficiary. This SAR may be exercised during the Awardee’s lifetime only by the Awardee; the Awardee’s guardian, power of attorney, or legal representative; or the trustee of the

Awardee’s revocable living trust or of a trust indenture of which Awardee is a grantor or a beneficiary.

4

(c) Recoupment. The awards granted pursuant to this Agreement are subject to the terms and

conditions contained in the Company’s Executive Compensation Recoupment Policy (“Recoupment Policy”), which permits the Company to recoup all or a portion of awards made to certain employees upon the occurrence of any Recoupment Event

(as defined in the Recoupment Policy).

(d) Designation of Beneficiaries. The Awardee may file with the Company a written

designation of a beneficiary or beneficiaries to exercise, in the event of the Awardee’s death, the SAR granted hereunder, subject to all of the provisions of the SAR Award and this Agreement. An Awardee may from time to time revoke or change

any such designation of beneficiary and any designation of beneficiary under the Plan shall be controlling over any other disposition, testamentary or otherwise; provided, however, that if the Committee shall be in doubt as to the right of any such

beneficiary to exercise the SAR, the Committee may recognize only an exercise by the personal representative of the estate of the Awardee, in which case the Company, the Committee and the members thereof shall not be under any further liability to

anyone.

(e) Changes in Capital Structure. If there is any change in the Common Stock by reason of any stock dividend, spin-off, split-up, spin-out, recapitalization, merger, consolidation, reorganization, combination or exchange of shares, the number of

SARs and the number, kind and class of shares available for SARs and the exercise price thereof, as and if applicable, shall be appropriately adjusted by the Committee. The issuance of Shares for consideration and the issuance of Share rights shall

not be considered a change in the Company’s capital structure. No adjustment provided for in this Section shall require the issuance of any fractional shares.

(f) Right to Continued Employment. Nothing in this Agreement shall confer on the Awardee any right to continued employment or interfere

with the right of an employer to terminate the Awardee’s employment at any time.

(g) Tax Withholding. Awardee must pay, or

make arrangements acceptable to the Company for the payment of any and all federal, state, and local tax withholding that in the opinion of the Company is required by law. Unless Awardee satisfies any such tax withholding obligation by paying the

amount in cash or by check, the Company will withhold Shares having a Fair Market Value on the date of withholding equal to the tax withholding obligation.

(h) Copy of Plan. By signing this Agreement, Awardee acknowledges receipt of a copy of the Plan and any offering circular related to

the Plan.

(i) Choice of Law. This Agreement will be governed by the laws of the State of Missouri, excluding any conflicts or

choice of law rule or principle that might otherwise refer construction or interpretation of this Agreement to another jurisdiction.

(j)

Execution. An authorized representative of the Company has signed this Agreement, and Awardee has signed this Agreement to evidence Awardee’s acceptance of the award on the terms specified in this Agreement, all as of the Effective Date.

5

SECTION 9

TERMS OF THE PLAN

This award is granted under and is expressly subject to all the terms and provisions of the Plan, which terms are incorporated herein by

reference. Capitalized terms used but not defined in this Agreement shall have the same meanings ascribed to them in the Plan.

IN WITNESS

WHEREOF, the parties hereto have executed this Agreement as of this 1st day of December, 2015.

|

|

|

| “Company” |

| Reinsurance Group of America, Incorporated |

|

|

| By: |

|

|

| Name: |

|

A. Greig Woodring |

| Title: |

|

Chief Executive Officer |

|

| “Awardee” |

|

| |

| Name: Anna Manning |

6

Exhibit 10.3

REINSURANCE GROUP OF AMERICA, INCORPORATED

FLEXIBLE STOCK PLAN

STOCK APPRECIATION RIGHT AWARD AGREEMENT

Reinsurance Group of America, Incorporated, a Missouri corporation (the “Company”), and Alain Néemeh (the

“Awardee”) hereby agree as follows:

SECTION 1

GRANT OF STOCK APPRECIATION RIGHT

Pursuant to the Reinsurance Group of America, Incorporated Flexible Stock Plan, as amended (“Plan”) and pursuant to action of the

Committee charged with the Plan’s administration, the Company has granted to the Awardee, effective December 1, 2015 (“Effective Date”), subject to the terms, conditions and limitations stated in this agreement

(“Agreement”), the Plan and the Company’s Executive Compensation Recoupment Policy (as discussed in Section 8(c)), a Stock Appreciation Right (“SAR”), which is granted with respect to

[ ] shares (each, a “SAR Share”) of Common Stock.

SECTION 2

EXERCISE

PRICE PER SAR SHARE

The “Exercise Price Per SAR Share” shall be

$[ ] which is the Fair Market Value of one Share of Common Stock as of the Effective Date of this Agreement.

SECTION 3

EXERCISE

OF SAR

(a) Right to Exercise. This SAR is exercisable during its Term, but only after the Vesting Date (as defined below).

(b) Terms of Exercise. Upon proper exercise of any vested portion of the SAR, the Awardee or the individual or entity authorized

to exercise such SAR as provided herein shall be entitled to receive the excess of (i) the Fair Market Value of the specified number of SAR Shares as of the date of exercise (which shall be determined by multiplying the number of SAR Shares

being exercised by the Fair Market Value of one Share on the date of exercise) over (ii) an amount equal to the Exercise Price Per Share multiplied by the number of SAR Shares being exercised. Such excess, if any, shall be paid either

(x) in whole Shares, the number of which shall be determined using the Fair Market Value of one Share as of the date of exercise, disregarding any fractional shares or (y) in cash, with such method of payment to be determined by the

Committee in its sole discretion from time to time.

(c) Method of Exercise. The SAR may be exercised in whole or in part by the

Awardee or other individual authorized pursuant to the terms of this Agreement to exercise the SAR at any time or from time to time in accordance with procedures established by the Committee from time to time. As promptly as practicable after such

exercise of the SAR, but in

no event later than 30 days following the date of exercise of the SAR, the Company shall issue the number of Shares or pay the amount of cash, as applicable, determined pursuant to

Section 3(b) above to the Awardee or the individual or entity authorized to exercise such SAR as provided herein.

SECTION 4

CONDITIONS AND LIMITATIONS ON RIGHT TO EXERCISE SAR

(a) Vesting. Subject to paragraph (b) of this Section and subject to Sections 6 and 7, this SAR shall vest in its entirety on

November 30, 2020 (the “Vesting Date”). The SAR must be exercised if at all no later than ten (10) years from the Effective Date (the “Expiration Date”). The SAR may be exercised in full or in part after it

becomes fully vested. Upon a partial exercise of this SAR, the number of SAR Shares available for future exercise shall be reduced by the portion of the SAR so exercised.

(b) Exercise if No Longer an Employee.

(1) Termination. Except as provided in paragraphs (2) or (3) below, the SAR may be exercised only by the

Awardee while the Awardee is an Employee or within 30 days following termination of the Awardee’s status as an Employee. For purposes of this Agreement, “Employee” means:

(i) an officer or employee of the Company or one of its subsidiaries as defined in Section 424(f) of the Internal Revenue

Code of 1986, as amended (“Code”), or

(ii) an officer or employee of the Company’s parent as defined in

Section 424(e) of the Code, provided the Awardee is serving in such capacity at the request of the Company and the Company’s Chief Executive Officer approves the Awardee’s continued participation in the Plan.

Notwithstanding the foregoing, the Awardee may exercise the SAR following termination only to the extent the SAR was vested and had not been

exercised prior to termination and in no event may the SAR be exercised after the Expiration Date.

An approved leave of absence shall not

constitute a termination for purposes of this Section so long as the Awardee’s right to re-employment is guaranteed either by statute, local law, contract or pursuant to any Company policy. Where re-employment is not so guaranteed, termination

shall be deemed to occur on the first day after the end of such approved period of leave (but not after the Expiration Date).

(2) Disability or Death. Notwithstanding the Vesting Date set forth in Section 4(a) above, in the event of the

Awardee’s Disability or death while serving as an Employee that is prior to the Vesting Date, the SAR shall become immediately 100% vested, and the SAR may be exercised at any time within five (5) years following the earlier to occur of

death or Disability, but in no event later than the Expiration Date. In

2

the event of the Awardee’s Disability or death while serving as an Employee that is after the Vesting Date but prior to the Expiration Date, the SAR may be exercised at any time within five

(5) years following the earlier to occur of death or Disability, but in no event later than the Expiration Date. Should this Section 4(b)(2) become operative because the Awardee died while serving as an Employee, or should the Awardee die

after the Awardee’s Disability, then the SAR may be exercised by (i) a legatee or legatees of the Awardee under the Awardee’s last will; (ii) the Awardee’s personal representative(s) under the Awardee’s last will or, if

the Awardee died without a will, the executor of the Awardee’s probate estate; or (iii) the trustee(s) of the Awardee’s revocable living trust or of a trust indenture of which Awardee is a grantor or a beneficiary.

For purposes of this Agreement, “Disability” means disability as defined in any long-term disability plan maintained by the Company

or an Affiliate which covers the Awardee or, in the absence of any such plan, the physical or mental condition of the Awardee arising prior to the Vesting Date, which in the opinion of a qualified physician chosen by the Company prevents the Awardee

from continuing employment with the Company and its Affiliates.

(3) Retirement. In the event of the Awardee’s

Retirement after the Vesting Date but prior to the Expiration Date, the SAR shall remain exercisable as if the Awardee had continued his or her employment with the Company following such Retirement. In no event may any portion of this SAR be

exercised after the Expiration Date. Notwithstanding the Vesting Date set forth in Section 4(a) above, in the event of the Awardee’s Retirement prior to the Vesting Date, this Agreement will terminate and be of no further force or effect

and the SAR awarded to Awardee hereunder shall be forfeited, unless otherwise determined by the Committee in its sole discretion. In the event of the Awardee’s death following Retirement after the Vesting Date but prior to the Expiration Date,

the SAR may be exercised at any time within five (5) years following the Awardee’s death (but in no event later than the Expiration Date) by (i) a legatee or legatees of the Awardee under the Awardee’s last will; (ii) the

Awardee’s personal representative(s) under the Awardee’s last will or, if the Awardee died without a will, the executor of the Awardee’s probate estate; or (iii) the trustee(s) of the Awardee’s revocable living trust or of a

trust indenture of which Awardee is a grantor or a beneficiary.

For purposes of this Agreement, “Retirement” means termination

of the Awardee’s status as an Employee after the Awardee has attained a combination of age and years of service that equals at least sixty-five (65); provided that, the maximum number of years of service credited for purposes of this

calculation shall be ten (10).

(c) Dividend Equivalents. SARs shall not include dividend equivalent payments or dividend credit

rights.

3

SECTION 5

DELIVERY OF SHARES

The Company shall not be required to issue or deliver any certificates for SAR Shares, if applicable, upon the exercise of this SAR prior to

(a) the admission of such shares to listing on any stock exchange on which the Company’s Common Stock may then be listed, (b) the completion of any registration and/or qualification of such shares under any state or federal laws

(including without limitation the Securities Act of 1933) or rulings or regulations of any governmental regulatory body, which the Company shall determine to be necessary or advisable, or (c) if the Company so requests, the filing with the

Company by the Awardee or the purchaser acting pursuant to Section 4(b) of a representation in writing at the time of such exercise that it is his or her present intention to acquire the shares being purchased for investment and not for resale

or distribution.

SECTION 6

CHANGE OF CONTROL

Notwithstanding the Vesting Date set forth in Section 4(a), in the event of a Change of Control prior to the Vesting Date, the SAR shall

become immediately 100% vested (but in no event may the Awardee exercise any portion of the SAR after the Expiration Date).

SECTION 7

CANCELLATION

Notwithstanding anything herein to the contrary, this Agreement shall be cancelled and the SAR granted hereby shall be forfeited, without any

further action by the Committee, as a result of the Awardee’s Malfeasance. In the event of such cancellation, all rights of the Awardee hereunder shall terminate, irrespective of whether the SAR is otherwise vested, and the shares reserved for

use hereunder shall be available for future grant in accordance with the Plan. “Malfeasance” means (1) any conduct, act or omission that is contrary to the Awardee’s duties as an Employee or that is inimical or in any way

contrary to the best interests of the Company or any of its Affiliates, or (2) employment of the Awardee by or association of the Awardee with an organization that competes with the Company or any of its Affiliates.

SECTION 8

MISCELLANEOUS

(a)

Rights in Shares Prior to Issuance. Prior to issuance of certificates for Shares (if applicable), neither the Awardee nor his or her legatees, personal representatives, or distributees (i) shall be deemed to be a holder of any Shares

subject to this SAR or (ii) have any voting rights with respect to any such Shares.

(b) Non-assignability. This SAR shall not

be transferable by the Awardee otherwise than by will or by the laws of descent and distribution; provided that, the Awardee may transfer the SAR during his or her lifetime to a revocable living trust of which the Awardee is grantor, or to another

form of trust indenture of which Awardee is a grantor or a beneficiary. This SAR may be exercised during the Awardee’s lifetime only by the Awardee; the Awardee’s guardian, power of attorney, or legal representative; or the trustee of the

Awardee’s revocable living trust or of a trust indenture of which Awardee is a grantor or a beneficiary.

4

(c) Recoupment. The awards granted pursuant to this Agreement are subject to the terms and

conditions contained in the Company’s Executive Compensation Recoupment Policy (“Recoupment Policy”), which permits the Company to recoup all or a portion of awards made to certain employees upon the occurrence of any Recoupment Event

(as defined in the Recoupment Policy).

(d) Designation of Beneficiaries. The Awardee may file with the Company a written

designation of a beneficiary or beneficiaries to exercise, in the event of the Awardee’s death, the SAR granted hereunder, subject to all of the provisions of the SAR Award and this Agreement. An Awardee may from time to time revoke or change

any such designation of beneficiary and any designation of beneficiary under the Plan shall be controlling over any other disposition, testamentary or otherwise; provided, however, that if the Committee shall be in doubt as to the right of any such

beneficiary to exercise the SAR, the Committee may recognize only an exercise by the personal representative of the estate of the Awardee, in which case the Company, the Committee and the members thereof shall not be under any further liability to

anyone.

(e) Changes in Capital Structure. If there is any change in the Common Stock by reason of any stock dividend, spin-off, split-up, spin-out, recapitalization, merger, consolidation, reorganization, combination or exchange of shares, the number of

SARs and the number, kind and class of shares available for SARs and the exercise price thereof, as and if applicable, shall be appropriately adjusted by the Committee. The issuance of Shares for consideration and the issuance of Share rights shall

not be considered a change in the Company’s capital structure. No adjustment provided for in this Section shall require the issuance of any fractional shares.

(f) Right to Continued Employment. Nothing in this Agreement shall confer on the Awardee any right to continued employment or interfere

with the right of an employer to terminate the Awardee’s employment at any time.

(g) Tax Withholding. Awardee must pay, or

make arrangements acceptable to the Company for the payment of any and all federal, state, and local tax withholding that in the opinion of the Company is required by law. Unless Awardee satisfies any such tax withholding obligation by paying the

amount in cash or by check, the Company will withhold Shares having a Fair Market Value on the date of withholding equal to the tax withholding obligation.

(h) Copy of Plan. By signing this Agreement, Awardee acknowledges receipt of a copy of the Plan and any offering circular related to

the Plan.

(i) Choice of Law. This Agreement will be governed by the laws of the State of Missouri, excluding any conflicts or

choice of law rule or principle that might otherwise refer construction or interpretation of this Agreement to another jurisdiction.

(j)

Execution. An authorized representative of the Company has signed this Agreement, and Awardee has signed this Agreement to evidence Awardee’s acceptance of the award on the terms specified in this Agreement, all as of the Effective Date.

5

SECTION 9

TERMS OF THE PLAN

This award is granted under and is expressly subject to all the terms and provisions of the Plan, which terms are incorporated herein by

reference. Capitalized terms used but not defined in this Agreement shall have the same meanings ascribed to them in the Plan.

IN WITNESS

WHEREOF, the parties hereto have executed this Agreement as of this 1st day of December, 2015.

|

|

|

| “Company” |

| Reinsurance Group of America, Incorporated |

|

|

| By: |

|

|

| Name: |

|

A. Greig Woodring |

| Title: |

|

Chief Executive Officer |

|

| “Awardee” |

|

| |

| Name: |

|

Alain Néemeh |

6

Exhibit 10.4

REINSURANCE GROUP OF AMERICA, INCORPORATED

FLEXIBLE STOCK PLAN

RESTRICTED SHARE UNIT AGREEMENT

Reinsurance Group of America, Incorporated, a Missouri corporation (the “Company”), and Donna H. Kinnaird (“Employee”),

hereby agree as follows:

SECTION 1

GRANT OF RESTRICTED SHARE UNITS

Pursuant to the Reinsurance Group of America, Incorporated Flexible Stock Plan, as amended (the “Plan”), and pursuant to action of

the Committee charged with the Plan’s administration, the Company has granted to Employee, effective December 1, 2015 (the “Date of Grant”), subject to the terms, conditions and limitations stated in this Agreement, the Plan and

the Company’s Executive Compensation Recoupment Policy (as discussed in Section 6(a)), an award of restricted share units with respect to [ ] shares of Common Stock

(“Shares”). The rights awarded to Employee in this Agreement are referred to herein as “Restricted Share Units.” The number of Restricted Share Units granted under this Section 1 are referred to in this Agreement as

the “Target Grant.”

SECTION 2

TERMS OF GRANT

(a)

Vesting Date. The vesting date for this award is January 11, 2017 (the “Vesting Date”).

(b) Payment.

(1) Restricted Share Units Payable In Common Stock. Subject to early termination of this Agreement pursuant to Sections 3(b) or 4

below, within thirty (30) days following the Vesting Date, the Company will deliver to Employee one (1) Share of the Company’s Common Stock for each Restricted Share Unit earned under this Agreement; provided, however, that any

fractional Restricted Share Unit shall be paid in cash equal to such fraction of the Fair Market Value of a Share of Common Stock on the date of payment.

(2) Dividend Equivalents. Restricted Share Units shall not include dividend equivalent payments or dividend credit rights.

SECTION 3

CONDITIONS

AND LIMITATIONS ON RIGHT TO RECEIVE RSU

OR COMMON SHARES

(a) Demotion or Transfer. In the event that Employee is demoted or transferred to a position with the Company or any of its Affiliates

in which Employee is not eligible to participate in the Plan, as determined by the Committee in its sole discretion, this Agreement will terminate and be of no further force or effect and the Restricted Share Units awarded to Employee hereunder

shall be forfeited.

1

(b) Termination of Employment.

(1) Disability or Death. Notwithstanding the Vesting Date set forth in Section 2(a) above, in the event of

Employee’s Disability or death while serving as an employee and prior to the Vesting Date, the Restricted Share Unit award shall become immediately 100% vested and the Shares shall be delivered pursuant to Section 2(b). For purposes of

this Agreement, “Disability” means disability as defined in any long-term disability plan maintained by the Company or an Affiliate which covers Employee or, in the absence of any such plan, the physical or mental condition of Employee

arising prior to the Vesting Date, which in the opinion of a qualified physician chosen by the Company prevents Employee from continuing employment with the Company and its Affiliates.

(2) Other Termination. In the event that Employee’s employment with the Company and its Affiliates is terminated

prior to the Vesting Date, whether voluntarily or involuntarily, for any reason other than death or Disability, this Agreement will terminate and be of no further force or effect and the Restricted Share Units awarded to Employee hereunder shall be

forfeited, unless otherwise determined by the Committee in its sole discretion.

SECTION 4

CHANGE OF CONTROL

Notwithstanding the Vesting Date set forth in Section 2(a), in the event of a Change of Control prior to the Vesting Date, the Restricted

Share Unit award shall become immediately 100% vested and the Shares shall be delivered pursuant to Section 2(b).

SECTION 5

MISCELLANEOUS

(a) Rights in Shares Prior to Issuance. Prior to issuance of certificates for Shares, neither Employee nor his or her legatees,

personal representatives, or distributes (i) shall be deemed to be a holder of any Shares represented by the Restricted Share Units awarded hereunder or (ii) have any voting rights with respect to any such Shares.

(b) Non-assignability. The Restricted Share Units shall not be transferable by Employee otherwise than by will or by the laws of

descent and distribution; provided that, Employee may transfer the Restricted Share Units during his or her lifetime to a revocable living trust of which Employee is grantor, or to another form of trust indenture of which Employee is a grantor or a

beneficiary.

(c) Recoupment. The awards granted pursuant to this Agreement are subject to the terms and conditions contained in

the Company’s Executive Compensation Recoupment Policy (“Recoupment Policy”), which permits the Company to recoup all or a portion of awards made to certain employees upon the occurrence of any Recoupment Event (as defined in the

Recoupment Policy).

2

(d) Securities Law Requirements. The Company shall not be required to issue Shares

pursuant to this Agreement unless and until (i) such Shares have been duly listed upon each stock exchange on which the Company’s Common Stock is then registered and (ii) a registration statement under the Securities Act of 1933 with

respect to such Shares is then effective.

(e) Designation of Beneficiaries. Employee may file with the Company a written

designation of a beneficiary or beneficiaries to receive, in the event of Employee’s death, the Shares determined in accordance with Section 3(b) and subject to all of the provisions of this Agreement. An Employee may from time to time

revoke or change any such designation of beneficiary and any designation of beneficiary under the Plan shall be controlling over any other disposition, testamentary or otherwise; provided, however, that if the Committee shall be in doubt as to the

right of any such beneficiary to receive Shares, the Committee may recognize only receipt of such Shares by the personal representative of the estate of Employee, in which case the Company, the Committee and the members thereof shall not be under

any further liability to anyone.

(f) Changes in Capital Structure. If there is any change in the Common Stock by reason of any

stock dividend, spin-off, split-up, spin-out, recapitalization, merger, consolidation, reorganization, combination or exchange of

shares, the number of Restricted Share Units and the number, kind and class of shares available for Restricted Share Units and the exercise price thereof, as applicable, shall be appropriately adjusted by the Committee. The issuance of shares of

Common Stock for consideration and the issuance of common stock rights shall not be considered a change in the Company’s capital structure. No adjustment provided for in this Section shall require the issuance of any fractional shares.

(g) Right to Continued Employment. Nothing in this Agreement shall confer on Employee any right to continued employment or interfere

with the right of an employer to terminate Employee’s employment at any time.

(h) Tax Withholding. Employee must pay, or make

arrangements acceptable to the Company for the payment of any and all federal, state, and local tax withholding that in the opinion of the Company is required by law. Unless Employee satisfies any such tax withholding obligation by paying the amount

in cash or by check, the Company will withhold Shares having a Fair Market Value on the date of withholding equal to the tax withholding obligation.

(i) Copy of Plan. By signing this Agreement, Employee acknowledges receipt of a copy of the Plan and any offering circular related to

the Plan.

(j) Choice of Law. This Agreement will be governed by the laws of the State of Missouri, excluding any conflicts or

choice of law rule or principle that might otherwise refer construction or interpretation of this Agreement to another jurisdiction.

3

(k) Execution. An authorized representative of the Company has signed this Agreement, and

Employee has signed this Agreement to evidence Employee’s acceptance of the award on the terms specified in this Agreement, all as of the Date of Grant.

(l) Section 409A. This Agreement is intended to comply with Section 409A of the Code or an exemption thereunder and shall be

construed and interpreted in a manner that is consistent with the requirements for avoiding additional taxes or penalties under Section 409A of the Code. Notwithstanding the foregoing, the Company makes no representations that the payments and

benefits provided under this Agreement comply with Section 409A of the Code and in no event shall the Company be liable for all or any portion of any taxes, penalties, interest or other expenses that may be incurred by Employee on account of

non-compliance with Section 409A of the Code. Notwithstanding anything herein to the contrary, in the event that Employee is determined to be a specified employee within the meaning of Section 409A of the Code, any payment on account of

termination of employment shall be made on the first payroll date which is more than six months following the date of Employee’s termination of employment to the extent required to avoid any adverse tax consequences under Section 409A of

the Code. To the extent necessary for compliance with Code Section 409A, references to termination of employment under this Agreement shall mean a “separation from service” within the meaning of Section 409A of the Code.

SECTION 6

TERMS OF

THE PLAN

This award is granted under and is expressly subject to all the terms and provisions of the Plan, which terms are

incorporated herein by reference. Capitalized terms used but not defined in this Agreement shall have the same meanings ascribed to them in the Plan. The Plan authorizes several forms of equity awards, and the Restricted Share Units granted in

accordance with this Agreement shall be deemed Other Stock Based Awards as defined and described in the Plan.

Signature page follows.

4

IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of this 1st day of

December, 2015.

|

|

|

| Reinsurance Group of America, Incorporated |

|

|

| By: |

|

|

|

|

A. Greig Woodring |

|

|

Chief Executive Officer |

|

| Employee |

|

| |

| Name: |

|

Donna H. Kinnaird |

5

Exhibit 99.1

|

|

|

| Reinsurance Group of America, Incorporated |

|

|

| 16600 Swingley Ridge Road, Chesterfield, Missouri, U.S.A.

63017-1706 |

|

Press Release

RGA

Names Anna Manning as President; Greig Woodring to Retire in 2016

St. Louis, Missouri, U.S.A. November 23, 2015 – The Board of

Directors of Reinsurance Group of America, Incorporated (NYSE: RGA) today announced that Anna Manning has been elected to the role of President, effective December 1, 2015, succeeding A. Greig Woodring, currently President and Chief Executive

Officer. Woodring will remain CEO until his planned retirement in late 2016. The Board plans to appoint Manning as Chief Executive Officer at the end of 2016. The Board also plans to elect her to the Board of Directors effective in January 2016.

“On behalf of RGA’s Board of Directors, I would like to recognize Greig’s leadership of RGA for nearly thirty years, both as a

distinguished steward of the business, and as an innovative visionary,” said Cliff Eason, Chairman of the Board of Directors of RGA. He continued, “Anna is the right person to lead RGA into the future and to capitalize on the abundant

opportunities we see ahead. The Board initiated the formal CEO succession process several years ago, to identify and develop potential successors for the role. It was important to the Board that we identify someone with strong strategic

capabilities, depth and experience in all areas of our business, and an ability to combine vision with the capabilities to drive results. Anna has clearly demonstrated these qualities, as well as a passion for RGA that gives us confidence that she

will continue RGA’s rich legacy.”

Manning currently holds the position of Senior Executive Vice President, Structured Solutions, which includes

the company’s Global Financial Solutions and Global Acquisitions businesses, as well as Global Analytics and In-Force Optimization teams. Prior to assuming this role, she spent four years as Executive Vice President, U.S. Markets. Manning

joined RGA in 2007, and shortly after assumed the role of Executive Vice President and Chief Operating Officer for the International Division. In that role, she was responsible for setting standards, procedures and controls for pricing,

underwriting, administration and claims functions of RGA’s businesses located outside North America. Manning will continue to serve in her Structured Solutions role while assuming her new responsibilities as President.

Prior to joining RGA, Manning spent 19 years in actuarial consulting at Tillinghast Towers Perrin in a series of progressively more responsible roles,

following a successful actuarial career in the Canadian marketplace at Manulife Financial from 1981-1988. She holds a B.Sc. in Actuarial Science from the University of Toronto, is a Fellow of the Canadian Institute of Actuaries, and a Fellow of the

Society of Actuaries.

Woodring joined the reinsurance division of General American Life Insurance Company in 1979 as an actuary, and assumed

responsibility for General American’s reinsurance business in 1986. General American’s reinsurance division led to the formation of RGA and its initial public offering in May 1993. RGA has grown to become one of the world’s leading

life reinsurers, with offices in 27 countries and revenues of $11 billion for the year ended December 31, 2014.

“It has been extraordinarily gratifying to have spent the majority of my working years leading RGA’s

dedicated teams, through challenges and triumphs, to build a highly successful global organization,” said Woodring. “Although I will continue as CEO throughout 2016, I plan to gradually turn over my responsibilities to Anna so she is fully

transitioned by the end of next year. Anna shares my optimism about the future of the insurance industry, and we agree that RGA will play a meaningful role in identifying significant opportunities and navigating ongoing changes in the complex

industry in which we operate.”

“I am grateful for the opportunity to lead our great company, and for the trust and confidence placed in me by

Cliff, Greig and the Board,” said Manning. “It is humbling to follow such an influential visionary as Greig, who guided RGA to become one of the world’s leading life reinsurers. Over the years, he fostered a culture driven by a

relentless focus on our clients and a desire to help each of them succeed. I am committed to continuing his legacy, and with the help of the talented people at RGA, I know we can retain and build upon the special culture and growth engine he has

created.”

Reinsurance Group of America, Incorporated (NYSE: RGA), a FORTUNE 500 company, is among the leading global providers of life reinsurance

and financial solutions, with approximately $2.8 trillion of life reinsurance in force and assets of $47.6 billion as of September 30, 2015. Founded in 1973, today RGA is widely recognized for its deep technical expertise in risk and capital

management, innovative solutions, and commitment to serving its clients. From its headquarters in St. Louis, Missouri and operations in 27 countries, RGA delivers expert solutions in individual life reinsurance, individual living benefits

reinsurance, group reinsurance, health reinsurance, facultative underwriting, product development, and financial solutions.To learn more about RGA and its businesses, visit the company’s website at www.rgare.com.

For further information, please contact:

Sally Smith

Vice President, Corporate Communications

(636)

736-8167

ssmith@rgare.com

Jeff Hopson

Senior Vice President, Investor Relations

(636) 736-2068

jhopson@rgare.com

2

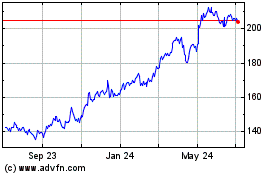

Reinsurance Group of Ame... (NYSE:RGA)

Historical Stock Chart

From Mar 2024 to Apr 2024

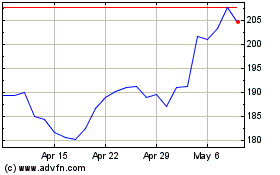

Reinsurance Group of Ame... (NYSE:RGA)

Historical Stock Chart

From Apr 2023 to Apr 2024