Current Report Filing (8-k)

November 18 2016 - 8:01AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM 8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of

The

Securities Exchange Act of 1934

Date

of report (Date of earliest event reported)

November

18, 2016

Radian Group Inc.

(Exact

Name of Registrant as Specified in Its Charter)

|

Delaware

|

1-11356

|

23-2691170

|

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

|

1601

Market Street, Philadelphia, Pennsylvania

|

19103

|

|

(Address

of Principal Executive Offices)

|

(Zip

Code)

|

(215) 231 - 1000

(Registrant’s

Telephone Number, Including Area Code)

(Former

Name or Former Address, if Changed Since Last Report)

Check the

appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any

of the following provisions

(

see

General Instruction

A.2. below)

:

⃞

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

⃞

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

⃞

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

⃞

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

Item 8.01.

Other Events

.

Radian Group Inc. (the “Company”) is providing certain terms for the

potential future redemption of its 2.25% Convertible Senior Notes due

2019 (the “Notes”).

The Company currently has outstanding $68.0 million principal amount of

the Notes. Under the indenture governing the Notes, the Company has the

option to redeem all or part of the Notes as long as the daily closing

sale price per share of its common stock is at least 130 percent of the

then-current conversion price (currently this threshold is $13.78) for

at least 20 out of the immediately preceding 30 consecutive trading days

before the delivery of a redemption notice (the “Redemption Trigger”).

If the Company elects to redeem the Notes, the Company currently intends

to settle in cash any conversions of the Notes occurring between the

date of the redemption notice and the redemption date, as well as any

Notes redeemed on the redemption date.

The Company is providing this information as contemplated in its Annual

Report on Form 10-K for the year ended December 31, 2015 (the “2015 Form

10-K”). The Company is not making any assurances that the Redemption

Trigger will be satisfied or that it will redeem the Notes. The Company

may subsequently elect to use an alternate settlement method in

accordance with the terms of the indenture governing the

Notes. However, in that event, the Company will announce the new

settlement method as contemplated in its 2015 Form 10-K.

FORWARD-LOOKING STATEMENTS

Some of the statements in this Current Report on Form 8-K may constitute

“forward-looking statements” within the meaning of Section 27A of the

Securities Act of 1933, Section 21E of the Securities Exchange Act of

1934 and the United States Private Securities Litigation Reform Act of

1995. These statements are made on the basis of management's current

views and assumptions with respect to future events. Any forward-looking

statement is not a guarantee of future performance and actual results

could differ materially from those contained in the forward-looking

statement. These statements speak only as of the date they were made,

and we undertake no obligation to update or revise any forward-looking

statements, whether as a result of new information, future events or

otherwise. We operate in a changing environment. New risks emerge from

time to time and it is not possible for us to predict all risks that may

affect us. The forward-looking statements, as well as our prospects as a

whole, are subject to risks and uncertainties that could cause actual

results to differ materially from those set forth in the forward-looking

statements. For more information regarding these risks and

uncertainties as well as certain additional risks that we face, you

should refer to the Risk Factors detailed in Item 1A of Part I of our

Annual Report on Form 10-K for the year ended December 31, 2015 and

subsequent reports and registration statements filed from time to time

with the Securities and Exchange Commission.

SIGNATURES

Pursuant to

the requirements of the Securities Exchange Act of 1934, the registrant

has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

RADIAN GROUP INC.

|

|

|

|

(Registrant)

|

|

|

|

|

|

Date:

|

November 18, 2016

|

By:

|

/s/ Edward J. Hoffman

|

|

|

|

|

Edward J. Hoffman

|

|

|

|

|

Executive Vice President and General Counsel

|

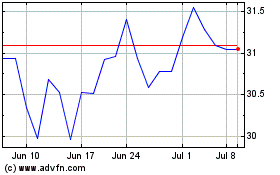

Radian (NYSE:RDN)

Historical Stock Chart

From Mar 2024 to Apr 2024

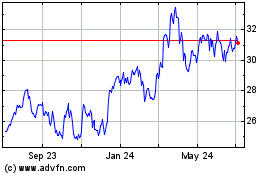

Radian (NYSE:RDN)

Historical Stock Chart

From Apr 2023 to Apr 2024