UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 11-K

FOR ANNUAL REPORTS OF EMPLOYEE STOCK REPURCHASE SAVINGS AND SIMILAR PLANS PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

(Mark One):

| |

x | ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

OR

| |

o | TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 1-11356

| |

A. | Full title of the plan and the address of the plan, if different from that of the issuer named below: |

RADIAN GROUP INC. SAVINGS INCENTIVE PLAN

| |

B. | Name of issuer of the securities held pursuant to the plan and the address of its principal executive office: |

RADIAN GROUP INC.

1601 Market Street

Philadelphia, PA 19103

RADIAN GROUP INC.

SAVINGS INCENTIVE PLAN

INDEX

|

| |

| |

| Page (s) |

| |

| |

Financial Statements: | |

| |

| |

| |

| |

| |

| |

| |

Supplemental Schedule * | |

| |

| |

| |

| |

| |

| |

| |

Exhibits: | |

| |

Exhibit 23.1—Consent of Independent Registered Public Accounting Firm—GRANT THORNTON LLP | |

| |

* | All other schedules required by Section 2520-103-10 of the United States Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974 have been omitted because they are not applicable. |

Report of Independent Registered Public Accounting Firm

To the Participants and Administrator of

Radian Group Inc. Savings Incentive Plan

We have audited the accompanying statements of net assets available for benefits of the Radian Group Inc. Savings Incentive Plan (the “Plan”) as of December 31, 2014 and 2013, and the related statement of changes in net assets available for benefits for the year ended December 31, 2014. These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. We were not engaged to perform an audit of the Plan’s internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Plan’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the net assets available for benefits of Radian Group Inc. Savings Incentive Plan as of December 31, 2014 and 2013, and the changes in net assets available for benefits for the year ended December 31, 2014 in conformity with accounting principles generally accepted in the United States of America.

The supplemental information in the accompanying schedule of assets (held at year end) as of December 31, 2014 has been subjected to audit procedures performed in conjunction with the audit of Radian Group Inc. Savings Incentive Plan’s financial statements. The supplemental information is presented for purposes of additional analysis and is not a required part of the basic financial statements but include supplemental information required by the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. The supplementary information is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental information reconciles to the basic financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information in the accompanying schedule, we evaluated whether the supplemental information, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information referred to above is fairly stated, in all material respects, in relation to the basic financial statements taken as a whole.

|

|

|

/s/ GRANT THORNTON LLP |

Philadelphia, PA |

June 25, 2015 |

Radian Group Inc. Savings Incentive Plan

Statements of Net Assets Available for Benefits

December 31, 2014 and 2013

|

| | | | | | | |

| December 31, |

| 2014 | | 2013 |

Assets | | | |

Investments (at fair value) | $ | 140,534,408 |

| | $ | 126,238,438 |

|

Receivables: | | | |

Employer contributions receivable | 1,043,302 |

| | 988,222 |

|

Notes receivable from participants | 1,463,466 |

| | 1,294,050 |

|

Total receivables | 2,506,768 |

| | 2,282,272 |

|

Net assets available for benefits at fair value | 143,041,176 |

| | 128,520,710 |

|

Adjustment from fair value to contract value for fully benefit-responsive investment contracts | (332,979 | ) | | (339,042 | ) |

Net assets available for benefits | $ | 142,708,197 |

| | $ | 128,181,668 |

|

The accompanying notes are an integral part of these statements.

Radian Group Inc. Savings Incentive Plan

Statement of Changes in Net Assets Available for Benefits

For the Year Ended December 31, 2014

|

| | | |

| Year Ended December 31, 2014 |

Investment Activity: | |

Net appreciation in fair value of investments | $ | 7,722,197 |

|

Interest | 231,286 |

|

Dividends | 3,958,027 |

|

Total investment income | 11,911,510 |

|

Contributions: | |

|

Participants | 5,723,106 |

|

Employer | 3,868,655 |

|

Rollover | 791,506 |

|

Total contributions | 10,383,267 |

|

Other Additions: | |

Interest income on notes receivable from participants | 55,180 |

|

Total additions | 22,349,957 |

|

Deductions: | |

|

Benefits paid to participants | 7,801,573 |

|

Administrative expenses | 21,855 |

|

Total deductions | 7,823,428 |

|

Net increase in net assets available for benefits | 14,526,529 |

|

Net assets available for benefits, beginning of year | 128,181,668 |

|

Net assets available for benefits, end of year | $ | 142,708,197 |

|

The accompanying notes are an integral part of this statement.

RADIAN GROUP INC. SAVINGS INCENTIVE PLAN

NOTES TO FINANCIAL STATEMENTS

A. Plan Description

The following description of the Radian Group Inc. Savings Incentive Plan (the “Plan”) provides only general information. Participants should refer to the Plan documents for a complete description of the Plan’s provisions.

General

The Plan is a defined-contribution plan designed to allow eligible employees of Radian Group Inc. (“Radian Group” or the “Company”) and its participating subsidiaries (collectively with Radian Group, the “Company”) to save for their retirement. Each eligible employee may participate in the Plan as of his or her date of hire. The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974 (“ERISA”), as amended.

On June 30, 2014, Radian Group acquired all of the outstanding equity interests of Clayton Holdings LLC (“Clayton”). Eligible employees of Clayton have the opportunity to participate in the Clayton Holdings LLC 401(k) plan and are not currently eligible to participate in the Radian Group Inc. Savings Incentive Plan.

Contributions

Eligible employees may elect to contribute to the Plan on a pretax and/or after-tax (Roth) basis up to 100% of their eligible compensation, subject to limits set pursuant to the Plan (not to exceed the indexed limitations contained in the Internal Revenue Code of 1986 (the “Code”)). These limits were $17,500 for both 2014 and 2013. Participants who attain age 50 or older before the close of the Plan year (December 31) are entitled to make catch-up contributions in accordance with, and subject to the limitations of, the Code. The maximum catch-up contribution was $5,500 for both 2014 and 2013. Participants may also roll over amounts into the Plan, representing distributions from other qualified retirement plans.

Eligible employees are automatically enrolled in the Plan (subject to their right to elect not to participate or to participate at a different contribution level) at a beginning participant contribution rate of 3% of eligible compensation. If a participant is automatically enrolled in the Plan and does not elect to discontinue or change such participant’s contribution rate, such participant’s contribution rate will be automatically increased by one percent each year until the contribution rate reaches 6%.

The Company makes a “matching contribution” with respect to 100% of the salary reduction contributions of each participant, up to 6% of a participant’s annual eligible compensation. Matching contributions are contributed (subject to the discretion of the Plan administrator): (i) in cash in accordance with the participants’ current investment elections, except to the extent that a participant has elected to invest all or a portion of his or her matching contribution in the Radian Group Inc. Common Stock Fund (the “Radian Common Stock Fund”); and (ii) in the Company’s common stock, to the extent a participant has elected to invest all or a portion of his or her matching contribution in the Radian Common Stock Fund.

The Company may make discretionary contributions to the Plan in amounts determined annually by the Company’s Board of Directors (the “Board”). Any such contribution may be made in a fixed dollar amount or may be made as a percentage of the Company’s net profits, percentage of a participant’s compensation, or any other method determined by the Board. Discretionary contributions are allocated pro rata among the participant’s investment elections at the time the discretionary contribution is made. The Company did not make any discretionary contributions for the year ended December 31, 2014.

Participant Accounts

The Vanguard Group (“TVG”), the record keeper for the Plan, maintains an account in the name of each participant that is comprised of the sum of: (1) such participant’s contributions; (2) Company matching, discretionary and transition credit contributions; (3) rollover contributions; and (4) share of the net earnings, losses and expenses of the various investment funds, less; (5) any loans and withdrawals. Allocations are based on participant earnings, account balances, or specific participant transactions. Each participant is entitled to the vested benefit of his or her account.

Vesting

Participants are at all times fully vested in: (i) amounts they contribute to the Plan; (ii) amounts received as transition credits, including any earnings on such amounts; (iii) rollover amounts; and (iv) matching contributions.

Discretionary contributions to participants vest upon the completion of three years of eligible service with the Company. Participants also have a 100% non-forfeitable interest in their discretionary contribution amounts upon attainment of normal retirement (age 65), total disability, or death prior to termination of service.

Forfeited Accounts

Participants forfeit any discretionary contributions made to them, and any earnings thereon, that are unvested at the time of their termination of service. As of December 31, 2014 and 2013, the forfeiture account balance was $20,546 and $22,109, respectively. The 2014 amount includes $3,183 that was forfeited in 2014. Employer contributions receivable at December 31, 2014 reflect a reduction of $4,912, which represents the amount to be utilized from the forfeiture balance to fund the employer match in 2015. See Vesting above for information regarding the vesting of discretionary contributions.

Trustee

Vanguard Fiduciary Trust Company (“Vanguard”) serves as trustee (the “Trustee”) for the Plan.

Investment Options

All investments in the Plan are participant-directed. Employee and employer contributions are allocated pro rata among the investment elections that have been selected by the participant at the time the contribution is made. If a participant does not select an investment election, the initial employee and/or employer contribution will be made to the default fund, which is a Target Retirement Fund, based on the participant’s anticipated retirement date. Participants may choose to have their contributions invested entirely in one, or in any combination of investment options, in whole percentage increments. Participants may change their contribution rate and investment selection for future contributions on any business day. Changes will take effect for the next eligible pay cycle so long as the request is completed before the respective cutoff dates. Participants may transfer part or all of their existing account balances among funds in the Plan at any time. Participants are permitted to make transfers out of the Radian Common Stock Fund and into any other investment option available under the Plan at any time, subject to compliance with the Company’s Policy Regarding Securities Trading. Generally, under ordinary market conditions, all collective trust positions provide daily market liquidity to Plan participants and the Plan. The Plan invests in collective trusts, in which participant transactions (issuances and redemptions) may occur daily. Were the Plan to initiate a full redemption of these collective trusts, TVG reserves the right to temporarily delay withdrawal from the trust in order to ensure that securities liquidations will be carried out in an orderly business manner. See Note G below.

Payment of Benefits and Withdrawals

On termination of service, a participant may receive a lump-sum amount equal to the value of the participant’s vested interest in his or her account.

Participants are permitted to make two hardship withdrawals and one non-hardship withdrawal in any Plan Year or 12-month period. The minimum withdrawal permitted is the lesser of $500 or the full value of the participant’s applicable account. Withdrawals for financial hardship are permitted if they are necessary to satisfy an immediate financial need. The Plan administrator may assess reasonable fees for participant loan origination and annual loan maintenance, with such fees to be specified in flat dollar amounts and which do not vary based on the amount of the loan. Participant loan repayments will be suspended for a participant’s bona fide leave of absence or 12 months, whichever is less. A participant must exhaust the possibility of all other withdrawals under the Plan and under all other retirement plans maintained by the Company, including non-taxable loans, before being eligible for a hardship withdrawal. Participants’ deferral contributions must be suspended for a period of six months following a hardship withdrawal.

Participants may also elect in-service withdrawals after reaching age 59-1/2. Rollover account balances may be withdrawn at any time. Minimum required distributions for participants who have reached age 70-1/2 also apply in accordance with Internal Revenue Service (“IRS”) regulations.

Notes Receivable from Participants

Eligible participants may borrow from the vested portion of their account balances a minimum of $1,000 and up to a maximum equal to the lesser of $50,000 (reduced by the excess of the highest outstanding loan balance during the 12-month period before the new loan is made over the outstanding loan balance on the date of the new loan), or 50% of their vested account balance. The maximum loan period is five years, subject to a limited exception for the purchase of a primary residence where the loan period can be up to 25 years. A participant may have only one loan outstanding at any one time. Loans bear interest at the prime rate at the time the loan is originated plus 1%. The rates on existing loans currently range from 4.25% to 9.20%, and loan payments are paid through payroll deductions. Outstanding loans are due and payable upon termination of service with the Company.

Recent Accounting Pronouncements

In May 2015, the FASB issued a new accounting standard update regarding disclosures for investments that are measured by using net asset value per share. The amendments in this update remove the requirement to categorize within the fair value hierarchy all investments for which fair value is measured using the net asset value per share practical expedient. The amendments also remove the requirement to make certain disclosures for all investments that are eligible to be measured at fair value using the net asset value per share practical expedient. This update is effective for the Plan for fiscal years beginning after December 15, 2015, and interim periods within those fiscal years and should be applied retrospectively to all periods presented. Early adoption is permitted for financial statements that have not been previously issued. The retrospective approach requires that an investment for which fair value is measured using the net asset value per share practical expedient be removed from the fair value hierarchy in all periods presented in an entity’s financial statements.

B. Significant Accounting Policies

Basis of Presentation and Use of Estimates

The financial statements of the Plan are prepared under the accrual method of accounting in conformity with accounting principles generally accepted in the United States of America (“GAAP”). GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the changes therein during the reporting period. Actual results may differ significantly from those estimates.

Investment Valuation and Income Recognition

Participants in the Plan can invest in a variety of funds, including registered investment company funds, collective trusts, and the Radian Common Stock Fund.

The Plan’s investments are stated at fair value, including all collective trusts, except for TVG Retirement Savings Trust, as explained below. The Company defines fair value as the current amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The Plan’s Retirement Plans Committee (defined below) determines the Plan’s valuation policies utilizing information provided by the investment advisors and Vanguard. See Note F for a discussion of fair value measurements.

TVG Retirement Savings Trust is a collective trust with investments in traditional investment contracts issued by insurance companies and banks, alternative contracts and short-term investments. Investments in TVG Retirement Savings Trust are valued based on the unit value of the trust, which is based on the fair market value of the underlying investments calculated by discounting the expected cash flows at market interest rates for similar instruments with comparable durations. This fair value calculation is then adjusted to reflect contract value. Although investment contracts held by a defined-contribution plan are generally required to be reported at fair value, contract value is the relevant measurement attribute for valuing the interest in a collective trust relating to fully benefit-responsive investment contracts, such as TVG Retirement Savings Trust, because contract value is the amount participants would receive if they were to initiate permitted transactions under the terms of the Plan. Therefore, the Statements of Net Assets Available for Benefits present the Plan’s interest in TVG Retirement Savings Trust at fair value, and also include an additional line item disclosing the adjustment from fair value to contract value for the Plan’s interest in the collective trust relating to fully benefit-responsive investment contracts. The Statement of Changes in Net Assets Available for Benefits is presented on a contract-value basis.

Dividends are recorded on the ex-dividend date and interest income is recorded when earned. Purchases and sales of securities are recorded as of the trade date. Net appreciation in fair value of investments includes the Plan’s gains and losses on investments bought and sold, as well as those held during the year.

Notes receivable from participants

Notes receivable from participants are measured at their unpaid principal balance plus any accrued but unpaid interest. Interest income is recorded on the accrual basis. Related fees are recorded as administrative expenses and are expensed when they are incurred.

If a participant ceases to make loan repayments and the plan administrator deems the participant loan to be in default, the participant loan balance is reduced and a benefit payment is recorded. Therefore, no allowance for credit losses has been recorded as of December 31, 2014 or 2013.

Payment of Benefits

Benefits are recorded when paid.

Expenses

Certain expenses of maintaining the Plan are paid directly by the Company and are excluded from these financial statements. Fees related to the administration of notes receivable from participants are charged directly to the participant’s account and are included in administrative expenses. Investment related expenses are included in net appreciation in fair value of investments.

C. Administration/Termination of the Plan

The Plan administrator is a committee (the “Retirement Plans Committee”) comprised of members of management that are appointed by the Board. The Plan administrator has fiduciary responsibility for the general operation of the Plan. The Company’s Human Resources group is responsible for the administrative duties of the Plan. TVG assists the Company in fulfilling some of the administrative functions of the Plan. The Company does not receive compensation from the Plan for services provided. Certain costs of the Plan are deducted from participants’ accounts, including: (i) brokerage fees and commissions, which are included in the cost of investments and in determining net proceeds on sales of investments; and (ii) investment management fees, which are paid from the assets of the respective funds. Other administrative and operational costs of the Plan for the year ended December 31, 2014 were paid by the Company.

Although the Company has not expressed any intention to do so, the Company reserves the right to terminate the Plan at any time. In the event the Plan is terminated, all benefits would become fully vested and non-forfeitable and the net assets of the Plan would be allocated as required by the Plan and in accordance with ERISA.

D. Tax Status

The IRS has determined and informed the Company by letter dated November 7, 2012, that the Plan and related trust is designed in accordance with applicable sections of the Code. Once qualified, the Plan is required to operate in conformity with the Code to maintain its qualification. Although the Company has amended the Plan since this determination, the Plan administrator believes that the Plan continues to be designed and operated in compliance with the applicable requirements of the Code. The Company will take any action necessary to maintain the Plan’s tax-qualified status. Accordingly, no provision for income taxes has been included in the financial statements.

GAAP requires Plan management to evaluate tax positions taken by the Plan and recognize a tax liability (or asset) if the Plan has taken an uncertain position that more likely than not would not be sustained upon examination by the IRS. Plan management has analyzed the tax positions taken by the Plan and has concluded that as of December 31, 2014 and 2013, there are no uncertain positions taken or expected to be taken that would require recognition of a liability (or asset) or disclosure in the financial statements. The Plan is subject to routine audits by taxing jurisdictions; however, there are no audits for any tax periods in progress. The Plan administrator believes that the trust underlying the Plan is no longer subject to income tax examinations for years prior to 2012.

E. Investments

Investments representing five percent or more of the fair value of the Plan’s net assets as of the periods indicated were as follows:

|

| | | |

| December 31, 2014 |

| Fair Value |

Radian Group Inc. Common Stock | $ | 22,829,154 |

|

TVG Wellington Fund | 12,758,678 |

|

TVG Morgan Growth Fund | 12,494,043 |

|

TVG Retirement Savings Trust III | 11,513,166 |

|

TVG 500 Index Fund | 10,639,794 |

|

TVG Target Retirement 2035 | 8,338,471 |

|

TVG Target Retirement 2025 | 7,338,553 |

|

| |

| December 31, 2013 |

| Fair Value |

Radian Group Inc. Common Stock | $ | 20,211,410 |

|

TVG Retirement Savings Trust | 12,844,131 |

|

TVG Wellington Fund | 11,981,074 |

|

TVG Morgan Growth Fund | 8,958,778 |

|

TVG Target Retirement 2035 | 6,818,088 |

|

TVG Target Retirement 2025 | 6,673,639 |

|

During 2014, the Plan’s investments (including gains and losses on investments bought and sold, as well as held during the year) appreciated by $7,722,197 as follows:

|

| | | |

Radian Group Inc. Common Stock | $ | 3,623,193 |

|

Registered Investment Company Funds | 2,060,755 |

|

Collective Trust Funds | 2,038,249 |

|

Total | $ | 7,722,197 |

|

F. Fair Value Measurements

GAAP has established a three-level valuation hierarchy for disclosure of fair value measurements based on the transparency of inputs to the valuation of an asset or liability as of the measurement date. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level I measurements) and the lowest priority to unobservable inputs (Level III measurements). The level in the fair value hierarchy within which the fair value measurement falls is determined based on the lowest level input that is significant to the measurement in its entirety. The three levels of the fair value hierarchy are described below:

| |

Level I | — Unadjusted quoted prices for identical assets or liabilities in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities; |

| |

Level II | — Prices or valuations based on observable inputs other than quoted prices in active markets for identical assets and liabilities; and |

| |

Level III | — Prices or valuations that require inputs that are both significant to the fair value measurement and unobservable. Level III inputs are used to measure fair value only to the extent that observable inputs are not available. |

The level of market activity used to determine the fair value hierarchy is based on the availability of observable inputs market participants would use to price an asset or a liability, including market value price observations. For markets in which inputs are not observable or limited, we use significant judgment and assumptions that a typical market participant would use to evaluate the market price of an asset or liability. Given the level of judgment necessary, another market participant may derive a materially different estimate of fair value. These assets and liabilities are classified in Level III of our fair value hierarchy.

Unrealized gains (losses) from TVG Retirement Savings Trust, a collective trust, are not included in the Statements of Changes in Net Assets Available for Benefits as the contract is recorded at contract value for purposes of the net assets available for benefits. (See Note B, Investment Valuation and Income Recognition.) All other collective trusts are valued at fair value.

The availability of observable market data is monitored to assess the appropriate classification of financial instruments within the fair value hierarchy. Changes in economic conditions or model-based valuation techniques may require the transfer of financial instruments from one valuation hierarchy level to another. In such instances, the transfer is reported as of the beginning of the reporting period.

For the year ended December 31, 2014, there were no transfers between Levels I and II.

The following are descriptions of our valuation methodologies for assets measured at fair value:

Registered Investment Company Funds—Shares of registered investment company funds are valued at quoted market prices based on the net asset value of shares held by the Plan on the last day of the Plan year (Level I).

Common Stock Fund—The Radian Common Stock Fund, with underlying investments consisting of Radian Group common stock and a money market account, is valued based on the net asset value of units held by the Plan at year end, which is based on the fair market value of the underlying investments (Level I).

Collective Trusts—Collective trusts, with underlying investments in indexed funds or investment contracts, are valued based on the net asset value of units held by the Plan at year end, which is based on the fair market value of the underlying investments (Level II). The Target Retirement Funds invest in TVG mutual funds using an asset allocation strategy designed for investors planning to retire and leave the workforce in or within a few years of the target year, with the trust’s asset allocation becoming more conservative over time.

At December 31, 2014 and 2013, there were no Level III investments.

The following is a list of assets that are measured at fair value by hierarchy level as of December 31, 2014 and 2013:

|

| | | | | | | | | | | |

| Assets at Fair Value as of December 31, 2014 |

| Level I | | Level II | | Total |

Registered Investment Company Funds: | | | | | |

Domestic balanced funds | $ | 12,758,678 |

| | $ | — |

| | $ | 12,758,678 |

|

Bond funds | 8,938,357 |

| | — |

| | 8,938,357 |

|

Domestic stock funds | 43,856,306 |

| | — |

| | 43,856,306 |

|

International stock funds | 8,511,823 |

| | — |

| | 8,511,823 |

|

Total Registered Investment Company Funds | 74,065,164 |

| | — |

| | 74,065,164 |

|

Common Stock Fund: | | | | | |

Radian Group Inc. Common Stock | 22,829,154 |

| | — |

| | 22,829,154 |

|

Money Market Fund | 69,680 |

| | — |

| | 69,680 |

|

Total Common Stock Fund | 22,898,834 |

| | — |

| | 22,898,834 |

|

Collective Trust Funds: | | | | | |

Target Retirement Funds | — |

| | 32,057,244 |

| | 32,057,244 |

|

TVG Retirement Savings Trust III | — |

| | 11,513,166 |

| | 11,513,166 |

|

Total Collective Trust Funds | — |

| | 43,570,410 |

| | 43,570,410 |

|

Total Investments at Fair Value | $ | 96,963,998 |

| | $ | 43,570,410 |

| | $ | 140,534,408 |

|

|

| | | | | | | | | | | |

| Assets at Fair Value as of December 31, 2013 |

| Level I | | Level II | | Total |

Registered Investment Company Funds: | | | | | |

Domestic balanced funds | $ | 37,995,027 |

| | $ | — |

| | $ | 37,995,027 |

|

Bond funds | 7,887,067 |

| | — |

| | 7,887,067 |

|

Domestic stock funds | 38,447,716 |

| | — |

| | 38,447,716 |

|

International stock funds | 8,800,415 |

| | — |

| | 8,800,415 |

|

Total Registered Investment Company Funds | 93,130,225 |

| | — |

| | 93,130,225 |

|

Common Stock Fund: | | | | | |

Radian Group Inc. Common Stock | 20,211,410 |

| | — |

| | 20,211,410 |

|

Money Market Fund | 52,672 |

| | — |

| | 52,672 |

|

Total Common Stock Fund | 20,264,082 |

| | — |

| | 20,264,082 |

|

Collective Trust Fund: | | | | | |

TVG Retirement Savings Trust | — |

| | 12,844,131 |

| | 12,844,131 |

|

Total Collective Trust Fund | — |

| | 12,844,131 |

| | 12,844,131 |

|

Total Investments at Fair Value | $ | 113,394,307 |

| | $ | 12,844,131 |

| | $ | 126,238,438 |

|

The following tables summarize investments measured at fair value based on net asset value per share as of December 31, 2014 and 2013:

|

| | | | | | | | | | |

| December 31, 2014 |

| Fair Value | | Unfunded Commitments | | Redemption Frequency (if currently eligible) | | Redemption Notice |

Target Retirement Funds | $ | 32,057,244 |

| | n/a | | Daily | | Daily | |

TVG Retirement Savings Trust III | 11,513,166 |

| | n/a | | Daily | | Daily | |

|

| | | | | | | | | | |

| December 31, 2013 |

| Fair Value | | Unfunded Commitments | | Redemption Frequency (if currently eligible) | | Redemption Notice |

TVG Retirement Savings Trust | $ | 12,844,131 |

| | n/a | | Daily | | Daily | |

G. Investment in TVG Retirement Savings Trust III

As of December 31, 2014 and 2013, the Plan has applied the practical expedient to its investment in TVG Retirement Savings Trust III (and its predecessor, TVG Retirement Savings Trust), a collective trust fund. TVG Retirement Savings Trust III’s investment objective is to seek the preservation of capital and to provide a competitive level of income over time that is consistent with the preservation of capital. Participants’ ownership of TVG Retirement Savings Trust III is represented as units. Units are issued and redeemed daily at TVG Retirement Savings Trust III’s constant net asset value (“NAV”) of $1 per unit. TVG Retirement Savings Trust III allows for daily liquidity with no additional days notice required for redemption. It is the policy of TVG Retirement Savings Trust III to use its best efforts to maintain a stable NAV of $1 per unit; although there is no guarantee that TVG Retirement Savings Trust III will be able to maintain this value.

Participants ordinarily may direct the withdrawal or transfer of all or a portion of their investment in TVG Retirement Savings Trust III at contract value. Contract value represents contributions made to TVG Retirement Savings Trust III, plus earnings, less participant withdrawals and administrative expenses. TVG Retirement Savings Trust III imposes certain restrictions on the Plan, and TVG Retirement Savings Trust III itself may be subject to circumstances that impact its ability to transact at contract value, as described in the following paragraphs. Plan management believes the occurrence of events that would cause TVG Retirement Savings Trust III to transact at less than contract value is not probable.

The underlying assets of TVG Retirement Savings Trust III primarily include investment contracts that are issued by insurance companies and commercial banks and contracts that are backed by bond trusts and are selected by the Trustee. The issuers’ ability to meet these obligations may be affected by economic developments in their respective companies and industries. TVG Retirement Savings Trust III is presented in the Statements of Net Assets Available for Benefits at fair value with an adjustment to contract value.

The contract values of the investments as of December 31, 2014 and 2013 were $11,180,187 and $12,505,089, respectively. There are no reserves against contract value for credit risk of the contract issuer or otherwise. The trust consists of both traditional insurance contracts and synthetic investment contracts. The crediting interest rate on traditional contracts is typically fixed for the life of the investment. The crediting rate of synthetic investment contracts resets every quarter based on the performance of the underlying investment portfolio. To the extent that TVG Retirement Savings Trust III has unrealized gains and losses (that are accounted for under contract value accounting, through the value of the synthetic contract), the interest crediting rate may differ from then-current market rates. At December 31, 2014 and 2013, the crediting interest rate was 2.39% and 2.06%, respectively. The average yield credited to participants was 2.14% during the year ended December 31, 2014.

H. Risks and Uncertainties

The Plan invests in various investment securities. Investment securities are subject to various risks such as interest rate, market volatility and credit risks. Due to the level of risk associated with certain investment securities, it is at least reasonably possible that changes in the values of investment securities will occur in the near term and that such changes could materially affect participants’ account balances and the amounts reported in the Statements of Net Assets Available for Benefits.

Market values of the Plan’s investments may decline for a number of reasons, including among others, changes in prevailing market and interest rates, increases in defaults, increases in voluntary prepayments for investments that are subject to prepayment risk under normal market conditions, and widening of credit spreads.

I. Exempt Party-in-Interest and Related Party Transactions

The Plan permits investments in various investment funds managed by TVG. TVG is the record keeper of the Plan and an affiliate of the Plan’s Trustee. The Plan permits notes receivable from participants. These transactions qualify as party-in-interest transactions that are exempt from the prohibited transaction rules of ERISA.

In addition, the Plan held 1,369,547 and 1,431,403 shares of Radian Group common stock at December 31, 2014 and 2013, respectively, within the Radian Common Stock Fund. The cost basis of the Radian Common Stock Fund was $12,132,472 and $11,332,251 as of December 31, 2014 and 2013, respectively. During the year ended December 31, 2014, the Plan recorded dividend income in the Radian Common Stock Fund of $14,032. Contributions into the Radian Common Stock Fund during the year ended December 31, 2014 totaled $321,142, including $121,223 in Company matching contributions. Transactions in the Radian Common Stock Fund qualify as party-in-interest transactions that are exempt from the prohibited transaction rules of ERISA.

The Company also provides certain accounting, record-keeping and additional services to the Plan for which it receives no compensation.

J. Plan Amendments

On November 24, 2014, the Plan was amended to recognize Radian Advisors LLC as a participating employer and to grant credit for prior service to former employees of Global Financial Advisors Inc.

On December 19, 2014, the Plan was amended in response to a request by an IRS auditor to clarify certain categories of excluded employees.

K. Reconciliation of Financial Statements to Form 5500

The following is a reconciliation of net assets available for benefits per the financial statements to Form 5500 as of December 31, 2014 and 2013:

|

| | | | | | | |

| December 31, |

| 2014 | | 2013 |

Statements of Net Assets Available for Benefits: | | | |

Net assets available for benefits per the financial statements | $ | 142,708,197 |

| | $ | 128,181,668 |

|

Adjustment from contract value to fair value for fully benefit-responsive investment contracts | 332,979 |

| | 339,042 |

|

Net assets available for benefits per Form 5500 | $ | 143,041,176 |

| | $ | 128,520,710 |

|

The following is a reconciliation of the change in net assets available for benefits per the financial statements to Form 5500 for the year ended December 31, 2014:

|

| | | |

| December 31, 2014 |

Statement of Changes in Net Assets Available for Benefits: | |

Net increase in net assets available for benefits per the financial statements | $ | 14,526,529 |

|

Change in adjustment from contract value to fair value for fully benefit-responsive investment contracts from December 31, 2013 to December 31, 2014 | (6,063 | ) |

Total increase in net assets available for plan benefits per Form 5500 | $ | 14,520,466 |

|

L. Subsequent Events

We have evaluated all events subsequent to December 31, 2014 up through the date of the filing of this report. In June 2015, new investment options were added to the Plan and certain current investment options were removed from the Plan. Participant amounts in funds that were removed were automatically transferred to the new investment funds. Participants were able to transfer amounts either before or after this transfer occurred.

******

Radian Group Inc. Savings Incentive Plan

Supplemental Schedule

Form 5500, Schedule H, Part IV Line 4i: Schedule of Assets (Held at End of Year)

December 31, 2014

EIN: 23-2691170

Plan # 001

|

| | | | | | | |

(a) | (b) Identity of Issue, Borrower, Lessor, or Similar Party | (c) Description of investment, including maturity date, rate of interest, collateral, par or maturity value | (d) Cost | | (e) Current Value |

* | TVG Wellington Fund | Registered Investment Company | ** |

| $ | 12,758,678 |

|

* | TVG Morgan Growth Fund | Registered Investment Company | ** |

| 12,494,043 |

|

* | TVG Retirement Savings Trust III | Collective Trust | ** |

| 11,513,166 |

|

* | TVG 500 Index Fund | Registered Investment Company | ** |

| 10,639,794 |

|

* | TVG Target Retirement 2035 Fund | Collective Trust | ** |

| 8,338,471 |

|

* | TVG Target Retirement 2025 Fund | Collective Trust | ** |

| 7,338,553 |

|

* | TVG Mid-Cap Growth Fund | Registered Investment Company | ** |

| 5,957,141 |

|

* | TVG Total Bd Mkt Indx Fund | Registered Investment Company | ** |

| 5,892,134 |

|

* | TVG Mid-Cap Index Fund | Registered Investment Company | ** |

| 4,456,054 |

|

* | TVG Target Retirement 2045 Fund | Collective Trust | ** |

| 4,447,871 |

|

* | TVG Target Retirement 2015 Fund | Collective Trust | ** |

| 4,256,944 |

|

* | TVG Windsor II Fund Inv | Registered Investment Company | ** |

| 3,729,810 |

|

* | TVG Sm-Cap Index Fund | Registered Investment Company | ** |

| 3,554,929 |

|

* | TVG Total Int'l Stock Idx Fund | Registered Investment Company | ** |

| 3,183,281 |

|

* | TVG Selected Value Fund | Registered Investment Company | ** |

| 2,745,662 |

|

* | TVG Target Retirement 2030 Fund | Collective Trust | ** |

| 2,545,699 |

|

* | TVG Target Retirement 2020 Fund | Collective Trust | ** |

| 1,953,313 |

|

* | TVG Target Retirement 2040 Fund | Collective Trust | ** |

| 1,648,480 |

|

* | TVG Target Retirement Income | Collective Trust | ** |

| 819,175 |

|

* | TVG Target Retirement 2050 Fund | Collective Trust | ** |

| 351,170 |

|

* | TVG Target Retirement 2010 Fund | Collective Trust | ** |

| 241,424 |

|

* | TVG Target Retirement 2055 Fund | Collective Trust | ** |

| 75,861 |

|

* | TVG Target Retirement 2060 Fund | Collective Trust | ** |

| 40,283 |

|

* | Radian Group Inc. | Radian Group Inc. Common Stock | ** |

| 22,829,154 |

|

* | Vanguard | Money Market Fund | ** | | 69,680 |

|

| Artisan International Fund | Registered Investment Company | ** |

| 5,328,542 |

|

| Met West Total Ret Bond | Registered Investment Company | ** |

| 3,046,223 |

|

| Munder: Sm-Cap Val | Registered Investment Company | ** |

| 171,152 |

|

| Eagle Small Cap Growth | Registered Investment Company | ** |

| 107,721 |

|

| Total Investments at fair value | |

|

| $ | 140,534,408 |

|

* | Notes receivable from participants | Interest rates from 4.25% to 9.20%, maturing between 2015 and 2039 |

|

| $ | 1,463,466 |

|

________________

| |

* | Indicates a party-in-interest to the Plan. |

| |

** | Cost is not required to be disclosed for participant-directed investments. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Plan Administrator has duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

| | | |

| | RADIAN GROUP INC. SAVINGS INCENTIVE PLAN |

| | | |

Date: | June 25, 2015 | By: | /s/ Anita Scott |

| | | Anita Scott |

| | | Senior Vice President, Human Resources |

Exhibit Index

|

| | |

| | |

Exhibit No. | | Description |

| | |

23.1 | | Consent of Independent Registered Public Accounting Firm—Grant Thornton LLP |

Exhibit 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We have issued our report dated June 25, 2015, with respect to the financial statements and supplemental schedule included in the Annual Report of the Radian Group Inc. Savings Incentive Plan on Form 11-K for the year ended December 31, 2014. We hereby consent to the incorporation by reference of said reports in the Registration Statement of Radian Group Inc. on Form S-8 (File No. 333-154275).

|

|

|

|

|

/s/ GRANT THORNTON LLP |

|

Philadelphia, Pennsylvania |

June 25, 2015 |

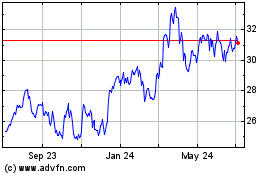

Radian (NYSE:RDN)

Historical Stock Chart

From Mar 2024 to Apr 2024

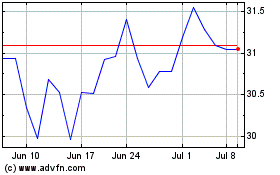

Radian (NYSE:RDN)

Historical Stock Chart

From Apr 2023 to Apr 2024