Radian Group CEO Calls For Unity To Stabilize Housing Market

October 23 2011 - 5:58PM

Dow Jones News

The chief executive officer of Radian Group Inc. (RDN) warned

that lenders and insurers need to work closely with the U.S.

government to prevent further "shocks" to the housing market in the

wake of the takeover of a rival mortgage insurer by Arizona

regulators last week.

"The housing industry is in a very fragile situation," said

Radian CEO S.A. Ibrahim in an interview Sunday. "We all need to

work very collaboratively to do everything we can to make sure the

housing industry doesn't suffer any more shocks," he said. The

warning comes as regulators and legislators are working to overhaul

the mortgage market on several fronts, with the aims of reducing

the government's role and avoiding a repetition of the conditions

that resulted in record foreclosures when the most-recent housing

bubble burst.

The Arizona Department of Insurance last week seized control of

PMI Group Inc. (PMI), ordering the mortgage insurer to pay just 50%

on any future claims, with the remainder to be deferred.

Mortgage insurers pay lenders on a portion of their losses if

homeowners default on their loans. The regulator's order means

mortgage investors such as Fannie Mae, Freddie Mac and Wells Fargo

& Co. (WFC) will likely be footing more of the bill than they

expected on defaulted loans insured by PMI.

"I hope PMI's announcement doesn't cause further psychological

harm to the homeowners market," Ibrahim said. But Ibrahim said the

remaining mortgage insurers are healthier than PMI, and should be

allowed to continue selling new coverage. Mortgage insurers

tightened their underwriting standards after the housing bubble

burst and insist the coverage they are selling now will be highly

profitable.

"There's a huge advantage to all of us to being allowed to

continue to write new business," Ibrahim said. "As long as the

remaining players continue to write business, the industry model

will be scarred but whole. Should any more players be forced to

stop writing business, it starts to cost the taxpayers even more

money" because a shuttered company wouldn't be able to use profits

on more-recent policies to pay off claims on the older ones.

Even PMI could have benefited from being allowed to sell

coverage, he said. The regulators in Arizona forced the company to

stop insuring new mortgages in August in advance of last week's

takeover. Because new business is profitable, Ibrahim said, "to

some extent, it may have been better if [Fannie and Freddie] and

others could have worked to allow PMI more flexibility. It may have

been better for the policyholders than getting paid 50%."

Ibrahim said that, unlike PMI, Radian's available capital is

well above the triggers that would require waivers from Fannie,

Freddie and state insurance regulators to keep selling new

business. In addition, the company has said it will have $630

million available at its holding company at the end of the year

that it could distribute to its mortgage-insurance subsidiary if

needed to further boost capital levels.

-By Erik Holm, Dow Jones Newswires; erik.holm@dowjones.com

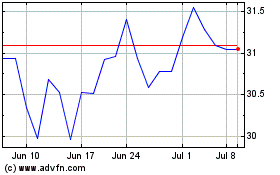

Radian (NYSE:RDN)

Historical Stock Chart

From Mar 2024 to Apr 2024

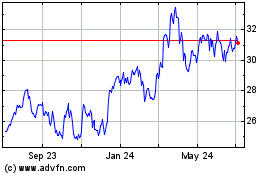

Radian (NYSE:RDN)

Historical Stock Chart

From Apr 2023 to Apr 2024