Carnival Profit Soars as Fuel Costs Slide

March 30 2016 - 11:20AM

Dow Jones News

Carnival Corp. said its earnings nearly tripled in the latest

quarter as the cruise-ship operator continued to benefit from a

slide in fuel costs.

Shares rose 5%, to $52.10, in early trading as adjusted

per-share earnings and revenue beat expectations.

For the fiscal year ending in November, the company narrowed its

adjusted earnings estimate to $3.20 to $3.40 a share, from its

previous estimate of $3.10 to $3.40. The company expects to benefit

from higher booking volumes and higher prices.

The company backed its and net revenue yield growth of roughly

3%.

For the current quarter, the company forecast adjusted earnings

of 34 cents to 38 cents a share. Analysts polled by Thomson Reuters

expected 38 cents.

The cruise-ship company, which operates Carnival Cruise Lines as

well as the Princess, Cunard and Holland America lines, has

benefited in recent quarters from broad-based booking strength and

lower fuel costs.

In the latest quarter, the company reported that its fuel

expenses fell 41%, to $187 million from $318 million a year ago.

Carnival said that since January, booking volumes for the remainder

of the year are running ahead of last year's historically high

levels at higher prices.

Chief Executive Arnold Donald said the company's efforts to

improve guests' experiences, as well as marketing efforts, "have

driven additional demand for our brands, resulting in a strong

booked position."

The company said Cuba last week granted approval for Carnival to

run cruises from the U.S. starting in May. Carnival said it is

cleared to operate a 704-passenger ship through its Fathom brand to

Cuba amid thawing in U.S.-Cuban relations.

For the period ended Feb. 29, Carnival reported a profit of $142

million, or 18 cents a share, up from $49 million, or 6 cents a

share, a year earlier.

Excluding items, per-share earnings rose to 39 cents from 20

cents.

The company expected per-share earnings between 28 cents and 32

cents.

Revenue increased 3.4%, to $3.65 billion. Analysts expected

revenue of $3.63 billion.

Net cruise costs excluding fuel and currency impacts rose 1.6%,

below the company's projection of an increase of 2.5% to 3.5%,

because of the timing of expenses between quarters.

Net revenue yields—a measure of revenue relative to

capacity—rose 5.7% in the latest quarter when adjusted for currency

fluctuations, above the company's expectations for growth of 3.5%

to 4.5%.

Carnival's report also boosted shares of fellow cruise operator

Royal Caribbean Cruises Ltd., which climbed 4.1%. The firm had

issued disappointing guidance early last month that walloped its

stock performance.

Tess Stynes contributed to this article.

Write to Joshua Jamerson at joshua.jamerson@wsj.com

(END) Dow Jones Newswires

March 30, 2016 11:05 ET (15:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

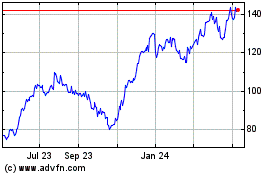

Royal Caribbean (NYSE:RCL)

Historical Stock Chart

From Mar 2024 to Apr 2024

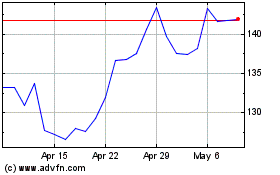

Royal Caribbean (NYSE:RCL)

Historical Stock Chart

From Apr 2023 to Apr 2024