Cruise-Liner Shares Leave Many Stocks in Their Wake

October 01 2015 - 8:20AM

Dow Jones News

Three years ago, investors in cruise-ship companies joined

passengers in taking their money elsewhere.

But major cruise-liner shares have staged a comeback. Business

is recovering following the calamities that befell the industry,

from sick-passenger outbreaks to the 2012 grounding of the Carnival

Corp.-owned Costa Concordia. Meanwhile, lower fuel prices and a

pickup in consumer spending have translated into higher profits and

revenues for cruise operators.

Shares of Carnival, Royal Caribbean Cruises Ltd. and Norwegian

Cruise Line Holdings Ltd. have notched double-digit percent gains

in their stock prices in the past year.

The stocks have pulled back in recent weeks as investors have

trimmed top-performing shares. But cruise lines have held up

relatively well in recent months as jitters over global growth have

undermined the six-year-old bull market in stocks.

Investors have been rewarded for sticking to shares of companies

tied to this year's uptick in consumer spending. Restaurants, food

companies and drink makers are among the corners of the market that

have held up this year despite a broader market slump, as many

money managers continue to bet on an accelerating U.S. economy.

"There is a scarcity of growth and this is one of the few areas

that is offering it," said Peter Stournaras, a portfolio manager at

the $4.7 trillion asset-manager BlackRock. "There's a lot of

consumer tailwinds … and they're in the bull's-eye."

Mr. Stournaras, who oversees $17.8 billion in large-cap funds,

has been a longtime owner of cruise-line stocks. He also has been a

buyer of shares of restaurant companies and other

consumer-discretionary shares, though has stayed away from shares

of many retailers, arguing that consumers are increasingly opting

to spend their extra dollars on novelties like cruises rather than

on traditional goods.

Among the factors working in cruise operators' favor has been

the yearlong tumble in energy prices. Fuel typically accounts for

about 20% of the industry's operating expenses, a figure that has

been declining and is likely to continue shrinking in the coming

years assuming oil prices remain near current levels, according to

Robin Farley, an analyst at UBS who follows the industry. Crude

prices have fallen 50% from a year ago, a factor that has also put

more money in the pockets of cruise passengers.

The prospects of new routes to Cuba and nascent growth in China,

where cruise lines are still making inroads, have also made the

stocks more attractive, investors say.

At the same time, the industry has rebounded from its troubles

of a few years ago, allowing companies to once again start raising

cruise fares, helping to boost profits and revenue, investors

said.

Shares of Royal Caribbean have fallen 2.2% this week through

Wednesday, while Norwegian stock is down 5.6% and Carnival is off

2.3%. And the possibility of another cruise-ship disaster could

once again sour consumers on cruise vacations and force another

round of painful price cuts, investors warned.

"There's always the risk that one of these cruise ships hits a

rock, or you get an outbreak of some disease on a ship and it

freaks everyone out," said John Toohey, portfolio manager on the

$2.3 billion USAA Cornerstone Moderately Aggressive Fund, which has

been buying shares of cruise companies over the last year.

Other buyers cautioned that the sector's strong performance of

the past year has made the stocks pricey.

Companies in the sector have posted among the strongest earnings

among big companies in recent quarters. In the first half of the

year, profits at Carnival more than quadrupled, while earnings at

Norwegian grew 26% and Royal Caribbean earnings rose 20%.

Profits at S&P 500 companies contracted for the first time

in three years in the second quarter, and analysts project another

decline in the third, according to FactSet.

"We have a positive consumer backdrop in the U.S. and we have a

healthier labor market," said Susan Bao, portfolio manager of the

$12 billion J.P. Morgan U.S. Equity Fund, a longtime owner of

cruise line stocks. "We expect better demand going forward from a

leisure-demand perspective."

Write to Dan Strumpf at daniel.strumpf@wsj.com

Access Investor Kit for "CitiGroup Inc"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=US1729674242

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 01, 2015 08:05 ET (12:05 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

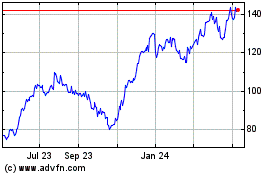

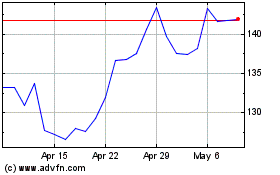

Royal Caribbean (NYSE:RCL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Royal Caribbean (NYSE:RCL)

Historical Stock Chart

From Apr 2023 to Apr 2024