Additional Proxy Soliciting Materials (definitive) (defa14a)

May 15 2015 - 4:10PM

Edgar (US Regulatory)

|

UNITED STATES |

|

SECURITIES AND EXCHANGE COMMISSION |

|

Washington, D.C. 20549 |

|

|

|

SCHEDULE 14A |

|

|

|

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. ) |

|

|

|

Filed by the Registrant x |

|

|

|

Filed by a Party other than the Registrant o |

|

|

|

Check the appropriate box: |

|

o |

Preliminary Proxy Statement |

|

o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

o |

Definitive Proxy Statement |

|

x |

Definitive Additional Materials |

|

o |

Soliciting Material under §240.14a-12 |

|

|

|

RITE AID CORPORATION |

|

(Name of Registrant as Specified In Its Charter) |

|

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

|

|

Payment of Filing Fee (Check the appropriate box): |

|

x |

No fee required. |

|

o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

(1) |

Title of each class of securities to which transaction applies: |

|

|

|

|

|

|

(2) |

Aggregate number of securities to which transaction applies: |

|

|

|

|

|

|

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

|

|

|

|

(4) |

Proposed maximum aggregate value of transaction: |

|

|

|

|

|

|

(5) |

Total fee paid: |

|

|

|

|

|

o |

Fee paid previously with preliminary materials. |

|

o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

Amount Previously Paid: |

|

|

|

|

|

|

(2) |

Form, Schedule or Registration Statement No.: |

|

|

|

|

|

|

(3) |

Filing Party: |

|

|

|

|

|

|

(4) |

Date Filed: |

|

|

|

|

|

|

|

|

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This report, including the letter to stockholders, as well as our other public filings or public statements, include forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are often identified by terms and phrases such as “anticipate,” “believe,” “intend,” “estimate,” “expect,” “continue,” “should,” “could,” “may,” “plan,” “project,” “predict,” “will” and similar expressions and include references to assumptions and relate to our future prospects, developments and business strategies.

Factors that could cause actual results to differ materially from those expressed or implied in such forward-looking statements include, but are not limited to:

· our high level of indebtedness;

· our ability to make interest and principal payments on our debt and satisfy the other covenants contained in our credit facilities and other debt agreements;

· general economic conditions, inflation and interest rate movements;

· the continued impact of private and public third party payors reduction in prescription drug reimbursement and their efforts to limit access to payor networks, including mail order;

· our ability to achieve the benefits of our efforts to reduce the costs of our generic and other drugs;

· our ability to continue to improve the operating performance of our stores in accordance with our long term strategy;

· our ability to maintain or grow prescription count and realize front-end sales growth;

· our ability to hire and retain qualified personnel;

· competitive pricing pressures, including aggressive promotional activity from our competitors;

· decisions to close additional stores and distribution centers or undertake additional refinancing activities, which could result in further charges to our operating statement;

· our ability to manage expenses and working capital;

· continued consolidation of the drugstore and the pharmacy benefit management industries;

· changes in state or federal legislation or regulations, and the continued impact from the ongoing implementation of the Patient Protection and Affordable Care Act as well as other healthcare reform;

· the outcome of lawsuits and governmental investigations;

· risks related to compromises of our information or payment systems or unauthorized access to confidential or personal information of our associates or customers;

· our ability to complete the pending acquisition of EnvisionRx and realize the benefits of this transaction; and

· other risks and uncertainties described from time to time in our filings with the Securities and Exchange Commission (the “SEC”).

We undertake no obligation to update or revise the forward-looking statements included in this report, including the letter to stockholders, whether as a result of new information, future events or otherwise, after the date of this report. Our actual results, performance or achievements could differ materially from the results expressed in, or implied by, these forward-looking statements. Factors that could cause or contribute to such differences are discussed in the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Overview and Factors Affecting Our Future Prospects” included in our Annual Report on Form 10-K for the fiscal year ended February 28, 2015, which we filed with the SEC on April 23, 2015.

May 2015

Dear Fellow Investors,

Despite a challenging start, Fiscal 2015 was a year of growth and transformation in which we continued to generate strong financial results while making important strategic investments to further position Rite Aid for long-term success. In a year with many highlights, we delivered growth in same-store sales and prescription count, strategically increased capital expenditures and effectively managed our expenses to record our third consecutive year of increased profitability.

It was also a year in which we executed many key initiatives that we believe will position Rite Aid to better compete in the evolving retail healthcare marketplace, including our Wellness store remodel program, the grand openings of our first RediClinics at Rite Aid stores, the conversion of all stores to our new drug purchasing and distribution arrangement with McKesson and the announcement of our pending acquisition of EnvisionRx, a leading, national pharmacy benefit management (PBM) company.

In Fiscal 2015, these and other initiatives helped us take significant steps in transforming Rite Aid into a retail healthcare company that can better meet the growing demand for affordable, high-quality health services. We are excited about the opportunity we have to build upon our success in Fiscal 2016 and deliver a higher level of care, value and convenience to the communities we serve.

Our Unique Brand of Health and Wellness is Stronger than Ever

Since its launch in 2010, our award-winning wellness+ loyalty program has become the cornerstone of our unique brand of health and wellness. In Fiscal 2016, we will focus on taking this highly successful program to the next level through wellness+ with Plenti, which is part of the first national coalition loyalty program in the United States.

Through wellness+ with Plenti, our members will continue to receive the same great wellness+ benefits they know and love. By joining forces with some of the largest brands in the country, members can also earn Plenti points at Rite Aid and other Plenti partners like AT&T, Exxon, Macy’s, Mobil and Nationwide and redeem them at certain Plenti partners, including Rite Aid.

This program represents a great opportunity to introduce new customers to our brand of wellness and drive incremental sales. As a team, we are focused on making the most of this historic opportunity to provide a robust and innovative loyalty offering that consumers won’t find anywhere else.

We are Delivering a Higher Level of Care

Over the past several years, we have worked aggressively to leverage our resources — including the skills and expertise of our 11,000 Rite Aid pharmacists — to provide care beyond prescriptions and meet the growing demand for convenient, high-quality health services. In addition to being a key catalyst for growth, our expanded health and wellness offering gives us additional tools for driving positive health outcomes and aligning our business with the future of health care.

In Fiscal 2015, we continued to strengthen our pharmacy services by administering a company record 3.7 million immunizations, facilitating additional pharmacist-patient consultations through our new “Quit for You” smoking cessation program, and launching Vaccine Central, a comprehensive set of online and in-store tools that promote the availability and importance of all vaccinations.

And as they perform an increasing number of Medication Therapy Management (MTM) consultations, which help patients take their medications as prescribed and avoid costly health complications, our pharmacists are also playing a key role in our innovative Rite Aid Health Alliance program, which includes partnerships with seven medical practices. This unique pilot program facilitates the collaboration of Rite Aid pharmacists, local physicians and in-store care coaches from Health Dialog in delivering comprehensive care to patients with chronic conditions.

We also made a key acquisition in Fiscal 2015 that is already helping us deliver yet another convenient layer of care in strategic markets. We announced our acquisition of RediClinic in April 2014 and unveiled our first 24 RediClinics in Rite Aid stores this past February in the Philadelphia and Baltimore/Washington D.C. markets. We expect to add 50 clinics in Fiscal 2016, including additional locations in Texas, where RediClinic is already a leading provider of convenient care clinic services.

We are Positioning Rite Aid to Better Compete

Our recent success gave us the opportunity to make another bold strategic move: our agreement to acquire EnvisionRx, a PBM company that also offers a broad range of pharmacy services. This acquisition will significantly expand our health and wellness offering and allow us to create a compelling pharmacy offering across retail, specialty and mail order channels. In addition, EnvisionRx offers prescription drug plans in one of healthcare’s fastest-growing markets — seniors enrolled in Medicare Part D.

We are making considerable progress as we work toward completing the acquisition. We expect the transaction to close by September 2015 — if not sooner — subject to remaining regulatory approvals and customary closing conditions. Simply put, we believe that our pending acquisition of EnvisionRx will position our company to better compete in today’s rapidly evolving healthcare marketplace.

We are Successfully Managing Our Business for Growth

By successfully turning around our company’s performance, we now have new opportunities to invest in our business while more aggressively pursuing opportunities for growth. A great example is our Fiscal 2016 capital expenditure plan to spend approximately $650 million, an increase of $400 million compared to Fiscal 2012. This includes an allocation of $100 million for our highly successful prescription file buy program, which continues to generate a strong return on investment.

We will also continue to invest heavily in our Wellness store remodel program, which has played an important role in our growth strategy. Thanks to their engaging design, innovative merchandising, expanded wellness categories and the outstanding service provided by our nearly 2,000 Wellness Ambassadors, these stores continue to outperform the rest of the chain in terms of same-store front-end sales and prescription count. We now have a grand total of 1,634 Wellness stores, which represents 36 percent of our entire chain.

As we continue to perform Wellness store remodels — with 400 planned for Fiscal 2016 — we are also building up our real estate pipeline to include additional store relocations and new stores. One of the highlights of Fiscal 2015 came when we completed the construction of our first net new Rite Aid store in nearly five years. And we are very excited to accelerate these efforts in the coming years, including our plans for 33 relocations and 11 new stores in Fiscal 2016.

We are Committed to Delivering Long-term Shareholder Value

Our strategy to become a growing retail healthcare company is specifically designed to deliver a truly differentiated experience to our customers and long-term value for our shareholders. We believe that Rite Aid is well positioned to capitalize on the tremendous opportunities that exist in the healthcare marketplace and we are committed to executing our comprehensive strategy and ensuring that it meets the unique needs of our Rite Aid customers.

As Rite Aid begins a new fiscal year, we thank our nearly 90,000 associates for their dedication to serving our valued customers each and every day. We thank our supplier partners for collaborating with

us to deliver innovation and value. We are grateful to our Board of Directors for their guidance as we execute our strategy for growth. And we thank you, our investors, for your continued support as we position Rite Aid to be the customer’s number one choice for health and wellness.

|

Sincerely, |

|

|

|

|

|

|

|

|

|

|

|

John Standley |

|

|

Rite Aid Chairman and CEO |

|

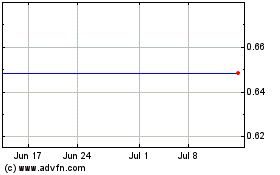

Rite Aid (NYSE:RAD)

Historical Stock Chart

From Mar 2024 to Apr 2024

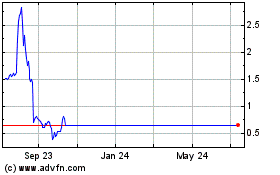

Rite Aid (NYSE:RAD)

Historical Stock Chart

From Apr 2023 to Apr 2024