Pearson Shares Dive on Profit Warning -- 2nd Update

January 18 2017 - 6:01AM

Dow Jones News

By Ian Walker

LONDON--Shares in Pearson PLC plunged more than 26% on Wednesday

after the world's largest education company issued a profit warning

for 2018, warned of lower future dividends and said it plans to

sell its stake in its Penguin Random House publishing joint

venture.

Pearson blamed further declines in the North American

higher-education courseware business for the warning, but said it

still expects its 2016 operating profit to be in line with its

previous guidance.

It plans to sell or recapitalize its 47% stake in Penguin Random

House to bolster its finances and invest in other parts of its

business. Its joint-venture partner, German media company

Bertelsmann SE, said it was open to raising its stake in the

publishing house "provided the financial terms are fair."

The publishing house was formed in 2013 when the two companies

combined their book-publishing businesses.

Pearson's share price has almost halved in the past three years

and the company has laid off thousands of employees amid trading

pressures in key markets. It has sold several assets during the

period, including the Financial Times newspaper and its 50%

noncontrolling stake in the publisher of the Economist magazine, to

fund its growth across global education, raising billions of

dollars.

While higher education in North America remains Pearson's

biggest problem, the company also has faced setbacks in its efforts

to capitalize on the Common Core primary- and secondary-education

standards that have faced a backlash in several U.S. states.

Wednesday's stake sale will form part of broader plan by Pearson

to reshape its portfolio while it accelerates its digital

transition into higher education.

It reported an 8% fall in revenue in 2016 in underlying terms,

which strip out one-off items. It expects to report an adjusted

operating profit of GBP630 million ($777.1 million) for the

year.

The company added that it plans to recommend a final dividend of

34 pence for 2016, making a total payout for the year of 52 pence.

However, it said that from 2017 it intends to rebase its dividend

to reflect portfolio changes, increased investment, and earnings

guidance.

Ulrike Dauer in Frankfurt contributed to this article.

Write to Ian Walker at ian.walker@wsj.com

(END) Dow Jones Newswires

January 18, 2017 05:46 ET (10:46 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

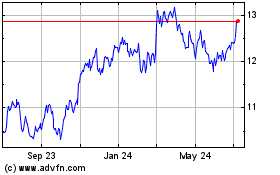

Pearson (NYSE:PSO)

Historical Stock Chart

From Mar 2024 to Apr 2024

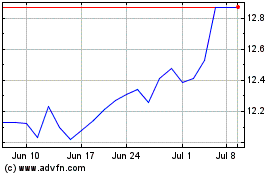

Pearson (NYSE:PSO)

Historical Stock Chart

From Apr 2023 to Apr 2024