Pearson 1Q Sales Fall

April 29 2016 - 2:55AM

Dow Jones News

By Simon Zekaria

LONDON--Pearson PLC (PSON.LN), the U.K.-based education

specialist, Friday posted a fall in first-quarter sales, but said

it is trading in line with its expectations.

The company said sales on an adjusted basis in the first three

months of the year fell 6% year-over-year. On an adjusted basis,

sales fell 4%, hit by weakness in the U.S. and U.K. At constant

exchange rates, sales fell 9%.

It continues to expect to report adjusted operating profit

between GBP580 million ($849 million) and GBP620 million and

adjusted earnings per share between 50 pence and 55 pence for

2016.

"Pearson has had a solid start to the year, in line with our

expectations," said Chief Executive John Fallon.

The company proposed a final dividend of 34 pence a share,

giving a total dividend of 52 pence for 2015, up 2%

year-over-year.

At the start of this year, Pearson launched fresh cost-savings

program worth half a billion dollars and axed 10% of its workforce

world-wide to absorb the impact of trading pressures across its key

markets, including the U.S.

News Corp. (NWS), which owns Dow Jones & Co., publisher of

The Wall Street Journal, competes with Pearson's book publishing

and education divisions.

Shares closed Thursday at 815 pence, valuing the company at

GBP6.69 billion.

Write to Simon Zekaria at simon.zekaria@wsj.com

(END) Dow Jones Newswires

April 29, 2016 02:40 ET (06:40 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

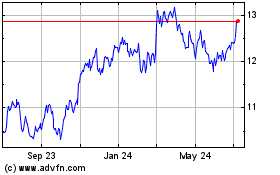

Pearson (NYSE:PSO)

Historical Stock Chart

From Mar 2024 to Apr 2024

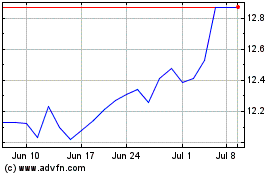

Pearson (NYSE:PSO)

Historical Stock Chart

From Apr 2023 to Apr 2024