Pearson Warns on Profit; Launches Cost-Cutting Plan

January 21 2016 - 3:00AM

Dow Jones News

By Simon Zekaria

LONDON--Pearson PLC (PSON.LN) Thursday again cut its full-year

earnings guidance, citing longer-than-anticipated trading impacts

in key markets, and unveiled a fresh cost-saving plan to drive

profit.

The education specialist expects to report adjusted operating

profit of approximately 720 million pounds ($1.02 billion) and

earnings per share of between 69 pence and 70 pence. It previously

forecast EPS to come in at the lower end of a range of 70 pence to

75 pence. In October, the company also cut its forecasts.

It intends to propose an unchanged final dividend of 34 pence

per share, giving a total dividend for 2015 of 52 pence per share,

up 2% year-over-year on 2014.

The group will take on restructuring costs of approximately

GBP320 million in 2016 and expects to book yearly savings of

approximately GBP350 million, with approximately GBP250 million in

2016 and a further GBP100 million in 2017.

In 2016, it expects to report operating profit and adjusted

earnings per share before restructuring costs of between GBP580

million and GBP620 million and between 50 pence and 55 pence,

respectively.

Pearson said it expects adjusted operating profit to be at or

above GBP800 million in 2018.

Pearson shares closed Tuesday at 658 pence, valuing the company

at GBP5.4 billion. The share price has dropped 45% in the past

three months.

Write to Simon Zekaria at simon.zekaria@wsj.com

(END) Dow Jones Newswires

January 21, 2016 02:45 ET (07:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

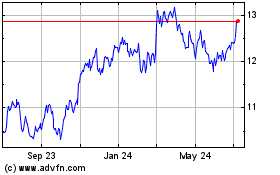

Pearson (NYSE:PSO)

Historical Stock Chart

From Mar 2024 to Apr 2024

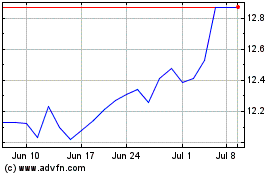

Pearson (NYSE:PSO)

Historical Stock Chart

From Apr 2023 to Apr 2024