Financial Times Faces Possible Strike--Update

November 11 2015 - 1:12PM

Dow Jones News

By Simon Zekaria

LONDON--Journalists at the Financial Times are set to decided

later this month whether to strike over union fears that the

paper's final salary pension scheme is under threat, just months

after Nikkei Inc. struck a multibillion-dollar deal to acquire the

British business-focused newspaper.

The National Union of Journalists, a trade union for journalists

in the U.K. and Ireland, said Wednesday that ballot papers were

sent last week with a decision due on Nov. 19.

In a statement last month, the NUJ said Nikkei and FT management

had failed "to honor promises over maintaining equivalent terms of

employment", citing proposals to take at least GBP4 million ($6.08

million) a year from pension funds to pay for rent and other

costs.

The NUJ says Nikkei wants to use the money to pay for the

running costs of the newspaper's offices at One Southwark Bridge.

The offices weren't included as part of the agreement struck

between Pearson PLC and Nikkei earlier this year. The $1.32 billion

deal will see Nikkei adding the salmon-colored FT to its stable of

assets, which includes Nihon Keizai Shimbun, as well as other

publications and broadcasting operations.

A spokeswoman for the FT said the publication is "hopeful" it

can resolve the row, with ongoing consultation meetings involving

employee representatives and unions. She added that the row

wouldn't threaten the agreement between Pearson and Nikkei, nor

push back completion on the deal. The transaction is expected to

close during the fourth quarter of this year.

Nikkei wasn't immediately available to comment.

"Staff are in open revolt," said Steve Bird, head of the FT's

NUJ chapel, in a statement published by the union. "Hundreds of

senior staff will see their pensions cut by up to a half in order

to pay rent on the FT building."

"Whatever financial constraints Nikkei have placed on the FT are

being passed on to the journalists," said Mr. Bird.

The spokeswoman for the FT said "any savings stay within the FT

and will be reinvested in the business and in people," adding "it

is not and has never been the intention of FT management or Nikkei

to cut costs through pension changes."

"We have made it clear that we are committed to giving the

necessary time, consideration and consultation needed to arrive at

a solution that is as good as it can be for individuals within the

financial constraints of the business."

Mr. Bird said the company was trying to force through serious

changes to the pension scheme by the end of November.

"Discussions are very much ongoing," said the FT spokeswoman.

About a third of the FT Group's approximate 600 journalists are NUJ

members and about 10% of FT Group's employees are in the pension

scheme.

"We continue to work directly with employees. We are listening

to all comments and will consider each of them. We will take the

time needed to achieve the best possible outcome and to make sure

all our staff have the opportunity to raise any questions directly.

We have a common goal of finding the right balance between

individual benefits and the sustainable financial future of the FT

for all."

Pearson shares closed down 0.4%.

News Corp, which owns Dow Jones & Co., publisher of The Wall

Street Journal, competes with Pearson's book publishing,

business-news and education divisions. News Corp also competes with

Nikkei.

Corrections & Amplifications

About a third of the FT Group's approximate 600 journalists are

NUJ members. An earlier version of this article said there was

approximately 500 journalists.

Write to Simon Zekaria at

simon.zekaria@wsj.com<mailto:simon.zekaria@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 11, 2015 12:57 ET (17:57 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

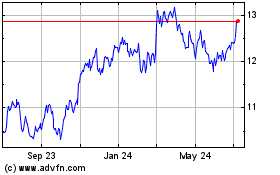

Pearson (NYSE:PSO)

Historical Stock Chart

From Mar 2024 to Apr 2024

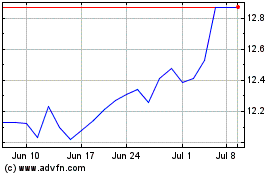

Pearson (NYSE:PSO)

Historical Stock Chart

From Apr 2023 to Apr 2024