Pearson Shares Dive on Profit Warning -- Update

October 21 2015 - 5:18AM

Dow Jones News

By SIMON ZEKARIA

LONDON--Shares in Pearson PLC dropped more than 16% on Wednesday

after the education company warned of tough market conditions and

cut its full-year earnings guidance.

Pearson, which makes most of its revenue from educational

services in the U.S., said it expects adjusted earnings a share for

2015 to come in at the lower end of a range of 70 pence to 75

pence, down from a previous range of between 75 pence and 80

pence.

"The key cyclical and policy-related factors which have been

hurting our markets for some years have yet to improve," said Chief

Executive John Fallon.

Shares in the company, which has recently sold trophy publishing

assets such as the Financial Times newspaper, fell sharply on the

news to 996 pence, down 16%. Bernstein analyst Claudio Aspesi said

the earnings forecast downgrade is "extremely disappointing" and

that "a lack of visibility on the business is becoming painful to

manage."

Pearson said third-quarter sales fell 2% compared with the same

period last year. For the nine months of 2015, sales rose 2%.

The company said its trading performance remained strong in the

first nine months of the year, with share gains across major

markets including the U.S. and U.K. However, it said some of its

operations, including U.S. higher education and emerging markets,

were hit.

"In particular, lower community college enrollments and higher

returns [affected] the U.S. higher education market, and lower

purchasing in certain provinces affecting the school textbook

market in South Africa," Pearson said.

Pearson also said the revised earnings forecast was made

following the disposal of PowerSchool, FT Group and The Economist

Group, as well as movements in foreign-exchange rates.

It added that the guidance was based on current exchange rates

continuing to the end of the year, no further acquisitions or

disposals, a tax rate of approximately 15% and an interest charge

of approximately GBP70 million ($108 million).

In August, Pearson sold its 50% noncontrolling stake in the

publisher of the Economist magazine for GBP469 million. The

disposal swiftly followed Pearson's landmark sale of the FT Group,

which includes the Financial Times newspaper, to Nikkei Inc. of

Japan for GBP844 million.

Pearson is plowing proceeds from the deals into its global

education business, which includes textbooks in Western markets,

digital learning programs and English language schools.

It has restructured its operations and booked hundreds of

millions of dollars in cost savings to counter a slowdown in mature

educational markets and boost its push into emerging economies such

as Brazil and China where there is greater demand for learning

services.

Write to SIMON ZEKARIA at simon.zekaria@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 21, 2015 05:03 ET (09:03 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

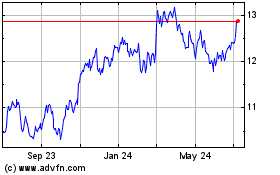

Pearson (NYSE:PSO)

Historical Stock Chart

From Mar 2024 to Apr 2024

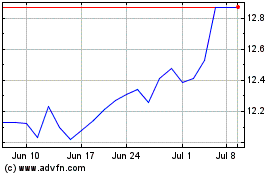

Pearson (NYSE:PSO)

Historical Stock Chart

From Apr 2023 to Apr 2024