Current Report Filing (8-k)

May 17 2016 - 12:00PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date

of earliest event reported): May 12, 2016

|

Commission

File Number

|

Registrant; State of Incorporation;

Address and Telephone Number

|

IRS Employer

Identification No.

|

|

1-11459

|

PPL Corporation

(Exact name of Registrant as specified in its charter)

(Pennsylvania)

Two North Ninth Street

Allentown, PA 18101-1179

(610) 774-5151

|

23-2758192

|

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

[ ]

|

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

[ ]

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

[ ]

|

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

[ ]

|

|

Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c))

|

Section 2 - Financial Information

Item 2.03 Creation of a Direct Financial Obligation

or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

and

Section 8 - Other Events

Item 8.01 Other Events

On May 12, 2016, PPL Capital Funding, Inc. ("PPL Capital

Funding") and PPL Corporation ("PPL") entered into an Underwriting Agreement (the "Underwriting Agreement")

with Barclays Capital Inc., Credit Suisse Securities (USA) LLC, Mitsubishi UFJ Securities (USA), Inc. and Wells Fargo Securities,

LLC as representatives of the several underwriters named therein (the "Underwriters"), relating to the offering and sale

by PPL Capital Funding of $650,000,000 of its 3.100% Senior Notes due 2026 (the "Notes"). The Notes are fully and unconditionally

guaranteed as to payment of principal, premium, if any, and interest under guarantees (the "Guarantees") of PPL. A copy

of the Underwriting Agreement is attached as Exhibit 1(a) to this Current Report on Form 8-K.

The Notes were issued on May 17, 2016, under an indenture

(the "Indenture"), dated as of November 1, 1997, among PPL Capital Funding, PPL and The Bank of New York Mellon (as successor

to JPMorgan Chase Bank, N. A. (formerly known as The Chase Manhattan Bank)), as trustee, as supplemented by Supplemental Indenture

No. 15 thereto (the "Supplemental Indenture"), dated as of May 17, 2016, and an Officers' Certificate of PPL Capital

Funding and PPL (the "Officers' Certificate"), dated May 17, 2016, establishing the terms of the Notes. Copies of the

Indenture, Supplemental Indenture and Officers' Certificate are attached or incorporated by reference as Exhibits 4(a), 4(b) and

4(c), respectively, to this Current Report. The maturity date of the Notes is May 15, 2026, subject to early redemption at PPL

Capital Funding's option. PPL Capital Funding and PPL expect the net proceeds from the sale of the Notes to be invested in or loaned

to subsidiaries of PPL, which will use the funds to repay short-term debt obligations, including commercial paper borrowings, and

for general corporate purposes.

The Notes and the Guarantees were offered and sold under

PPL's and PPL Capital Funding's joint Registration Statement on Form S-3 on file with the Securities and Exchange Commission (Registration

Nos. 333-202290 and 333-202290-05).

Section 9 - Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

|

|

1(a)

|

Underwriting Agreement, dated May 12, 2016, among PPL Capital Funding, Inc., PPL Corporation and Barclays Capital Inc., Credit

Suisse Securities (USA) LLC, Mitsubishi UFJ Securities (USA), Inc. and Wells Fargo Securities, LLC as representatives of the several

underwriters named therein.

|

|

|

4(a)

|

Indenture, dated as of November 1, 1997, among PPL Capital Funding, Inc., PPL Corporation and The Bank of New York Mellon (as

successor to JPMorgan Chase Bank, N. A. (formerly known as The Chase Manhattan Bank)), as Trustee (incorporated by reference to

Exhibit 4.1 to PPL Corporation's Current Report on Form 8-K (File No. 1-11459) dated November 12, 1997).

|

|

|

4(b)

|

Supplemental Indenture No. 15, dated as of May 17, 2016, among PPL Capital Funding, Inc., PPL Corporation and The Bank of New

York Mellon (as successor to JPMorgan Chase Bank, N. A. (formerly known as The Chase Manhattan Bank)), as Trustee.

|

|

|

4(c)

|

Officers' Certificate, dated May 17, 2016, pursuant to Section 301 of the Indenture.

|

|

|

5(a)

|

Opinion of Frederick C. Paine, Senior Counsel of PPL Services Corporation.

|

|

|

5(b)

|

Opinion of Davis Polk & Wardwell LLP.

|

|

|

23(a)

|

Consent of Frederick C. Paine, Senior Counsel of PPL Services Corporation (included as part of Exhibit 5 (a)).

|

|

|

23(b)

|

Consent of Davis Polk & Wardwell LLP (included as part of Exhibit 5(b)).

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act

of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

PPL CORPORATION

|

|

|

|

|

|

|

|

By:

|

/s/ Stephen K. Breininger

|

|

|

|

|

Stephen K. Breininger

Vice President and Controller

|

|

Dated: May 17, 2016

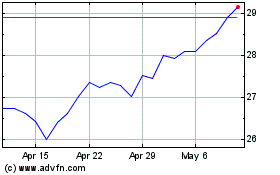

PPL (NYSE:PPL)

Historical Stock Chart

From Mar 2024 to Apr 2024

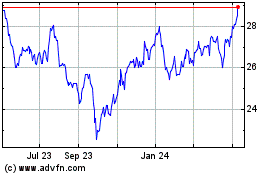

PPL (NYSE:PPL)

Historical Stock Chart

From Apr 2023 to Apr 2024