UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported): June

30, 2015

Commission File

Number |

Registrant; State of Incorporation;

Address and Telephone Number |

IRS Employer

Identification No. |

| |

|

|

| 1-11459 |

PPL Corporation

(Exact name of Registrant as specified in its charter)

(Pennsylvania)

Two North Ninth Street

Allentown, PA 18101-1179

(610) 774-5151 |

23-2758192 |

| |

|

|

|

333-173665

|

LG&E and KU Energy LLC

(Exact name of Registrant as specified in its charter)

(Kentucky)

220 West Main Street

Louisville, KY 40202-1377

(502) 627-2000 |

20-0523163 |

| |

|

|

|

1-2893

|

Louisville Gas and Electric Company

(Exact name of Registrant as specified in its charter)

(Kentucky)

220 West Main Street

Louisville, KY 40202-1377

(502) 627-2000 |

61-0264150 |

| |

|

|

|

1-3464

|

Kentucky Utilities Company

(Exact name of Registrant as specified in its charter)

(Kentucky and Virginia)

One Quality Street

Lexington, KY 40507-1462

(502) 627-2000 |

61-0247570

|

| |

|

|

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| [ ] |

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| [ ] |

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| [ ] |

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| [ ] |

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Section 7 - Regulation FD

Item 7.01 Regulation FD Disclosure

A copy of the Companies' (as defined below) below-described press

release is furnished as Exhibit 99.1 to this report.

Section 8 - Other Events

Item 8.01 Other Events

On June 30, 2015, Louisville Gas and Electric

Company ("LG&E") and Kentucky Utilities Company ("KU" and, together with LG&E, the

"Companies") issued a press release announcing that the Kentucky Public Service Commission ("KPSC") has

approved the unanimous settlement agreement in the Companies' rate increase proceedings. The settlement agreement was previously

announced on April 21, 2015. The rate changes become effective on July 1, 2015.

The order provides for increases of $125 million in the annual

revenue requirement associated with KU base electric rates and $7 million in the annual revenue requirement associated with

LG&E base gas rates. The annual revenue requirement associated with base electric rates at LG&E will not increase. No

return on equity was established for base rates. The order, however, authorizes a 10% return on equity with respect to the

Companies' environmental cost recovery and gas line tracker rate mechanisms. The order also provides for deferred recovery of

portions of certain pension-related and certain plant-related costs.

Section 9 - Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits

| |

(d) |

|

Exhibits |

|

| |

|

|

|

|

| |

|

|

99.1 - |

Press Release dated June 30, 2015 of Louisville Gas and Electric Company and Kentucky Utilities Company. |

| |

|

|

|

|

|

Statements in this report and the accompanying press release,

including statements with respect to future events and their timing, including the Companies' future rates, rate mechanisms or

returns on equity ultimately authorized or achieved, as well as statements as to future costs or expenses, regulation, corporate

strategy and performance, are "forward-looking statements" within the meaning of the federal securities laws. Although

the Companies believe that the expectations and assumptions reflected in these forward-looking statements are reasonable, these

expectations, assumptions and statements are subject to a number of risks and uncertainties, and actual results may differ materially

from the results discussed in the statements. The following are among the important factors that could cause actual

results to differ materially from the forward-looking statements: subsequent phases of rate relief and regulatory cost recovery;

market demand and prices for electricity; political, regulatory or economic conditions in states and regions where the Companies

conduct business; and the progress of actual construction, purchase or repair of assets or operations subject to tracker mechanisms. Any

such forward-looking statements should be considered in light of such important factors and in conjunction with PPL Corporation's,

LG&E and KU Energy LLC's and the Companies' Form 10-K and other reports on file with the Securities and Exchange Commission.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrants have duly caused this report to be signed on their behalf by the undersigned hereunto duly

authorized.

| |

PPL CORPORATION |

| |

|

|

|

| |

By: |

/s/ Stephen K. Breininger |

|

| |

|

Stephen K. Breininger

Vice President and Controller |

|

| |

LG&E AND KU ENERGY LLC |

| |

|

|

|

| |

By: |

/s/ Kent W. Blake |

|

| |

|

Kent W. Blake

Chief Financial Officer |

|

| |

LOUISVILLE GAS AND ELECTRIC COMPANY |

| |

|

|

|

| |

By: |

/s/ Kent W. Blake |

|

| |

|

Kent W. Blake

Chief Financial Officer |

|

| |

KENTUCKY UTILITIES COMPANY |

| |

|

|

|

| |

By: |

/s/ Kent W. Blake |

|

| |

|

Kent W. Blake

Chief Financial Officer |

|

Dated: July 1, 2015

Exhibit 99.1

|

|

Media Contact: Chris Whelan

24-hour media hotline:

1-888-627-4999 |

June 30, 2015

KPSC approves settlement reached in LG&E and KU rate cases

New rates for KU electric and LG&E natural gas customers to

take effect July 1

(LOUISVILLE, Ky.) — Stating that the unanimous settlement

agreement reached by the parties to the LG&E and KU rates cases was “fair, just and reasonable,” the Kentucky Public

Service Commission today announced its approval to increase base rates for KU electric and LG&E natural gas customers.

While the monthly basic service charge

will remain unchanged, the per-kilowatt charge will be modified to provide additional annual cost-recovery revenues of $125 million

for KU, incorporating costs associated with the new 640-megawatt natural gas combined-cycle generating plant at the companies’

Cane Run site, among other investments. KU owns 78 percent of that facility, with LG&E owning the remaining 22 percent.

“We are pleased to receive the commission’s

approval of this case,” said Ed Staton, vice president of State Regulation and Rates. “Each of the parties was willing

to compromise to develop a unanimous settlement that was fair, just and reasonable and the commission acknowledged the importance

of that agreement.”

The settlement agreement provides no increase in revenues for LG&E’s

electric operations and a $7 million increase in LG&E’s gas operations.

A residential LG&E electric customer, using an average of 984

kWh per month, will see a 10 cent decrease in their overall monthly bill. A residential LG&E natural gas customer, using an

average of 57 Ccf per month, will see an increase of $1.23 per month. A KU residential customer, using an average of 1,200 kWh

per month, will see an increase of $8.98 per month.

The settlement does not attach specific

dollars or concessions to any particular issue in the case, but provides an overall settlement that, on balance, is a fair, just

and reasonable result. No return on equity was established with respect to base rates; however,

the average customer’s monthly bill will reflect an authorized 10 percent return on equity investment related to the environmental

cost recovery mechanism and the gas line tracker mechanism. The settlement agreement also provides for deferred cost recovery of

a portion of the costs associated with pensions and KU’s Green River plant which is currently scheduled to be retired in

April 2016.

In addition to LG&E and KU, parties to the unanimous settlement

agreement included: the Attorney General of the Commonwealth of Kentucky; the Kentucky Industrial Utilities Customers; the Lexington-Fayette

Urban County Government; the Kroger Company; the Community Action Council of Lexington-Fayette, Bourbon, Harrison, and Nicholas

Counties; Kentucky Cable Telecommunications Association; Kentucky School Boards Association; Sierra Club; Wal-Mart Stores East,

LP and Sam’s East; Association of Community Ministries; and Metropolitan Housing Coalition.

LG&E and KU also agreed to a minimum annual contribution of

shareholder funds of $1.15 million to low-income programs. The current Home Energy Assistance program also will become a permanent

program under the companies’ tariffs and maintain its current rate of 25 cents per meter.

The agreement also provides for an extension of the collection period

for residential customer deposits from four to six months. Additionally, LG&E and KU have agreed to develop an energy efficiency

filing for Kentucky’s school districts and reaffirmed their commitment to study the feasibility of energy efficiency programs

for industrial customers.

Customers will notice the adjustments on their bills beginning July

1.

###

Louisville

Gas and Electric Company and Kentucky Utilities Company, part of the PPL Corporation (NYSE: PPL) family of companies, are

regulated utilities that serve a total of 1.2 million customers and have consistently ranked among the best companies for customer

service in the United States. LG&E serves 321,000 natural gas and 400,000 electric customers in Louisville and 16 surrounding

counties. Kentucky Utilities serves 543,000 customers in 77 Kentucky counties and five counties in Virginia. More information is

available at www.lge-ku.com

and www.pplweb.com.

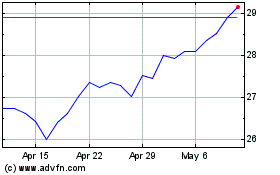

PPL (NYSE:PPL)

Historical Stock Chart

From Mar 2024 to Apr 2024

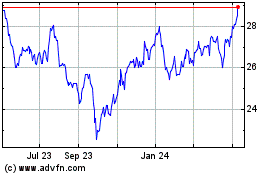

PPL (NYSE:PPL)

Historical Stock Chart

From Apr 2023 to Apr 2024