Additional Proxy Soliciting Materials (definitive) (defa14a)

May 14 2015 - 12:08PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of

1934 (Amendment No. )

Filed by the

Registrant þ

Filed by a Party other than the

Registrant ¨

Check the appropriate box:

|

|

|

|

|

| ¨ |

|

Preliminary Proxy Statement |

| ¨ |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ |

|

Definitive Proxy Statement |

| þ |

|

Definitive Additional Materials |

| ¨ |

|

Soliciting Material Pursuant to §240.14a-12 |

PPL CORPORATION |

| (Name of Registrant as Specified In Its Charter) |

|

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

| Payment of Filing Fee (Check the appropriate box): |

|

|

| þ |

|

No fee required. |

| ¨ |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

|

|

|

(1) |

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

|

(2) |

|

Aggregate number of securities to which transaction

applies: |

|

|

|

|

|

|

|

(3) |

|

Per unit or other underlying value of transaction computed

pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

|

|

|

|

|

(4) |

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

|

(5) |

|

Total fee paid:

|

|

|

|

|

|

|

|

|

|

|

|

|

| ¨ |

|

Fee paid previously with preliminary materials. |

|

|

| ¨ |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously.

Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

|

|

|

(1) |

|

Amount Previously Paid: |

|

|

|

|

|

|

|

(2) |

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

|

(3) |

|

Filing Party:

|

|

|

|

|

|

|

|

(4) |

|

Date Filed:

|

|

|

|

|

|

|

|

|

|

|

| William H. Spence

Chairman, President and Chief Executive Officer |

|

PPL Corporation

Two North Ninth Street Allentown, PA 18101-1179

Tel. 610.774.5151 www.pplweb.com |

|

|

May 14, 2015

Dear Shareowner:

As PPL Corporation prepares to host its annual meeting of

shareowners May 20, 2015, I’d like to thank you for your continued investment in PPL and ask for your continued support of the 13 individuals nominated for election to our Board of Directors.

In recent years, PPL’s Board has led the company through an exceptional transformation into one of the Top 10 largest investor-owned utility companies in the

United States.

During that period – a time of tumultuous change and challenge within the power and utility sector – PPL not only weathered the

challenges, but grew, boldly seizing opportunities to both preserve and create value for its shareowners. A strong Board with insightful leaders was essential to the successful transformation of your company.

Under the Board’s guidance, PPL expanded its regulated businesses with major acquisitions in 2010 and 2011 in both Kentucky and the United Kingdom, nearly doubling

the corporation’s regulated asset base, increasing annual revenues by about 70 percent, and significantly improving the company’s risk profile and enabling PPL to continue to grow its dividend.

As a result of those changes in PPL’s business mix, the company’s regulated businesses accounted for more than 85 percent of PPL’s earnings in 2014.

That’s in sharp contrast to just four years ago, when our competitive power generation business earnings accounted for more than 70 percent of PPL earnings.

As a result of the Board’s sharp focus on optimizing shareowner value, PPL expects on June 1 to complete the spinoff and combination of its supply business with

the competitive power business owned by Riverstone Holdings. The unique transaction will create Talen Energy Corporation, a stand-alone, publicly traded independent power producer.

The spinoff will give investors clear choices and, we believe, unlock the full value of both businesses for shareowners. PPL shareowners will own 65 percent of Talen

Energy upon closing. Both PPL and Talen Energy will emerge as stronger companies.

Looking forward, PPL is poised for continued growth as a pure-play utility

company made up of 7 high performing, award-winning regulated companies in three constructive jurisdictions in the U.S. and U.K. We have solid business plans in place to achieve compound annual earnings growth of 4 to 6 percent through at least

2017. And infrastructure investment in these utilities is expected to grow the combined rate base by 30 percent over the next five years.

PPL will maintain a strong balance sheet, investment-grade credit ratings and strong cash flow. Moreover, PPL’s stable

stream of utility earnings will allow it to continue to grow its dividend even as it spins off the Supply business.

The Board maintains strong and effective

corporate governance practices, including the following.

| |

• |

|

12 out of the 13 nominees for election to the PPL Board are fully independent; |

| |

• |

|

PPL has an independent Lead Director; |

| |

• |

|

The full Board is elected annually; |

| |

• |

|

We have a majority vote standard for election of directors (carve-out for contests) with a director resignation policy; |

| |

• |

|

All our directors hold shares or rights to shares that are deferred; |

| |

• |

|

Understanding how important it is to enhance the Board with members who have a variety of skills, expertise and diversity of thought and backgrounds, we added two new directors in 2014: Rod Adkins and Armando Zagalo de

Lima. Each director brings experience from global business operations and services, as well as emerging technologies, and Mr. Adkins also provides critical insight to supply chain management. |

| |

• |

|

We have clearly delineated an effective process for shareowners to raise concerns to the Board; and |

| |

• |

|

We previously eliminated any supermajority voting provisions in our articles and bylaws. |

Guided by the Board’s

vision and the bold leadership of PPL’s executives, PPL is well positioned to continue to deliver strong returns for you, our shareowners. Your support of PPL’s 13 nominees for the Board better enables us to fulfill our mission to both

shareowners and customers. I appreciate your consideration and thank you for the trust you’ve placed in PPL.

Sincerely

yours,

William H. Spence

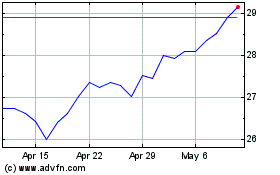

PPL (NYSE:PPL)

Historical Stock Chart

From Mar 2024 to Apr 2024

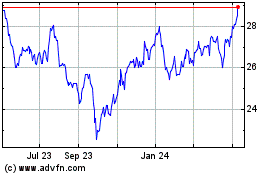

PPL (NYSE:PPL)

Historical Stock Chart

From Apr 2023 to Apr 2024