UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report

(Date of earliest event reported): April 21, 2015

Commission File

Number |

Registrant; State of Incorporation;

Address and Telephone Number |

IRS Employer

Identification No. |

| |

|

|

| 1-11459 |

PPL Corporation

(Exact name of Registrant as specified in its charter)

(Pennsylvania)

Two North Ninth Street

Allentown, PA 18101-1179

(610) 774-5151 |

23-2758192 |

| |

|

|

333-173665

|

LG&E and KU Energy

LLC

(Exact name of Registrant

as specified in its charter)

(Kentucky)

220 West Main Street

Louisville, KY 40202-1377

(502) 627-2000 |

20-0523163 |

| |

|

|

1-2893

|

Louisville Gas and

Electric Company

(Exact name of Registrant

as specified in its charter)

(Kentucky)

220 West Main Street

Louisville, KY 40202-1377

(502) 627-2000 |

61-0264150 |

| |

|

|

1-3464

|

Kentucky Utilities

Company

(Exact name of Registrant

as specified in its charter)

(Kentucky and Virginia)

One Quality Street

Lexington, KY 40507-1462

(502) 627-2000 |

61-0247570

|

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

| [ ] |

|

Written communications pursuant to Rule 425

under the Securities Act (17 CFR 230.425) |

| [ ] |

|

Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| [ ] |

|

Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| [ ] |

|

Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Section 7 – Regulation

FD

Item 7.01 Regulation FD Disclosure

A copy of the Companies' below-described

press release is furnished as Exhibit 99.1 to this report.

Section 8 - Other Events

Item 8.01 Other Events

On April 21, 2015, Louisville

Gas and Electric Company ("LG&E") and Kentucky Utilities Company ("KU" and, together with LG&E, the

"Companies") issued a press release announcing that they have entered into a unanimous settlement agreement with the

intervenors in their proceedings commenced in November 2014 before the Kentucky Public Service Commission ("KPSC") regarding

increases in base electric rates at LG&E and KU and base gas rates at LG&E. Subject to KPSC review and approval, the rate

changes could become effective on or after July 1, 2015.

The proposed settlement provides

for increases in the annual revenue requirements associated with KU base electric rates of $125 million and LG&E base gas

rates of $7 million. The annual revenue requirement associated with base electric rates at LG&E will not increase. No return

on equity was established for base rates, however the settlement authorizes a 10% return on equity with respect to the Companies'

environmental cost recovery and gas line tracker rate mechanisms. The settlement agreement also provides for deferred recovery

of portions of certain pension-related and plant-related costs.

A hearing on the settlement

took place on April 21, 2015. An order with respect to the rate proceedings is anticipated from the KPSC on or before June

30, 2015.

Section 9 - Financial Statements

and Exhibits

Item 9.01 Financial Statements

and Exhibits

| |

(a) |

|

Exhibits |

|

| |

|

|

|

|

| |

|

|

99.1 - |

Press Release dated April 21, 2015 announcing the unanimous

rate proceeding settlement of Louisville Gas and Electric Company and Kentucky Utilities Company. |

Statements in this report

and the accompanying press release, including statements with respect to future events and their timing, including the Companies’

potential regulatory outcomes regarding the requested rate increases, rate mechanisms and future rates or returns on equity ultimately

authorized or achieved, as well as statements as to future costs or expenses, regulation, corporate strategy and performance,

are “forward-looking statements” within the meaning of the federal securities laws. Although the Companies

believe that the expectations and assumptions reflected in these forward-looking statements are reasonable, these expectations,

assumptions and statements are subject to a number of risks and uncertainties, and actual results may differ materially from the

results discussed in the statements. The following are among the important factors that could cause actual results

to differ materially from the forward-looking statements: subsequent phases or rate relief and regulatory cost recovers; market

demand and prices for electricity; political, regulatory or economic conditions in states and regions where the Companies conduct

business; and the progress of actual construction, purchase or repair of assets or operations subject to tracker mechanisms. Any

such forward-looking statements should be considered in light of such important factors and in conjunction with PPL Corporation’s,

LG&E and KU Energy LLC’s and the Companies’ Form 10-K and other reports on file with the Securities and Exchange

Commission.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrants have duly caused this report to be signed on their behalf by the undersigned

hereunto duly authorized.

| |

PPL CORPORATION |

| |

|

|

|

| |

By: |

/s/ Stephen K. Breininger |

|

| |

|

Stephen K. Breininger

Vice President and Controller |

|

| |

LG&E AND KU ENERGY LLC |

| |

|

|

|

| |

By: |

/s/ Kent W. Blake |

|

| |

|

Kent W. Blake

Chief Financial Officer

|

|

| |

LOUISVILLE GAS AND ELECTRIC COMPANY |

| |

|

|

|

| |

By: |

/s/ Kent W. Blake |

|

| |

|

Kent W. Blake

Chief Financial Officer |

|

| |

KENTUCKY UTILITIES COMPANY |

| |

|

|

|

| |

By: |

/s/ Kent W. Blake |

|

| |

|

Kent W. Blake

Chief Financial Officer |

|

Dated: April 22, 2015

Exhibit 99.1

Media Contact: Chris Whelan

24-hour media hotline:

1-888-627-4999

April 21, 2015

LG&E, KU and interested parties reach unanimous settlement

in rate proceedings

No increase to the monthly basic service charge

(LOUISVILLE, Ky.) — Louisville Gas and Electric Company

and Kentucky Utilities Company have reached a unanimous settlement agreement with all of the parties in the base rate cases before

the Kentucky Public Service Commission. The settlement agreement was filed with the KPSC today and remains subject to KPSC approval.

Under the settlement agreement, the monthly basic service charge

for LG&E and KU residential customers will not change. Instead, the per-kilowatt charge will be modified to provide additional

annual cost-recovery revenues of $125 million for KU, incorporating costs associated with the new 640-megawatt natural gas combined-cycle

generating plant at the company’s Cane Run site among other investments. KU owns 78 percent of that facility, with LG&E

owning the remaining 22 percent.

The settlement agreement provides no increase in revenues for

LG&E’s electric operations and a $7 million increase in LG&E’s gas operations. The average KU residential customer

bill will increase by approximately $9 per month. The average LG&E electric customer will see a slight reduction of 10 cents

per month, while the average LG&E gas customer will see a monthly increase of approximately $1.25 per month.

A settlement does not attach specific dollars or concessions

to any particular issue in the case, but provides an overall settlement that on balance is a fair, just and reasonable result.

This means that no return on equity was established with respect to base rates; however, the average customer’s monthly bill

will reflect a 10 percent return on equity investment related to the environmental cost recovery mechanism and the gas line tracker

mechanism. The settlement agreement also provides for deferred cost recovery of a portion of the costs associated with pensions

and KU’s Green River plant which is currently scheduled to be retired in April 2016.

In addition to LG&E and KU, parties to the unanimous settlement

agreement included: the Attorney General of the Commonwealth of Kentucky; the Kentucky Industrial Utilities Customers; the Lexington-Fayette

Urban County Government; the Kroger Company; the Community Action Council of Lexington-Fayette, Bourbon, Harrison, and Nicholas

Counties; Kentucky Cable Telecommunications Association; Kentucky School Boards Association; Sierra Club; Wal-Mart Stores East,

LP and Sam’s East; Association of Community Ministries; and Metropolitan Housing Coalition.

“The open and direct dialogue between all parties enabled

this settlement agreement,” said Kent Blake, chief financial officer. “While it is likely no single party got everything

they wanted, this settlement agreement provided all parties with an agreement they could support in the best interests of our customers.”

LG&E and KU also agreed to a minimum annual contribution

of shareholder funds of $1.15 million to low-income programs. The current Home Energy Assistance program also will become a permanent

program under the companies’ tariffs and maintain its current rate of 25 cents per meter.

The agreement also provides for an extension of the collection

period for residential customer deposits from four to six months. Additionally, LG&E and KU have agreed to develop an energy

efficiency filing for Kentucky’s school districts and reaffirmed their commitment to study the feasibility of energy efficiency

programs for industrial customers.

If approved, the new rates and all elements of the settlement

agreement with the utilities and interested parties would take effect July 1.

###

Louisville Gas and Electric Company and Kentucky Utilities

Company, part of the PPL Corporation (NYSE: PPL) family of companies, are regulated utilities that serve a total of 1.2 million

customers and have consistently ranked among the best companies for customer service in the United States. LG&E serves 321,000

natural gas and 400,000 electric customers in Louisville and 16 surrounding counties. Kentucky Utilities serves 543,000 customers

in 77 Kentucky counties and five counties in Virginia. More information is available at www.lge-ku.com

and www.pplweb.com.

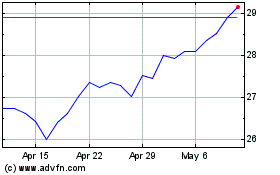

PPL (NYSE:PPL)

Historical Stock Chart

From Mar 2024 to Apr 2024

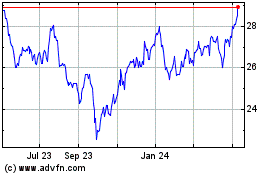

PPL (NYSE:PPL)

Historical Stock Chart

From Apr 2023 to Apr 2024