UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

|

|

|

|

|

|

|

| þ |

|

Filed by the Registrant |

|

¨ |

|

Filed by a Party other than the Registrant |

|

|

|

| Check the appropriate box: |

| |

|

| ¨ |

|

Preliminary Proxy Statement |

| |

|

| ¨ |

|

Confidential, for use of the Commission only (as permitted by Rule

14a-6(e)(2)) |

| |

|

| þ |

|

Definitive Proxy Statement |

| |

|

| ¨ |

|

Definitive Additional Materials |

| |

|

| ¨ |

|

Soliciting Material Pursuant to §240.14a-12 |

PIEDMONT NATURAL GAS COMPANY, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

|

|

|

|

|

| Payment of Filing Fee (Check the appropriate box): |

|

þ |

|

|

No fee required. |

|

¨ |

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

|

|

(1 |

) |

|

Title of each class of securities to which transaction applies: |

| |

|

|

(2 |

) |

|

Aggregate number of securities to which transaction applies: |

| |

|

|

(3 |

) |

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth

the amount on which the filing fee is calculated and state how it was determined): |

| |

|

|

(4 |

) |

|

Proposed maximum aggregate value of transaction: |

| |

|

|

(5 |

) |

|

Total fee paid: |

|

¨ |

|

|

Fee paid previously with preliminary materials. |

|

¨ |

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and

identify the filing for which the

offsetting fee was paid previously. Identify the previous filing

by registration statement number, or the Form or Schedule and the date of its filing. |

| |

|

|

(1 |

) |

|

Amount Previously Paid: |

| |

|

|

(2 |

) |

|

Form, Schedule or Registration Statement No.: |

| |

|

|

(3 |

) |

|

Filing Party: |

| |

|

|

(4 |

) |

|

Date Filed: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

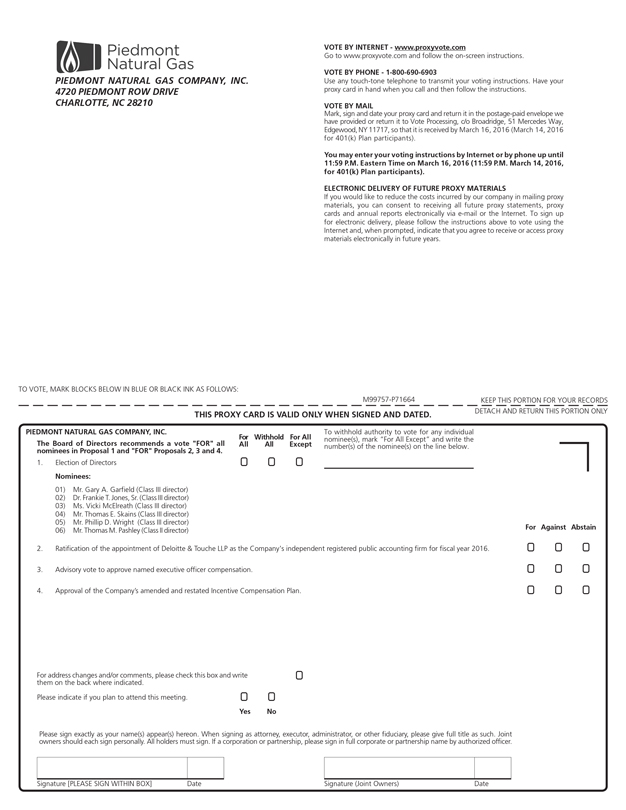

Notice of 2016 Annual Meeting of

Shareholders |

|

|

|

|

|

|

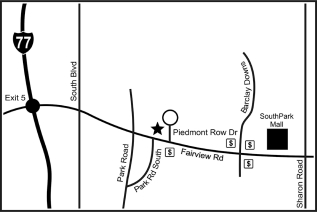

March 17, 2016

8:30 a.m. Eastern Time Piedmont Natural Gas

Company, Inc. Corporate Headquarters, 4720 Piedmont Row Drive, Charlotte, North Carolina 28210

Items of Business

1) Election of Mr. Gary A. Garfield, Dr. Frankie T.

Jones, Sr., Ms. Vicki McElreath, Mr. Thomas E. Skains and Mr. Phillip D. Wright to Class III of the Board of Directors, each for a term of three years, and Mr. Thomas M. Pashley to Class II of the Board of Directors for a term of two

years. 2) Ratification of the appointment of

Deloitte & Touche LLP as the Company’s independent registered public accounting firm for fiscal year 2016.

3) Advisory vote to approve named executive officer

compensation. 4) Approval of the Company’s

amended and restated Incentive Compensation Plan. Who Can Vote

You may vote if you owned shares of the Company’s common stock at the close of business on January 22, 2016.

How to Vote

Your vote is important. If you own your shares

directly as a registered shareholder or through the Company’s 401(k) Plan, please vote in one of these ways: |

|

|

|

|

|

|

|

|

Online at www.proxyvote.com. |

|

|

|

|

|

|

|

|

By mail, if you received or request a paper proxy card, by marking, signing, dating and promptly returning the proxy card in the postage-paid envelope. |

|

|

|

|

|

|

|

|

By telephone, if you received or request a paper proxy card, by

calling the telephone number on the proxy card. |

|

|

|

|

|

|

|

|

In person, by submitting a ballot at the Annual Meeting of Shareholders. |

|

|

|

|

|

|

If you own your shares indirectly through a bank, broker or other nominee, you may vote in accordance with the

instructions provided by your bank or broker. You may also obtain a legal proxy from your bank or broker and submit a ballot in person at the Annual Meeting of Shareholders.

Important Notice Regarding the Availability of Proxy Materials for

the Shareholder Meeting To Be Held on March 17, 2016: The

Company’s Notice of 2016 Annual Meeting of Shareholders, Proxy Statement on Schedule 14A, form of proxy card and 2015 Annual Report on Form 10-K are available at https://materials.proxyvote.com/720186.

By order of the Board of Directors,

February 2, 2016

Judy Z. Mayo

Vice President, Corporate Secretary and

Deputy General Counsel |

|

|

|

|

Table of Contents

THOMAS E. SKAINS

Chairman of the Board, President and Chief Executive Officer

February 2, 2016

Dear fellow shareholder:

You are cordially invited to attend the 2016 Annual Meeting of Shareholders (the “Annual Meeting”) of Piedmont Natural Gas Company, Inc.

(“Piedmont” or the “Company”) to be held beginning at 8:30 a.m. Eastern Standard Time on March 17, 2016 at the Company’s corporate headquarters, 4720 Piedmont Row Drive, Charlotte, North Carolina 28210.

At the Special Meeting of Shareholders held on January 22, 2016, Piedmont shareholders approved our merger with a subsidiary of Duke Energy

Corporation, pursuant to which Piedmont shareholders have the right to receive $60.00 per share in cash, subject to the satisfaction or waiver of specified conditions. We are now working towards the required requlatory approvals and the satisfaction

of the other conditions provided in the merger agreement.

Even though the merger is pending, it is appropriate to hold the Annual Meeting so that,

among other things, Piedmont shareholders can vote on the approval of the Company’s amended and restated Incentive Compensation Plan. We will also consider the election of directors, the advisory vote on executive compensation, and the

ratification of the appointment of our independent registered public accounting firm for 2016. These items are described in the Notice of 2016 Annual Meeting of Shareholders and in the Proxy Statement accompanying this letter. The Proxy Statement

contains important information about the matters to be voted on and the process for voting, along with information about the Company, its directors, its management and its governance. If the merger is completed in 2016, the 2016 Annual Meeting will

be the final annual meeting of our public shareholders.

Please note that, pursuant to the New York Stock Exchange rules, brokers are not

permitted to vote your shares on certain proposals if you have not given your broker specific instructions on how to vote. Please be sure to give specific voting instructions to your broker so that your vote can be counted.

On behalf of the Board of Directors, management and employees of Piedmont, thank you for your support and ownership of our Company.

Sincerely,

Thomas E. Skains

4 PIEDMONT NATURAL GAS

COMPANY, INC. - 2016 Proxy Statement

SUMMARY INFORMATION

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all the information that you should

consider, and you should read this entire Proxy Statement carefully before you vote. The page references in this summary will guide you to more complete information. Information regarding our fiscal year 2015 performance can be found in our 2015

Annual Report on Form 10-K.

This Proxy Statement, accompanied by the Notice of 2016 Annual Meeting of Shareholders, the form proxy card and the 2015

Annual Report on Form 10-K, which includes audited financial statements and financial statement schedules, is first being made available to shareholders on or about February 2, 2016.

Your Vote Matters!

|

|

|

| It is very important that you cast your vote. Under rules of the New York Stock Exchange, if you hold your shares through a broker, bank

or other nominee, they cannot vote on your behalf on Proposals 1, 3 or 4 at this year’s meeting, because they are considered “non-discretionary” matters. Thus, it is important that you cast your vote on these and all items

listed below to make sure your voice is heard. Our 2016

Annual Meeting of Shareholders is on March 17, 2016 at 8:30 a.m. Eastern Time at our corporate headquarters at 4720 Piedmont Row Drive, Charlotte, North Carolina 28210. |

|

|

Items of Business that Require Your Vote

|

|

|

|

|

|

|

| |

|

|

|

For more

information |

|

Board

recommendation |

| Proposal 1 |

|

Election of Mr. Gary A. Garfield, Dr. Frankie T. Jones, Sr., Ms. Vicki McElreath, Mr. Thomas E. Skains and Mr. Phillip D. Wright to Class III of the Board of Directors, each for a term of three years, and Mr. Thomas M. Pashley to

Class II of the Board of Directors for a term of two years. |

|

Page 15 |

|

FOR each nominee |

| Proposal 2 |

|

Ratification of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for fiscal year 2016. |

|

Page 37 |

|

FOR |

| Proposal 3 |

|

Advisory vote to approve named executive officer compensation. |

|

Page 40 |

|

FOR |

| Proposal 4 |

|

Approval of the Company’s amended and restated Incentive Compensation Plan. |

|

Page 67 |

|

FOR |

Cast Your Vote Right Away

Voting is easy. Here is how:

|

|

|

|

|

|

|

|

|

|

Log on to www.proxyvote.com and follow the instructions, using the Control Number shown on the Notice of Internet Availability of Proxy Materials (or paper proxy

card if you received or request one). The deadline for voting online is 11:59 p.m. Eastern Time, March 16, 2016 (11:59 p.m. Eastern Time, March 14, 2016, for 401(k) Plan participants). |

|

|

|

If you received or request a proxy card, call the telephone number and follow the instructions shown on the proxy card, using the Control Number shown on the card. The

deadline for voting by telephone is 11:59 p.m. Eastern Time, March 16, 2016 (11:59 p.m. Eastern Time, March 14, 2016, for 401(k) Plan participants). |

|

|

|

|

|

|

|

If you received or request a proxy card, mark, sign and date the proxy card and promptly return it in the prepaid envelope so that it is received by March 16, 2016 (March

14, 2016 for 401(k) Plan participants). |

|

|

|

Submit a ballot in person at the Annual Meeting. You may also be represented by another person at the meeting by executing a proper proxy designating that

person. |

PIEDMONT NATURAL GAS COMPANY, INC.

- 2016 Proxy Statement 5

SUMMARY INFORMATION

If you own shares through a bank, broker or other nominee, they may provide other instructions for voting.

If you own shares in different accounts or in more than one name, you may receive more than one Notice of Internet Availability of Proxy Materials (or paper proxy card or

voting instruction form if you requested one), which will contain different voting instructions for each type of ownership. Please vote all your shares. See the “Commonly Asked

Questions” section beginning on page 11 for more details about voting.

2015 Business

Highlights

The Company achieved another year of solid performance in fiscal year 2015, including the following highlights:

|

|

|

| ü |

|

Entered into the Agreement and Plan of Merger with Duke Energy Corporation (“Duke Energy”) and its wholly-owned

subsidiary Forest Subsidiary, Inc., pursuant to which Piedmont would become a wholly-owned direct subsidiary of Duke Energy (the “Duke Merger”). Subject to the satisfaction or waiver of specified conditions to closing, Piedmont

shareholders will have the right to receive $60 cash per share. This represents a 51% premium to the 30-day volume weighted average price of the Company’s stock prior to October 26, 2015, the date the transaction was

announced. |

| ü |

|

We generated net income of $137 million and basic earnings per share of $1.74. |

| ü |

|

We generated a total shareholder return (stock price appreciation and dividends) of 58% for the three-year period ended October 31, 2015. |

| ü |

|

Our Board of Directors approved a 3.1% increase in the annualized dividend, the 37th consecutive year of annual dividend increases for our Company. |

| ü |

|

We increased our customer additions by 5% over last year. |

| ü |

|

We achieved target performance on our Company Mission, Values and Performance (“MVP”) Plan. The MVP Plan is a balanced scorecard designed to address the

interests of our shareholders, customers, employees and communities. |

| ü |

|

We executed a utility capital expenditure program of $455 million resulting in a total asset growth of more than $2 billion since 2010, an increase of 67%. |

| ü |

|

We received approval of $27.5 million in total annual margin revenue adjustments in North Carolina and $19.6 million in total in Tennessee under integrity management

regulatory mechanisms. |

| ü |

|

We generated $81 million in wholesale secondary marketing margins, of which $60 million was credited to lower the gas costs of our customers. |

| ü |

|

We successfully completed a public offering of $150 million of long-term debt while maintaining our favorable credit ratings. |

| ü |

|

We raised $54.1 million from issuing 1.5 million shares under an at-the-market equity sales program. |

Please refer to our 2015 Annual Report on Form 10-K for more information.

6 PIEDMONT NATURAL GAS

COMPANY, INC. - 2016 Proxy Statement

SUMMARY INFORMATION

2015 Executive Compensation Highlights

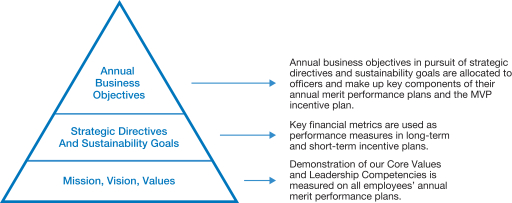

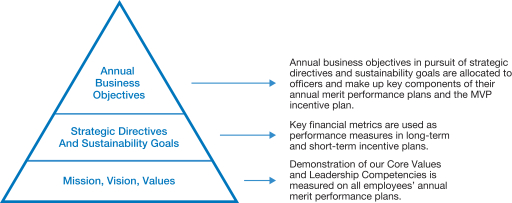

Piedmont’s executive compensation program establishes a strong connection between the incentive compensation opportunities for our executives under

the program and the business strategies and financial and operating success of the Company.

There is a Strong Connection Between Piedmont’s

Business Strategies and Executive Compensation

|

|

|

|

|

| Strategic Directives |

|

|

|

Incentive Compensation Components

|

| Expand Our Core Natural Gas and Complementary Energy-Related Businesses to Enhance Shareholder Value |

|

|

|

Relative total shareholder return (TSR), return on equity (ROE)* and earnings per share (EPS) growth are the metrics used to measure performance under the Long-Term Incentive Plan (LTIP). |

| Preserve Financial Strength and Flexibility |

|

|

|

Annual EPS performance carries the heaviest weight and serves as an incentive payout trigger on the Company MVP Plan. It is the only measure under

the Short-Term Incentive Plan (STIP). Relative TSR, ROE and EPS growth are the metrics used to

measure LTIP performance. |

| Promote the Benefits of Natural Gas |

|

|

|

Performance on Customer Loyalty, Community Involvement and Company Reputation is measured through external customer surveys. These are performance measures on the MVP Incentive Plan. |

| Be the Energy and Service Provider of Choice |

|

|

| Achieve Excellence in Customer Service Every Time |

|

|

| Execute Sustainable Business Practices |

|

|

|

Employee participation in our Safety programs is measured on the MVP Plan. |

| Enhance Our Healthy, High-Performance Culture |

|

|

|

Employee participation in health screenings, risk assessments and other wellness activities is a performance measure on the MVP

Plan. Merit increases are based in part on demonstration of core values and leadership

competencies. |

| All Strategic Directives |

|

|

|

Achievement by the named executive officers (“NEOs”) of specific business objectives supporting the strategic directives is a significant factor in determining the NEO’s merit increase. |

In fiscal 2015, the Compensation Committee approved an increase in target opportunities in the STIP for the NEOs to align

with median market practices. The results of the “say-on-pay” vote on the executive compensation program at the 2015 annual meeting of shareholders, with 97% of votes cast in favor, as well as feedback received in our 2015 institutional

investor outreach program, supported the continuation of the executive compensation program.

Based on their performance under the Company’s

incentive plans, for the 2015 fiscal year the named executive officers earned:

| • |

|

Mission, Values, Performance (MVP) Incentive Plan awards at 100% of the target level, based on target results for 2015 adjusted EPS and between threshold and

stretch achievement of the non-financial performance measures;

|

| • |

|

Short-Term Incentive Plan awards equal to 100% of the target level, based on target results for 2015 adjusted EPS; and |

| • |

|

Long-Term Incentive Plan awards equal to 102% of the target level for the three-fiscal-year period that ended October 31, 2015, based on near-target

results for adjusted EPS growth, target results for relative TSR, and above-target results for return on equity.

|

PIEDMONT NATURAL GAS COMPANY, INC.

- 2016 Proxy Statement 7

SUMMARY INFORMATION

The Company incurred significant expenses related to merger negotiations at the end of fiscal 2015. This

resulted in EPS performance below the threshold levels under the 2015 MVP and 2015 Short-Term Incentive Plan, which would result in no payout under these broad-based employee incentive plans, as well as EPS growth performance below the threshold

level under the EPS growth component of the 2015 Long-Term Incentive Plan, which would also result in no payout under

that component. Because EPS performance was tracking at target performance level prior to merger negotiations and continued at target level through the end of fiscal 2015 but for merger-related

expenses, the Compensation Committee exercised its discretion to exclude $11 million of after-tax merger-related expenses from the calculation of the EPS performance measures under the Company’s

incentive compensation plans, to arrive at an adjusted EPS for compensation purposes of $1.87.

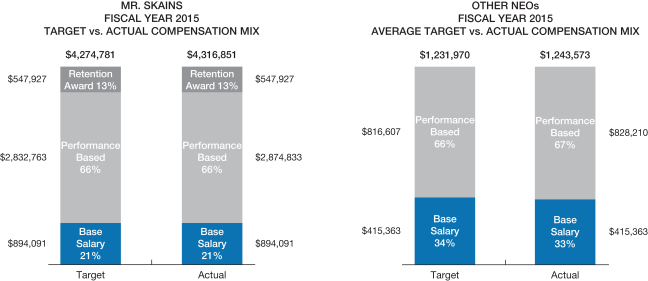

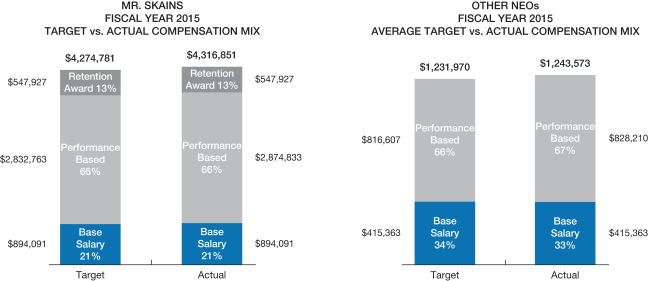

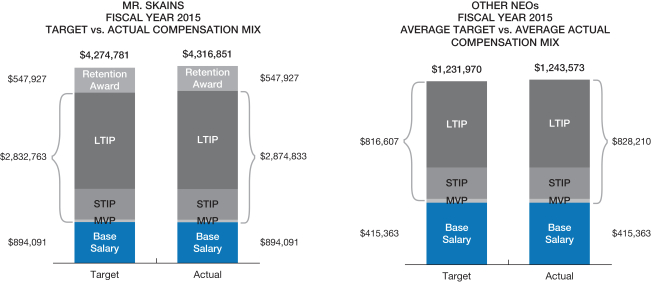

The charts below show the

target total direct compensation opportunities and the compensation actually earned and realized in fiscal year 2015 for Chairman, President and Chief Executive Officer Thomas E. Skains and the other named executive officers, expressed

as a percentage of total direct compensation. Performance-based compensation includes MVP, STIP and LTIP. The retention award for Mr. Skains includes the payout of the first of three tranches, which is equal to 20% of the award. The award,

granted in December 2011, intended to preserve continuity of CEO leadership while the Company executes the important long-term objectives and initiatives included in the Company’s Board-approved strategic plan.

The table below summarizes the total direct compensation Mr. Skains realized in 2015. Realized

compensation differs from the compensation amounts shown in the Summary Compensation Table on page 59, which includes some elements of compensation, such as the grant date value of equity awards, that may or may not be realized in the future. The

realized compensation table is intended to show the value Mr. Skains actually realized from equity awards as well as his other current realized compensation.

MR. SKAINS FISCAL YEAR 2015 REALIZED COMPENSATION

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Equity Awards |

|

|

|

|

|

|

|

| Base

Salary |

|

MVP/

STIP |

|

|

LTIP |

|

|

Retention

Award

Vesting |

|

|

Other |

|

|

Total |

|

| $ 894,091 |

|

$ |

729,222 |

|

|

$ |

2,145,611 |

|

|

$ |

547,927 |

|

|

$ |

24,561 |

|

|

$ |

4,341,412 |

|

The base salary and MVP/STIP amounts in the realized compensation table are the same as the amounts reported in the

Summary Compensation Table on page 59. The “Other” column includes the amounts reported in the “All Other Compensation” column of the Summary Compensation Table other than matching contributions to the Company’s 401(k) Plan

and Company contributions to the

Company’s Defined Contribution Restoration Plan, because payment of those contributions is deferred until Mr. Skains’ retirement. See “Executive Compensation—Compensation

Discussion and Analysis” beginning on page 41 for more information.

Upon the effectiveness of the Duke Merger:

| • |

|

outstanding equity awards held by the named executive officers convert to a right to receive cash based on specified performance levels (which are no less

than target level) or convert into Duke Energy restricted stock units; |

| • |

|

STIP and MVP awards will be paid at target (or in certain circumstances at the actual performance level, if higher), prorated for the performance period;

|

| • |

|

account balances under the Company’s Defined Contribution Restoration Plan will be subject to accelerated vesting; and |

| • |

|

Mr. Skains shall receive, and the other named executive officers may also be entitled to receive, severance payments under their severance agreements.

|

See “Executive Compensation—Compensation Discussion and Analysis —Treatment of Compensation Plans upon Effectiveness

of Merger” beginning on page 56 for more information.

8 PIEDMONT NATURAL GAS

COMPANY, INC. - 2016 Proxy Statement

SUMMARY INFORMATION

2015 Governance Highlights

|

|

|

| Director Independence and Related Person Transactions |

|

• All

members of the Board are independent (other than Mr. Skains, Piedmont’s Chairman of the Board, President and Chief Executive Officer who does not sit on any Committee).

• In fiscal 2015, there were no related person transactions between the Company and

its directors or executive officers. See “Director Independence and Related Person

Transactions” on page 26 for more information. |

| Director Engagement |

|

• In fiscal 2015, all directors attended all meetings of the

Board and of each committee on which they served (except for one director who attended 8 of 9 Board meetings and one director who attended 7 of 8 committee meetings).

• Committee chairs meet regularly with management, and communication between

directors and management is constant and unfettered. See “Attendance at Annual Shareholders

Meeting and Board and Committee Meetings” on page 30 for more information. |

| Independent Lead Director |

|

Piedmont’s Independent Lead Director, Malcolm E. Everett III:

• Chairs all executive sessions of the Board and Board meetings where the Chairman

is absent • Approves the annual calendar and agendas for all meetings of the

Board and its committees • Consults with the President and Chief Executive

Officer on business issues • Convenes the Board at his discretion

See “Board Leadership Structure and Independent Lead Director” on page 27 for more

information. |

| Board Self-Evaluations |

|

• The Board and its Committees evaluate their performance

annually. • The Chairman of the Board conducts one-on-one feedback sessions with

several directors each year on a rotating basis on the performance of the Board, the Committees and the directors. • The Directors and Corporate Governance Committee is responsible for recommending to the Board specific adjustments to improve the functioning of the Board and its Committees.

See “Board Self-Evaluation Process” on page 17 for more information.

|

| Board Skills Assessment |

|

• The Board identifies the key skills and

attributes that are most critical for a Company director given the Company’s strategic directives and the opportunities and challenges it faces.

• The compilation is used to identify areas where directors may benefit from

additional training. • The Board periodically updates the key skills and

attributes so that they continue to reflect the current state of the Company. See “Director

Qualifications Assessment, Continuing Education and Succession Planning” on page 16 for more information. |

| Director Education Program |

|

• The Board identifies for each director the industry,

economic, governance and other training and education opportunities that best enhance the director’s role and contributions to the Company.

See “Director Qualifications Assessment, Continuing Education and Succession Planning” on page 16 for more information.

|

| Director Succession Planning |

|

• The Board uses a compilation of key Board

skills and attributes described above to assist in identifying potential Board members.

• The succession planning process emphasizes strategic identification and

cultivation of director candidates. • Two directors were added to the Board in

fiscal 2015 based on attributes identified through this process. See “Director

Qualifications Assessment, Continuing Education and Succession Planning” on page 16 for more information. |

| Board Diversity |

|

• The Board embraces a policy to champion diversity among its

members so as to consider and evaluate issues affecting the Company with more effective thought leadership from different perspectives.

• Over one-fourth of the Board is female or minority.

• The Company has been recognized as having one of the most diverse public company

boards in North Carolina. See “Qualifications and Nomination of Directors” beginning on

page 15 and “Board of Directors” beginning on page 17 for more information. |

| Director Resignation Policy |

|

• Directors are required to tender their

resignation upon: – receipt of more “Withhold” votes than

“For” votes in an uncontested election, or – any significant

change in personal or professional circumstances that would reasonably cause a re-examination of the director’s continued membership on the Board.

• The Directors and Corporate Governance Committee and the Board would determine

whether to accept the resignation or take some other appropriate action in the best interests of the Company and its shareholders.

See “Resignation Policy” on page 34 for more information. |

PIEDMONT NATURAL GAS COMPANY, INC.

- 2016 Proxy Statement 9

SUMMARY INFORMATION

|

|

|

| Director and Management Stock Ownership Guidelines and Hedging Prohibition |

|

• All directors and all leadership-level employees are expected

to own Piedmont common stock worth a multiple of their cash retainer or base salary within a certain period of time (See “Director Stock Ownership Guidelines” on page 33 and “Executive Stock Ownership Guidelines” on page 55 for

more information). • All directors and all NEOs are in compliance with the

Company’s stock ownership guidelines. • Every director chose to invest all

amounts earned by him or her as fees, retainers and grants in fiscal year 2015 in Piedmont common stock (see “Director Compensation” on page 31).

• Our employees and directors are prohibited from hedging Piedmont stock, and

significant restrictions are placed on the pledging of Piedmont stock (see “Hedging and Pledging Company Securities” on page 33). |

| Shareholder Engagement Program |

|

• Piedmont’s outreach program invites

our largest institutional shareholders, representing almost 30% of Piedmont’s outstanding shares, to discuss financial performance, executive compensation and governance matters.

• For 2015 the feedback was generally supportive, though the general governance goal

of removing supermajority voting thresholds was reiterated. Since 2012, we have proposed twice to our shareholders to reduce supermajority voting thresholds, and both times the proposal failed to receive the requisite shareholder approval.

See “Investor Outreach” on page 35 for more information. |

| Enterprise Risk Management |

|

• The Finance and Enterprise Risk Committee of the Board is

charged with specific oversight of the Company’s enterprise risk management program, but the full Board retains overall oversight responsibility.

• The Company has identified risk appetite tolerance levels for the Company’s

key risks that are aligned with the Company’s strategic plan, together with risk metrics that measure adherence with that risk appetite.

• The Company’s risk appetite and metrics are approved by the Board, and risk

adherence is measured and reported to the Board quarterly through the Finance and Enterprise Risk Committee and annually directly to the full Board.

See “Board Role in Risk Oversight” on page 29 for more information. |

| Robust Ethics and

Compliance Programs |

|

• We deliver the right results in the right way by making our values the basis of

every decision we make. • We continuously refresh and update our Code of Ethics

and Business Conduct. • We train our employees throughout the year on a rotating

series of compliance, ethics and leadership topics. |

Director Nominees

The following table provides summary information for each director nominee. If elected, Mr. Gary A. Garfield, Dr. Frankie T. Jones,

Sr., Ms. Vicki McElreath, Mr. Thomas E. Skains and Mr. Phillip D. Wright will each serve a three year term expiring at the 2019 Annual Meeting of Shareholders. If Mr. Thomas M. Pashley is elected, he will serve a

two year term, expiring at the 2018 Annual Meeting of Shareholders. See the “Corporate Governance Information” section beginning on page 15 for more information about the Board of Directors and the director nominees.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Name |

|

Age |

|

|

Director Since |

|

Expertise and Qualifications |

|

Independent |

|

Attendance at Fiscal 2015

Board and Committee Meetings(1) |

|

| Mr. Gary A. Garfield |

|

|

59 |

|

|

2015 |

|

• Attorney

• Senior management experience

• Financial expertise

• Media/public relations experience

• Risk management experience

• Industrial/large customer perspective |

|

Yes |

|

|

100% |

|

| Dr. Frankie T. Jones, Sr. |

|

|

68 |

|

|

2007 |

|

• Leadership experience

• Business development expertise

• Media/public relations expertise

• Human resource expertise |

|

Yes |

|

|

100% |

|

| Ms. Vicki McElreath |

|

|

66 |

|

|

2006 |

|

• Senior management experience

• Financial and accounting expertise

• Public company expertise

• Risk management expertise |

|

Yes |

|

|

100% |

|

| Mr. Thomas E. Skains |

|

|

59 |

|

|

2002 |

|

• Senior management experience

• Intimate knowledge of the Company

• Natural gas industry expertise

• Legal training and experience |

|

No |

|

|

100% |

|

| Mr. Phillip D. Wright |

|

|

60 |

|

|

2012 |

|

• Senior management experience

• Finance experience

• Sales and marketing expertise

• Risk management expertise

• Natural gas industry expertise

• Engineering expertise |

|

Yes |

|

|

100% |

|

| Mr. Thomas M. Pashley |

|

|

46 |

|

|

2015 |

|

• Senior management

experience • Accounting experience

• Sales and marketing expertise

• Customer service expertise

• Media/public relations expertise |

|

Yes |

|

|

100% |

|

| (1) |

Percentage attendance at meetings of the Board and meetings of the Board committees on which they served in fiscal year 2015. Mr. Garfield joined the Board

in June 2015 and Mr. Pashley joined the board in September 2015 |

10 PIEDMONT NATURAL GAS

COMPANY, INC. - 2016 Proxy Statement

COMMONLY ASKED QUESTIONS

What will be voted on?

| • |

|

Proposal 1: Election of Mr. Gary A. Garfield, Dr. Frankie T. Jones, Sr., Ms. Vicki McElreath, Mr. Thomas E. Skains

and Mr. Phillip D. Wright to Class III of the Board of Directors, each for a term of three years, and Mr. Thomas M. Pashley to Class II of the Board of Directors for a term of two years. |

| • |

|

Proposal 2: Ratification of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for

fiscal year 2016. |

| • |

|

Proposal 3: Advisory vote to approve named executive officer compensation. |

| • |

|

Proposal 4: Approval of the Company’s amended and restated Incentive Compensation Plan. |

Voting will also take place on such other business, if any, as may properly come before the Annual Meeting or any adjournment of the Annual Meeting.

How many votes are needed to adopt the

proposals?

For Proposal 1 (the election of directors), the five nominees for Class III and the one nominee for Class

II receiving the highest number of affirmative votes cast for each respective class will be elected. Proposal 2 (ratification of the appointment of Deloitte & Touche LLP) requires the affirmative vote of a majority of the votes cast on that

proposal. The result of the vote on Proposal 3 (advisory vote to approve named executive officer compensation) is non-binding and the Board of Directors will consider the outcome of the vote when making future executive compensation decisions.

Proposal 4 (approval of the Company’s amended and restated Incentive Compensation Plan]) requires the affirmative vote of a majority of the votes cast on the

proposal. Other matters that may properly come before the Annual Meeting may require more than a majority vote under the Company’s Amended and Restated Bylaws, its Restated Articles of

Incorporation, the laws of the State of North Carolina or other applicable laws or regulations. Abstentions will not be counted as votes cast with respect to any of the Company’s proposals. Broker non-votes (when beneficial owners do not

provide specific voting instructions and either nominees have no discretionary power to vote or choose not to vote the uninstructed shares on a matter over which they have discretionary power to vote) will not be counted as votes cast.

Who is entitled to vote?

Holders of record of shares of the Company’s common stock (“Common Stock”) at the close of

business on January 22, 2016, the record date established by the Company’s Board of Directors, are entitled to notice of and to vote at the Annual Meeting, either in person or by proxy. Each shareholder of record will have one vote for

every share of Common Stock owned by that shareholder on the record date.

If your shares are registered directly in your name with the Company’s

stock transfer agent, Wells Fargo Bank Shareowner Services, you are considered, with respect to those shares, the shareholder of record (“registered shareholder”). If your shares are held in a stock brokerage

account or by a bank or other nominee, you are considered the beneficial owner of those shares, which are held in “street name” (“beneficial owners”). You may also own shares

through the Company’s 401(k) Plan Piedmont Stock Fund. The Notice of Internet Availability of Proxy Materials (or proxy materials in paper form if you have so previously elected) has been made available to you by your broker, bank or other

nominee who is considered, with respect to those shares, the shareholder of record. By voting online, by telephone or by completing the voting instruction form provided to you by your broker, bank or other nominee, you direct how to vote your

shares.

Who is soliciting my vote?

The Company’s Board of Directors is

soliciting proxies to be voted at the Annual Meeting on the matters described in this Proxy Statement and such other business as may properly come before the Annual Meeting or any adjournment of the Annual Meeting.

Why did I receive a notice in the mail regarding the internet availability of proxy materials instead of a full set of proxy materials?

In accordance with rules adopted by the Securities and Exchange Commission (“SEC”), we may

furnish proxy materials, including this Proxy Statement and our 2015 Annual Report on Form 10-K, to our shareholders by providing access to such documents on the internet instead of mailing printed copies. Most shareholders will not receive printed

copies of the proxy materials unless they request them. Instead, the Notice

of Internet Availability of Proxy Materials, which was mailed to most of our shareholders, will instruct you as to how you may access and review all of the proxy materials on the internet and how

you may submit your vote on the internet. If you would like to receive a paper or email copy of our proxy materials, please follow the instructions for requesting such materials in the Notice of Internet Availability of Proxy Materials.

PIEDMONT NATURAL GAS COMPANY, INC.

- 2016 Proxy Statement 11

COMMONLY ASKED QUESTIONS

What should I do if I received more than one Notice of Internet Availability of Proxy Materials (or paper proxy card and voting instruction form, if you requested

one)?

There are circumstances under which you may receive more than one Notice of Internet Availability of Proxy

Materials. For example, if you hold your shares in more than one brokerage account, you may receive a separate voting instruction card for each such brokerage account. In addition, if you are a registered shareholder and your shares are

registered in more than one name, you will receive more than one Notice of Internet Availability of Proxy Materials. Please vote in accordance with the instructions of each Notice of Internet

Availability of Proxy Materials separately, since each one represents different shares that you own. Please vote all of your shares.

How do I vote?

If you are a registered shareholder or own your shares through the Company’s 401(k) Plan, you can vote

using any one of the following methods:

| • |

|

Online: Log on to www.proxyvote.com and follow the instructions, using the Control Number shown on the Notice of Internet Availability of Proxy

Materials (or paper proxy card if you received or request one). The deadline for voting online is 11:59 p.m. Eastern Time, March 16, 2016 (11:59 p.m. Eastern Time, March 14, 2016, for 401(k) Plan participants). |

| • |

|

By mail: If you received or request a proxy card, mark, sign and date the proxy card and promptly return it in the prepaid envelope so that it is

received by March 16, 2016 (March 14, 2016 for 401(k) Plan participants). |

| • |

|

By telephone: If you received or request a proxy card, call the telephone number and follow the instructions shown on the proxy card, using the Control

Number shown on the proxy card. The deadline for voting by telephone is 11:59 p.m. Eastern Time, March 16, 2016 (11:59 p.m. Eastern Time, March 14, 2016, for 401(k) Plan participants). |

| • |

|

In person at the Annual Meeting: Submit a ballot at the Annual Meeting. You may also be represented by another person at the meeting by executing a

proper proxy designating that person. |

If you own your shares through a bank, broker or other nominee, you may vote in accordance

with the instructions provided by your bank, broker or nominee, which may include the following:

| • |

|

Online: Log on to www.proxyvote.com and follow the instructions, using the Control Number shown on the Notice of Internet Availability

|

| |

|

of Proxy Materials (or voting instruction form if you received or request one). The deadline for voting online is 11:59 p.m. Eastern Time, March 16, 2016. |

| • |

|

By mail: If you received or request a voting instruction form, mark, sign and date the voting instruction form and promptly return it in the prepaid

envelope so that it is received by March 16, 2016. |

| • |

|

By telephone: If you received or request a voting instruction form, call the telephone number and follow the instructions shown on the voting

instruction form, using the Control Number shown on the voting instruction form. The deadline for voting by telephone is 11:59 p.m. Eastern Time, March 16, 2016. |

| • |

|

In person at the Annual Meeting: Obtain a legal proxy from your broker, bank or other nominee indicating that you were the owner of the shares on the

record date and present it to the inspectors of election with your ballot. |

When you vote online or by telephone or properly submit

your proxy card or voting instruction form, proxies will be voted in accordance with the voting instructions provided to the Company. If no instructions are provided, proxies will be voted as indicated below under “What if I submit my proxy but

don’t provide voting instructions?”

You can vote your shares for all, for some (by withholding authority to vote for any individual

nominee) or none of the director nominees. You can vote for, against or abstain from voting for Proposals 2, 3 and 4.

What happens if I do not vote?

If you are a registered shareholder or hold your shares through the Company’s 401(k) Plan, then your

shares will not be voted or counted towards a quorum if you do not submit a vote (whether online, by telephone or by mail) or do not vote in person at the Annual Meeting.

If you hold your shares through a bank, broker or other nominee (called “street name”) and do not provide voting instructions by voting online,

by telephone or by submitting a paper voting instruction form, then the nominee will not be able to vote your shares on your behalf for Proposals 1, 3 and 4, which are considered

“non-discretionary,” and may choose not to vote your shares for Proposal 2, for which it has discretion to vote in accordance with its best judgment under the rules of the New York Stock Exchange.

How do I vote shares held in the Company’s

401(k) Plan?

Under the Company’s

401(k) Plan, the plan trustee will vote your plan shares in accordance with the directions you indicate by voting online or by telephone or on the proxy card. Please see “How do I vote?” above for further information on these voting

methods.

12 PIEDMONT NATURAL GAS

COMPANY, INC. - 2016 Proxy Statement

COMMONLY ASKED QUESTIONS

How can I revoke my proxy?

You can revoke your proxy by sending written notice of revocation of your proxy to the Corporate Secretary at 4720 Piedmont Row Drive, Charlotte, North

Carolina 28210 so that it is received prior to 5:00 p.m. Eastern Time on March 16, 2016 (March 14, 2016 for 401(k) Plan participants).

Can I change my

vote?

You can change your vote by:

| • |

|

Submitting a later dated vote by using the online or telephone voting procedure described above under “How do I vote?” prior to 11:59 p.m. Eastern

Time, March 16, 2016 (March 14, 2016 for 401(k) Plan participants); |

| • |

|

Marking, signing, dating and returning a new proxy card with a later date to the Corporate Secretary at 4720 Piedmont Row Drive, Charlotte North Carolina

28210, or a new voting instruction form with

|

| |

a later date to the address noted on that form, so that it is received prior to 5:00 p.m. Eastern Time on March 16, 2016 (March 14, 2016 for 401(k) Plan participants); or

|

| • |

|

Attending the Annual Meeting and voting in person. If you own your shares through a broker, bank or other nominee, you must obtain a legal proxy as described

in “How do I vote?” above and deliver it to the Corporate Secretary at the Annual Meeting. |

What if I submit my proxy but don’t

provide voting instructions?

Registered shareholders—If you are a registered shareholder and your proxy is properly submitted

(whether online, by telephone or by mail) and not revoked, but you do not give voting instructions for a proposal, the proxy will be voted in accordance with the recommendations of the Board of Directors for that proposal, which is “FOR”

all nominees in Proposal 1 and “FOR” Proposals 2, 3 and 4.

401(k) Plan shares—If you hold your shares through the Company’s

401(k) Plan and your proxy is properly submitted (whether online, by telephone or by mail) and not revoked, but you do not provide voting instructions to the plan trustee, then your shares will be voted in accordance with directions given to the

plan trustee by the Company’s Benefit Plan Committee, or if no such directions are given, your shares will be voted by the plan trustee in the same proportion as the 401(k) Plan shares that were properly voted.

Beneficial owners—If you hold your shares in street name and properly submit a proxy (whether online,

by telephone or by mail) with no voting instructions on Proposal 2, your broker, bank or other nominee may vote your shares on that proposal in accordance with its best judgment because this matter is considered “discretionary” under the

applicable rules, but may not vote your shares on Proposals 1, 3 and 4 if you do not provide voting instructions for those proposals.

All

shareholders of record—Should other matters properly come before the Annual Meeting that are “discretionary,” or should matters for which proper notice was not given pursuant to the Company’s Amended and Restated Bylaws be

permitted to come before the Annual Meeting, the proxy holders named in the proxy card will vote the proxies on such matters in accordance with their best judgment.

How many shares must be present to conduct the

Annual Meeting?

As of the record date, 81,248,880 shares of Common Stock were issued and outstanding and entitled to

vote at the Annual Meeting. Each share of Common Stock is entitled to one vote. A majority of those shares, present or represented by proxy, constitutes a quorum for the purposes of conducting the Annual Meeting and voting on

proposals at the Annual Meeting. If you vote online or by telephone or submit a properly executed proxy card or voting instruction form, then your shares will be considered part of the quorum.

Abstentions and broker non-votes, if any, will be counted for purposes of determining whether a quorum is present at the Annual Meeting.

Who can attend the Annual Meeting?

All shareholders as of the record date, or

their duly authorized proxies, can attend the Annual Meeting.

Who pays the costs of proxy solicitation?

We have hired Alliance Advisors, LLC to assist us with the distribution of our proxy materials and to

solicit proxies. Alliance Advisors, LLC’s fee for these services is $7,500, plus out-of-pocket expenses. Directors, officers and employees of the Company may solicit proxies and will not be entitled to any additional compensation for any such

solicitation.

The Company will bear the full cost of the solicitation and will reimburse brokerage firms and other

custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy and solicitation material to beneficial owners.

PIEDMONT NATURAL GAS COMPANY, INC.

- 2016 Proxy Statement 13

COMMONLY ASKED QUESTIONS

Can multiple shareholders sharing my address receive just one copy of the Notice of Internet Availability of Proxy Materials or other proxy materials in paper

format?

The Company has adopted a process for mailing the Notice of Internet Availability of Proxy Materials (and

other proxy materials for those shareholders that previously requested them) called “householding.” Householding means that shareholders who share the same address and agree to householding will receive only one copy of the Notice of

Internet Availability of Proxy Materials (or other proxy materials, as applicable), unless we receive instructions to the contrary from any shareholder at that address.

If you are a registered shareholder who shares the same address as another registered shareholder, you can agree to householding by:

| • |

|

Indicating that you consent to householding on your proxy card, if you received one; or

|

| • |

|

Writing to or calling our transfer agent, Wells Fargo Bank Shareowner Services, 110 Centre Pointe Curve, Suite 101, Mendota Heights, MN 55120-4100 or

1-877-724-6451. |

Householding reduces the Company’s printing costs and postage fees, and we encourage you to participate. If

you wish to discontinue householding or receive a separate copy of the Notice of Internet Availability of Proxy Materials (or other proxy materials, as applicable) for this year and in the future, you may so notify us, via the transfer agent at the

telephone number or address above, and we will promptly comply with your request.

If you own your shares through a broker, bank or other nominee, you

may request householding or request separate copies of the Notice of Internet Availability of Proxy Materials (or other proxy materials, as applicable) by notifying your broker, bank or nominee.

When are shareholder proposals due for the 2017

annual meeting of shareholders?

If the Duke Merger is consummated, the 2016 Annual Meeting will be the last meeting of our public

shareholders. If the 2017 annual meeting of shareholders does occur, under our Amended and Restated Bylaws, shareholders must follow certain procedures in order to nominate persons for election as directors or to introduce an item of business at an

annual meeting of shareholders. Under these procedures, nominations for director or an item of business to be introduced at the 2017 annual meeting of shareholders:

| • |

|

Must be submitted in writing by registered or certified mail to the Corporate Secretary at 4720 Piedmont Row Drive, Charlotte North Carolina 28210; and

|

| • |

|

Must be received no earlier than October 18, 2016 (which is 150 days before the anniversary of the date of this year’s Annual Meeting) and no later

than November 17, 2016 (which is 120 days before the anniversary of the date of this year’s Annual Meeting). |

Notice of intent to nominate a director must include the information specified in the “Advance Notice

of Director Nominations and Other Business” section of the Amended and Restated Bylaws, which includes the nominee’s occupation(s), certain information about the nominee’s background, other board memberships and evidence of

willingness to serve.

The chairman of the 2017 annual meeting may refuse to allow the transaction of any business, or to acknowledge the nomination

of any person, not made in compliance with the foregoing procedures.

In addition to the procedures described in the previous paragraph, in order for

a shareholder proposal to be considered for inclusion in next year’s proxy statement and proxy card, it must be provided in the manner set forth in Rule 14a-8 of the SEC no later than October 5, 2016.

How can I contact a member of the Board of

Directors?

Any shareholder or interested party can contact the Board of Directors, any member of the Board of

Directors, including the Independent Lead Director, or the non-management or independent directors as a group by writing to the Board of Directors, the non-management or independent directors as a group or any individual director in care of the

Company at 4720 Piedmont Row Drive, Charlotte North Carolina 28210, or by sending a written communication to the Corporate Secretary at that address.

Any communication addressed to an individual director at that address will be delivered or forwarded to the

addressee as soon as practicable. Communications addressed to the Board of Directors or to an unspecified director will be forwarded to the Chairman of the Board, and communications addressed to the non-management or independent directors as a group

will be forwarded to the Independent Lead Director.

14 PIEDMONT NATURAL GAS

COMPANY, INC. - 2016 Proxy Statement

PROPOSAL 1 ELECTION OF

DIRECTORS

The Board of Directors recommends a vote FOR each nominee.

The Amended and Restated Bylaws of the Company provide that the Board of Directors shall consist of such

number of directors as shall be fixed from time to time by resolution of the Board, but shall not be fewer than nine. The number of directors to serve immediately following the 2016 Annual Meeting is fixed at 13. The Restated Articles of

Incorporation divide the Board into three classes, designated Class I, Class II and Class III, with one class standing for election each year for a three-year term. The Restated Articles of Incorporation provide that each class shall consist as

nearly as possible of one-third of the total number of directors constituting the entire Board.

The Board of Directors has nominated

Mr. Gary A. Garfield, Dr. Frankie T. Jones, Sr., Ms. Vicki McElreath, Mr. Thomas E. Skains and Mr. Phillip D. Wright, whose terms expire at the 2016 Annual Meeting, to stand for election or re-election as

Class III directors. In addition, Mr. Thomas M. Pashley, whose term expires at the 2016 Annual Meeting, is standing for election as a Class II director. Mr. Garfield and Mr. Pashley were recommended by the members of

the Directors and Corporate Governance Committee (all independent non-management directors) and were appointed as directors effective June 5, 2015 and September 2, 2015, respectively.

The Board has determined that, with the exception of Mr. Skains, each of these directors is an independent member of the Board. (Information

about director independence is set forth below in “Corporate Governance Information—Director Independence and Related Person Transactions.”) The terms of the Class III directors elected at the Annual Meeting will expire in 2019. The

terms of the Class II director elected at the Annual Meeting will expire in 2018. (Information as to the six nominees is set forth below in “Corporate Governance Information—Board of Directors.”)

The Board does not know of any nominee who will be unable or unwilling to serve, but in such event the proxies will be voted under discretionary authority

for a substitute designated by the Board, or the Board may take appropriate action for a lesser number of directors.

CORPORATE GOVERNANCE INFORMATION

|

|

|

|

|

|

|

| ü |

|

All non-management directors are independent |

|

ü |

|

100% director attendance at 2015 annual shareholder meeting |

|

ü |

|

Fully independent Audit, Compensation and Directors and Corporate Governance Committees |

|

ü |

|

100% attendance by all directors at all 2015 Board meetings, except for one director who attended 8 out of

9 |

|

ü |

|

Diversity of gender, race, experience and perspective |

|

ü |

|

100% attendance by all directors at all respective 2015 Committee meetings, except for one director who attended

7 out of 8 |

|

ü |

|

No related person transactions |

|

ü |

|

All directors exceed stock ownership requirements, except those joining the Board in fiscal 2014 and

2015 |

|

ü |

|

Independent Lead Director |

|

ü |

|

Robust director skills and attributes assessment |

|

ü |

|

No Compensation Committee interlocks |

|

ü |

|

Formal director education program |

|

ü |

|

Risk management oversight by the Board, the Finance and Enterprise Risk Committee and each other Committee |

|

ü |

|

Formal director succession planning process |

|

ü |

|

Two Audit Committee financial experts |

|

ü |

|

Annual Board performance evaluation process |

|

ü |

|

Executive sessions of independent directors at each Board meeting |

|

ü |

|

Director retirement policy |

| ü |

|

Investor outreach program |

|

ü |

|

Director resignation policy |

Qualifications and Nomination of Directors

The Directors and Corporate Governance Committee has a process of identifying and evaluating potential

nominees for election as members of the Board. The Committee and the Board each has a policy that potential nominees shall be evaluated the same way, regardless of whether the nominee is recommended by a shareholder, a Board member or Company

management. This Committee considers potential nominees from all these sources, develops information from many sources concerning the potential nominee and evaluates the potential nominee as to the qualifications that the Committee and the Board

have established. Specifically, the Committee assesses the Board’s current strengths and needs by reviewing its profile, its director qualification standards described below and the Company’s current

and future needs. From this assessment, candidates are screened against the Board’s director qualification standards described below and then, if appropriate, interviewed by the Chair of the

Committee, the Independent Lead Director, the Chief Executive Officer and other Board members. Based on input derived from candidate interviews and a reference check, the Committee determines whether the candidate should be recommended for Board

membership and subsequent election to the Board. In fiscal year 2015, the Company did not pay any compensation or other consideration to third parties in connection with identifying or evaluating potential nominees for consideration for election as

a member of the Board.

PIEDMONT NATURAL GAS COMPANY, INC.

- 2016 Proxy Statement 15

CORPORATE GOVERNANCE INFORMATION

Qualifications

Factors considered in identifying candidates for Board membership include:

| • |

|

Extensive experience in a senior executive role with a major business organization, preferably as either a Chief Executive Officer, President or Chairman, and

equivalent experience from other backgrounds such as academic, government, legal, accounting, audit or other recognized professions. |

| • |

|

Possession of the intelligence, integrity, strength of character and sense of timing required to provide the leadership and guidance to effectively govern and

to recommend alternative solutions to challenges confronting the Company. |

| • |

|

Possession of the commitment, sense of urgency and spirit of cooperation that will enable the director to work with other Board members in directing the

future profitable growth of the Company in an ethically responsible fashion. |

| • |

|

Exposure to the numerous programs a corporation employs relative to creating shareholder value, while balancing the needs of all stakeholders.

|

| • |

|

Awareness of both the business and social environment within which the Company operates. |

| • |

|

Independence necessary to make an unbiased evaluation of management performance and effectively carry out oversight responsibilities. |

| • |

|

No association with organizations that have competitive lines of business or other conflicts of interest with the Company. |

| • |

|

Possession of skills and attributes that are most critical for a Company director given the Company’s strategic directives and the opportunities and

challenges it faces. |

The Directors and Corporate Governance Committee reviews at each of its meetings the list of skills and

attributes that the Board believes are most important for a Company director to possess, and recommends changes to the Board as needed to reflect the evolution of the Company (for example, the increasing mileage of its transmission pipelines), of

business practices (for example, more robust risk management) and of its culture (for example, community involvement). No changes to the key skills and attributes were made in fiscal 2015.

Diversity

Diversity, in the broad sense of the word, is an important component of the list of key director skills and

attributes. The Board embraces a policy to champion diversity among its members so as to consider and evaluate issues affecting the Company with more effective thought leadership from different perspectives and viewpoints. Thus the Company’s

Corporate Governance Guidelines require the Board to consider diversity of thought, experience, talent, background and perspective, including that which exists with respect to gender, race and national origin, in evaluating candidates for Board

membership. The Board’s Directors and Corporate Governance Committee reviews

diversity each quarter as part of the director qualifications review described below, to ensure that the present Board and committee composition provides the benefits of diversity. The Board and

the Directors and Corporate Governance Committee believe that this diversity policy has been effective and Piedmont is proud to have been named as having one of the most diverse boards of North Carolina’s largest corporations by the Director

Diversity Initiative at the University of North Carolina School of Law in 2012 (the last time the study was conducted). The Board and the Directors and Corporate Governance Committee will continue to encourage Board diversity under the policy.

Director Qualifications Assessment, Continuing

Education and Succession Planning

At each of its quarterly meetings, the Directors and Corporate Governance Committee reviews the

qualifications of the members of the Board of directors to ensure that the Board membership continues to reflect the oversight needs of the Board and the Company. In 2015, the Directors and Corporate Governance Committee reviewed each director

against the refreshed key director skills and attributes discussed above under “Qualifications,” taking into account each director’s Committee appointments. The result has been the confirmation of key skills possessed by each director

as well as identification of opportunities for additional education and training to optimize each director’s performance as a Board and Committee member. These additional opportunities were provided in 2015 through continuing education programs

at Board meetings.

Director succession planning is closely tied to the assessment of director skills and qualifications. As directors approach

retirement, the

Board needs to ensure that it identifies potential directors that will maintain an appropriate mix of key skills and attributes on the Board. If the assessment of skills and qualifications

identifies any areas in which the Board believes additional expertise is appropriate, the Board is able to strategically cultivate potential directors with that expertise. The Board believes that continuous assessment of director skills and

qualifications, regardless of tenure, will provide the Company with a Board best suited to guide the Company and represent shareholder interests. In 2015, Gary A. Garfield and Thomas M. Pashley joined the Board of Directors based on the Board’s

assessment that the Board would benefit from additional representation of the Company’s Nashville and Eastern North Carolina service areas, more age diversity, the perspective of a large industrial entity, additional financial literacy, and

additional marketing, sales and risk management experience.

16 PIEDMONT NATURAL GAS

COMPANY, INC. - 2016 Proxy Statement

CORPORATE GOVERNANCE INFORMATION

Board Self-Evaluation Process

Once a year, each Committee as well as the Board performs a self-evaluation as a scheduled meeting agenda

item. Each respective body evaluates the execution of its responsibilities, structure and functioning, and information and resources. The results of the self-evaluations, including any action items, are shared with the full Board. Additionally, each

year the Chairman meets individually with several directors on a rotating basis specifically to discuss the performance of Committees, the Board, the director and the other directors. The Chairman shares the feedback from the interviews with the

Chair of the Directors and Corporate Governance Committee, the Independent Lead Director, the Corporate Secretary, the General Counsel and relevant members of

management. Relevant feedback is also shared with the chair of each Committee. Areas identified for improvement are enhanced through measures such as targeted education, process improvements and

Committee charter and corporate governance guideline amendments.

The Directors and Corporate Governance Committee considers whether any additional

changes to Board or Committee practices or procedures should be recommended to the Board after reviewing the results of each Committee’s self-assessment, action items identified by the Committees, and the results of the Chairman’s director

interviews.

Shareholder Recommendations

The Directors and Corporate Governance

Committee will consider nominees recommended by shareholders upon submission in writing to the Corporate Secretary of the names of such nominees, together with their qualifications for service and evidence of their willingness to serve. Under our

Amended and Restated Bylaws, certain procedures are provided that a shareholder must follow to nominate persons for election as directors. These procedures are described in “Commonly Asked Questions—When are shareholder proposals due for

the 2017 annual meeting of shareholders?” above.

Board of Directors

Certain biographical information about the current members of the Board is set out on the following pages. Also described below are the particular

experiences, qualifications, attributes or skills that led the Board to conclude that the current members of the Board, including nominees for election to the Board at the Annual Meeting, are qualified to serve as Board members.

PIEDMONT NATURAL GAS COMPANY, INC.

- 2016 Proxy Statement 17

CORPORATE GOVERNANCE INFORMATION

Nominees for Class III Directors Continuing in Office Until 2019

|

|

|

|

|

| |

|

|

|

Mr. Gary A. Garfield |

| |

Independent |

| |

Director since: 2015 |

| |

Age: 59 |

| |

Finance and Enterprise Risk Committee; Compensation Committee |

| |

|

Mr. Garfield has been the Chief Executive Officer and President of Bridgestone Americas, Inc., headquartered in

Nashville, Tennessee, since March 2010, and was appointed as its Executive Chairman of the Board in January 2016. Mr. Garfield served as Vice President and General Counsel of Bridgestone Americas, Inc. since 2007. Effective January 2016, he was

appointed Executive Vice President of Bridgestone Corporation, the parent corporation of Bridgestone Americas headquartered in Tokyo, Japan, having served as a Senior Vice President since 2014 and Vice President and Senior Officer since 2011.

Mr. Garfield joined then-Bridgestone/Firestone, Inc. in 1991 as Senior Counsel. He has also served as Chief Compliance Officer and Secretary of Bridgestone Americas. Bridgestone Americas, has over 55,000 teammates globally and operates in five

continents. Mr. Garfield received his Bachelor of Arts degree with honors in political science and philosophy from Wittenberg University and his Juris Doctorate from the University of Cincinnati where he was a member of the Law Review and was

admitted to the Order of the Coif. Mr. Garfield serves as a member of the board of directors of several charitable and industry organizations, including the Tennessee Chapter of the Crohn’s & Colitis Foundation of America, the

Community Foundation of Middle Tennessee, the United Way of Middle Tennessee and the Rubber Manufacturer’s Association He joined the Board of Visitors—Vanderbilt Owen Graduate School of Business in 2011, and in 2012 was named National

Chair for the Take Steps Be Heard walk program for the Crohn’s and Colitis Foundation of America.

Qualifications, Experience, Key Attributes and Skills

| • |

|

Leadership. By virtue of his senior-level executive positions in a global manufacturing company, Mr. Garfield possesses strong strategic planning,

business development and managerial skills, as well as financial literacy, human resources, customer service and operations experience. |

| • |

|

Expertise. Mr. Garfield is a seasoned attorney with litigation, transactional and crisis management experience. He is the. chairperson of the

Bridgestone global committee on risk management. As a CEO, he is responsible for overseeing the financial success of a global manufacturing company. This expertise makes him a highly valuable member of the Board and its Compensation Committee and

Finance and Risk Management Committee. |

| • |

|

Unique Perspective. Mr. Garfield’s experience as CEO of an industrial company gives him the perspective of one of the Company’s

significant customer bases, the large industrial customer. His experience managing a major tire recall also gives him a unique risk management and public relations perspective. Additionally, his involvement with numerous civic and charitable

organizations in the Middle Tennessee region, where the Company has significant business operations, is an asset to the Company’s business and its philanthropic and charitable activities in the community.

|

|

|

|

|

|

| |

|

|

|

Dr. Frankie T. Jones, Sr. |

| |

Independent |

| |

Director since: 2007 |

| |

Age 68 |

| |

Benefits Committee; Finance and Enterprise Risk Committee |

| |

|

Dr. Jones has served as President and Chief Executive Officer of Phoenix One Enterprises, Inc., a management

consulting firm located in Greensboro, North Carolina, since January 2010. From January 1997 until December 2009, Dr. Jones was President and Chief Operating Officer of B&C Associates, Inc., an international public relations, research,

marketing and crisis management services firm headquartered in High Point, North Carolina. Dr. Jones holds a bachelor’s degree, two master’s degrees and a doctorate. His studies were completed at North Carolina A&T University,

Wayne State University, Duke University, Shaw University and Virginia University of Lynchburg. He completed postdoctoral graduate work at the Oxford Graduate School, concentrating in philosophy and transformational leadership. Dr. Jones is a

retired United States Air Force senior officer with 20 years of service. Dr. Jones was awarded the National NAACP “Roy Wilkins Meritorious Service Award” in 1990.

Qualifications, Experience, Key Attributes and Skills

| • |

|

Leadership. Dr. Jones has proven leadership experience, not only in his roles in senior executive positions at both B&C Associates, Inc. and

Phoenix One Enterprises, Inc., but also in his ability to counsel members of management at top companies across a broad range of industries on effective leadership. |

| • |

|

Expertise. In addition to his proven leadership ability and management skills, Dr. Jones also has vast experience working in marketing,

communications strategies, business development, crisis management and corporate social responsibility. |

| • |

|

Unique Perspective. Dr. Jones’ merit to Piedmont is demonstrated by his years of service as a senior officer in the United States Air Force,

his desire to continue his education in philosophy and leadership and his receipt of the National NAACP Roy Wilkins Meritorious Service Award, which is given to U.S. military members who distinguish themselves by contributing to military equal

opportunity policies and programs. |

18 PIEDMONT NATURAL GAS

COMPANY, INC. - 2016 Proxy Statement

CORPORATE GOVERNANCE INFORMATION

|

|

|

|

|

| |

|

|

|

Ms. Vicki McElreath |

| |

Independent |

| |

Director since: 2006 |

| |

Age 66 |

| |

Audit Committee (Chair); Benefits Committee |

| |

|

Ms. McElreath served as the Managing Partner of PricewaterhouseCoopers LLP (PwC) in the Carolinas from 1999 until her

retirement in June 2006. She joined Price Waterhouse, one of the predecessor firms of PwC, in 1979 and was admitted to the partnership in 1990. Ms. McElreath is a Certified Public Accountant (inactive) and graduated summa cum laude from Georgia

State University with a bachelor’s degree in business administration, majoring in accounting. From March 2012 until June 2015 she was a director of RBC Bank (Georgia), a subsidiary of The Royal Bank of Canada, and served as Chair of its Audit

Committee and of its Risk Committee. Previously she served as a director of RBC Bank, a former subsidiary of The Royal Bank of Canada, where she chaired its Audit Committee and served on its Trust and Compliance Committees. In 2014,

Ms. McElreath was appointed to the Board of Directors of Hatteras Financial Corp., a publicly-traded real estate investment trust headquartered in Winston Salem, North Carolina, and serves on its Audit Committee.

Qualifications, Experience, Key Attributes and Skills

| • |

|

Leadership. Ms. McElreath brings to the Piedmont Board her wealth of leadership and operational experience as a partner at PwC for 16 years and

Managing Partner in the Carolinas for seven years, and as a director of regulated for-profit entities headquartered in North Carolina and Georgia. |

| • |

|

Expertise. While a Certified Public Accountant and auditor with a major international accounting firm for more than 25 years, Ms. McElreath gained

experience dealing with complex accounting principles and judgments, internal controls, financial reporting rules and regulations and evaluating the financial results and financial reporting processes of large public companies such as Piedmont. This

experience makes Ms. McElreath well qualified to chair Piedmont’s Audit Committee, on which she serves as one of the Committee’s two designated Audit Committee Financial Experts. She also brings to the Board valuable risk management

expertise developed from her audit and board experience with companies having complex risk management practices, including as past chair of the Risk Committee of RBC Bank (Georgia), |

| • |

|

Unique Perspective. Ms. McElreath’s service on the boards of various private entities and not-for-profit organizations in Georgia provides

local perspective to the Company’s business venture in the Georgia market.

|

|

|

|

|

|

| |

|

|

|