Prologis to Build First Multistory Warehouse in the U.S.

November 01 2016 - 1:36PM

Dow Jones News

By Erica E. Phillips

Developers are having a harder time finding space for new

warehouses in increasingly crowded and expensive U.S. cities. Their

answer: build upward.

Prologis Inc., the world's biggest warehouse owner, is starting

construction next year on a three-floor 580,000-square-foot

warehouse just outside downtown Seattle that is scheduled to be

completed in 2018, the company told The Wall Street Journal. The

building will look like two warehouses stacked on top of each

other, with a truck ramp to loading docks on the second level and a

third floor, accessible via freight elevators, for lighter-scale

warehouse operations.

It will be the first building of its kind in the U.S., though

multistory warehouses are already common in countries like Japan

and Singapore, as well as elsewhere in Asia and Europe, where

vacant land is harder to find.

In the U.S., plenty of open space is available in rural areas

and suburbs. But as e-commerce sales grow, many retailers are

bringing warehouse operations closer to their customers, who

increasingly demand speedy delivery. Available warehouse space has

hit record lows in many urban markets in the U.S., driving up the

value of industrial land and pushing rental rates to new

heights.

"Major urban areas are running out of industrial space," said

Hamid Moghadam, chief executive of Prologis. "The only way the

logistics sector can compete is with this more dense format."

Large developers like Prologis have contributed to industrial

vacancy rates that remain below 5% in several major cities around

the country. As rents have risen, Prologis and other large

real-estate investment trusts have been reluctant to build new

space without a customer lined up for fear of flooding the market.

Mr. Moghadam has said constrained development drives down vacancy

rates, giving landlords the power to set rent prices at a

premium.

In Seattle, geographic features -- mountains, lakes and Puget

Sound -- also constrain available land for development. According

to real-estate firm Jones Lang LaSalle Inc., industrial vacancy was

2.5% in urban Seattle last quarter and land values have shot up 20%

to 25% over the last two years.

Prologis said it is also exploring multistory warehouses in

other cities where space is tight, including New York City, the San

Francisco Bay Area and the west side of Los Angeles. The firm

doesn't have tenants lined up for the Seattle project, but hopes to

have leases in place within a year of completing the facility.

For potential tenants, multistory operations in urban centers

don't come cheap: analysts estimate that rental rates for

Prologis's multistory facility could be as much as 50% higher than

standard warehouse rates.

Still, those rates could make sense for many retailers who will

be saving money on delivery costs by locating closer to customers,

said Andrew Hogenson, a Seattle-based retail consultant with Ernst

& Young LLP.

"The model has changed," Mr. Hogenson said. "You're no longer

just moving big volumes from one point to second point," such as

from remote distribution centers to big-box suburban stores,

"you're moving much smaller volumes to many points."

Retailers who can't reach their customers quickly could lose

those sales, Mr. Hogenson added. That is especially true in

Seattle, where homegrown Amazon.com Inc. offers free two-hour

delivery of many goods through its Prime Now service.

Large warehouse developments have faced resistance in some

regions. The Brookings Institution says denser warehouse

development could mean more trucks on city streets, leading to

potential negative effects on traffic, noise and air quality.

Residents from Newberry Township, Penn., to Moreno Valley, Calif.,

have called on lawmakers to halt large warehouse projects, citing

road congestion, public health and other concerns.

"With the surge in e-commerce shipments...a lot of regions are

currently grappling with what that means for long-term freight

planning and economic development," said Joseph Kane, a researcher

at Brookings. The Prologis project presents a "grand experiment"

that other cities can observe before approving similar facilities,

he said.

Seattle's city planners have supported the Prologis development,

which will create hundreds of jobs, said Nathan Torgelson, director

of the city's department of construction and inspections. He said

the city is processing two permits and expects to issue them within

the next 18 months.

Write to Erica E. Phillips at erica.phillips@wsj.com

(END) Dow Jones Newswires

November 01, 2016 13:21 ET (17:21 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

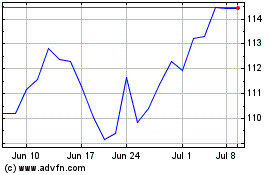

Prologis (NYSE:PLD)

Historical Stock Chart

From Mar 2024 to Apr 2024

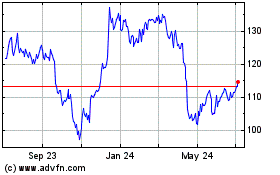

Prologis (NYSE:PLD)

Historical Stock Chart

From Apr 2023 to Apr 2024