Private-equity giant Blackstone Group LP has cut a deal to pay

$1.5 billion for a portfolio of logistics centers, in the latest

sign that this e-commerce-driven business is one of the hottest

area in the commercial-property industry.

Blackstone, the world's largest private real-estate owner, has

signed a contract to buy the 12 million-square-foot portfolio of

mostly West Coast property from LBA Realty LLC, an Irvine,

Calif.-based investment company with properties in the western

U.S., according to people familiar with the matter.

Once closed, the deal will mark Blackstone's biggest purchase of

U.S. distribution centers since it exited from the U.S. logistics

business in 2015 by selling IndCor Properties for $8.1 billion.

Logistics properties typically include warehousing and

distribution facilities for moving goods from manufacturers to

stores and customers.

Investor demand for such real estate has shown unusual

resilience during what many analysts and investors consider to be a

late stage of a bull market for commercial property. Prices keep

rising even as those in other commercial-real-estate sectors, such

as office buildings and malls, have shown signs of cooling.

Executives at logistics companies say their businesses are

benefiting from the growing importance of distribution in retail

and other industries. Increasingly, business profitability is being

determined by the efficiency, speed and costs of moving goods, they

say.

Some businesses, like retailing, are being completely

transformed by distribution as consumers migrate online, cutting

out the need for bricks-and-mortar stores. Many mall owners have

suffered while owners of logistics properties have been the big

winner from this trend.

"Distribution used to be just another part of the supply chain,"

said Charles Sullivan, president of U.S. operations for Global

Logistic Properties Ltd., the second-largest owner in the U.S.

sector. "Now logistics has moved up in its importance in corporate

strategy."

Big private-equity firms like Blackstone and foreign investors

such as Singapore's GIC Pte. Ltd. and the Abu Dhabi Investment

Authority have been among the most recent investors. Meanwhile,

other investors such as private-equity giant TPG, LBA and Ross

Perot Jr.'s Hillwood Development Co. have been responding by

putting logistics portfolios on the block. Hillwood sold a $1.1

billion portfolio earlier this month to Singapore-based Global

Logistic, whose major shareholders include GIC.

Stock investors also have been bullish. Big public logistics

companies such as Prologis Inc. are trading at a premium of about

7% to the value of their properties, according to analysts.

Companies that own other properties like malls, office buildings

and hotels are trading below asset values.

The logistics sector's strength is being fueled by rising demand

for space from Amazon.com Inc. and other Internet retailers. Rents

and occupancy rates are rising beyond the expectations of many

analysts and industry participants.

Net income of real-estate investment trusts that focus on

logistics, warehouses and other industrial property is expected to

rise 4.8% this year, more than any other property type except

apartment buildings and self-storage, according to Green Street

Advisors LLC. Last year, income in the industrial sector increased

4.5% versus the industry average of 4.2%.

Investing now could be particularly risky. An expected surge in

new supply in several parts of the country—including the Atlanta

and Dallas regions—could weigh on returns, analysts said, while the

torrid growth of e-commerce could slow. Because of razor-thin

margins and high delivery costs, online retail remains unprofitable

or barely profitable for many companies despite its surging

popularity.

But so far, demand growth from tenants is outpacing new supply,

according to analyst Eric Frankel of Green Street. "In some markets

there's meaningful new supply, but it's being absorbed very

quickly," he said.

Investor appetite for logistics property began growing in the

early years of the economic recovery and expansion partly because

they expected online retail to grow. Also prices were low thanks to

the pounding the sector took during the downturn.

As the economy strengthened, the sector was helped by

improvements in the home-building and automotive industries, both

heavy users of warehousing and distribution space. In some regions,

other factors fueled demand, including marijuana legalization.

"In the Denver market, all the functionally obsolete space got

absorbed by the marijuana industry," said Andrew Van Tuyle, chief

acquisitions officer of BH Management Inc., which owns about

500,000 square feet in that market. "All of a sudden the vacancy

for the overall industrial market became very low."

Changes in the online retail business also have fueled demand

for logistics space. As Amazon and others began offering faster

delivery, they began looking for so-called in-fill properties

closer to population centers that were partly designed to process

individual packages rather than pallets of goods bound for

stores.

TPG spent about $300 million of equity capital to build a

portfolio of about 16 million square feet of in-fill properties

starting in 2014, which it named Evergreen Industrial Properties.

Earlier this summer, the firm hired Eastdil Secured LLC to sell

Evergreen.

Blackstone was one of the early movers of the recovery in the

logistics market. It built its IndCor portfolio through about 18

acquisitions, often buying buildings from distressed sellers like

the Lehman Brothers estate. Blackstone cut a deal to sell IndCor to

Global Logistic in late 2014.

Blackstone made its IndCor investment through one of its

"opportunity" funds, which tend to make shorter-term, more highly

leveraged bets in pursuit of higher returns. Its purchase of the

LBA portfolio is through one of Blackstone's "core-plus" funds that

typically uses less leverage and hold investments for longer

periods of time, say people familiar with the matter.

Blackstone also owns 150 million square feet of logistics real

estate in Europe that it accumulated during the recovery. The firm

has been expected to try to sell it soon in an initial public

offering but so far hasn't announced its plans.

Write to Peter Grant at peter.grant@wsj.com

(END) Dow Jones Newswires

September 20, 2016 14:05 ET (18:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

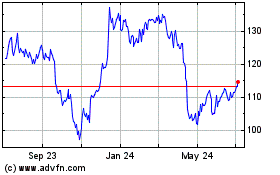

Prologis (NYSE:PLD)

Historical Stock Chart

From Mar 2024 to Apr 2024

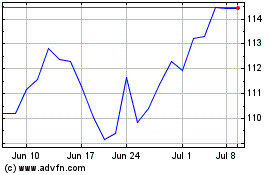

Prologis (NYSE:PLD)

Historical Stock Chart

From Apr 2023 to Apr 2024