Prologis Lifts Profit Outlook as Results Soar

October 20 2015 - 9:40AM

Dow Jones News

Prologis Inc. said profit and revenue soared in the third

quarter, as the San Francisco-based industrial real-estate company

continued to benefit from higher rents and occupancy rates.

The company boosted its earnings guidance for the year to $1.51

to $1.53 a share, up from its previous range of $1.12 to $1.16 a

share.

Prologis also narrowed its current-year forecast for core funds

from operations to a range of $2.19 to $2.21 a share from its

previous guidance of $2.18 to $2.22.

The current Prologis was formed in June 2011, when the nation's

two biggest publicly traded warehouse owners—Prologis and AMB

Property Corp.—merged in one of the largest real estate deals since

the recession.

In the latest quarter, Prologis said occupancy for real estate

it owns and manages ticked up to 96% from 95% a year earlier.

In all for the period ended Sept. 30, Prologis's profit rose to

$259 million from $136.2 million a year earlier. On a per-share

basis after the payout of preferred dividends, the company earned

49 cents a share, up from 23 cents a year earlier.

Core funds from operations were 58 cents a share, compared with

48 cents a share a year earlier.

Revenue surged 40% to $580.6 million.

Analysts polled by Thomson Reuters had forecast 19 cents a share

in earnings on $486.8 million in revenue.

Write to Chelsey Dulaney at Chelsey.Dulaney@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 20, 2015 09:25 ET (13:25 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

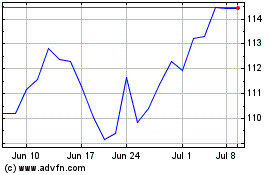

Prologis (NYSE:PLD)

Historical Stock Chart

From Mar 2024 to Apr 2024

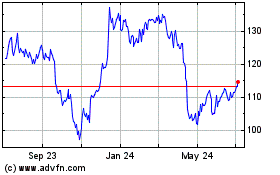

Prologis (NYSE:PLD)

Historical Stock Chart

From Apr 2023 to Apr 2024