Prologis Lifts Profit Outlook as Results Soar

October 20 2015 - 9:18AM

Dow Jones News

By Chelsey Dulaney

Prologis Inc. said profit and revenue soared in the third

quarter, as the San Francisco-based industrial real-estate company

continued to benefit from higher rents and occupancy rates.

The company boosted its earnings guidance for the year to $1.51

to $1.53 a share, up from its previous range of $1.12 to $1.16 a

share.

Prologis also narrowed its current-year forecast for core funds

from operations to a range of $2.19 to $2.21 a share from its

previous guidance of $2.18 to $2.22.

The current Prologis was formed in June 2011, when the nation's

two biggest publicly traded warehouse owners--Prologis and AMB

Property Corp.--merged in one of the largest real estate deals

since the recession.

In the latest quarter, Prologis said occupancy for real estate

it owns and manages ticked up to 96% from 95% a year earlier.

In all for the period ended Sept. 30, Prologis's profit rose to

$259 million from $136.2 million a year earlier. On a per-share

basis after the payout of preferred dividends, the company earned

49 cents a share, up from 23 cents a year earlier.

Core funds from operations were 58 cents a share, compared with

48 cents a share a year earlier.

Revenue surged 40% to $580.6 million.

Analysts polled by Thomson Reuters had forecast 19 cents a share

in earnings on $486.8 million in revenue.

Write to Chelsey Dulaney at Chelsey.Dulaney@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 20, 2015 09:03 ET (13:03 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

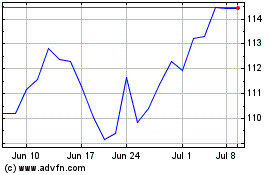

Prologis (NYSE:PLD)

Historical Stock Chart

From Mar 2024 to Apr 2024

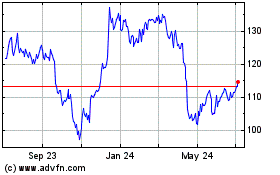

Prologis (NYSE:PLD)

Historical Stock Chart

From Apr 2023 to Apr 2024