Asian Shares Trade Higher Following Banner Day in the U.S.

November 22 2016 - 10:20PM

Dow Jones News

Asian shares traded in positive territory Wednesday, taking a

lead from record gains in the U.S. overnight that were driven by

continuing post-election exuberance.

The S&P/ASX 200 was recently up 0.9% and South Korea's Kospi

gained 0.3%. Japanese markets were closed for a public holiday.

The Dow Jones Industrial Average on Tuesday closed above 19,000

for the first time. It ended the day 0.4% higher at 19,023.87

points. The S&P 500 was up 0.2%.

Hong Kong's Hang Seng Index rose 0.4% Wednesday, the Shanghai

Composite was 0.3% higher and Taiwan's Taiex was up 0.5%.

While traders initially reacted badly to the prospect of a

Donald Trump presidency—particularly in Asia, where he is seen as

being skeptical of free-trade pacts—investors are coming around to

the view that his aggressive stimulus plans will counter most

negatives.

"The market views have changed," said Ric Spooner, chief market

analyst at CMC Markets in Sydney. "The overriding sentiment is that

[initial] misgivings about a Trump presidency are being offset by

expectations that he has proposed a fiscal stimulus."

Mr. Trump has promised to increase spending on infrastructure,

which would lift global prices for steel and cement. Demand for

commodities, especially copper, would also benefit, Mr. Spooner

said.

In Australia, miners BHP Billiton and Rio Tinto gained 2.7% and

2.2% respectively while Korean steelmaker and miner Posco added

1%.

Prices of copper, nickel and zinc were trading higher on the

London Metal Exchange, according to FactSet data.

Average growth in the U.S. is expected to rise to 2.2% in 2017

from 1.5% in 2016, Deutsche Bank Wealth Management said in a note

Wednesday.

U.S. home buying activity rose in October for the second

straight month to a new cyclical high, an indication of robust

demand. October sales of previously owned homes rose at the

strongest pace since February 2007.

Elsewhere, traders were watching an interest-rate decision from

the Malaysian central bank. Bank Negara Malaysia is expected to

hold its policy rate at 3% as the recent weakening of the ringgit

has crimped its headroom in spite of a benign inflation

outlook.

Write to Kenan Machado at kenan.machado@wsj.com

(END) Dow Jones Newswires

November 22, 2016 22:05 ET (03:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

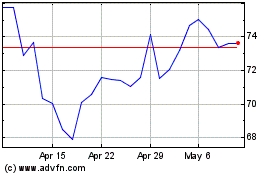

POSCO (NYSE:PKX)

Historical Stock Chart

From Mar 2024 to Apr 2024

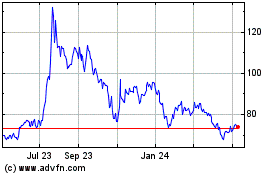

POSCO (NYSE:PKX)

Historical Stock Chart

From Apr 2023 to Apr 2024