Report of Foreign Issuer (6-k)

February 22 2016 - 9:08AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

February 22, 2016

POSCO

———————————————————————————————————

|

|

(Translation of registrant’s name into English)

|

|

|

|

POSCO Center, 440 Teheran-ro, Gangnam-gu, Seoul, Korea, 135-777

|

———————————————————————————————————

(Address of principal executive office)

|

|

|

|

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F: [x] Form 20-F [ ] Form 40-F

|

|

|

|

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): [ ]

|

|

|

|

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): [ ]

|

|

|

|

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934: [ ] Yes [x] No

|

|

|

|

If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): n/a

|

|

|

An English-language translation of documents with respect to Resolution on

Merger decision.

SIGNATURES

|

|

|

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

POSCO

|

|

|

|

|

|

Date: February 22, 2016

|

By:

|

/s/ Noh, Min Yong

|

|

|

Name:

|

Noh, Min Yong

|

|

|

Title:

|

Senior Vice President

|

|

|

|

|

EXHIBIT INDEX

|

Exhibit No.

|

|

Description

|

|

|

|

|

99.1

|

|

Resolution on Merger Decision

|

|

|

|

|

Resolution on Merger decision

On February 19, 2016, the Board of Directors of POSCO resolved to acquire and merge POSCO

GREEN GAS TECHNOLOGY, one of the subsidiaries into POSCO. The type of merger is a “small scale

merger”, which is based on the Article 527-3 of the Commercial Law(Korea).

The information in detail is as follows :

| |

|

|

| |

|

Enhancing the shareholders’ value by : |

Purpose of the

Merger

|

|

- increasing operational efficiency

- creating synergies between businesses |

|

|

|

|

| Effect on Management

|

|

As of the public disclosure date, POSCO holds a 100% stake in POSCO

GREEN GAS TECHNOLOGY. The merger ratio is 1:0, and POSCO will not be

issuing new shares. The status of largest shareholder of POSCO stays

the same.

On the completion of merger, POSCO will remain as a surviving company. |

|

|

|

|

Other information

for investors

|

|

By the Article 527-3 of the Commercial Law(Korea), in the case of

small scale merger, appraisal right by stockholders of POSCO is not

applicable.

By the Article 527-4 of the Commercial Law(Korea), this merger may be

canceled if more than 20% stockholders of surviving company notice

objection on merger in writing within two weeks from merger

announcement day. The merger will be approved by The Board of

Directors on March 25, 2016. |

|

|

|

|

<Company profile>

| |

|

|

|

|

|

|

|

|

|

|

| Company Name |

|

POSCO GREEN GAS TECHNOLOGY |

| |

|

|

| Main Business |

|

Sales of Synthetic Natural Gas |

| |

|

|

Financial status(2014) (in KRW)

|

|

Total Asset

|

|

|

894,226,037,501 |

|

|

Total Capital

|

|

|

68,260,000 |

|

|

|

|

|

|

|

|

|

|

|

|

Total Liabilities

|

|

|

214,914,628,914 |

|

|

Sales revenue

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

Total Equity

|

|

|

679,311,408,587 |

|

|

Net profit

|

|

|

-3,288,591,413 |

|

|

|

|

|

|

|

|

|

|

|

|

<Timeline>

| |

|

|

Resolution on merger decision(The Board of Directors)

|

|

February 19, 2016 |

|

|

|

Notice of Closing of the Shareholders Registry

|

|

February 22, 2016 |

|

|

|

Conclusion of a contract

|

|

February 26, 2016 |

|

|

|

Record date for Closing of the Shareholders Registry

|

|

March 8, 2016 |

|

|

|

Period for Closing of the Shareholders Registry

|

|

March 9, 2016~ March 16, 2016 |

|

|

|

Merger announcement

|

|

March 9, 2016 |

|

|

|

Period for Receiving Shareholders’ Objection on merger

|

|

March 9, 2016~ March 23, 2016 |

|

|

|

Resolution on merger approval(The Board of Directors)

|

|

March 24, 2016 |

|

|

|

Notice of Receiving Creditors’ Objection on merger

|

|

March 29, 2016 |

|

|

|

Period for Receiving Creditors’ Objection on merger

|

|

March 30, 2016~ April 30, 2016 |

|

|

|

Date of merger

|

|

May 1, 2016 |

|

|

|

Notice of completion of merger

(Approval of the Board of Directors required)

|

|

May 13, 2016

|

|

|

|

Registration of merger

|

|

May 16, 2016 |

|

|

|

*The timeline may be adjusted.

*If you wish to object to the merger, please contact Jayne Whalen at Computershare at 201-222-4412

for the objection form. Completed form needs to be faxed to Citibank, N.A., as Depositary, prior to

4:00 p.m. (New York City time) on March 18th, 2016 at 201-222-4593 (attn.: Jayne Whalen).

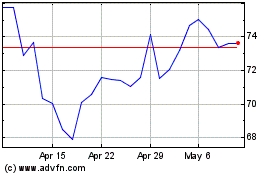

POSCO (NYSE:PKX)

Historical Stock Chart

From Mar 2024 to Apr 2024

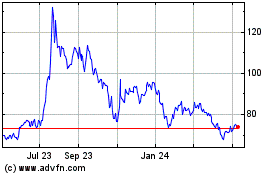

POSCO (NYSE:PKX)

Historical Stock Chart

From Apr 2023 to Apr 2024

See More Message Board Posts

It looks like you are not logged in. Click the button below to log in and keep track of your recent history.