ADRs End Mixed; Royal Dutch Shell, Total Rise

January 28 2016 - 6:24PM

Dow Jones News

International stocks trading in New York were mixed on

Thursday.

The BNY Mellon index of American depositary receipts edged up

0.05% to 117.31. The European index rose 0.05% to 118.03, the Asian

index eased 0.12% to 124.79, the Latin American index rose 0.9% to

132.65 and the emerging markets index increased 0.08% to

195.94.

Royal Dutch Shell PLC's (RDSA, RDSA.LN) and Total SA (TOT,

FP.FR) were among the companies with ADRs that traded actively.

BG Group PLC's shareholders signed off on Shell's roughly $50

billion takeover bid for the company, clearing the final hurdle to

a deal that will create one of the world's largest liquefied

natural gas producers while also bolstering Shell's deep water oil

projects. Shell's ADRs rose 3.7% to $43.33.

Iranian Oil Minister Bijan Zanganeh said his country will sign

an agreement with Total allowing the French oil major to buy

hundreds of thousands of barrels of Iranian crude oil a day,

ramping up the country's efforts to attract investment in its oil

industry following the lifting of international sanctions. ADRs

rose 1.8% to $44.05.

Alibaba Group Holding Ltd. (BABA) posted stronger-than-expected

earnings in its latest quarter despite a slowdown in China's

economy, highlighting the resilience of China's consumers. Still,

ADRs of the Chinese e-commerce giant fell 3.8% to $66.92.

Banco Bradesco SA (BBDO, BBD, BBDC4.BR) warned on of little or

no increase in business demand for credit this year as Brazil

remains mired in recession. While Brazil's fourth-largest bank in

terms of assets reported a rise in fourth-quarter net profit, its

also recorded an increase in bad debts. ADRs fell three cents to

$4.74.

Diageo PLC (DEO, DGE.LN) reported that its half-year operating

profit tumbled on lower sales in the U.S., adding to pressure on

Chief Executive Ivan Menezes to turn around the company's most

important market. ADRs of the maker of Johnnie Walker whisky and

Smirnoff vodka fell 13 cents to $106.29.

The U.K. government said it has postponed a planned sale of

shares in the partially state-owned lender Lloyds Banking Group PLC

(LYG, LLOY.LN), citing continuing turmoil in financial markets. The

British government began selling its stake in the lender last year

and currently owns less than 10% of the bank, which was bailed out

by taxpayers in 2008. ADRs rose 1.1% to $3.75.

Brazilian oil company Petroleo Brasileiro SA (PBR, PETR3.BR,

PETR4.BR) unveiled changes to its management structure intended to

save 1.8 billion reais ($441.5 million) per year. The changes are

necessary for the state-controlled company, known as Petrobras, to

adapt to "the new reality of the oil and gas sector" and to give a

greater priority to profit and financial discipline, the company

said in a note to Brazil's market regulator. ADRs rose 2.2% to

$3.20.

Posco (PKX, 005490.SE), the world's fifth-largest steelmaker by

output, reported its first ever annual loss, hit by China's

slowdown, investment write-downs and a weaker local currency that

inflated its overseas debt. South Korean steelmaker's ADRs rose

five cents to $35.72.

Write to Tess Stynes at tess.stynes@wsj.com

(END) Dow Jones Newswires

January 28, 2016 18:09 ET (23:09 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

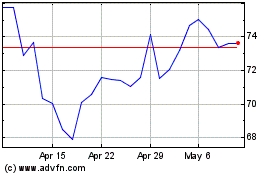

POSCO (NYSE:PKX)

Historical Stock Chart

From Mar 2024 to Apr 2024

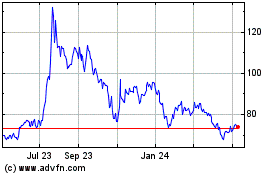

POSCO (NYSE:PKX)

Historical Stock Chart

From Apr 2023 to Apr 2024