SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15D-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of July, 2015

Commission File Number: 1-13368

POSCO

(Translation of registrant’s name into English)

POSCO Center, 440 Teheran-ro, Gangnam-gu, Seoul, Korea, 135-777

(Address of principal executive office)

(Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F x Form 40-F ¨

[Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the

Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ¨ No

x

[If “Yes” is marked, indicate below the file number assigned to the registrant in

connection with Rule 12g3-2(b) : 82- .]

POSCO is furnishing under cover of Form 6-K:

Exhibit 99.1: An English-language translation of documents with respect to Performance in 2Q 2015 of POSCO

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

POSCO |

|

|

|

|

|

|

(Registrant) |

|

|

|

|

| Date: July 15, 2015 |

|

|

|

By |

|

/s/ Noh, Min-Yong |

|

|

|

|

|

|

(Signature)* |

|

|

|

|

Name: |

|

Noh, Min-Yong |

|

|

|

|

Title: |

|

Senior Vice President |

| * |

Print the name and title under the signature of the signing officer. |

|

| Exhibit 99.1

|

Exhibit 99.1

posco

2015 2Q Earnings Release

July 15, 2015

Q Operating Performance

Business Strategy (IP

2.0)

Figures in this presentation are based on unaudited financial statements of the company.

Certain contents in this presentation are subject to change during the course of auditing process.

2Q Operating Performance

Parent Income

Profitability improved as WP product sales increased, despite the slow market

Production Sales Income

(in thousand tons) (in thousand tons, thousand KRW/ton) (in billion KRW)

9.2% 9.2%

741

9,260 9,316 670

9,183 7.6%

Crude 620

Steel Carbon OP 8,930 Steel Price Margin

8,601 8,600 8,876

8,542 8,532 7,420 6,788

6,576

Revenue

Steel 622 608

565

Product

Operating Profit

2014.2Q 2015.1Q 2015.2Q 2014.2Q 2015.1Q 2015.2Q 2014.2Q 2015.1Q 2015.2Q

[Sales Volume and Inventories] [WP* Product Sales Portion ] 2014.2Q 2015.1Q 2015.2Q 2014.2Q 2015.1Q 2015.2Q (thousand

tons, %) 37.7 Carbon 32.8

8,165 8,170 8,452 Domestic 4,697 4,223 4,367 Portion

Steel 3,132

Sales 2,581

S T S 436 430 478 Exports 3,845 4,309

4,509

(portion) (45.0) (50.5) (50.8) Volume

* Gwangyang) No.4 HR mill completion : Invento-

977 1,276 1,257 2014.2Q 2015.2Q

October 2014 ries

*World Premium : POSCO’s high-end product category

3

POSCO Earnings Release July 15, 2015

2Q Operating Performance

Consolidated Income

Profit declined due to poor performance of domestic and overseas affiliates

Revenue Operating Profit Net Profit

(in billion KRW) (in billion KRW) (in billion KRW)

OP 5.0% ROE 4.3%

16,704 4.8% 3.0%

Margin 4.5%

1.0% 15,101 15,189 839 487 335 731

686 117

2014.2Q 2015.1Q 2015.2Q

? Net profit declined YoY

· Plantec-related losses : (’15.Q2)170 2014.2Q 2015.1Q 2015.2Q 2014.2Q 2015.1Q 2015.2Q · Forex-related losses: (’14.Q2)283 (’15.Q2)78

Revenue Operating Profit Net Profit*

(in billion KRW)

2014.2Q 2015.1Q 2015.2Q 2014.2Q

2015.1Q 2015.2Q 2014.2Q 2015.1Q 2015.2Q

Steel 12,564 11,764 11,505 643 551 478 570 352 ?26 Trade 7,970 7,003

7,079 108 114 97 96 95 61 E & C 2,581 2,435 2,561 51 29 36 13 82 132 Energy 571 584 471 35 89 20 14 62 11 I C T 273 218 241 14 5 9 3 2 13 Chem/Mat’l /Others 821 756 705 35 20 7 43 2 ?9 Total 24,780 22,760 22,562 886 808 647 627 427 105

* Net Profit : Internal trading included (ex. impairment loss by Plantec share price drop)

4

POSCO Earnings Release July 15, 2015

2Q Operating Performance

Financial Structure

Liabilities to Equity ratio returned to the level of 2Q 2014, supported by sales of POSCO Specialty Steel

Assets Liabilities Equity

(in billion KRW) (in billion KRW) (in billion KRW)

Liabilities

84,631 to Equity 89.8

84,567

(%) 86.9

83,656 86.8

45,271

44,573 44,762 40,058

39,296

38,894

2014.2Q 2015.1Q 2015.2Q 2014.2Q 2015.1Q 2015.2Q 2014.2Q 2015.1Q 2015.2Q

POSCO Earnings Release July 15, 2015

2015 Business Plan

Consolidated Business Target

2014 2015(F)

POSCO Target (Parent)

Revenue (trillion 29.2 27.7

KRW)

Crude Steel Production (million 37.7 37.8

tons)

Product Sales () 34.3 35.4 Investment (trillion 3.0 3.0

KRW)

Consolidated Target

Revenue (trillion 65.1 63.9 KRW)

Investment () 5.4 4.2

POSCO Earnings Release July 15, 2015

Appendix#1. Business Environment

Global Steel

Demand

China’s Steel Economy Steel Demand in Major Countries

“Expect modest recovery in 2H, “Global demand to slightly fall, influenced by China” with the effect of the

economy stimulus plan”

Actual economic sentiment worsened as the price and

China : Steep demand fall in 1H will cause 2015 demand to demand fell during 1H decline more than expected (0.5%) despite

2H recovery

—Steel demand fell within 5%, Steel PMI for June was at its worst since 2008 US : 2015 demand

to remain stable yoy as automobile and construction demand increased despite declined Demand and price are to recover due to restocking adjustments and the state infrastructure investment energy pipe demand

—Chinese government approved 800 billion Yuan worth of Emerging Countries : Partially offset the effect from

China’s infrastructure investment in 1H weak demand as the countries will show firm growth of 4~6%

- 2H

restocking demand to pick up as 1H inventories dry out

[China’s Crude Steel Production and Steel PMI]

[Outlook for Demand in Major Countries]

(in million tons)

48.2 Steel PMI (pt) 2012 2013 2014 2015

45.1 YoY YoY

43.0 43.0 42.4 US

37.4 96.2 95.7 106.9 11.7% 106.5 0.4% EU 139.2 140.4 146.8 4.5% 149.9 2.1%

14.7 15.2

13.7 12.9 12.9 China 660.1 735.1 710.8 3.3% 690.0 3.0%

11.0

India 72.4 73.7 75.3 2.2% 80.0 6.2% Steel

SEA 58.9 63.2 65.3 3.2% 68.9 5.5%

Distribution Stocks

(million tons) MENA 66.2 66.8 70.1 5.0% 72.9 4.1% Global 1,439.3 1,528.4 1,537.3 0.6% 1,507.0 ?2.0%

‘15.1 2 3 4 5 6

* World Steel Association, Mysteel, China Federation of Logistics & Purchasing * World Steel Association(April 2015), POSRI

7

POSCO Earnings Release July 15, 2015

Appendix 1. Business Environment

Domestic Steel

Demand

Outlook for Demand Industries

Production dropped as 1H exports struggled, 3Q to rebound slightly YoY (thousand units) 1,214

1,206

1,108 1,002

Automobile Domestic (thousand units) : 345 (‘15.1Q) 393 (2Q) 350 (3Q) 976

Production

Exports (thousand units) : 734 (‘15.1Q) 818 (2Q) 652 (3Q) (million GT)

6.3 6.0 6.4

While 3Q orders continue to decline,

3Q building is to steadily go up 5.7 4.9

Shipbuilding Building (million GT): 6.3 (‘15.1Q) 6.0

(2Q) 6.4 (3Q) Building Order (million GT): 4.9 (‘15.1Q) 7.9 (2Q) 3.8 (3Q) (trillion KRW)

55.5

Both 3Q investments on construction and

engineering to climb up YoY 53.2 53.7

(trillion KRW) 26.0 (‘15.1Q) 35.5 35.7 (3Q) 51.9 39.6

Construction Construction : (2Q) Investment

Engineering (trillion KRW) : 13.6 (‘15.1Q) 20.0 (2Q) 17.9 (3Q) 2014.3Q 4Q 2015.1Q 2Q 3Q

* POSRI(July 2015)

“3Q steel consumption to decline slightly as inventory level remains

Outlook for Supply/Demand due to slow automobile sales, while production will be stable YoY as imports decline and demand industries recover”

(in thousand tons) 2013 2014 2015

1Q 2Q 3Q YoY

Nominal Consumption 51,762 55,521

54,710 13,021 14,480 13,580 -0.2% Export 29,191 32,257 32,890 7,888 7,880 8,075 -1.2% Production 69,146 74,109 74,688 17,695 19,210 18,625 +1.1% Import 11,807 13,669 12,912 3,214 3,150 3,030 -9.8% Incld. Semi-products 19,393 22,749 22,153 5,554

5,195 5,195 -7.8%

* POSRI(2015.7)

8

POSCO Earnings Release July 15, 2015

Appendix 1. Business Environment

Raw Materials

Iron Ore Coking Coal

Price went up due to temporarily tight supply and

Price slightly upturned after reaching its bottom demand, as exports from Brazil and Australia to 2015.2Q 2015. 2Q on spot

basis in May (FOB U$82/ton, May 11).

China during March~April declined. However, as

However, as 3Q benchmark price (U$93/ton) was set

Chinese steelmakers’ margin shrank, the price low, the price movement stabilized downturned

“Fine ore within CFR U$55/ton” “Hard Coking Coal within FOB U$88/ton”

Price is to stay weak due to decreased purchasing Under the oversupply situation, the price is to stay 2015.3Q power in the upcoming slow season, existing 2015.3Q weak at current level due

to weak fundamentals for steel market depression in China, and inflow of market upturn and slow demand, at the backdrop new productions of major miners, such as RoyHill of the slow season in Chinese steel economy approaches

[Iron Ore Price] (US$/ton) [Coking Coal Price] (US$/ton)

133 135

120 142 142

122

103 113 112 111 105 90

74 62 58 88 88

55

2013 2013 2014 2014 2014 2014 2015 2015 2015 2013 2013 2014 2014 2014 2014 2015 2015 2015

3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q(f) 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q(f)

*Platts 62% Fe IODEX CFR China (Quarter Average Spot) *Platts HCC Peak Downs Region FOB Australia (Quarter Average Spot)

9

POSCO Earnings Release July 15, 2015

Appendix 2. Financial Statements

Summarized

Statements of Income

(in billion KRW)

2014.2Q 2015.1Q 2015.2Q QoQ Revenue 16,704 15,101 15,189 +88 Gross Profit 1,813 1,798 1,721 77 (Gross Margin) (10.9%) (11.9%) (11.3%)—Selling & Admin. Expenses 973

1,066 1,035 31 Operating Profit 839 731 686 45 (Operating Margin) (5.0%) (4.8%) (4.5%)—

Other

Operating Profit ?242 58 ?135 ?193

Share of Profit (loss) of

37 63 22 +85

Equity-accounted investees

Finance Items Gains

160 ?122 ?269 ?147

Foreign Currency Transaction

283 978 69

& Translation Gains (loss)

Net Profit 487 335

117 ?218

(Net Margin) (2.9%) (2.2%) (0.8%)—

Owners of the Controlling

511 339 198 141

Company

10

POSCO Earnings Release July 15, 2015

Appendix 2. Financial Statements

Consolidated

Statements of Financial Position

(in billion KRW)

2014.2Q 2015.1Q 2015.2Q QoQ Current Assets 31,874 31,948 31,473 475 Cash & Financial Goods* 5,456 6,577 7,435

+858 Account Receivable 12,276 11,653 11,134 ?519 Inventories 10,876 10,046 9,352 694 Non-Current Assets 52,693 52,683 52,183 500

Other Long-term

Financial Assets** 4,655 3,514

3,355 ?159

PP&E 35,500 35,210 34,917 ?293

Total Assets 84,567 84,631 83,656 975 Liabilities 39,296 40,058 38,894 1,164 Current Liabilities 21,075 22,559 22,028 531

Non-Current Liabilities 18,221 17,499 16,866 633 (Interest-bearing Debt) 26,974 28,094 27,771 323 Equity 45,271 44,573 44,762 +189

Owners of the

Controlling Company 41,585 41,237

41,517 +280

Total Liabilities & Equity 84,567 84,631 83,656 ?975

* Cash & Financial Goods : Cash and cash equivalents, Short-term financial goods, Short-term available for sale

securities, Current portion of held-to-maturity securities, and Derivatives asset held for trading **Including Other bonds 11

POSCO Earnings Release July 15, 2015

2Q Operating Performance

Business Strategy (IP

2.0)

Innovation POSCO 2.0

—Accelerating

innovation through management reforms

July 15, 2015

POSCO

* IP : Innovation POSCO

Contents I. IP 1.0

Vision & Results

1. Background of IP 1.0

2. IP 1.0 Results

II. Introduction of IP 2.0

III. Key Strategies

IV. 2017 Financial Target & Vision

Posco

External environment

-1. Background of IP 1.0

Launched the vision of “POSCO the Great” and IP 1.0 strategies (Mar. ’14)

Loss-making businesses increased as investment weighed on growth

Steel oversupply & margin squeeze intensified

2013 perfomance plunged compared to 2008

–

Unfocused investments on wide range

– OP Margin: 17.2 ? 4.8% (con.) – Heavy oversupply of

500 million tons (‘13) of businesses (materials/energy/infra.)

– Liabilities to Equity: 65.2

84.3%(con.) – OP margin gap among 5 major competitiors*

– Poor performance results of growth biz

– Credit Rating: A1? Baa2 (Moody’s) shortened

(Mg smelting, High-purity alumina, etc) (’08)

12.2 (‘13) 4.6%p.

Survival

– Performance of large overseas investments

endangered * A-M, NSSMC, JFE, TKS, Baoshan at risk (TKS in parent basis)

1 Strengthen 2 Select and Focus 3 Improve 4 Renew Steel New Growth Financial Structure Management Competitiveness Business

Infrastructure

Innovation POSCO 1.0 Agendas

15

-2. IP 1.0 Results

Generated substantial results

as of 1H 2015 with IP 1.0

2014 target for mid-term reached (consolidated EBITDA 6.5 trillion KRW)

(Target) 6.2 trillion KRW

Expanded high-end products sales with solution-marketing ’14 ’15.1H

Solution-based

Secured World Top technology

advantage of WF/WB* sales volume 130 97

100 90 products (10 thousand tons)

Targe Results

* World First / World Best

Executed Smart Exit on

non-core biz (ex. civil mining) 16

Set base for commercial sales of POSCO’s own tech. Non-core Biz 14

Smart Exit

—Lithium extraction, Ni convergent smelting technologies (cases) 2 3 verified at pilot plant stage

Improved financial soundness with non-debt financing .1

(raised 3.6 trillion KRW) Financing 2.0

1.5

Restructuring

Steps taken to recover Credit Ratings (trillion KRW, 0.8

- S&P rating (Jun, ‘15): BBB+Negative BBB+Stable cases) cases (2 (21) (9 (10)

Settled project-based working environment

IP PJT

1.4

Nurtured experts and performance-based compensation expected profit 0.7

(545 cases)

(PCP* increased, salary paid by results) (trillion KRW) (410 cases)

| * |

|

POSCO Certified Professional |

Non-debt financing target reached, while efforts to turn around loss-making businesses and restructuring remained

disappointing ? Lack of responsibility management system and complacent attitude remains 16

Strengthen steel

competitiveness

Select & focus new growth biz

Improve financial structure

Renew management infrastrucuture

Remaining tasks

Contents I. IP 1.0 Vision & Results

II.

Introduction of IP 2.0

1. Importance of IP 2.0

2. Meaning of IP 2.0

3. IP 2.0 Strategy

. Key Strategies

. 2017 Financial Target & Vision

* IP : Innovation POSCO

-1. Importance of IP 2.0

Mid-term target

challenged due to recently worsened corporate environment and rise of trust crisis

Steel price trend($)

Subsidiaries contribution (%) Stock price of major steelmakers

POSCO Subsidiaries (aggregated) NSSMC

* HR : Chinese Guangzhou price (+1%)

* Slab : CIS export price (FOB) Total Revenue Total OP

(trillion

KRW)

(98.2) (45.3) (3.5) (1.5) POSCO 100% (-25%)

50% 70% 70%

ArcelorMittal

32% 16% (-29%)

* 2015 HR price outlook was $535,

at the time ‘14 ‘15(1Q) ‘14 ‘15(1Q) of setting mid-term strategy (April, 2014) ’14.Jan ’14.Jun ‘15.Jan ‘15.Jun

Worsened steel market

Weak performance of

Subsidiaries

Rise of trust crisis

Both demand and product price fell

Global steel

demand down 1.5% , Product price fell 22% (‘15.1H)

Oversupply and competition intensified

Japanese mills with the low yen and Chinese mills and CIS pressured price

Subsidiaries under more pressure

POSCO OP increased by 140 billion KRW yoy, while consolidated OP fell by 150 billion KRW yoy (‘15.1H)

Recovery of overseas business delayed—‘14) Overseas NP margin 0.7%

Reputation tarnished

Slush fund scandal of

P-E&C

Overpriced takeover of underperfoming companies

Lack of trust as resturcturing delayed

Need to upgrade to IP 2.0 through revising IP 1.0

18

?-2. Meaning of IP 2.0

Strategy of IP 1.0

reinforced through fundamental reforms

Innovation POSCO (IP) 2.0

Action and trust doubled

Innovation POSCO (IP) 1.0

One, Top, New Improve

Recover Performance trust

Renewed Emergency 4 Innovative Agendas

Management Council

Activated Derived Reform Management Plans The year 2018, groundwork for the next 50-years

19

Worsened external environment

Continued poor performance of domestic affiliates and overseas businesses

Execution power weakened as trust issues rise

-3. IP 2.0 Strategy

Enhance corporate value with

ethical management and restructuring

Rebuild trust by setting responsibility management and creating

sustainable business structure

IP 1.0 IP 2.0 Innovative Agenda Causes Innovative Agenda

Strengthen

Steel Prolonged margin squeeze Strengthen Steel Overseas profit pressured as emerging markets slow down Competitiveness

Competitiveness

Improve Concerns over lack of restructuring on low-profit businesses Speed-up Financial recessions and Prolonged increased volatility risk Restructuring

Structure

Reached non-debt financing target of 3.6 trillion KRW

Demand for renewable energy fell due to oil price decline

Select & Focus ? Materials market yet to boom and profitability weak due Generate Results of

New Growth Biz to recession New Growth Biz

Complete early-exit on weak new business (19 businesses)

Renew Trust crisis conjured up with request for corporate reform Build Ethical Management ? Need to reinforce

performance-based compensation and Management

Infrastructure responsibility Infrastructure

20

Strengthen

Steel Competitiveness

POSCO the Great The Most Respected & Beloved Company Globally

Vision

Innovative POSCO 2.0

Innovative

Agenda

Speed-up Restructuring

3 Generate

Results of

New Growth Biz

4 Build Ethical

Management Infrastructure

management reform to rebuild execution power and trust

Clean POSCO

Mgmt.

Ideas

One POSCO

New POSCO

Top POSCO

IP 2.0 Vision

2 3 4

Clean One New Top POSCO POSCO POSCO POSCO

21

Contents I. IP 1.0 Vision & Results II. Introduction of IP 2.0

III Key Strategies

1. Strengthen Steel

Competitiveness

2. Speed-up Restructuring

3. Generate Results of New Growth Biz

4. Build Ethical Management Infrastructure

IV.

2017 Financial Target & Vision

* IP : Innovation POSCO

III-1. Strengthen Steel Competitiveness

Recover

World-Top level of profitability

IP 2.0 Key Strategy Target

2.5

Rebuild strategy for overseas investments 2.3

Solution-based Sales 1.8

1.3 45 50%

<Upstream> Volume 40

33

- Avoid new upstream investments (WP ratio)

-

Lower the risk with local partnerships on pre-invested ’14 ’15 ‘16 ‘17

2.5 million

tons upstreams

<Downstream> Automotive Steel 9.5

8.7 9.1

- Downstream overseas expansion, based on CGL and Sales Volume

8.3 357 thousand

Coil Center (Automotive CG)

322 tons

- Proceed joint expansion overseas with suppliers 289 294

Elevate POSCO’s own solution-marketing 9.5 million tons

’14 ’15 ‘16 ‘17

? Number of CGL line

(‘15) Domestic 6,

Overseas 4 ?

+ + (‘17) Domestic 7, Overseas 5

91%

Cost competitiveness with pursuing more Competitive Tender 84 profitability-based transactions Portion 77

74

- 100% competitive tender, Reduce

internal-trading

- Remove excessiveness and execute extreme cost- 91 % ’14 ’15 ‘16

‘17 reduction (0.5 trillion KRW/yr) (To reach 99% by 2018) 23

Technical

Solution

Commercial

Solution

Human

Solution

III-2. Speed-up Restructuring

Solidify financial

base by focusing on restructuring low-profitability businesses IP 2.0 Key Strategy Target

Realign the group

portfolio Group Portfolio

- Foucs on steel and 4 main domains and keep its progress

Steel+4 domains

Reduce low-performing domestic affiliates by 50%

- Dispose subsidiaries lacking independent competitiveness 47

42

- Strict control on insolvent new businesses 33

Domestic Affiliates

22

Reduce 30% of overseas businesses within the

25 companies to reduce

group * Based on fair-trade law ’14 ’15 ‘16 ‘17

- Pursue early turn-around of newly run overseas steel biz.

- Dispose/liquidate/merger non-core business within the group 181

167

Overseas Subsidiaries 141

Set regular

restructuring system

117

- Run resturcturing task-force team (namely Work-out TF) 64 companies to reduce

- Stronger risk management on liquidty and businesses of ’14 ’15 ‘16 ‘17 subsidiaries

Aggregated performance results of companies target for restructuring (based on 2014 )

: Operating Loss 292.6 billion, Net Loss 548.2 billion KRW

24

Materials steel trading infra. energy

III-3. Generate Results of New Growth Biz

Early

development of new growth businesses

IP 2.0 Key Strategies Target

New growth business : Invest by using TPB-based profit : Over 120 billion KRW (‘16) POSCO-owned technology A

- Core Technology: Finex, CEM, Li Extraction, Ni E

Smeltering, fuel cell battery, etc

B Hub

- Recreate business terms through TPB*

strategy (POSCO)

? A~E : Partner * Technology based Platform Biz companies

Commercialize technology that bears global edge C T : POSCO sales tech.

D E : Engineering tech.

- Lithium Extraction: D/P* to finalize by 2016, Start M : Money commercial production by 2017 (20,000 tons) T’, T” : Tech. of partners

- Nickel Smeltering : Proven availability to commercialize <Technology-based Platform Biz.(TPB)> in 2015, Start

building D/P by 2016 (5,000 tons)

- Fuel cell : Finalized the plant in 2015, Develop

* Demo Plant Commercialization of ‘17 Commercial Production

convergence solution by 2016

Lithium by 2017

(20,000 tons/year) ’16.E

Complete Demo Plant

Find ‘Smart Industry Platform’ based new business

’15. Proved technology for

- Set Smart Factory for steel-making process (to apply in Mar. large scale demo plant Plate line in Gwangyang in 2016) (PP3)

- Proceed Smart Building, Smart City project

(in relation with PIF) Product price (as of July 2015)

—Hydroxide Lithium U$9,000/ton, Carbon Lithium U$6,500/ton

<Timeline for Li Commercialization>

25

M+t” M t t M+t’ T+E m

M+T” T+E

III-4. Build Ethical Management Infrastructure

Renew ethical management culture through extreme reforms

IP 2.0 Key Strategies

Build global top level of ethical management system [Recent views of Interest Parties]

- Apply ‘One Strike Out Rule’ to 4 major unethical conducts*

- Optimize Business Compliance Risk Management system Lack of

* Bribery, Embezzlement, Sexual harassment, Spin control customer-based

Discard malpractice regarding transaction, outsourcing, attitude and personnel affairs Favoritism over ‘Indiscreet

- The 3 100% rule (100% competition, 100% record, 100% open) POSCO-bre anagement’

- Run ‘Clean POSCO System’ to rule out bribery

Strengthen manpower by not allowing favoritism Weak ethical over POSCO-bred and conducting fair promotion management

—Extend global job postings and recruit outside experts among global compnaies

- Level-up the management competency through stronger evaluation system towards executives

Reduce staff-level to increase organizational

efficiency Untransparent Lack of responsibility

-

Repost excess-labor to frontline by organizational purchsing process for performance restructuring

- Increase

labor efficency by running optimal level of each department

26

Customer society employee partner

Contents I. IP 1.0 Vision & Results II. Introduction of IP 2.0 III. Key Strategies

IV. 2017 Financial Target & Vision

* IP

: Innovation POSCO

-1. 2017 Financial Target

Reach EBITDA 7.5

trillion and D/E ratio of 3.1 through 4 innovative agendas

EBITDA : 7.5 trillion KRW D/E ratio : 3.1 times

4.6 4.6

Consolidated POSCO Debt/EBITDA

7.5 trillion 3.7

27.4 3.1

6.5 5.0 trillion 26.8

4.5 23.5

Debt 20.7 trillion

‘14 ‘17 ‘14 ‘17 ‘14 ‘15 ‘16 ‘17

Add value to steel business and generate Cost reduction over 500 billion per year results from new growth business

—2017 WP product sales portion : over 50% 500 billion KRW

50

—2017 Automotive steel sales volume :

9.5 million tons 300

Labor

—Complete 1st stage of lithium commercialization by 2017

(20,000 tons) cost 300 POSCO

Expenses

Speed-up restructuring affiliates/overseas sites 150

—Effect by reducing operating losses : over 290 billion KRW Outsourcing cost 200 Subsidiaries

Non-debt financing over 2 trillion KRW Materials cost

28

Raise additional consolidated EBITDA of 1.0 trillion KRW from 2014

Reduce consolidated debt by 6.7 trillion KRW from 2014

-2. Vision (2025)

Build the groundwork for the

next 50 years, supporting shareholders’ value and the economy

Expand New Growth Business

in Steel and 4 Major Domains

“Independent Provider of “Steelmaker with World-Top “Source Materials Maker clean energy” profitability” with top competitiveness”

Top domestic IPP Global No.1 Energy storage-maker

Global No.1 Steelmaker,

- No.1 Fuel cell

producer, with technology and cost leadership—Global Top 3 Ni-provider leading the market

Cost leadership

Techno lity “Support strengthening

“Smart Industry Provider” Platform Innovation Advantage group portfolio with global network”

29

POSCO the Great

The Most Respected &

Beloved Company Globally

Expand New Growth Business in Steel and 4 Major Domains

Energy

Steel

Materials

Infrastructure

Cost

leadership

Trading

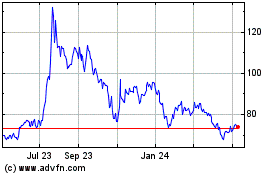

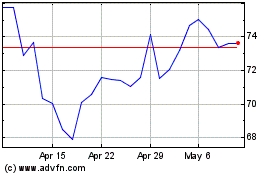

POSCO (NYSE:PKX)

Historical Stock Chart

From Mar 2024 to Apr 2024

POSCO (NYSE:PKX)

Historical Stock Chart

From Apr 2023 to Apr 2024