UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): January 19, 2016

Packaging Corporation of America

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

1-15399 |

|

36-4277050 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

1955 West Field Court, Lake Forest, Illinois 60045

(Address of Principal Executive Offices, including Zip Code)

(847) 482-3000

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2 (b) under the Exchange Act (17 CFR 240.14d-2 (b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4 (c) under the Exchange Act (17 CFR 240.13e-4 (c)) |

| Item 5.02. |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers |

On January 19, 2016, Packaging Corporation of America (“PCA”) and Richard B. West, PCA’s former chief financial officer,

entered into an agreement in connection with Mr. West’s retirement (which was previously disclosed pursuant to Item 5.02 of PCA’s Current Report on Form 8-K filed on June 5, 2015).

The agreement provides that the retirement date will now be January 29, 2016 and that Mr. West will perform certain project work for

PCA after the retirement date through December 31, 2016, the expiration date. Mr. West will be subject to customary confidentiality, non-competition and non-solicitation covenants. Mr. West will receive compensation of $30,000 per month

during the term of the agreement and all unvested equity awards, consisting of 60,647 shares of restricted stock and 20,604 performance units, held by Mr. West will vest or be paid out on his retirement date.

The agreement is filed herewith as Exhibit 10.1, which is incorporated by reference herein. The above summary is qualified in its entirety by

reference to the entire agreement.

| Item 9.01. |

Financial Statements and Exhibits. |

|

|

|

|

|

| 10.1 |

|

Agreement, dated January 19, 2016, between PCA and Richard B. West |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

| PACKAGING CORPORATION OF AMERICA |

| (Registrant) |

|

|

| By: |

|

/s/ Kent A. Pflederer |

|

|

Senior Vice President, General Counsel and

Secretary |

Date: January 22, 2016

Exhibit 10.1

AGREEMENT

This Agreement

dated as of January 19, 2016, by and between PACKAGING CORPORATION OF AMERICA, having its principal place of business at 1955 West Field Court, Lake Forest, Illinois 60045 (together with its consolidated subsidiaries, “PCA”), and

Richard B. West (“Mr. West”).

WHEREAS, Mr. West will retire as an employee of PCA effective January 29, 2016 (the

“Retirement Date”).

WHEREAS, PCA desires that Mr. West be available to provide certain project work upon his retirement

and agree to non-competition, non-solicitation and certain other covenants;

WHEREAS, Mr. West desires to perform project work and

abide by the covenants and agreements set forth herein;

NOW, THEREFORE, in consideration of the mutual promises herein contained, the

parties do hereby agree:

1. Projects. Mr. West will perform specific projects and assignments as

determined by Mark W. Kowlzan, Chairman and CEO of PCA and agreed upon by Mr. West from time to time. Time spent by Mr. West on such projects and assignments will not exceed 20% of normal full time hours and Mr. West shall not be

subject to a minimum time commitment. Mr. West will devote best efforts in his performance hereunder and will act in the best interest of PCA in such performance. Mr. West shall cooperate as requested by PCA as to legal or other matters

involving PCA arising out of Mr. West’s previous employment with PCA. The parties acknowledge and agree that Mr.

West shall perform this Agreement only as an independent contractor and not as an employee or agent of PCA, and that Mr. West shall determine the manner and method of provision of his

performance. PCA will provide reasonable administrative support, office space and information technology support as needed for such performance

2. Fees. Mr. West shall be paid a fee in cash equal to $30,000 per month, payable at regular intervals as

agreed upon by the parties, subject to any required tax withholding. Mr. West shall be entitled to reimbursement for reasonable expenses incurred in connection with his performance of the projects and assignments hereunder.

3. Termination. It is hereby understood that Mr. West’s termination of employment is a voluntary

retirement and, subject to Section 18, shall be determined to be a Retirement for purposes of the Amended and Restated Long-Term Equity Incentive Plan and other PCA health, welfare and retirement plans.

4. Restricted Stock, Performance Units. Subject to the execution, delivery and performance of this Agreement

and the accompanying release (the “Release”) by Mr. West, the Compensation Committee of PCA’s board of directors has agreed as follows:

| |

a. |

to vest on the Retirement Date 60,647 shares of restricted stock that were awarded to Mr. West in 2012, 2013 and 2014; and |

| |

b. |

to vest and to be paid out at 100% on the Retirement Date, 12,000 performance units that were awarded to Mr. West in 2013 and 8,604 performance units that were awarded to Mr. West in 2014. |

5. Other Benefits and Plans. Subject to Section 18 hereof: (i) Mr. West shall be paid out all

accrued vacation and receive all benefits accrued through the Retirement Date under PCA’s retirement, health and welfare plans, in accordance with the terms of such plans; and (ii) such benefits will be paid according to the terms of those

plans.

2

6. No Benefits. PCA and Mr. West agree that the remuneration

provided for above shall constitute the total compensation due for performance hereunder after the Retirement Date and that no employee benefits of any kind will be provided except as due Mr. West as a result of prior service as a PCA employee

under PCA’s plans in which Mr. West participated. Mr. West will not accrue additional benefits or service time as a result of the performance of this Agreement.

7. Term. The term of this Agreement shall commence on the Retirement Date and shall continue in full force and

effect until December 31, 2016. This agreement may be terminated earlier only (i) upon the mutual written agreement of the parties; or (ii) by Mr. West for convenience at any time by delivering at least 30 days’ prior

written notice to the other party.

8. Confidential Information. Mr. West acknowledges that the

information, observations and data (including without limitation trade secrets, know-how, research plans, business, accounting, distribution and sales methods and systems, manufacturing methods and systems, sales and profit figures and margins and

other technical or business information, business, marketing and sales plans and strategies, cost and pricing structures, and manufacturing techniques of PCA disclosed or otherwise revealed to his or discovered or otherwise obtained by his or of

which he has become or becomes aware, directly or indirectly, while employed or otherwise acting for PCA, whether prior to the date of this Agreement as an employee, pursuant to this Agreement or otherwise) (all of the foregoing being collectively,

“Confidential Information”) are the

3

property of PCA, and Mr. West agrees that PCA has a protectable interest in such Confidential Information. Therefore, Mr. West agrees that he shall not disclose to any person or use for

his own purposes any Confidential Information without the prior written consent of PCA, unless and only to the extent that the aforementioned matters: (a) become or are generally known to and available for use by the public other than as a

result of Mr. West’s acts or omissions or (b) are required to be disclosed by judicial process or law (provided that Mr. West shall give advance written notice of such requirement to PCA as soon as practicable under the

circumstances to enable PCA to seek an appropriate protective order or confidential treatment). Mr. West shall deliver to PCA at any time that PCA may reasonably request all memoranda, notes, plans, records, reports, computer tapes, printouts

and software and other documents and data (and copies thereof) which constitute Confidential Information or Work Product (as defined below) which he may then possess or have under his control. This Section 8 shall survive the termination of

this Agreement.

9. Work Product.

(a) Mr. West hereby assigns to PCA all right, title and interest in and to all inventions, developments, methods,

process, designs, analyses, reports and all similar or related information (in each case whether or not patentable), all copyrightable works, all trade secrets, confidential information and know-how, and all other intellectual property rights that

both (a) were conceived, reduced to practice, developed or made by Mr. West while employed by PCA or as a result of, and in the course of providing, the services provided hereunder and (b) either (i) relate to PCA’s business

or (ii) are conceived, reduced to practice, developed or made using any of the equipment, supplies, facilities,

4

assets or resources of PCA (including but not limited to, any intellectual property rights) (“Work Product”). All Work Product prepared by Mr. West shall be deemed to have

been prepared for PCA and shall be considered as works for hire and all rights and the copyrights therefor shall be owned by PCA. Mr. West hereby assigns to PCA all rights, titles and interests in and to said copyrights in the United States of

America and elsewhere, including registration and publication rights, rights to create derivative works and all other rights which are incident to copyright ownership.

(b) In the event any court holds such Work Product not to be works for hire, Mr. West shall assign such creative

works to PCA, at its request, in consideration of the fees paid to Mr. West hereunder. Mr. West shall promptly at PCA’s sole cost and expense perform all actions reasonably requested by PCA to establish and confirm PCA’s

ownership of the Work Product (including, without limitation, executing and delivering assignments, consents, powers of attorney, applications and other instruments). This Section 9(b) shall survive the termination of this Agreement.

10. Noncompetition. Mr. West agrees that, for the period commencing on the date hereof and ending on

December 31, 2016 (the “Noncompete Period”), he shall not, directly or indirectly (whether for compensation or otherwise) own or hold any interest in, manage, operate, control, consult with, render services for, or in any

manner participate in the business of manufacturing, marketing, designing, distributing or selling containerboard (including, without limitation, linerboard and corrugating medium); corrugated containers, displays or products; uncoated freesheet

paper or coated release liners (collectively, and each individually, being the “Business”) or any business

5

competitive with the Business, whether as a general or limited partner, proprietor, common or preferred equity holder, officer, director, agent, employee, consultant, trustee, affiliate or

otherwise. Mr. West acknowledges that PCA plans to conduct the Business internationally and agrees that the provisions in this Section 10 shall operate throughout the world. Nothing in this Section 10 shall prohibit

Mr. West from being a passive owner of not more than 5% of the outstanding securities of any publicly traded company engaged in the Business, so long as Mr. West has no active participation in the business of such company.

11. Non-Solicitation. During the Noncompete Period, Mr. West shall not directly or indirectly through

another entity (i) induce or attempt to induce any employee of PCA, or any of their respective affiliates to leave the employ of PCA or any of its affiliates, or in any way interfere with the relationship between PCA or any of its affiliates

and any employee thereof, (ii) solicit to hire any person who, at any time during the Noncompete Period, was an employee of PCA or any of its affiliates or (iii) induce or attempt to induce any customer, developer, client, member,

supplier, licensee, licensor, broker, sales agent, franchisee or other business relation of PCA or any of its affiliates to cease doing business with PCA or any of its affiliates, or in any way interfere with the relationship between any such

customer, developer, client, member, supplier, licensee, licensor, broker, sales agent, franchisee or business relation and PCA or any of its affiliates (including, without limitation, making any negative statements or communications about PCA or

its affiliates).

6

12. Enforcement. If, at the time of enforcement of any of

Sections 8 through 11, a court of competent jurisdiction shall hold that the period, scope or area restrictions stated herein are unreasonable under circumstances then existing, the parties hereto agree that the maximum period, scope

or area reasonable under such circumstances shall be substituted for the stated period, scope or area and that the court shall be allowed and directed to revise the restrictions contained herein to cover the maximum period, scope and area permitted

by applicable law. The parties hereto acknowledge and agree that Mr. West has had access to Confidential Information and Work Product, that the provisions of Sections 8 through 11 are necessary, reasonable and appropriate for the

business interests of the PCA, that irreparable injury will result to PCA if Mr. West breaches any of the provisions of Sections 8 through 11 and that money damages would not be an adequate remedy therefor and that PCA will not have any

adequate remedy at law for any such breach. Therefore, in the event of a breach or threatened breach of this Agreement, in addition to other rights and remedies existing in its favor, PCA shall be entitled to specific performance and/or immediate

injunctive or other equitable relief from any court of competent jurisdiction in order to enforce or prevent any violations of the provisions hereof (without the necessity of showing actual money damages, or posting a bond or other security).

Nothing contained herein shall be construed as prohibiting PCA or any of its successors or assigns from pursuing any other remedies available to it for such breach or threatened breach, including the recovery of damages.

13. Mr. West’s Representations and Acknowledgements. Mr. West hereby represents and warrants to PCA that

(i) Mr. West is not a party to or bound by any

7

employment agreement, noncompete agreement, nonsolicitation agreement or confidentiality agreement with any person other than PCA, and (ii) this Agreement constitutes the valid and binding

obligation of Mr. West, enforceable against Mr. West in accordance with its terms. Mr. West hereby acknowledges and represents that he fully understands the terms and conditions contained herein and intends for such terms and

conditions to be binding on and enforceable against her. Mr. West expressly agrees and acknowledges that the restrictions contained in Sections 8 through 11 do not preclude Mr. West from earning a livelihood, nor do they

unreasonably impose limitations on Mr. West’s ability to earn a living. Mr. West acknowledges that he has carefully read this Agreement and has given careful consideration to the restraints imposed upon Mr. West by this

Agreement, and is in full accord as to the necessity of such restraints. Mr. West expressly acknowledges and agrees that each and every restraint imposed by this Agreement is reasonable with respect to subject matter, time period and

geographical area.

14. Notices. All notices and other communications hereunder shall be in writing and

shall be deemed if delivered personally or by facsimile transmission, or mailed by registered or certified mail (return receipt requested), postage prepaid, to the parties at the following addresses (or at such other address for a party as shall be

specified by like notice; provided that notices of a change of address shall be effective only upon receipt thereof):

Packaging Corporation of America

1955 West Field Court

Lake Forest, IL 60045

8

Attention: CEO

with a copy to: General Counsel

Facsimile No: 847-482-2194

The address on file with PCA

15. Assignment. This Agreement and the rights and responsibilities hereunder shall not be assigned or delegated

by either party without the prior written consent of the other party; provided, however, that PCA shall have the right, without the prior written consent of Mr. West, to assign and transfer its rights under that Agreement to any of its

affiliates or any purchaser who acquires all or a substantial part of the assets of its business or capital stock.

16. Entire Agreement. This Agreement and the accompanying Release constitutes the complete and only Agreement

between the parties relating to the subject matter hereof and all prior agreements relating to the subject matter hereof are merged into this Agreement. No amendment or modification of the Agreement between the parties hereto shall be of effect or

enforceable unless stated in writing and signed by Mr. West and an officer of PCA.

17. Governing Law;

Venue. This Agreement shall be governed by, and construed in accordance with, the substantive laws of Illinois without regard to conflict of laws. Jurisdiction and venue with regard to any suit in connection with this Agreement shall reside

solely and exclusively in the courts of Lake County, Illinois.

9

18. Section 409A Compliance. It is the intention that this

Agreement conform and be administered in all respects in a manner that complies with Section 409A of the Internal Revenue Code (together with all rules and regulations thereunder, “Section 409A”); provided, however, that PCA does not

make any representations or guarantees of the tax treatment of any amount paid or described under Section 409A or otherwise.

Notwithstanding any provision contained in this Agreement to the contrary, if (i) any payment hereunder or otherwise described herein is

subject to Section 409A, (ii) such payment is to be paid on account of the Mr. West’s separation from service (within the meaning of Section 409A) and (iii) Mr. West is a “specified employee”

(within the meaning of Section 409A), then such payment shall be delayed, if necessary, until the first day of the seventh month following Mr. West’s separation from service (or, if later, the date on which such payment is otherwise

to be paid under this Agreement). With respect to any payments hereunder that are subject to Section 409A and that are payable on account of a separation from service, the determination of whether Mr. West has had a separation from service

shall be determined in accordance with Section 409A.

10

IN WITNESS HEREOF, the parties have signed and delivered this Agreement on the date first above written.

Packaging Corporation of America

|

|

|

| /s/ Mark W. Kowlzan |

|

/s/ Richard B. West |

Name: Mark W. Kowlzan

Title:

Chairman and CEO

11

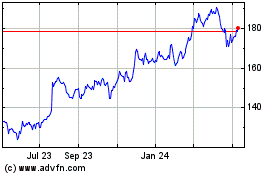

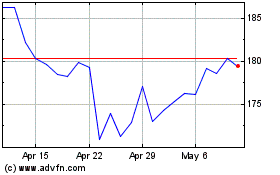

Packaging (NYSE:PKG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Packaging (NYSE:PKG)

Historical Stock Chart

From Apr 2023 to Apr 2024