Current Report Filing (8-k)

July 01 2016 - 10:34AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 30, 2016

PULTEGROUP, INC.

(Exact name of registrant as specified in its Charter)

|

|

|

|

|

|

|

Michigan

|

1-9804

|

38-2766606

|

|

(State or other jurisdiction

|

(Commission

|

(IRS Employer

|

|

of incorporation)

|

File Number)

|

Identification No.)

|

3350 Peachtree Road NE, Suite 150, Atlanta, Georgia 30326

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code

(404) 978-6400

____________________________________________________

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

_

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

_

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

_

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

_

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

ITEM 1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

On June 30, 2016, PulteGroup, Inc. (the “Company”), entered into an Amended and Restated Credit Agreement ("Amended Credit Agreement") providing for a senior, unsecured revolving credit facility (“Revolving Credit Facility” or “Facility”) among Bank of America, N.A., as Administrative Agent, JPMorgan Chase Bank, N.A. as Syndication Agent, Citibank, N.A., Mizuho Bank, Ltd., and SunTrust Bank as Documentation Agents, and the other Lenders party thereto. The Amended Credit Agreement replaces the previous credit agreement that contained substantially similar terms but increases the Revolving Credit Facility amount from $500 million to $750 million and extends the maturity date from July 21, 2017 to June 28, 2019. The Facility has an uncommitted accordion feature under which the Company may increase the aggregate commitment amount to $1.25 billion, subject to certain conditions and availability of additional bank commitments. The Amended Credit Agreement also provides for the issuance of letters of credit with a sublimit equal to 50% of the aggregate commitment amount, for an initial sublimit of $375 million.

Similar to the previous credit agreement, the Amended Credit Agreement contains financial covenants that require the Company to maintain a minimum Interest Coverage Ratio and Tangible Net Worth and to maintain a Debt to Capitalization Ratio below a maximum level as defined therein. Outstanding borrowings under the Facility are guaranteed by the Company’s wholly-owned subsidiaries listed as guarantors to the Amended Credit Agreement.

A copy of the Amended Credit Agreement is attached as Exhibit 10.1 hereto and is herein incorporated by reference. The above referenced summary of the material terms of the Amended Credit Agreement is qualified in its entirety by reference to Exhibit 10.1.

On June 30, 2016, the Company also entered into an amendment (the “Term Loan Amendment”) to its existing senior, unsecured term loan credit facility dated as of September 30, 2015, among the Company and the Lenders party thereto, to, among other things, amend the financial covenants and guarantors therein to be substantially the same as under the Amended Credit Agreement described above.

A copy of the Term Loan Amendment is filed as Exhibit 10.2 and is herein incorporated by reference. The above referenced summary of the material terms of the Term Loan Amendment is qualified in its entirety by reference to Exhibit 10.2.

ITEM 2.03 CREATION OF A DIRECT FINANCIAL OBLIGATION OR AN OBLIGATION UNDER AN OFF-BALANCE SHEET ARRANGEMENT OF A REGISTRANT

All the information set forth above under Item 1.01 is hereby incorporated by reference into this Item 2.03.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits

10.1 Amended and Restated Credit Agreement dated as of June 30, 2016 among PulteGroup, Inc., as Borrower, Bank of America, N.A., as Administrative Agent, and the other Lenders party thereto.

10.2 First Amendment to the Term Loan Agreement dated as of June 30, 2016 among PulteGroup, Inc., as Borrower, Bank of America, N.A., as Administrative Agent, and the other Lenders party thereto.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

PULTEGROUP, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date:

|

July 1, 2016

|

|

By:

|

/s/ Steven M. Cook

|

|

|

|

|

|

Name:

|

Steven M. Cook

|

|

|

|

|

|

Title:

|

Executive Vice President, Chief Legal Officer, and Corporate Secretary

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

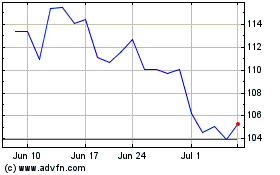

PulteGroup (NYSE:PHM)

Historical Stock Chart

From Mar 2024 to Apr 2024

PulteGroup (NYSE:PHM)

Historical Stock Chart

From Apr 2023 to Apr 2024