By Chris Kirkham

In the home-building business, land purchases are every bit as

important as the concrete, wood and insulation.

Buy land at a low price in a good location and you can generate

significant profits from home sales on those lots. Buy the wrong

land at the wrong time and you can be saddled with expenses years

down the line.

As a battle between the founder of home builder PulteGroup Inc.

and its chief executive shifts to its annual shareholders' meeting

Wednesday, the land game has emerged as a major flashpoint in the

debate over the company's future.

"PulteGroup's land position is deep, but CEO [Richard] Dugas has

not been able to figure out how to utilize this asset," said

William J. "Bill" Pulte, the company's founder and largest

shareholder, in a recent letter that took aim at board members who

support Mr. Dugas, the current chief executive and chairman. "The

ability to deliver more homes on existing owned lots is untapped

potential with the right leader at PulteGroup."

PulteGroup management has dismissed that assessment, arguing the

company will significantly boost the number of home sales this

year, making its pipeline of land "comparable to the rest of the

industry."

Over the past month, Mr. Pulte has launched an offensive against

Mr. Dugas, a onetime protégé whom Mr. Pulte handpicked to become

chief executive in 2003. Amid pressure from Mr. Pulte, Mr. Dugas

last month announced he would be retiring next year. Mr. Dugas

declined to comment on Mr. Pulte's assertions.

But Mr. Pulte has continued to demand Mr. Dugas's immediate

resignation, arguing to board members and shareholders that

PulteGroup's stock performance has lagged behind rival home

builders throughout the housing recovery. He vowed to vote against

every board member at this week's shareholders' meeting if they

didn't replace Mr. Dugas and the lead director, James Postl.

Despite the rhetoric, analysts don't expect much to change after

Wednesday's annual meeting. The skirmish has been public for only a

month, leaving little time for Mr. Pulte to galvanize

investors.

Mr. Pulte is the largest shareholder, but with 8.9% of

outstanding shares he has far from a controlling interest.

Mr. Pulte has pointed to the company's stock price since the

beginning of 2014, which has fallen by 5% as competitors D.R.

Horton Inc. and Lennar Corp. have gained 43% and 17%,

respectively.

A key reason for that underperformance, Mr. Pulte said, is slow

growth in home closings. PulteGroup's closings have declined by

about 3% since 2013, while D.R. Horton has boosted closings by 52%

and Lennar by 33% over the same period, according to the most

recent annual data.

Mr. Pulte has argued the company isn't taking advantage of the

lots it already has on its books, and is continuing to spend money

acquiring new land at a time when lots are expensive. He said the

company's land is "sitting there like dead wood." Mr. Dugas

declined to comment.

In a statement, the company said it is focused on driving "more

profitable growth and higher returns rather than just delivering

growth for growth's sake." PulteGroup cited recording a 40%

compounded annual growth rate in pretax profit between 2011 and

2015 on only 3% compounded annual growth in home deliveries over

the same period.

The skirmish dates back to the last recession. In 2009

PulteGroup announced a merger with Dallas home builder Centex,

which specialized in entry-level homes at lower price points. For

marketing the deal to investors, one of the key selling points was

the enormous inventory of lots the combined company would be able

to harvest once housing demand picked up.

By May 2010, PulteGroup was projecting a return to profitability

for the year. Instead, by the end of 2010 the company had to record

write-downs on the Centex deal totaling more than $1.2 billion -- a

sum that nearly matched what PulteGroup had paid up front in stock.

The company declined to comment on the deal.

With a large supply of lots already on hand, the company

remained on the sidelines as the real-estate market bottomed in

2011. Other builders, particularly Lennar, bought attractive lots

at bargain prices between 2010 and 2013.

In 2012 and 2013, Lennar and D.R. Horton were spending more than

30% of revenue on land, according to data compiled by Barclays

analyst Stephen Kim, in a sign of investment in growth. PulteGroup,

by contrast, was spending about 20%.

In recent years, as land prices have risen, competitors have

decreased land spending, while PulteGroup has increased its

spending to 40% of revenue.

"They're continuing to spend on land at a very elevated rate,

even though they acknowledge they already have a lot of land," said

Mr. Kim.

Over the past five years, Mr. Dugas has outlined a strategy that

focuses less on the volume of home sales and more on profitability.

Analysts said the company might simply be playing the hand it has

been dealt.

"They were late to the game in terms of buying land, because of

the Centex deal they had to digest," said Susan Maklari, an analyst

with UBS. "But now's not the time to go out and start chasing

growth."

Write to Chris Kirkham at chris.kirkham@wsj.com

(END) Dow Jones Newswires

May 03, 2016 15:19 ET (19:19 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

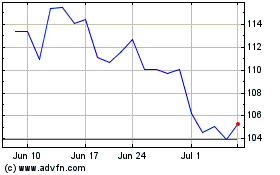

PulteGroup (NYSE:PHM)

Historical Stock Chart

From Mar 2024 to Apr 2024

PulteGroup (NYSE:PHM)

Historical Stock Chart

From Apr 2023 to Apr 2024