Amended Statement of Beneficial Ownership (sc 13d/a)

April 06 2016 - 4:56PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Rule 13d-101)

INFORMATION

TO BE INCLUDED IN STATEMENTS FILED

PURSUANT TO

RULE 13d-1(a) AND AMENDMENTS THERETO FILED

PURSUANT TO

RULE 13d-2(a)

Under the Securities

Exchange Act of 1934

(Amendment

No. 16)*

|

PulteGroup,

Inc.

|

|

(Name of Issuer)

|

|

|

|

Common Stock,

par value $0.01

|

|

(Title of Class of Securities)

|

|

|

|

745867101

|

|

(CUSIP Number)

|

William J. Pulte

6515 Thomas

Jefferson Court

Naples, Florida

34108

(248) 647-2750

Copy to:

|

Joel L. Rubinstein, Esq.

|

|

Winston & Strawn LLP

|

|

200 Park Avenue

|

|

New York, New York 10166-4193

|

|

(212) 294-6700

|

|

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

|

|

|

|

April 6,

2016

|

|

(Date of Event which Requires Filing of this

Statement)

|

If the filing person has previously filed a statement on Schedule

13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box.

¨

Note:

Schedules filed in paper format shall include

a signed original and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties to whom copies

are to be sent.

*The remainder of this cover page shall be filled out for a

reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment

containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder

of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act

of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other

provisions of the Act (however, see the Notes).

|

|

|

|

|

|

|

CUSIP

No.

745867101

|

|

|

|

1

|

NAMES OF

REPORTING PERSONS

William J. Pulte

|

|

2

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(see instructions)

(a)

¨

(b)

x

|

|

3

|

SEC

USE ONLY

|

|

4

|

SOURCE

OF FUNDS (see instructions)

N/A

|

|

5

|

CHECK IF

DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED

PURSUANT TO ITEMS 2(d) or 2(e)

¨

|

|

6

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

United States of America

|

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH

|

7

|

SOLE

VOTING POWER

30,740,239

|

|

8

|

SHARED

VOTING POWER

0

|

|

9

|

SOLE

DISPOSITIVE POWER

12,760,639

|

|

10

|

SHARED

DISPOSITIVE POWER

17,979,600

|

|

11

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

30,740,239

|

|

12

|

CHECK IF THE AGGREGATE AMOUNT

IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions)

x

|

|

13

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

8.87%*

|

|

14

|

TYPE

OF REPORTING PERSON (see instructions)

IN

|

|

|

*

|

The calculation of such percentage is based on 346,383,194 Common

Shares issued and outstanding on March 10, 2016, as disclosed by PHM in its Proxy Statement

on Schedule 14A, filed with the U.S. Securities and Exchange Commission on April 4, 2016.

|

The Amendment No. 16 to Schedule 13D (this

“

Amendment No. 16

”) amends and restates, where indicated, Amendment No. 15 to the statement on Schedule 13D

relating to the Common Shares of PHM filed by the Reporting Person with the U.S. Securities and Exchange Commission on April 4,

2016 (the “

Prior Schedule

”). Capitalized terms used in this Amendment No. 16 but not otherwise defined herein

have the meanings given to them in the Prior Schedule.

Except as otherwise set forth herein, this

Amendment No. 16 does not modify any of the information previously reported by the Reporting Person on the Prior Schedule.

Item 4.

Purpose of Transaction

.

Item 4 is amended and supplemented by the

addition of the following:

In light of recent actions

and statements by PHM and its Board, the Reporting Person is now considering whether further governance changes, beyond the

immediate removal of the CEO (including,

without limitation, potential changes in the Board), may be required in order to appropriately realign the strategic direction of PHM with the best

interests of its shareholders. The Reporting Person will continue to closely monitor the actions of PHM, the Board and

management and may engage in further communications with the Board, management and other shareholders, and may make public

statements, regarding these and other business strategy matters.

SIGNATURE

After reasonable inquiry and to the best

of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Date: April 6, 2016

|

|

WILLIAM J. PULTE

|

|

|

|

|

|

|

|

/s/ William J. Pulte

|

|

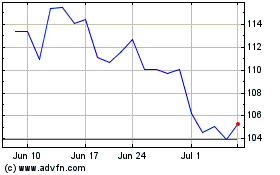

PulteGroup (NYSE:PHM)

Historical Stock Chart

From Mar 2024 to Apr 2024

PulteGroup (NYSE:PHM)

Historical Stock Chart

From Apr 2023 to Apr 2024