UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the

Registrant

x

Filed by

a Party other than the Registrant

¨

Check the appropriate box:

|

|

|

|

|

¨

|

|

Preliminary Proxy Statement

|

|

|

|

|

¨

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

¨

|

|

Definitive Proxy Statement

|

|

|

|

|

x

|

|

Definitive Additional Materials

|

|

|

|

|

¨

|

|

Soliciting Material Pursuant to §240.14a-12

|

PulteGroup, Inc.

(Name

of Registrant as Specified in its Charter)

(Name of Person(s)

Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

|

|

|

x

|

|

No fee required.

|

|

|

|

|

¨

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the

filing fee is calculated and state how it was determined):

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

¨

|

|

Fee paid previously with preliminary materials.

|

|

|

|

|

¨

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

(4)

|

|

Date Filed:

|

On April 5, 2016, James J. Postl, the Lead Independent Director for the Board of Directors of PulteGroup, Inc.

(the “Company”) issued the attached letter to shareholders.

Additional Information

This letter to shareholders may be deemed to be additional soliciting material with respect to the solicitation of proxies by the Board of Directors of the

Company with respect to the Company’s annual meeting of shareholders to be held on May 4, 2016 (the “Annual Meeting”). The Company filed its definitive proxy statement relating to the Annual Meeting (the “Proxy Statement”)

with the Securities and Exchange Commission (the “SEC”) on April 4, 2016. The Proxy Statement and the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015 were first made available to shareholders on or

about April 4, 2016. Shareholders can obtain the Proxy Statement, any amendments or supplements to the Proxy Statement and other documents filed by the Company with the SEC for no charge at the SEC’s website at www.sec.gov. Copies of the

proxy materials are also available to shareholders at no charge at www.proxyvote.com or by writing to the Company’s Corporate Secretary at PulteGroup, Inc., 3350 Peachtree Road Northeast, Suite 150, Atlanta, Georgia, 30326.

Dear PulteGroup Shareholders:

You may have seen the letter to our Board of Directors that was recently made public by Bill Pulte, who founded PulteGroup in 1950, stepped down as Chairman

in August 2009, and currently owns 8.87% of PulteGroup stock. In his letter, he made various allegations and attacks against the Company, its management and its strategy. We wanted to provide our shareholders with the facts relating to

recent actions by Mr. Pulte, his grandson and one of our directors, Jim Grosfeld, in their attempt to influence our considered succession planning process and change the strategic direction of PulteGroup. While we have significant respect for

Mr. Pulte as the founder of PulteGroup, we believe his campaign is misguided and is not in the best interests of shareholders.

In addition,

we want to

reassure our shareholders that the Board stands firmly behind the Company’s Value Creation strategy

, which has produced significantly higher profitability and shareholder returns since Richard Dugas, our CEO, and his team began implementing

it in 2011. We also are strongly supportive of our CEO as he continues to execute that plan over the coming year, and as he assists us in the process of identifying the next generation of leadership to continue the Value Creation plan.

Actions Leading to the Decision Not to Nominate Mr. Grosfeld as a Director at the May 2016 Annual Meeting of Shareholders

We have a strong, independent and diverse board, including top real estate expertise, financial expertise and real business leadership. The Board is

engaged and challenges management in a thoughtful, open-minded way in service to all of the shareholders of the Company.

We added Mr. Grosfeld as a

director effective December 2015, at the suggestion of Mr. Pulte. The Board’s decision not to nominate him as a Director at the May 2016 annual meeting reflects his participation in a number of actions over the past several weeks that we

believe are inconsistent with acceptable norms of corporate governance and without due regard for the interests of ALL shareholders. These actions include:

|

|

•

|

|

A demand for Mr. Dugas’ resignation.

On March 21, 2016, Mr. Dugas was summoned by Mr. Pulte to a meeting. To Mr. Dugas’ surprise, Mr. Pulte’s grandson and Mr. Grosfeld were also at the

meeting, where:

|

|

|

•

|

|

They made various critiques of the Company’s performance and strategy.

|

|

|

•

|

|

They criticized the Company’s decision to relocate its headquarters to Atlanta.

|

|

|

•

|

|

They stated they had identified Richard’s successor, but would not reveal the individual’s name.

|

|

|

•

|

|

Mr. Pulte demanded that Mr. Dugas agree within 10 days that he would be retiring in the near-term – or “there would be war”.

|

|

|

•

|

|

Attempting to circumvent the Board’s governance processes by failing to report to the Board.

Mr. Grosfeld never notified the Board about the meeting, or what was discussed at the meeting, before or after it

occurred.

|

|

|

•

|

|

Unwillingness to help the Company unless his personal demands were met.

Following the meeting on March 21, Mr. Dugas promptly debriefed the other independent directors about the situation, and the

independent directors caucused and decided to reach out to Mr. Grosfeld to try to arrange a meeting to open a dialogue with Mr. Grosfeld and the Pultes to better understand their concerns and assertions. The independent directors asked Mr.

Grosfeld to help arrange and participate in that follow-up meeting with Mr. Pulte, however, he initially refused to do so unless he received assurances that he would be nominated to the Board.

|

|

|

•

|

|

Taking action only when he was informed that he was not acting appropriately.

It was not until after we reminded Mr. Grosfeld of his fiduciary duties as a director that he agreed to assist the

independent directors in arranging a follow-up meeting with the Pultes.

|

|

|

•

|

|

The Pulte/Grosfeld demands relating to Board leadership.

At the follow-up meeting with two of PulteGroup’s independent directors, the Pulte/Grosfeld group ratcheted up their demands:

|

|

|

•

|

|

Reiterating their call for Mr. Dugas’ resignation, this time requiring that the resignation be announced in seven days and be effective by the end of May 2016.

|

|

|

•

|

|

Demanding that Mr. Grosfeld be nominated for election as a director at the 2016 annual meeting of shareholders.

|

|

|

•

|

|

Demanding that the Chairman role be shifted to another member of the Board.

|

|

|

•

|

|

Asserting that the Board add two Pulte/Grosfeld selections as new directors.

|

This is unacceptable behavior

for a sitting Board member

. The fact that Mr. Grosfeld did not discuss his participation in a meeting of this nature, nor his plan with the Pultes, with any of his fellow directors – until the independent directors reached out to him

– is inexcusable. Mr. Pulte’s statements, made at the meeting with our two independent directors, that he had been having serious issues with Mr. Dugas’ leadership “for two and a half to three years” and that he was

particularly upset about the relocation of the Company’s headquarters in 2013 are strong evidence that he and Mr. Grosfeld had undisclosed motives behind their efforts to have Mr. Grosfeld added to the Board last December.

For these and other reasons, the Board unanimously (other than Mr. Grosfeld) decided not to nominate Mr. Grosfeld to the Board.

In connection with these events, Mr. Dugas attempted to defuse the situation by offering to accelerate and make public his retirement plans. Before the

demands and threats by Mr. Pulte (supported by Mr. Grosfeld), Mr. Dugas had shared with the Board his preliminary thinking about retiring sometime in the next couple of years and had begun to set the stage for an orderly succession with some

well-considered promotions of individuals who would have the potential to follow him.

The recent Pulte/Grosfeld attacks have been targeted at Mr. Dugas,

and in particular seem to revolve around their unhappiness that the headquarters was moved from Detroit, Michigan to Atlanta, Georgia while Mr. Dugas was CEO – a decision spearheaded by the Board. The Board not only thanks Mr. Dugas for his

outstanding leadership, but the magnanimity he has displayed in offering to accelerate and make public his decision to retire, in the spirit of avoiding a costly, contested public battle with the Pultes that would risk destroying value for

shareholders.

We truly appreciate Mr. Dugas’ willingness to suggest this path and see the Company through this important stage of its strategic

plan. In particular, the ample time he has given the special committee of independent directors to conduct a formal, comprehensive internal and external search for his successor will help to ensure we are able to select an outstanding candidate as

our next CEO.

The Recent Attacks by the Pultes

Given Mr. Dugas’ attempt to provide the path for a constructive resolution, it is disappointing that the Pultes have decided to publicly play out their

personal vendetta against him, and attempt to hijack the Board’s succession planning.

Their attacks simply do not square with the facts:

|

|

•

|

|

Under Mr. Dugas’ leadership, PulteGroup’s Value Creation strategy was launched in 2011 after a comprehensive review of value drivers in homebuilding, including extensive interviews with investors. Value

Creation, which is focused on delivering improved financial performance through the housing cycle by maintaining robust homebuilding gross margin, driving greater overhead leverage, increasing asset efficiency, and disciplined capital allocation,

including the return of capital to shareholders – has delivered significant benefits to shareholders, as demonstrated in the following charts.

|

|

|

•

|

|

Mr. Dugas has also positioned PulteGroup to succeed in the future. We expect 2016 to be an important inflection point in the execution of this strategy, as prior investments and operational improvements drive

continued earnings growth. We strongly believe the Value Creation strategy is the right path forward, and that this team is positioned to execute it successfully.

|

The Company has made tremendous gains under its Value Creation strategy and we look forward to the ongoing progress we expect to realize in 2016 and

beyond. We thank you for the input that you have provided, as well as your continued support of the management team and Board of Directors.

Sincerely,

James J. Postl

Lead Independent Director

for the Board of Directors

Forward-Looking Statements

This press release includes “forward-looking statements.” These statements are subject to a number of risks, uncertainties and other factors that

could cause our actual results, performance, prospects or opportunities, as well as those of the markets we serve or intend to serve, to differ materially from those expressed in, or implied by, these statements. You can identify these statements by

the fact that they do not relate to matters of a strictly factual or historical nature and generally discuss or relate to forecasts, estimates or other expectations regarding future events. Generally, the words “believe,”

“expect,” “intend,” “estimate,” “anticipate,” “project,” “may,” “can,” “could,” “might,” “will” and similar expressions identify forward-looking

statements, including statements related to expected operating and performing results, planned transactions, planned objectives of management, future developments or conditions in the industries in which we participate and other trends, developments

and uncertainties that may affect our business in the future.

Such risks, uncertainties and other factors include, among other things: interest rate

changes and the availability of mortgage financing; continued volatility in the debt and equity markets; competition within the industries in which PulteGroup operates; the availability and cost of land and other raw materials used by PulteGroup in

its homebuilding operations; the impact of any changes to our strategy in responding to the cyclical nature of the industry, including any changes regarding our land positions; the availability and cost of insurance covering risks associated with

PulteGroup’s businesses; shortages and the cost of labor; weather related slowdowns; slow growth initiatives and/or local building moratoria; governmental regulation directed at or affecting the housing market, the homebuilding industry or

construction activities; uncertainty in the mortgage lending industry, including revisions to underwriting standards and repurchase requirements associated with the sale of mortgage loans; the interpretation of or changes to tax, labor and

environmental laws; economic changes nationally or in PulteGroup’s local markets, including inflation, deflation, changes in consumer confidence and preferences and the state of the market for homes in general; legal or regulatory proceedings

or claims; our ability to generate sufficient cash flow in order to successfully implement our capital allocation priorities; required accounting changes; terrorist acts and other acts of war; and other factors of national, regional and global

scale, including those of a political, economic, business and competitive nature. See PulteGroup’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015, and other public filings with the SEC for a further discussion of

these and other risks and uncertainties applicable to our businesses. PulteGroup undertakes no duty to update any forward-looking statement, whether as a result of new information, future events or changes in PulteGroup’s expectations.

About PulteGroup

PulteGroup, Inc. (NYSE: PHM), based in Atlanta, Georgia, is one of America’s largest homebuilding companies with operations in approximately 50 markets

throughout the country. Through its brand portfolio that includes Centex, Pulte Homes, Del Webb, DiVosta Homes and John Wieland Homes and Neighborhoods, the Company is one of the industry’s most versatile homebuilders able to meet the needs of

multiple buyer groups and respond to changing consumer demand. PulteGroup conducts extensive research to provide homebuyers with innovative solutions and consumer inspired homes and communities to make lives better.

For more information about PulteGroup, Inc. and PulteGroup brands, go to www.pultegroupinc.com; www.pulte.com; www.centex.com; www.delwebb.com;

www.divosta.com and www.jwhomes.com.

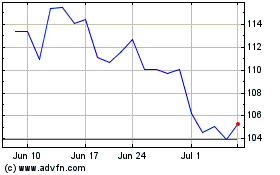

PulteGroup (NYSE:PHM)

Historical Stock Chart

From Mar 2024 to Apr 2024

PulteGroup (NYSE:PHM)

Historical Stock Chart

From Apr 2023 to Apr 2024