PulteGroup Profit Grows on Higher Closings, Orders -- Update

January 28 2016 - 9:28AM

Dow Jones News

By Joshua Jamerson

Home builder PulteGroup Inc. posted better-than-expected

earnings and revenue growth in the fourth quarter as orders and

closings climbed.

Shares, down 9.8% in the past 12 months as of Wednesday's close,

climbed 7.6% to $17.30 in premarket trading.

Builders have been confident in recent quarters that home buyers

will return to the housing market, drawn by an improved job market,

higher rental costs and low interest rates.

Chairman and Chief Executive Richard J. Dugas Jr. said Thursday

that while global economic concerns have created greater market

volatility, the company's results reflect "the favorable demand

environment we continue to experience within the housing

industry."

For the three months ended Dec. 31, PulteGroup reported that net

new home orders climbed 13% as closings increased 7% from a year

earlier. Its backlog grew 15% to 6,731 homes, and the backlog's

value rose 26% to $2.5 billion--its highest year-end value since

2007.

Home sales revenue grew 12% as average selling price increased

across each of its three national brands.

Mr. Dugas also said the results would provide momentum for

strong earnings growth in 2016.

For the quarter, PulteGroup reported profit of $228 million, or

64 cents a share, up from $217 million, or 58 cents a share, in the

year-earlier period.

Revenue grew 13% to $2.06 billion. Analysts polled by Thomson

Reuters expected earnings of 49 cents a share on revenue of $1.86

billion.

Write to Joshua Jamerson at joshua.jamerson@wsj.com

(END) Dow Jones Newswires

January 28, 2016 09:13 ET (14:13 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

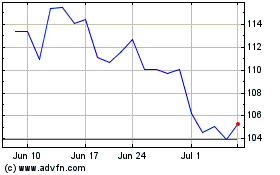

PulteGroup (NYSE:PHM)

Historical Stock Chart

From Mar 2024 to Apr 2024

PulteGroup (NYSE:PHM)

Historical Stock Chart

From Apr 2023 to Apr 2024