UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 10, 2015

PULTEGROUP, INC.

(Exact name of registrant as specified in its Charter)

|

| | |

Michigan | 1-9804 | 38-2766606 |

(State or other jurisdiction | (Commission | (IRS Employer |

of incorporation) | File Number) | Identification No.) |

3350 Peachtree Road NE, Suite 150, Atlanta, Georgia 30326

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code (404) 978-6400

____________________________________________________

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

_ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

_ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

_ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

_ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

ITEM 1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

On December 10, 2015, Pulte Mortgage LLC (“Pulte Mortgage”), a wholly-owned subsidiary of PulteGroup, Inc., entered into a First Amendment (the “Amendment”) to its Amended and Restated Master Repurchase Agreement ("Repurchase Agreement") with Comerica Bank, as Agent and representative of itself as a Buyer and the other Buyers ("Agent"), and the other Buyers listed therein. The Amendment includes an increase in the maximum aggregate commitment amount from $250 million to $310 million.

As a result of the Amendment, the borrowing capacity increases to $310 million on December 16, 2015, decreases to $175 million on January 19, 2016, and increases to $200 million on July 29, 2016. The purpose for the changes in the commitment amount during the term of the Repurchase Agreement is to lower associated fees during seasonally lower volume periods of mortgage origination activity.

A copy of the Amendment is attached as Exhibit 10.1 hereto and is herein incorporated by reference. The above referenced summary of the material terms of the Repurchase Agreement is qualified in its entirety by reference to Exhibit 10.1.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits

10.1 First Amendment to Amended and Restated Master Repurchase Agreement dated December 10, 2015.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | | |

| | | PULTEGROUP, INC. |

| | | | | |

| | | | | |

Date: | December 14, 2015 | | By: | /s/ Steven M. Cook |

| | | | Name: | Steven M. Cook |

| | | | Title: | Executive Vice President, Chief Legal Officer, and Corporate Secretary |

| | | | | |

| | | | | |

FIRST AMENDMENT TO AMENDED AND RESTATED MASTER REPURCHASE AGREEMENT

THIS FIRST AMENDMENT TO AMENDED AND RESTATED MASTER REPURCHASE AGREEMENT (the “Amendment”), dated as of December 10, 2015, is made and entered into among PULTE MORTGAGE LLC (the “Seller”), COMERICA BANK (“Comerica”), as agent (in such capacity, the “Agent”) and a Buyer, and the other financial institutions from time to time signatories thereto (the “Buyers”).

RECITALS:

A. The Agent, the Seller and the Buyers are parties to that certain Amended and Restated Master Repurchase Agreement dated as of September 4, 2015 (as amended or otherwise modified from time to time, the “Repurchase Agreement”).

B. The Agent, the Seller and the Buyers now desire to further amend certain provisions of the Repurchase Agreement as set forth herein.

AGREEMENT:

In consideration of the premises herein contained and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, all parties hereto agree as follows:

1.Capitalized terms used and not otherwise defined in this Amendment have the meanings specified in the Repurchase Agreement.

2. The reference to $250,000,000 in Section 2.6(b) is hereby deleted and replaced in its entirety with a reference to $310,000,000.

3. The Seller has requested in writing to the Agent a temporary increase in the Maximum Aggregate Commitment in accordance with Section 2.6(b) and (c) of the Repurchase Agreement. In connection therewith, Schedule BC of the Repurchase Agreement is amended and restated by Schedule BC attached hereto.

4. Reassertion of Representations and Warranties, No Default. The Seller hereby represents and warrants that on and as of the date hereof and after giving effect to this Amendment (a) all of the representations and warranties contained in the Repurchase Agreement are true, correct and complete in all material respects as of the date hereof as though made on and as of such date, except for changes permitted by the terms of the Repurchase Agreement, and (b) no Default or Event of Default has occurred and is continuing.

5. Authority, No Conflict, No Consent Required. The Seller represents and warrants that the Seller has the limited liability company power and authority to enter into this Amendment and has duly authorized as appropriate the execution and delivery of this Amendment by proper limited liability company action and none of the agreements contained herein contravene or constitute a default under any material agreement, instrument or indenture to which the Seller is a

party or a signatory or any provision of the Seller’s Articles of Organization, Operating Agreement or any requirement of law, or result in the imposition of any Lien on any of its property under any agreement binding on or applicable to the Seller or any of its property except, if any, in favor of the Buyers. The Seller represents and warrants that no consent, approval or authorization of or registration or declaration with any Person, including but not limited to any governmental authority, is required in connection with the execution and delivery by the Seller of this Amendment or the performance of obligations of the Seller herein described, except for those which the Seller has obtained or provided and as to which the Seller has delivered certified copies of documents evidencing each such action to the Buyers.

6. No Adverse Claim. The Seller hereby warrants, acknowledges and agrees that no events have taken place and no circumstances exist at the date hereof which would give the Seller a basis to assert a defense, offset or counterclaim to any claim of the Agent or the Buyers with respect to the Seller’s obligations under the Repurchase Agreement as amended by this Amendment.

7. Conditions Precedent. The effectiveness of the amendments hereunder shall be subject to satisfaction of the following conditions precedent:

| |

(a) | Receipt by the Agent of this Amendment duly executed by the Seller, the Agent and the Buyers. |

| |

(b) | Receipt by the Agent of a $20,000 amendment fee, to be distributed equally to the Buyers. |

8. Ratifications. The terms and provisions set forth in this Amendment shall modify and supersede all inconsistent terms and provisions set forth in the Repurchase Agreement and the other Repurchase Documents and except as expressly modified and superseded by this Amendment, the terms and provisions of the Repurchase Agreement and each other Repurchase Document are ratified and confirmed and shall continue in full force and effect.

9. Survival. The representations and warranties made by the Seller in this Amendment shall survive the execution and delivery of this Amendment.

10. Reference to Repurchase Agreement. Each of the Repurchase Documents, including the Repurchase Agreement and any and all other agreements, documents, or instruments now or hereafter executed and delivered pursuant to the terms hereof or pursuant to the terms of the Repurchase Agreement as amended hereby, are hereby amended so that any reference in such Repurchase Documents to the Repurchase Agreement shall mean a reference to the Repurchase Agreement as amended and modified hereby.

11. Applicable Law. This Amendment shall be governed by and construed in accordance with the laws of the State of Michigan as applicable to the Repurchase Agreement.

12. Successors and Assigns. This Amendment is binding upon and shall inure to the benefit of the Agent, the Buyers, the Seller and their respective successors and assigns, except that

the Seller may not assign or transfer any of its rights or obligations hereunder without the prior written consent of each of the Buyers.

13. Counterparts. This Amendment may be executed in one or more counterparts, each of which when so executed shall be deemed to be an original, but all of which when taken together shall constitute one and the same instrument.

14. Headings. The headings, captions, and arrangements used in this Amendment are for convenience only and shall not affect the interpretation of this Amendment.

15. ENTIRE AGREEMENT. THIS AMENDMENT AND THE OTHER REPURCHASE DOCUMENTS REPRESENT THE FINAL AGREEMENT AMONG THE PARTIES HERETO AND THERETO, AND MAY NOT BE CONTRADICTED BY EVIDENCE OF PRIOR, CONTEMPORANEOUS OR SUBSEQUENT ORAL AGREEMENTS OF THE PARTIES HERETO. THERE ARE NO UNWRITTEN ORAL AGREEMENTS AMONG THE PARTIES.

[Remainder of This Page Intentionally Left Blank]

In witness whereof the parties have caused this Amendment to be executed as of the date first written above.

PULTE MORTGAGE LLC,

as Seller and Servicer

By: s Scott E. Harris

Name: Scott E. Harris

Title: SVP/CFO

COMERICA BANK,

as Agent, Lead Arranger and a Buyer

By: s Trey Worley

Name: Trey Worley

Title: Senior Vice President

BMO HARRIS BANK N.A.

By: s Robert Bomben

Name: Robert Bomben

Title: Director

BRANCH BANKING AND TRUST COMPANY

By: s Samuel W. Bryan

Name: Samuel W. Bryan

Title: SVP

EVERBANK

By: s James C. Peary

Name: James C. Peary

Title: Vice President

SCHEDULE BC

TO Master Repurchase Agreement

The Buyers’ Committed Sums

(in dollars)

From September 4, 2015 through and including November 30, 2015

|

| | | |

Buyer | Committed Sum |

Comerica Bank |

| $61,250,000 |

|

BMO Harris Bank N.A. |

| $48,125,000 |

|

Branch Banking and Trust Company |

| $35,000,000 |

|

EverBank |

| $30,625,000 |

|

Maximum Aggregate Commitment |

| $175,000,000 |

|

From December 1, 2015 through and including December 15, 2015

|

| | | |

Buyer | Committed Sum |

Comerica Bank |

| $70,000,000 |

|

BMO Harris Bank N.A. |

| $55,000,000 |

|

Branch Banking and Trust Company |

| $40,000,000 |

|

EverBank |

| $35,000,000 |

|

Maximum Aggregate Commitment |

| $200,000,000 |

|

From December 16, 2015 through and including January 18, 2016

|

| | | |

Buyer | Committed Sum |

Comerica Bank |

| $100,000,000 |

|

BMO Harris Bank N.A. |

| $80,000,000 |

|

Branch Banking and Trust Company |

| $80,000,000 |

|

EverBank |

| $50,000,000 |

|

Maximum Aggregate Commitment |

| $310,000,000 |

|

From January 19, 2016 through and including July 28, 2016

|

| | | |

Buyer | Committed Sum |

Comerica Bank |

| $61,250,000 |

|

BMO Harris Bank N.A. |

| $48,125,000 |

|

Branch Banking and Trust Company |

| $35,000,000 |

|

EverBank |

| $30,625,000 |

|

Maximum Aggregate Commitment |

| $175,000,000 |

|

From July 29, 2016 and at all times thereafter

|

| | | |

Buyer | Committed Sum |

Comerica Bank |

| $70,000,000 |

|

BMO Harris Bank N.A. |

| $55,000,000 |

|

Branch Banking and Trust Company |

| $40,000,000 |

|

EverBank |

| $35,000,000 |

|

Maximum Aggregate Commitment |

| $200,000,000 |

|

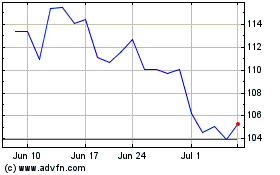

PulteGroup (NYSE:PHM)

Historical Stock Chart

From Mar 2024 to Apr 2024

PulteGroup (NYSE:PHM)

Historical Stock Chart

From Apr 2023 to Apr 2024