Philips to Sell Majority Stake in Lumileds to Apollo for $1.5 Billion -- Update

December 12 2016 - 6:59AM

Dow Jones News

By Maarten van Tartwijk

AMSTERDAM--Royal Philips NV on Monday said it had agreed to sell

a controlling stake in its Lumileds lighting business to

private-equity firm Apollo Global Management LLC for about $1.5

billion after a previous deal with a Chinese investor was blocked

by U.S. regulators.

The Dutch health-technology company said it would sell an 80.1%

stake in Lumileds, a maker of LED components and automotive

lighting products, in a deal that values the business at $2

billion. Philips will keep the remaining stake for at least three

years, after which it can dispose of the holding.

The deal comes less than a year after Philips was forced to

terminate a planned sale of most of Lumileds to a Chinese

investment group after it was rejected by the Committee of Foreign

Investment in the U.S., or CFIUS.

The committee, which vets global deals on national-security

grounds, raised undisclosed concerns about the deal, which valued

Lumileds at as much as $3.3 billion at the time. The move was the

latest example of heightened security concerns over a high-tech

shopping spree by Chinese companies.

Philips Chief Executive Frans van Houten said the number of

potential buyers became "considerably smaller" after CFIUS blocked

the deal, resulting in a lower transaction price. CFIUS is unlikely

to raise concerns again as Apollo is based in the U.S., he

added.

For the New York private-equity firm, the transaction marks the

latest in a year of prolific deal-making despite high-price markets

and intense competition from corporate buyers. The firm expects to

spend more in 2016 than it ever has in a single year, co-founder

Josh Harris said on a call with analysts in October.

Lumileds, which is based in the Netherlands, generated sales of

about $2 billion last year. It has around 9,000 employees

world-wide, with operations in more than 30 countries, including a

large research-and-development facility in San Jose, Calif.

For Philips, the sale marks another step in its efforts to

divest its 125-year-old lighting operations in an attempt to

concentrate on selling health-care technology products. Earlier

this year it sold a minority stake in its general lighting business

through an initial public offering and intends to fully exit the

business in the coming years.

Write to Maarten van Tartwijk at maarten.vantartwijk@wsj.com

(END) Dow Jones Newswires

December 12, 2016 06:44 ET (11:44 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

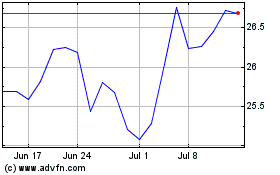

Koninklijke Philips NV (NYSE:PHG)

Historical Stock Chart

From Mar 2024 to Apr 2024

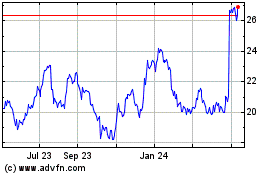

Koninklijke Philips NV (NYSE:PHG)

Historical Stock Chart

From Apr 2023 to Apr 2024