SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

June 1, 2016

KONINKLIJKE

PHILIPS N.V.

(Exact name of registrant as specified in its charter)

Royal Philips

(Translation of registrant’s name into English)

The Netherlands

(Jurisdiction of incorporation or organization)

Breitner Center, Amstelplein 2, 1096 BC Amsterdam, The Netherlands

(Address of principal executive offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F

x

Form 40-F

¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule101(b)(1):

¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule101(b)(7):

¨

Indicate by check mark whether the registrant by furnishing the information

contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes

¨

No

x

Name and address of person authorized to receive notices

and communications from the Securities and Exchange Commission:

M.J. van Ginneken

Koninklijke

Philips N.V.

Amstelplein 2

1096 BC Amsterdam – The Netherlands

This report comprises an extract of certain portions of the following press release:

“Settlement of Philips Lighting IPO”, dated May 31, 2016.

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf, by the

undersigned, thereunto duly authorized at Amsterdam, on the 1st of June, 2016.

KONINKLIJKE PHILIPS N.V.

/s/

M.J. van Ginneken

(General Secretary)

NOT FOR PUBLICATION, DISTRIBUTION OR RELEASE, DIRECTLY OR INDIRECTLY, IN OR INTO CANADA, AUSTRALIA OR JAPAN OR

ANY OTHER JURISDICTION IN VIOLATION OF THE RELEVANT LAWS OF SUCH JURISDICTION. PLEASE SEE THE IMPORTANT NOTICE AT THE END OF THE PRESS RELEASE.

May 31, 2016

Settlement of Philips Lighting IPO

Amsterdam, the Netherlands – Koninklijke Philips N.V. (“Royal Philips”) and Philips Lighting N.V. (“Philips Lighting” or the

“Company”) today announced the settlement of the Initial Public Offering of Philips Lighting.

Today the Initial Public Offering of Philips

Lighting N.V. (formerly named Philips Lighting NewCo B.V.) was settled. As a result Royal Philips has received €750 million in gross proceeds from the sale of 37.5 million existing ordinary shares in Philips Lighting (representing 25%

of Philips Lighting’s share capital).

The over-allotment option can be exercised until 30 days after 27 May 2016. If this option is fully

exercised, Royal Philips’ ownership in Philips Lighting’s outstanding share capital will be further reduced to 71.25%

1

. Royal Philips aims to sell all of its remaining shares over the

next several years as Royal Philips will focus on its HealthTech businesses.

Philips Lighting shares were listed and started trading on Euronext

Amsterdam (on an if-and-when-delivered basis) on 27 May 2016. As of today, the shares are traded unconditionally under the listing name ‘Philips Lighting’ and the symbol ‘LIGHT’. Philips Lighting announces that the

Netherlands is its Home Member State for purposes of the EU Transparency Directive.

/ / / /

Important Information

This document and the information

contained herein are not for distribution in or into Canada, Australia or Japan. This document does not constitute, or form part of, an offer to sell, or a solicitation of an offer to purchase, any securities (the “Shares”) of Philips

Lighting N.V. (the “Company”) in the United States of America (including its territories and possessions, any state of the United States of America and the District of Columbia) (the “United States”). The Shares of the Company

have not been and will not be registered under the U.S. Securities Act of 1933 (the “Securities Act”) and may not be offered or sold within the United States absent registration or an applicable exemption from, or in a transaction not

subject to, the registration requirements of the Securities Act. Any sale in the United States of the securities mentioned in this communication will be made solely to “qualified institutional buyers” as defined in, and in reliance on,

Rule 144A under the Securities Act.

The Company has not authorized any offer to the public of Shares in any Member State of the European Economic Area

other than the Netherlands. With respect to any Member State of the European Economic Area, other than the Netherlands, and which has implemented the Prospectus Directive (each a “Relevant Member State”), no action has been undertaken or

will be undertaken to make an offer to the public of Securities requiring publication of a prospectus in any Relevant

|

1

|

Excluding the effect of the sale of shares by the Selling Shareholder to the CEO and CFO of the Company

|

1

NOT FOR PUBLICATION, DISTRIBUTION OR RELEASE, DIRECTLY OR INDIRECTLY, IN OR INTO CANADA, AUSTRALIA OR

JAPAN OR ANY OTHER JURISDICTION IN VIOLATION OF THE RELEVANT LAWS OF SUCH JURISDICTION. PLEASE SEE THE IMPORTANT NOTICE AT THE END OF THE PRESS RELEASE.

Member State. As a result, the Shares may only be offered in that Relevant Member State (i) to any legal entity which is a qualified investor as defined in the Prospectus Directive; or

(ii) in any other circumstances falling within Article 3(2) of the Prospectus Directive. For the purpose of this paragraph, the expression “offer of securities to the public” means the communication in any form and by any means of

sufficient information on the terms of the offer and the Shares to be offered so as to enable the investor to decide to exercise, purchase or subscribe for the Shares, as the same may be varied in that Member State by any measure implementing the

Prospectus Directive in that Member State and the expression “Prospectus Directive” means Directive 2003/71/EC (as amended, including by Directive 2010/73/EU), and includes any relevant implementing measure in the Relevant Member State.

This document does not constitute a prospectus within the meaning of the Dutch Financial Markets Supervision Act (Wet op het financieel toezicht) and

does not constitute an offer to acquire securities. Any offer to acquire Shares has been made, and any investor should make his investment, solely on the basis of information that is contained in the prospectus made generally available in the

Netherlands in connection with such offering. Copies of the prospectus may be obtained at no cost from the Company or through the website of the Company.

In the United Kingdom, this communication is only being distributed to, and is only directed at “qualified investors” (as defined in section 86(7)

of the Financial Services and Markets Act 2000) who are (i) investment professionals falling within the meaning of Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”); or

(ii) persons falling within Article 49(2)(a) to (d) (“high net worth companies, unincorporated associations, etc.”) of the Order (all such persons together being referred to as “relevant persons”). In the United

Kingdom, any investment or investment activity to which this communication relates is available only to, and will be engaged in only with, relevant persons. Any person who is not a relevant person should not take any action on the basis of this

communication and should not act or rely on it or any of its contents.

Forward-looking Information

This document contains forward looking statements that reflect Royal Philips’ and the Company’s intentions, beliefs, or current expectations about

and targets for the Company’s future results of operations, financial condition, liquidity, performance, prospects, anticipated growth, strategies and opportunities and the markets in which the Company operates, including with respect to the

sell down of the majority holding of Royal Philips. Forward-looking statements involve all matters that are not historical facts. Philips Lighting has tried to identify forward-looking statements by using words as “may”, “will”,

“would”, “should”, “expects”, “intends”, “estimates”, “anticipates”, “projects”, “believes”, “could”, “hopes”, “seeks”, “plans”,

“aims”, “objective”, “potential”, “goal” “strategy”, “target”, “continue”, “annualized” and similar expressions or negatives thereof or other variations thereof or

comparable terminology, or by discussions of strategy that involve risks and uncertainties. The forward-looking statements are based on the Company’s beliefs, assumptions and expectations regarding future events and trends that affect the

Company’s future performance, taking into account all information currently available to the Company, and are not necessarily indicative or guarantees of future performance and results. These beliefs, assumptions and expectations can change as

a result of possible events or factors, not all of which are known to the Company or are within the Company’s control. If a change occurs, the Company’s business, financial condition, liquidity, results of operations, anticipated growth,

strategies or opportunities may vary materially from those expressed in, or suggested by, these forward-looking statements. In addition,

2

NOT FOR PUBLICATION, DISTRIBUTION OR RELEASE, DIRECTLY OR INDIRECTLY, IN OR INTO CANADA, AUSTRALIA OR

JAPAN OR ANY OTHER JURISDICTION IN VIOLATION OF THE RELEVANT LAWS OF SUCH JURISDICTION. PLEASE SEE THE IMPORTANT NOTICE AT THE END OF THE PRESS RELEASE.

the forward-looking estimates and forecasts reproduced in this document from third-party reports could prove to be inaccurate. A number of important factors could cause actual results or outcomes

to differ materially from those expressed in any forward-looking statement as a result of risks and uncertainties facing the Company, and its subsidiaries. Investors or potential investors should not place undue reliance on the forward-looking

statements in this document. In light of the possible changes to the Company’s beliefs, assumptions and expectations, the forward-looking events described in this document may not occur. Additional risks currently not known to the Company or

that the Company has not considered material as of the date of this document could also cause the forward-looking events discussed in this document not to occur. Forward-looking statements involve inherent risks and uncertainties and speak only as

of the date they are made. The Company undertakes no duty to and will not necessarily update any of the forward-looking statements in light of new information or future events, except to the extent required by applicable law. The prospectus also

contains a detailed description of risks related to investing in Philips Lighting shares.

3

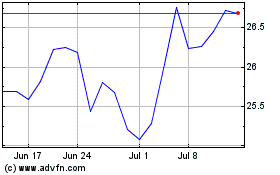

Koninklijke Philips NV (NYSE:PHG)

Historical Stock Chart

From Mar 2024 to Apr 2024

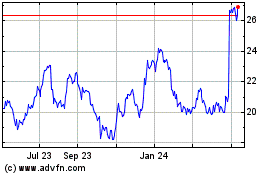

Koninklijke Philips NV (NYSE:PHG)

Historical Stock Chart

From Apr 2023 to Apr 2024