SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

May 17, 2016

KONINKLIJKE

PHILIPS N.V.

(Exact name of registrant as specified in its charter)

Royal Philips

(Translation of registrant’s name into English)

The Netherlands

(Jurisdiction of incorporation or organization)

Breitner

Center, Amstelplein 2, 1096 BC Amsterdam, The Netherlands

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form

20-F

x

Form 40-F

¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule101(b)(1):

¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule101(b)(7):

¨

Indicate by check mark whether the registrant by furnishing the information

contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes

¨

No

x

Name and address of person authorized to receive notices

and communications from the Securities and Exchange Commission:

M.J. van Ginneken

Koninklijke

Philips N.V.

Amstelplein 2

1096 BC Amsterdam – The Netherlands

This report comprises an extract of certain portions of the following press release:

“Royal Philips and Philips Lighting announce indicative price range and offer size of planned IPO of Philips Lighting and publication of

prospectus”, dated May 16, 2016.

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this

report to be signed on its behalf, by the undersigned, thereunto duly authorized at Amsterdam, on the 17th day of May, 2016.

KONINKLIJKE PHILIPS N.V.

/s/

M.J. van Ginneken

(General Secretary)

NOT FOR PUBLICATION, DISTRIBUTION OR RELEASE, DIRECTLY OR INDIRECTLY, IN OR INTO THE CANADA, AUSTRALIA

OR JAPAN OR ANY OTHER JURISDICTION IN VIOLATION OF THE RELEVANT LAWS OF SUCH JURISDICTION. PLEASE SEE THE IMPORTANT NOTICE AT THE END OF THE PRESS RELEASE.

May 16, 2016

Royal Philips and Philips Lighting announce indicative price range and offer size of planned IPO of Philips Lighting and publication of

prospectus

Amsterdam, the Netherlands – Koninklijke Philips N.V. (“Royal Philips”) and Philips Lighting NewCo B.V. (“Philips

Lighting” or the “Company”) today announced the indicative price range and offer size for the planned Initial Public Offering (the “IPO” or the “Offering”) of Philips Lighting on Euronext Amsterdam and the

publication of the prospectus. The IPO consists of an offering of 25% of Philips Lighting’s issued and outstanding ordinary shares (the “Shares”) held by its sole shareholder Royal Philips. Listing of and first trading in the Shares

on Euronext Amsterdam are expected on Friday, 27 May 2016.

Offering highlights

|

|

•

|

|

Royal Philips is offering 37.5 million existing Shares held by it, which represent 25% of the Company’s Shares.

|

|

|

•

|

|

The indicative price range for the Offering is set at between €18.50 – €22.50 (inclusive) per offered Share (the “Offer Price Range”), implying a market capitalisation of €2.78 –

€3.38 billion.

|

|

|

•

|

|

In addition, Royal Philips has granted the Underwriters (as defined in the prospectus), as part of the Offering, an over-allotment option for up to an additional 15% of the number of offered Shares (the

“Over-Allotment Shares”). The offered Shares and the maximum number of Over-Allotment Shares together represent 28.75% of the Company’s Shares.

|

|

|

•

|

|

On the basis of the Offer Price Range, the proceeds of the Offering (before underwriting commissions and offering expenses) would be approximately €694 – €844 million prior to any exercise of the

over-allotment option, or approximately €798 – €970 million assuming full exercise of the over-allotment option. Royal Philips will receive the net proceeds of the Offering.

|

|

|

•

|

|

Royal Philips and Philips Lighting will be subject to a lock-up of 180 days and the Philips Lighting Board of Management will be subject to a lock-up of 360 days, subject to certain customary exceptions. Royal Philips

aims to sell all of its remaining shares over the next several years as Royal Philips will focus on its HealthTech businesses.

|

|

|

•

|

|

Listing of and first trading in the Shares (on an “if-and-when-delivered” basis) on Euronext Amsterdam under the symbol “LIGHT” are expected on Friday, 27 May 2016.

|

|

|

•

|

|

Closing and settlement of the Offering and the start of unconditional trading in the Shares is expected to take place on Tuesday, 31 May 2016.

|

About Royal Philips

Royal Philips (NYSE: PHG, AEX:

PHIA) is a leading health technology company focused on improving people’s health and enabling better outcomes across the health continuum from healthy living and prevention, to diagnosis, treatment and home care. Philips leverages advanced

technology and deep clinical and consumer insights to deliver integrated solutions. The company is a leader in diagnostic imaging, image-guided therapy, patient monitoring and health informatics, as well as in consumer health and home care.

Headquartered in the Netherlands, Philips posted 2015 sales of €24.2 billion and employs approximately 105,000 employees with sales and services in more than 100 countries.

NOT FOR PUBLICATION, DISTRIBUTION OR RELEASE, DIRECTLY OR INDIRECTLY, IN OR INTO THE CANADA, AUSTRALIA

OR JAPAN OR ANY OTHER JURISDICTION IN VIOLATION OF THE RELEVANT LAWS OF SUCH JURISDICTION. PLEASE SEE THE IMPORTANT NOTICE AT THE END OF THE PRESS RELEASE.

About Philips Lighting

Philips Lighting is a global leader in lighting products, systems and services. Our understanding of how lighting positively affects people coupled with our

deep technological know-how enable us to deliver digital lighting innovations that unlock new business value, deliver rich user experiences and help to improve lives. Serving professional and consumer markets, we sell more energy efficient LED

lighting than any other company. We lead the industry in connected lighting systems and services, leveraging the Internet of Things to take light beyond illumination and transform homes, buildings and urban spaces. In 2015, we had sales of EUR 7.4

billion and employed 33,000 people worldwide.

Important Information

This document and the information contained herein are not for distribution in or into Canada, Australia or Japan.

This document does not constitute, or form part of, an offer to sell, or a solicitation of an offer to purchase, any securities (the “Shares”) of

Philips Lighting Newco B.V. and, after its conversion, Philips Lighting N.V. (the “Company”) in the United States of America (including its territories and possessions, any state of the United States of America and the District of

Columbia) (the “United States”). The Shares of the Company have not been and will not be registered under the U.S. Securities Act of 1933 (the “Securities Act”) and may not be offered or sold within the United States absent

registration or an applicable exemption from, or in a transaction not subject to, the registration requirements of the Securities Act. Any sale in the United States of the securities mentioned in this communication will be made solely to

“qualified institutional buyers” as defined in, and in reliance on, Rule 144A under the Securities Act.

The Company has not authorized any

offer to the public of Shares in any Member State of the European Economic Area other than the Netherlands. With respect to any Member State of the European Economic Area, other than the Netherlands, and which has implemented the Prospectus

Directive (each a “Relevant Member State”), no action has been undertaken or will be undertaken to make an offer to the public of Securities requiring publication of a prospectus in any Relevant Member State. As a result, the Shares may

only be offered in that Relevant Member State (i) to any legal entity which is a qualified investor as defined in the Prospectus Directive; or (ii) in any other circumstances falling within Article 3(2) of the Prospectus Directive. For the

purpose of this paragraph, the expression “offer of securities to the public” means the communication in any form and by any means of sufficient information on the terms of the offer and the Shares to be offered so as to enable the

investor to decide to exercise, purchase or subscribe for the Shares, as the same may be varied in that Member State by any measure implementing the Prospectus Directive in that Member State and the expression “Prospectus Directive” means

Directive 2003/71/EC (as amended, including by Directive 2010/73/EU), and includes any relevant implementing measure in the Relevant Member State.

This

document does not constitute a prospectus within the meaning of the Dutch Financial Markets Supervision Act (Wet op het financieel toezicht) and does not constitute an offer to acquire securities. Any offer to acquire Shares will be made, and any

investor should make his investment, solely on the basis of information that is contained in the prospectus made generally available in the Netherlands in connection with such offering. Copies of the prospectus may be obtained at no cost from the

Company or through the website of the Company.

NOT FOR PUBLICATION, DISTRIBUTION OR RELEASE, DIRECTLY OR INDIRECTLY, IN OR INTO THE CANADA, AUSTRALIA

OR JAPAN OR ANY OTHER JURISDICTION IN VIOLATION OF THE RELEVANT LAWS OF SUCH JURISDICTION. PLEASE SEE THE IMPORTANT NOTICE AT THE END OF THE PRESS RELEASE.

In the United Kingdom, this communication is only being distributed to, and is only directed at

“qualified investors” (as defined in section 86(7) of the Financial Services and Markets Act 2000) who are (i) investment professionals falling within the meaning of Article 19(5) of the Financial Services and Markets Act 2000

(Financial Promotion) Order 2005 (the “Order”); or (ii) persons falling within Article 49(2)(a) to (d) (“high net worth companies, unincorporated associations, etc.”) of the Order (all such persons together being

referred to as “relevant persons”). In the United Kingdom, any investment or investment activity to which this communication relates is available only to, and will be engaged in only with, relevant persons. Any person who is not a relevant

person should not take any action on the basis of this communication and should not act or rely on it or any of its contents.

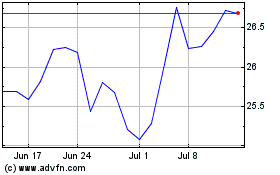

Koninklijke Philips NV (NYSE:PHG)

Historical Stock Chart

From Mar 2024 to Apr 2024

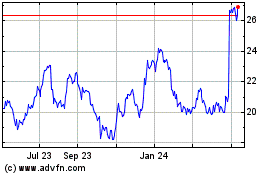

Koninklijke Philips NV (NYSE:PHG)

Historical Stock Chart

From Apr 2023 to Apr 2024