Philips More Likely to Sell Lighting Unit Via IPO Than Private Sale -- Update

April 25 2016 - 5:27AM

Dow Jones News

By Maarten van Tartwijk

AMSTERDAM--Royal Philips NV said Monday it is more likely to

sell its lighting business via an initial public offering rather

than a private sale, sending its shares plummeting.

The Dutch electronics group said it tilts toward an IPO even as

it continues to assess proposals in a private sale process.

"With equity markets' sentiment improving compared with the

first couple of months of the year, an IPO increasingly appears a

more likely outcome, " Philips said. A decision could be announced

"shortly", it said.

Shares in Philips fell more than 4% in Amsterdam as investors

appeared to react badly to the news of a possible listing. Liberum

analyst Daniel Cunliffe said the announcement dashed hopes of a

sale even as shareholders have known for more than a year that a

listing was possible.

Philips has said an IPO could take place before the end of June,

a timing that coincides with the U.K's June 23 referendum on its

membership of the European Union. A "no" vote is expected to send

ripples across financial markets, creating uncertainty for new

stock market listings.

The business has drawn interest from some investment groups,

including Blackstone Group LP and Onex Corp., and could be worth up

to EUR5 billion ($5.6 billion), The Wall Street Journal reported in

March.

Philips Chief Executive Frans van Houten said a disposal remains

an option, noting Philips has "not yet concluded on all proposals

in the private sale process and continues to assess the

attractiveness of this route." The proposals will be judged on

their value, contractual conditions as well as potential regulatory

hurdles, he added.

In January, Philips terminated a planned $2.8 billion sale of

most of its Lumileds unit to a Chinese investor, after the

Committee on Foreign Investment in the U.S. blocked the deal on

national-security grounds. Lumileds makes components for

light-emitting diodes, or LEDs, and will be sold separately from

the other lighting activities.

Philips' decision to separate its nearly 125-year-old lighting

arm is part of a wider strategic overhaul in which the company

seeks to focus on its more profitable and faster growing

health-care business, where it competes with Siemens AG and General

Electric Co.

The company said tax charges related to the separation of the

lighting business contributed to a drop in earnings in the first

three months of 2016. Net profit was EUR37 million, a drop of 63%

compared with the same period a year earlier.

Adjusted earnings before interest and taxes, the company's

preferred measure of its operational performance, rose to 14% to

EUR374 million. Sales rose 3% to EUR5.5 billion.

The company maintained its guidance for 2016, saying it expects

earnings to improve despite global macroeconomic headwinds.

Write to Maarten van Tartwijk at maarten.vantartwijk@wsj.com

(END) Dow Jones Newswires

April 25, 2016 05:12 ET (09:12 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

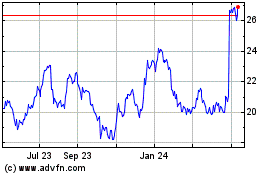

Koninklijke Philips NV (NYSE:PHG)

Historical Stock Chart

From Mar 2024 to Apr 2024

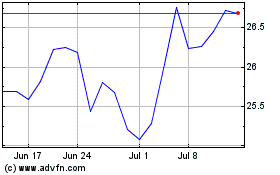

Koninklijke Philips NV (NYSE:PHG)

Historical Stock Chart

From Apr 2023 to Apr 2024