Philips Lighting Components Deal Halted by Regulatory Concerns -- 2nd Update

January 22 2016 - 10:00AM

Dow Jones News

By Maarten van Tartwijk

AMSTERDAM--U.S. regulators strike again.

Royal Philips NV said Friday that it terminated the planned $3.3

billion sale of its lighting components and automotive-lighting

unit to a Chinese investor, after the powerful Committee on Foreign

Investment in the U.S. blocked the deal on national-security

grounds.

The move comes just weeks after U.S. Justice Department concerns

about competition scuttled another $3.3 billion deal: General

Electric Co.'s sale of its appliance business to Sweden's

Electrolux AB. After pulling out of that deal in the face of a

Justice Department lawsuit, GE agreed to sell the business to

China's Haier Group for $5.4 billion.

Philips in March struck a deal to sell a 80% stake in its

Lumileds business to GO Scale Capital, an investment fund led by

Chinese venture-capital firm GSR Ventures. The proposed

transaction, however, raised concerns of the Committee on Foreign

Investment in the U.S., known as CFIUS, an interagency group led by

the Treasury Department that examines international transactions

for their impact on national security. Philips warned in October

that the deal could collapse.

The news comes as CFIUS has increased scrutiny of technology

deals in the U.S. involving Chinese buyers. Last year, Chinese

state-owned chip maker Tsinghua Unigroup Ltd. tried unsuccessfully

to buy Boise, Idaho-based Micron Technology Inc. for $23 billion,

with people familiar with the discussions saying talks fell through

in part because of the dim prospect of gaining U.S. regulatory

approval.

Lumileds, like parent Philips, is based in the Netherlands,

making the CFIUS action unusual. However, Lumileds has a large U.S.

patent portfolio for light-emitting diodes, or LED, and a sizable

presence in the U.S. through manufacturing and

research-and-development facilities in San Jose, Calif.

GO Scale Capital said it and Philips made persistent attempts to

explain the deal, but that their efforts failed to address

"unexplained government concerns."

"During the process, GO Scale Capital was very transparent about

its bona fide commercial and market-oriented interests," the group

said in a statement.

A Philips spokesman said he couldn't elaborate on the concerns

raised by CFIUS, citing the confidentiality of the talks. CFIUS

couldn't immediately be reached for comment.

Kepler Cheuvreux analyst Peter Olofsen said the CFIUS concerns

may relate to the potential transfer of technology from the U.S. to

China.

CFIUS makes recommendations to President Barack Obama on

transactions that would result in foreign control of U.S. assets,

but most of the committee's negative rulings lead to the demise of

a deal before the president weighs in.

In a rare action, Mr. Obama in 2012 ordered the sale of U.S.

wind-farm assets bought by Ralls Corp., a Chinese-controlled

company. The U.S. initially opposed Ralls's desired buyer for the

assets but reached a settlement with the company last year allowing

the sale to proceed.

Philips said it would engage with other potential buyers that

have shown an interest in Lumileds. Selling the unit is an

important step for Philips in its plan to exit its lighting

activities.

The Dutch company is currently preparing to dispose of its

remaining lighting business through a listing or sale and still

aims to sell the Lumileds business separately, a spokesman

said.

The selling price for Lumileds could be markedly lower with a

new buyer as the unit's earnings appear to have come under pressure

recently, Mr. Olofsen said.

Write to Maarten van Tartwijk at maarten.vantartwijk@wsj.com

(END) Dow Jones Newswires

January 22, 2016 09:45 ET (14:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

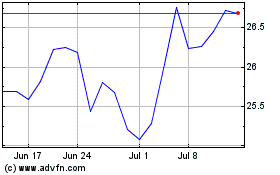

Koninklijke Philips NV (NYSE:PHG)

Historical Stock Chart

From Mar 2024 to Apr 2024

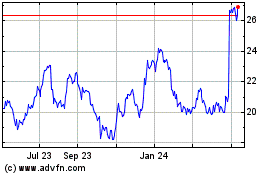

Koninklijke Philips NV (NYSE:PHG)

Historical Stock Chart

From Apr 2023 to Apr 2024