Nestlé Drops Targets as Consumer Giants Struggle -- 2nd Update

February 16 2017 - 10:18AM

Dow Jones News

By Brian Blackstone

VEVEY, Switzerland--Nestlé SA has thrown out its long-running

annual sales-growth target--at least for the next three year---as

the world's largest packaged-food company struggles alongside the

rest of the industry against ultralow inflation and fast-changing

consumer tastes.

The world's consumer-goods giants, once mostly insulated from

uncertain economic times, have all scrambled recently to boost

sales to combat a host of global economic difficulties. Low sales

growth in recent years at Procter & Gamble Co. has forced it to

cut costs and slim down. Earlier this week, Trian Fund Management

LP, a big activist fund, said it had taken a stake in P&G,

heightening urgency to turn things around.

Unilever PLC last month reported weaker 2016 underlying sales,

which strip out currency moves and acquisitions. On Wednesday,

Kraft Heinz Co. said it plans more savings than initially targeted

in the face of sluggish revenue growth.

Each company is dealing with different challenges in an array of

markets and product categories. But all are being buffeted by

broadly similar difficulties that are largely out of their control:

tough competition in many of their biggest markets; currency swings

that have affected costs; difficulty raising prices amid low global

inflation; and fickle changes in what consumers want.

Among companies like Nestlé, focused more on packaged food,

consumers have clamored for healthier offerings. But those products

have proven harder than expected to translate into big sales

drivers.

Amid those industrywide issues, Nestlé Chief Executive Mark

Schneider said Thursday the Swiss-based owner of Nesquik flavored

drinks, Puppy Chow pet food and Stouffer's frozen meals would take

a "time out" trying to boost organic sales by 5% to 6% each year--a

target it fell far short from hitting again in 2016. Nestlé said

Thursday organic sales grew just 3.2% last year, down from 4.2% in

2015.

It was the fourth straight year it missed the target, and the

weakest since the company started tracking the metric in 1996.

Organic sales exclude currency fluctuations, acquisitions and

divestments.

Nestlé had in recent years emerged as a gold standard of sorts

for consumer products, largely because of how well it performed in

the aftermath of the global financial crisis. But its stock has

lagged behind its peers recently, falling nearly 3% in the last

year compared with a 7.4% rise in the Stoxx 600 European consumer

goods index.

Nestlé shares were down 1.5% in early afternoon trading in

Europe.

Mr. Schneider, who started as CEO on Jan. 1, said the company's

new aim was to achieve a more flexible "mid-single-digit organic

growth," as opposed to the long-specified 5%-6% target. But even

that softer goal won't kick in until 2020.

"This is a timeout from that model," Mr. Schneider said in an

interview. "For [2017], 18, 19 we don't wish to be measured against

that."

Mr. Scheider said the company needed "time to cope with some of

the remaining deflationary trends we're seeing, and we also need

the time to adapt to some of these very fundamental changes that

we've witnessed in the consumer-goods industry," he said.

Mr. Schneider said deal making wasn't a fix. Nestlé isn't on the

hunt for any major acquisitions in the near term, he said, citing

the "fairly lofty valuations" in the consumer-goods area. Rather,

Nestlé said it would deepen cost-cutting, which will "increase

restructuring costs considerably" to maintain profitability.

Nestlé has moved on several fronts to align its stable of

products with changing tastes. It has cut sugar and changed its

marketing strategy for Nesquik, and revamped its frozen foods

business, which includes Lean Cuisine, with new recipes.

The company has invested heavily in nutrition and health

sciences. But that division, which contributed 17% of overall sales

last year, is still small compared with mainstay businesses such as

beverages and prepared food.

Mr. Schneider's appointment as CEO underscores the urgency of

Nestlé's efforts to pivot. He joined from German health-care

company Fresenius SE. He is the first outsider to run the company

in nearly a century, and comes with a deep background in the sort

of health-care businesses Nestlé has said is its future.

"Generally, the share of these products over time is going to

increase," Mr. Schneider said.

Things are unlikely to improve much in 2017, however. Nestlé

said it expects organic growth between 2% and 4% this year.

Nestlé said Thursday that 2016 sales were 89.47 billion Swiss

francs ($89 billion), up slightly from 2015 but just below

analysts' expectations. Net profit was 8.5 billion francs, down

from 9.1 billion francs in 2015 and well below analysts'

expectations of around 9.5 billion francs. Last year's profit was

weakened by a roughly half-billion franc, noncash adjustment

related to local taxes.

Write to Brian Blackstone at brian.blackstone@wsj.com

(END) Dow Jones Newswires

February 16, 2017 10:03 ET (15:03 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

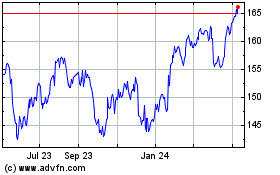

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Mar 2024 to Apr 2024

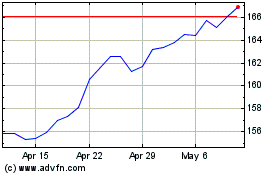

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Apr 2023 to Apr 2024