By David Benoit and Sharon Terlep

One of the biggest activist investors has built up a more than

$3 billion stake in Procter & Gamble Co., adding urgency to the

consumer-product giant's efforts to turn around its business and

boost its stock price.

Trian Fund Management LP, which in previous years has targeted

companies like PepsiCo Inc. and DuPont Co., disclosed Tuesday it

had bought shares in P&G, which has a market value of $225

billion. Trian's bet, at more than $3 billion, according to a

person familiar with the matter, is its largest investment ever.

It's unclear what changes Trian, which is known for publishing

detailed research reports on its investment targets, will seek at

the maker of Tide detergent, Gillette razors and Pampers

diapers.

"P&G welcomes investment in our company," the Cincinnati

company said, after The Wall Street Journal first reported on

Trian's investment Tuesday. Shares of the company, which have

lagged behind the broader market for the past year, jumped 3% in

late trading to $90.40.

P&G has been slashing costs and shedding dozens of brands to

refocus on its biggest businesses. But it has struggled to boost

sales growth as it battles a sluggish global economy, price

pressures and competition from internet upstarts like the Dollar

Shave Club.

Historically, Trian has focused on companies it believes need

tighter focus on core operations, as well as on cutting costs and

management bureaucracy. As with other activists, it also is known

for advocating for asset sales or breakups. Trian sometimes works

quietly from inside the boardroom and at other times wages public

battles for influence.

Trian didn't speak with P&G executives about its investment

before disclosing it publicly, people familiar with the matter

said.

This isn't the first time P&G has faced an activist. In

2012, William Ackman's Pershing Square Capital Management LP

invested in the company and called for a CEO change amid slumping

profits. A year later, Robert McDonald was replaced by his old

boss, A.G. Lafley, who remained chairman until last year. Company

veteran David Taylor is now chairman and CEO.

Mr. Taylor, who took over in November 2015, has opted against

launching new brands or buying a hot startup, instead relying on

P&G's traditional fundamentals: selling to the masses by way of

big retailers on the strength of meticulously collected consumer

research; a massive research-and-development operation; and the

world's biggest advertising budget.

"I understand the desire for faster growth and for a

single-minded short-term objective, but we've seen this movie

before, and frankly, we don't want to live the sequel," Mr. Taylor

said at a meeting with analysts in November after his first year at

the helm.

The company's closely watched organic sales growth, which

excludes acquisitions or divestments as well as currency swings,

has been stuck between 1% and 3% in recent years. In January,

P&G increased its target for the year ending in June to between

2% and 3% -- though that is still well below prerecession

levels.

Bernstein analyst Ali Dibadj has long advocated a breakup of

P&G. He said P&G's resistance to change may prompt Trian to

take a more active role. "We have always tried to keep P&G's

feet to the fire as we don't think it's living up to its

potential," he said. "We can imagine Trian sees the same thing and

will do the same."

P&G shares have gained 5.7% this year including dividends,

outpacing the S&P 500's 4.2% return, but the share's price has

trailed the benchmark over the past one-year and three-year

periods.

P&G fared better than many of its rivals in the second half

of 2016, capturing market share in many categories. Analysts say

the environment is tough for consumer-staples sellers, also because

of macroeconomic factors like currency volatility. Several big

research firms have downgraded P&G shares, including Goldman

Sachs Group Inc., which put a sell rating on the company in

January.

P&G, General Electric Co. and some other American

corporations are rushing to shed underperforming divisions and slim

down after years of bulking up through acquisitions outside their

core expertise. The change of heart among top executives was seen

as an admission that their companies had grown too big and bloated

to manage effectively, which caused their stock prices to languish

in recent years. It also came as activist investors used their war

chests to pressure boards to move more quickly.

P&G spent $80 billion over two decades scooping up brands

including Gillette razors, Duracell batteries and Iams pet food,

only to end up selling some of them to focus on boosting sales of

Tide, Pampers and other mainstays. In October, P&G completed

the $11.6 billion sale of dozens of beauty brands, including

CoverGirl makeup and Clairol hair dye, to Coty Inc., which included

the transfer of about 10,000 P&G employees.

The activist world has been in guessing mode on the new Trian

position, particularly since co-founder Nelson Peltz said in

December that he and his partners had started buying a new stock.

At that time, Mr. Peltz told CNBC that he hoped to talk to the

board and management before the investment became public, as the

firm has tried to distance itself from bare-knuckled activism and

position itself as a constructive, if opinionated, shareholder.

Trian didn't reveal a new investment in all of 2016, focusing

instead on its portfolio companies, after making three new

investments in 2015. One of them was then its biggest ever, a $2.2

billion stake in General Electric Co.

But it was also ramping up for this new bet by fundraising and

selling some other stakes. During 2016, it sold a $1.8 billion

investment in PepsiCo, after a three-year campaign that included a

bid to break up the soda and snack maker, and a $383 million

position in money-manager Legg Mason Inc., which marked one of the

few times in which Trian has helped remove a chief executive.

Trian raised a specific fund for the P&G position in recent

months, tapping large investment pools like sovereign-wealth funds

and pension funds, people familiar with the matter have said.

Trian on Tuesday disclosed a P&G stake of $539 million when

it released its portfolio as of the end of December. The investment

fund has continued buying throughout the new year and the stake has

risen to more than $3 billion, the people said.

Write to David Benoit at david.benoit@wsj.com and Sharon Terlep

at sharon.terlep@wsj.com

(END) Dow Jones Newswires

February 14, 2017 20:36 ET (01:36 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

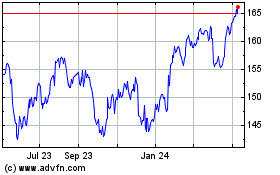

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Mar 2024 to Apr 2024

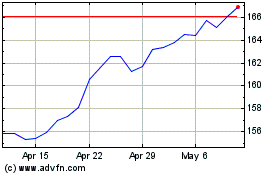

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Apr 2023 to Apr 2024