BT's Italian Accounting Scandal Deepens, Shares Tumble -- 3rd Update

January 24 2017 - 9:41AM

Dow Jones News

By Stu Woo and Simon Zekaria

LONDON--One of Britain's oldest and best-known companies lost a

fifth of its value Tuesday after saying it had grossly

underestimated the severity of an accounting scandal at its Italian

business.

BT Group PLC, parent company of British Telecommunications, said

it was taking a write-down of GBP530 million ($661 million), more

than three times its previous estimate of GBP145 million, for

yearslong "improper" accounting practices and transactions in

Italy.

In addition, BT lowered its forecast, citing a deteriorating

outlook for business from the British public sector and

international corporations.

The dual shocks sent BT shares tumbling 19%, wiping about GBP7

billion off its market capitalization, which stood around GBP31

billion as of the early afternoon. They also dealt a setback to the

high-spending ambitions of BT Chief Executive Gavin Patterson, a

former Procter & Gamble Co. shampoo executive known for his

salt-and-pepper mane and open shirt collars.

In October, BT announced an internal investigation into its

Italian business. The company said Tuesday that the investigation,

which included an independent review by auditing firm KPMG LLP,

found that "the extent and complexity of inappropriate behavior in

the Italian business were far greater than previously identified."

BT said only that the activity involved improper sales, purchase

and leasing transactions, which led BT to overstate its Italian

profit over "a number of years."

The company said it suspended several executives in Italy, who

have since left the business. BT has also appointed a new chief

executive of BT Italy to take charge Feb. 1. BT focuses on business

customers in Italy and has no consumer-focused brand. In 2015, the

last year for which data are available, BT had 2.3% of the total

fixed-line and mobile customers' expenditures in Italy, according

to the country's telecom regulator.

BT said it still expected to increase its yearly dividend by

10%, while fiscal third-quarter earnings were in line with market

expectations after stripping out the write-down's impact.

Mr. Patterson has tried to remold BT's image as a 171-year-old

former state monopoly that controls Britain's landline-telephone

network to that of an digital juggernaut that can provide mobile

services, high-speed internet and televised sports games. BT

surprised the U.K.'s media establishment by winning a three-year,

GBP900 million contract to air Europe's flagship soccer tournament

starting in 2015.

Tuesday's setbacks shouldn't hinder BT's ability to compete in

the coming sports-rights auctions, said Raymond James analyst

Stéphane Beyazian. "Financially, the company is sound, but there

are more structural challenges coming," he said. Mr. Beyazian said

Sky PLC, BT's major TV-and-internet-provider rival, presented a

serious challenge to BT with its new mobile-service offering.

21st Century Fox Inc. has announced plans to buy the 39.1% of

Sky it doesn't already own. Billionaire media mogul Rupert Murdoch

and his family are major stakeholders in Fox and News Corp,

publisher of The Wall Street Journal.

Write to Stu Woo at Stu.Woo@wsj.com and Simon Zekaria at

simon.zekaria@wsj.com

(END) Dow Jones Newswires

January 24, 2017 09:26 ET (14:26 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

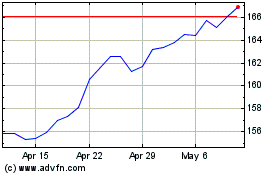

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Mar 2024 to Apr 2024

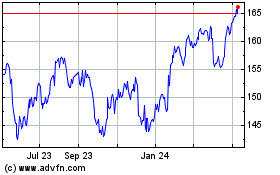

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Apr 2023 to Apr 2024