By WSJ Staff

Executives world-wide returned to work Wednesday to face a

radically changed political landscape as they weighed the

ramifications of Donald Trump's surprise election -- the second big

shift for global businesses in recent months after the U.K.'s vote

to leave the European Union.

U.S. businesses braced for revamped trade pacts and a potential

crackdown on overseas operations, coupled with the promise of lower

taxes, less regulation and higher infrastructure spending at home.

Executives in Asia and Europe said they were hopeful their close

ties with U.S. economy would endure the political upheaval and

heated campaign rhetoric.

In an open letter Wednesday to the president-elect, a group of

CEOs including the leaders of Boeing Co., Procter & Gamble Co.

and United Technologies Corp. expressed an "urgent need to restore

faith in our vital economic and government institutions."

Mr. Trump had harsh words on the campaign trail about big

companies like Ford Motor Co. and United Technologies for moving

jobs and operations overseas. For example, Mr. Trump promised to

slap 35% tariffs on cars imported to the U.S. from Mexico.

"We are aware that there will be times when we disagree on the

specifics of important policies," the CEOs wrote in a letter

organized by the National Association of Manufacturers, a major

trade group. "We do believe, however, that we can be

constructive... if we can all approach challenging situations in

good faith."

The President-elect has been critical of global trade, the North

American Free Trade Agreement and the Trans-Pacific Partnership, an

agreement to lower or eliminate tariffs between the U.S. and 11

other countries including Japan and Vietnam. He has also been

critical of China, the biggest U.S. trading partner.

"We hope President Trump is more nuanced than candidate Trump,"

said Jake Parker, vice president of China operations of the

U.S.-China Business Council.

Charlie Ergen, CEO of Dish Network Corp., said a Trump

administration could bring bipartisan support for infrastructure

spending, lighter regulation and a "more rational" tax code that

would bring offshore money back into the country. "You've got a lot

of potential positives for business in general," Mr. Ergen

said.

Mr. Trump's election sent waves through the U.S. health-care

industry, providing relief to drugmakers worried about the specter

of government price limits but fanning fears for hospital operators

and some health insurers that the Medicaid expansion in President

Obama's health law could get rolled back. That provision had

brought those companies more paying customers.

Mr. Trump has vowed to repeal the Affordable Care Act, though

many analysts think it is unlikely all of the ACA's effects would

be undone. Mr. Trump also took aim at high drug prices during his

campaign, hinting at measures such as re-importation of drugs and

giving Medicare powers to negotiate drug prices to limit price

rises.

J. Mario Molina, the CEO of Molina HealthCare Inc., a large

insurer of Medicaid patients, expects the new administration to

expand Medicaid further. "Health-care reform is in place, it's

going to be modified, it's going to move forward," he said. "We're

going to see Obamacare 2.0, maybe they will call it Trumpcare, or

Ryancare." He suggested that the law's exchanges might also survive

but change -- perhaps with reduced subsidies and more flexibility

for insurers.

Mr. Trump has promised to spend $1 trillion on infrastructure

projects, a position that was applauded by Caterpillar Inc., which

also relies heavily on export markets. "We've got a lot to do at

home on building our own infrastructure in this country, and we are

excited about some of the things that has said in this regard,"

said Kathryn Dickey Karol, Caterpillar's vice president for global

government and corporate affairs.

But Martin Richenhagen, CEO of farm-equipment maker Agco Corp.,

said he is concerned about Mr. Trump's repeated support for trade

protectionism. "That would be a nightmare if we make life difficult

for imports and exports," said Mr. Richenhagen, who was in Germany

this week. "We need to explain that to him. The Europeans are very

concerned."

Mr. Trump has proposed overhauling U.S. corporate taxes by

reducing the rate to 15% from 35%. His plan also provides for a

one-time tax rate of 10% for repatriated corporate profits, which

would help fund infrastructure projects. About $2.4 trillion in

overseas cash sits on the balance sheets of U.S. corporations,

sheltered from U.S. corporate income taxes because the companies

have declared it unlikely to be used in the U.S.

Mr. Trump said he would instruct the U.S. Trade Representative

to bring trade cases against the Chinese to punish them for

allegedly using unfair subsidies to help their companies. That gave

a boost to shares of U.S. producers like US Steel Corp. but could

spell trouble for everyone from Apple Inc. to Wal-Mart Stores Inc.,

which rely on Chinese factories.

The National Retail Federation is keeping a close eye on how Mr.

Trump might alter cross-border trade, tax policy and labor laws.

"The retail supply chain is a thoroughly global supply chain," said

David French, the group's senior vice president of government

relations. "Anything that threatens two-way trade can hurt retail

and consumers," Mr. French said.

Mr. Trump intentions for the energy industry were clear: put

coal miners back to work, undo subsidies for renewable power and

end U.S. participation in global efforts to stop climate

change.

Scott Sheffield, chief executive of Pioneer Natural Resources

Co., a major U.S. producer in West Texas, said removing onerous

regulations would help put oil employees hit hard by a two-year

energy bust back to work. "His message about creating jobs is why

he broke the blue wall" and attracted votes from Democrats in some

states, Mr. Sheffield said.

Continental Resources Inc. CEO Harold Hamm, Mr. Trump's chief

adviser on energy issues, said subsidies for renewable energy like

solar and wind should be eliminated. "None of it should be

subsidized, none of it," Mr. Hamm said Wednesday in an interview,

the morning after he attended Mr. Trump's victory party. "If it

makes it in the market, fine."

(END) Dow Jones Newswires

November 09, 2016 16:31 ET (21:31 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

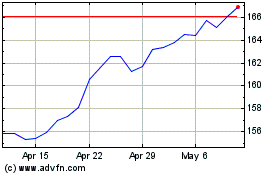

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Mar 2024 to Apr 2024

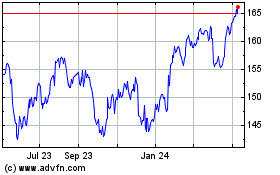

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Apr 2023 to Apr 2024