Coty Cites 'Massive Distraction' of Integration for Sales Decline

November 09 2016 - 3:10PM

Dow Jones News

Coty Inc. said the "massive distraction" involved in integrating

the $11.6 billion beauty business it acquired from Procter &

Gamble Co. led to an unexpected drop in sales, sending its shares

sharply lower.

The New York-based company Wednesday reported a 2.9% decline in

revenue for the quarter ended Sept. 30, with sales of fragrances

and color cosmetics both down 10%. The categories comprise the bulk

of Coty's $1.1 revenue for the quarter.

Analysts fretted that the sales decline reflects more of a

fundamental change in the business climate than Coty executives

acknowledged. "Help us have confidence that this really negative

trend isn't going to persist throughout the year," Citigroup

analyst Wendy Nicholson said in a call to discuss the results.

Coty Chairman Bart Becht said the company is going through a

transition bringing in the P&G brands but that now that the

integration with the new businesses is mostly complete it can

better focus on its operations. The company said its long-terms

earnings forecast remains intact.

"I think that's what you expected when you have a massive

distraction happening," Mr. Becht said. "At the same time, we

believe the longer-term outlook remains the same."

Shares of Coty fell 9.6% to $19.80 in afternoon trading, in what

would be its biggest one day fall.

The New York company has been aggressively hunting deals to

improve its business and grow its footprint. The P&G beauty

business came with labels such as CoverGirl makeup, Gucci

fragrances and Clairol hair dye.

In addition to the P&G deal, the company in October agreed

to buy hairstyle appliance maker Ghd for about $510 million. Last

year, it completed its purchase of Bourjois cosmetics from Chanel

and bought several Brazilian skin-care brands and struck a deal to

buy digital marketing firm Beamly in a bid to ramp up its

e-commerce business.

Coty paid $1 billion less for the P&G beauty brands than

initially disclosed due to an "insistence" by P&G that the deal

price be tied in part to Coty's share price, Mr. Becht said in an

interview. Coty agreed to pay $12.5 billion for the business when

it struck the deal in July 2015.

Coty shares rose between the time the deal was struck and its

closing, which pushed the final deal price down. "We knew what our

plans were and we had confidence that our share price might

increase further," he said. "We got a very nice discount."

P&G couldn't immediately be reached for comment. Company

executives have said previously that, despite the lower price,

P&G got a good price for the business.

For the quarter, Coty posted no profit, compared with net income

of $125.7 million in the same period a year ago.

Write to Sharon Terlep at sharon.terlep@wsj.com

(END) Dow Jones Newswires

November 09, 2016 14:55 ET (19:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

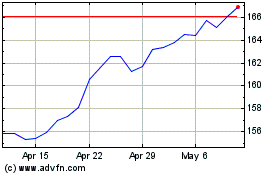

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Mar 2024 to Apr 2024

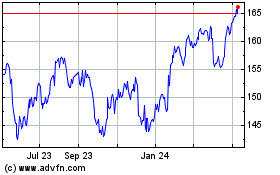

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Apr 2023 to Apr 2024