Earnings Watch -- WSJ

October 26 2016 - 3:03AM

Dow Jones News

PROCTER & GAMBLE

Pampers Maker Enjoys Higher Sales

Procter & Gamble Co. increased sales of staples from laundry

detergent to toothpaste in the most recent quarter, which boosted

the company's shares despite a warning that growth will be spotty

in the months ahead.

The maker of Gillette razors and Pampers diapers on Tuesday

posted an unexpected rise in profit for the quarter and said

organic sales -- a closely watched metric that strips out currency

moves, acquisitions and divestments -- grew 3%, the biggest

increase in more than a year. In 4 p.m. New York trading Tuesday,

the company's shares were up 3.4% at $86.97.

In all for the latest quarter, P&G reported profit of $2.71

billion for the first quarter ended Sept. 30, up 4.2% from a year

earlier. Revenue was essentially flat at $16.5 billion.

The company backed its 2017 forecast for per-share earnings

growth in the mid-single digits from fiscal 2016 and sales growth

of about 1%.

--Sharon Terlep and Anne Steel

UNITED TECHNOLOGIES

Profit Rises Despite Cost of Engine Rollout

United Technologies Corp. reported strong earnings and sales

growth, dodging pressure that has hurt rival industrial firms, even

as it struggles with the rollout of its new jet engine.

The third quarter showed that the company has been able to

balance out the rising cost of making the new jet engine -- the

product of more than a decade and $10 billion in investment -- with

strong performance across its other businesses, including its air

conditioning and building controls businesses and its aerospace

systems maker.

"Balance still works at UTC," Chief Executive Gregory Hayes said

on a conference call. Shares of the company rose about 1.85%,

closing at $101.36.

The company reported a 8.7% increase in third-quarter profit

while revenue grew 4.1% to $14.35 billion. The company raised its

2016 profit and sales forecasts.

At the same time, the company warned that profits will be flat

next year, weighed down by costs of building new jet engines and

clawing back market share for elevators.

--Anne Steele

MERCK

Cancer Drug Sales Provide a Boost

Merck & Co. posted increases in third-quarter revenue and

profit, helped by higher sales of a closely watched cancer

treatment and vaccines. Merck is trying to overcome pressure on

sales of its top products. The Kenilworth, N.J., company is

counting on rising sales of its new cancer drug Keytruda.

For the third quarter, Keytruda posted sales of $356 million, up

from $159 million in the same quarter last year.

The company posted a profit in the quarter of $2.18 billion, or

78 cents a share, up from $1.83 billion, or 64 cents a share, a

year prior. Excluding restructuring and acquisition-related costs

and other items, per-share earnings rose to $1.07 from 96 cents.

Sales grew 4.6% to $10.54 billion.

Analysts polled by Thomson Reuters had forecast per-share

earnings of 99 cents a share on revenue of $10.18 billion.

For the year, Merck now projects per-share adjusted earnings

between $3.71 and $3.78 on revenue between $39.7 billion and $40.2

billion. It had previously expected earnings of $3.67 to $3.77 and

revenue of $39.1 billion to $40.1 billion.

--Peter Loftus and Austen Hufford

(END) Dow Jones Newswires

October 26, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

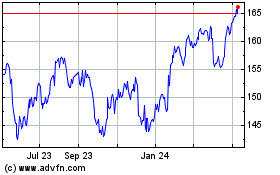

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Mar 2024 to Apr 2024

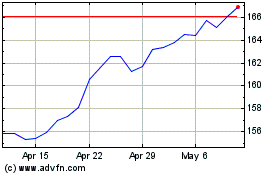

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Apr 2023 to Apr 2024