By Jon Sindreu

U.S. stocks edged lower Tuesday as investors considered a mixed

batch of corporate earnings.

The Dow Jones Industrial Average slipped 24 points, or 0.1%, to

18199 shortly after the opening bell. The S&P 500 dropped 0.2%,

and the Nasdaq Composite fell 0.1%.

Shares of Under Armour slid 14% after the athletic apparel

maker, whose profits grew in the third quarter, tempered its growth

expectations going forward.

Consumer-goods company Procter & Gamble posted an unexpected

rise in profit and gained 3.8%. Apple, which is set to report

earnings after the close of U.S. markets, edged up 0.3%.

Markets have generally steadied this week amid

better-than-expected corporate earnings and signs of stronger

health in developed nations across the globe. Business confidence

in the German manufacturing sector hit a two-year high in October,

according to data released Tuesday. On Monday, purchasing managers'

surveys showed activity in the eurozone at a 10-month high.

In Europe, the Stoxx Europe 600 slipped 0.1%.

A bright spot was the telecommunications sector. France's

biggest phone carrier, Orange SA, gained 4.5% after reporting a

0.4% increase in sales in the third quarter.

Investors also rewarded Swiss pesticide maker Syngenta AG, which

rose 1.6% after announcing sales in line with analyst expectations.

Another Swiss giant to report figures Tuesday, pharmaceutical

conglomerate Novartis AG, edged down 2.6%, despite its net income

rising in the three months to September.

Meanwhile, shares in troubled Italian lender Banca Monte dei

Paschi di Siena SpA were on a roller-coaster ride as investors

remained undecided about its turnaround plan, which will include

slashing 2,600 jobs and shutting 500 branches. After rising more

than 20% early morning, the stock was off 17% -- but is still up

roughly 60% over the past month.

Most investors are cautiously optimistic about the final quarter

of the year. The U.S. election and the Italian constitutional

referendum remain major concerns.

"Many of the uncertainties plaguing the eurozone economy may

have faded somewhat, but concerns about geopolitical risks,

instability in the financial sector and monetary policy are far

from likely to fade into the background permanently," said ING

analyst Bert Colijn.

U.S. investment manager BlackRock warned Tuesday that U.S.

earnings look better because analysts had previously lowered their

expectations.

"Early third-quarter earnings have beaten these reduced

expectations at a higher-than-average rate," said Richard Turnill,

BlackRock's chief investment strategist. "Yet fewer companies are

raising their future guidance than in a typical quarter."

Nevertheless, U.S. economic data for the third quarter, set to

be released Friday, is broadly forecast to show the world's biggest

economy growing at a faster pace. Markets price in a 74% chance

that interest rates will be higher by December, since strong growth

would clear the way for the Federal Reserve to tighten policy.

As a result, the dollar has risen against other major currencies

this month, pushing the euro to an eight-month low and the renminbi

to its lowest since 2010. Still, markets are less concerned than

they were earlier in the year about a sudden devaluation of the

Chinese currency.

"We don't think that the renminbi will depreciate much this

year, because the U.S. dollar does not have so much potential to

appreciate," said Amundi Asset Management strategist Bastien Drut.

"We don't believe there can be an acceleration of growth next year"

in the U.S., he said.

On Thursday, U.K. officials will provide a first glimpse at

post-Brexit Britain by releasing gross domestic product figures for

the third quarter. Economists expect households and businesses to

have shrugged off any immediate adverse effects stemming from the

U.K.'s vote to leave the European Union in June.

Strong data could lead markets to expect less monetary stimulus

from the Bank of England, which recently reignited its bond-buying

program -- known as quantitative easing, or QE.

For global investors, the question now is whether to fully

embrace risky assets after years in which ultrasafe bonds have been

the star performers due to loose policies by central banks.

This month, bond yields have started creeping up, a tentative

sign that stronger economic growth -- and worries that central

banks have reached the limits of their powers -- may put an end to

the rally in fixed income. BlackRock has already warned that 2017

could be "a rough year" for bonds.

Paul Griffiths, chief investor at First State Investments,

believes bonds remain globally overvalued, but stresses that they

can remain this way for years before they sell off.

"Whilst there is a steady level of QE happening across the world

the ability for bond yields to move in a sustained manner to more

normal levels is unlikely," he said.

Asian equity markets painted a mixed picture Tuesday, dragged

down by disappointing South Korean GDP data, which drove the Kospi

index to edge down 0.5%. By contrast, a weaker yen boosted the

Japanese Nikkei 225, which rose 0.8% and reached a six-month

high.

Write to Jon Sindreu at jon.sindreu@wsj.com

(END) Dow Jones Newswires

October 25, 2016 09:57 ET (13:57 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

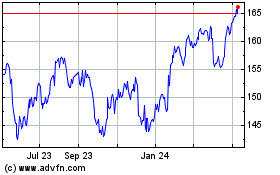

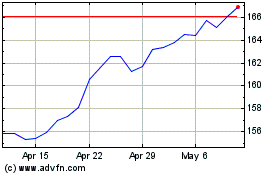

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Apr 2023 to Apr 2024