By Paul Ziobro

Being funny paid off handsomely for Michael Dubin.

The founder of Dollar Shave Club Inc. introduced his

subscription model for selling razors to the world in 2012 with a

slapstick YouTube video, in which he railed against high-price

blades and deadpanned: "Our blades are f -- ing great."

Now, he is selling Dollar Shave Club to Unilever PLC for $1

billion cash, lining his and his investors' pockets and giving the

company more ammunition to continue to go after the king of

shaving, Procter & Gamble Co.'s Gillette. Mr. Dubin, who held

on to a roughly 9% stake, stands to receive about $90 million from

the sale, said people familiar with the matter.

Humor has long come naturally to the 37-year-old Pennsylvania

native. He spent eight years after college honing his craft with

classes at the famed improv group Upright Citizens Brigade in New

York, while working television and marketing jobs.

But the fast rise of Dollar Shave Club also comes from Mr.

Dubin's instincts as a marketer. He exploited men's long-held

frustrations about the cost of razors and the inconvenience of

shopping for them, and took advantage of an industry that was slow

to change.

"He had a sense of what guys want to talk about and how to talk

with them, rather than shout at them," said David Pakman, a partner

at venture-capital firm Venrock, which led two rounds of funding

for Dollar Shave Club and owns a 15% stake.

Mr. Dubin said the company grew out of an encounter with his

friend's father at a California holiday party in 2010. He had asked

Mr. Dubin, who had some e-commerce experience, to help him sell

250,000 razors that he had acquired from Asia. Their conversation

sparked the idea for Dollar Shave Club.

But in 2011 the concept of selling blades for just $1 each

through a subscription model was met with skepticism. Michael

Jones, a former MySpace CEO who had founded Los Angeles-based tech

incubator and investor Science Inc., recalled thinking that it

would be hard to turn a profit after factoring in shipping

costs.

Then, Mr. Dubin played a rough cut of the now famous YouTube

spot. "The video pushed me over the edge," Mr. Jones said.

Mr. Dubin started the business out of his apartment in Venice,

Calif., where he had moved to be near an ex-girlfriend. He

assembled a team that included former executives from News Corp,

AOL and Gilt Groupe. But his laid-back attitude continued to

encounter resistance as he tried to disrupt an industry that's slow

to change.

Ken Hill, who heads the U.S. arm of Korean razor maker Dorco

Co., recalls his first meeting with Mr. Dubin before Dorco became

Dollar Shave Club's supplier of blades and an investor. "He has on

white pants, sneakers, and looked like he just rolled out of bed,"

Mr. Hill said in an interview. "I looked at my finance guy, rolled

my eyes and said, 'Oh, boy.'"

A former executive with Schick, Mr. Hill had doubts about the

subscription model. "It wasn't compelling enough to sign a

contract, but it was certainly compelling for us to listen to him,"

he said. Dollar Shave Club had to pay for the first order

upfront.

When orders poured in after his video went live in March 2012,

Mr. Dubin had one small printer running nearly 24 hours a day, with

a fan near it to keep the motor cool. The address labels were

collected in trash bags, tossed over a fence to the fulfillment

center and affixed to packages the next day. "That was a very raw

time, the you-got-to-do-whatever-it-takes phase," Mr. Dubin said

Wednesday.

Mr. Dubin continued to push the company introducing hair

products, body washes and moist towelettes. A new product, called

One Wipe Charlies, also introduced with a YouTube video called

"Let's Talk About #2," was a bit uncomfortable to present to

investors.

"He introduced it in a humorous way, but it was backed by data,"

said Mr. Pakman, of Venrock. The company raised about $150 million

in venture capital to fuel its growth. Membership reached 3.2

million, and revenue is on pace to top $200 million this year.

While the growth came fast over the past four years, Mr. Dubin

said he wasn't sure how far the company's come until it opened a

fulfillment center in Torrance, Calif., in late 2015. "You get a

sense of just how many tens of thousands of packages are going out

everyday," Mr. Dubin said. "For the first time, when I looked at

that, I said, 'This is a big business.'"

--Rolfe Winkler and Sharon Terlep contributed to this

article.

Write to Paul Ziobro at Paul.Ziobro@wsj.com

(END) Dow Jones Newswires

July 20, 2016 21:51 ET (01:51 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

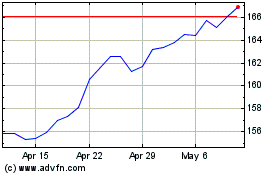

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Mar 2024 to Apr 2024

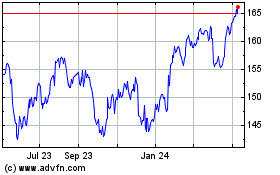

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Apr 2023 to Apr 2024