Annual Report of Employee Stock Plans (11-k)

June 24 2016 - 3:24PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 11-K

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2015, OR

|

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM _________ to _________

|

Registration numbers: 33-50273 and 333-208411

|

A.

|

Full title of the plan and the address of the plan, if different from that of the issuer named below:

The Procter & Gamble Commercial Company Employees' Savings Plan, Two Procter & Gamble Plaza, Cincinnati, Ohio 45202.

|

|

B.

|

Name of issuer of the securities held pursuant to the plan and the address of its principal executive office: c/o The Procter & Gamble Company, One Procter & Gamble Plaza, Cincinnati, Ohio 45202.

|

REQUIRED INFORMATION

|

Item 4

|

Plan Financial Statements and Schedules Prepared in Accordance with the Financial Reporting Requirements of ERISA.

|

|

|

|

Pursuant to the requirements of the Securities Exchange Act of 1934, the Trustees (or other persons who administer the employee benefit plan) have duly caused this Annual Report to be signed on its behalf by the undersigned hereunto duly authorized.

THE PROCTER & GAMBLE COMMERCIAL

COMPANY EMPLOYEES' SAVINGS PLAN

Date: June 24, 2016

By:

_/s/ Eric S. Baumgardner_____________________

Eric S. Baumgardner

Associate Director, HRSS Finance, Global Business Services

|

23

|

Consent of Deloitte & Touche LLP

|

|

|

The Procter & Gamble

Commercial Company

Employees' Savings Plan

Plan #002

EIN# 66-0676831

Financial

Statements as of and for the

Years Ended December 31, 2015 and 2014,

Supplemental Schedules as of and for the

Year Ended December 31, 2015, and Report of Independent

Registered Public

Accounting

Firm

|

THE PROCTER & GAMBLE COMMERCIAL COMPANY

EMPLOYEES' SAVINGS PLAN

|

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

|

Page

|

|

|

|

|

|

|

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

|

|

1

|

|

|

|

|

|

|

FINANCIAL STATEMENTS:

|

|

|

|

|

|

|

|

|

|

Statements of Net Assets Available for Benefits as of December 31, 2015 and 2014

|

|

2

|

|

|

|

|

|

|

|

Statements of Changes in Net Assets Available for Benefits for the Years Ended December 31, 2015 and 2014

|

|

3

|

|

|

|

|

|

|

|

Notes to Financial Statements as of and for the Years Ended December 31, 2015 and 2014

|

|

4-9

|

|

|

|

|

|

|

SUPPLEMENTAL SCHEDULES:

|

|

10

|

|

|

|

|

|

|

|

Form 5500, Schedule H, Part IV, Line 4i — Schedule of Assets (Held at End of Year) as of December 31, 2015

|

|

11

|

|

|

|

|

|

|

|

Form 5500, Schedule H, Part IV, Line 4j — Schedule of Reportable Transactions

for the Year Ended December 31, 2015

|

|

12

|

|

|

|

|

|

|

NOTE:

|

All other schedules required by Section 2520.103-10 of the Department of Labor's Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974 have been omitted because they are not applicable

|

|

|

|

|

|

|

|

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To The Procter & Gamble U.S. Business Services Company:

We have audited the accompanying statements of net assets available for benefits of The Procter & Gamble Commercial Company Employees' Savings Plan (the "Plan") as of December 31, 2015 and 2014, and the related statements of changes in net assets available for benefits for the years then ended. These financial statements are the responsibility of the Plan's management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Plan is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Plan's internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, such financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2015 and 2014, and the changes in net assets available for benefits for the years then ended in conformity with accounting principles generally accepted in the United States of America.

The supplemental schedules listed in the table of contents have been subjected to audit procedures performed in conjunction with the audit of the Plan's financial statements. The supplemental schedules are the responsibility of the Plan's management. Our audit procedures included determining whether the supplemental schedules reconcile to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental schedules. In forming our opinion on the supplemental schedules, we evaluated whether the supplemental schedules, including their form and content, are presented in compliance with the Department of Labor's Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, such schedules are fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ Deloitte & Touche LLP

Cincinnati, Ohio

June 23, 2016

|

THE PROCTER & GAMBLE COMMERCIAL COMPANY

|

|

|

|

|

EMPLOYEES' SAVINGS PLAN

|

|

|

|

|

|

|

|

|

|

STATEMENTS OF NET ASSETS AVAILABLE FOR BENEFITS

|

|

|

|

|

AS OF DECEMBER 31, 2015 AND 2014

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2015

|

|

|

2014

|

|

|

|

|

|

|

ASSETS:

|

|

|

|

|

Investments — at fair value:

|

|

|

|

|

Cash

|

$ 33,330

|

|

$ 2,706

|

|

The Procter & Gamble Company common stock

|

16,412,935

|

|

19,388,729

|

|

The J.M. Smucker Company common stock

|

71,167

|

|

63,278

|

|

Mutual funds

|

17,033,186

|

|

18,037,222

|

|

|

|

|

|

|

Total investments

|

33,550,618

|

|

37,491,935

|

|

|

|

|

|

|

Receivables:

|

|

|

|

|

Other

|

3,348

|

|

-

|

|

Notes receivable from participants

|

13,891

|

|

18,988

|

|

|

|

|

|

|

Total receivables

|

17,239

|

|

18,988

|

|

|

|

|

|

|

Total assets

|

33,567,857

|

|

37,510,923

|

|

|

|

|

|

|

LIABILITY — Excess contributions payable

|

-

|

|

3,344

|

|

|

|

|

|

|

NET ASSETS AVAILABLE FOR BENEFITS

|

$ 33,567,857

|

|

$ 37,507,579

|

|

|

|

|

|

|

See notes to financial statements.

|

|

|

|

|

THE PROCTER & GAMBLE COMMERCIAL COMPANY

|

|

|

|

|

EMPLOYEES' SAVINGS PLAN

|

|

|

|

|

|

|

|

|

|

STATEMENTS OF CHANGES IN NET ASSETS AVAILABLE FOR BENEFITS

|

|

|

|

FOR THE YEARS ENDED DECEMBER 31, 2015 AND 2014

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2015

|

|

|

2014

|

|

|

|

|

|

|

ADDITIONS:

|

|

|

|

|

Contributions:

|

|

|

|

|

Participant contributions

|

$ 826,780

|

|

$ 1,075,285

|

|

Employer contributions

|

216,852

|

|

285,174

|

|

|

|

|

|

|

Total contributions

|

1,043,632

|

|

1,360,459

|

|

|

|

|

|

|

Investment (loss)/income:

|

|

|

|

|

Net (depreciation)/appreciation in fair value of investments

|

(2,861,012)

|

|

3,073,317

|

|

Dividends and interest

|

885,593

|

|

870,531

|

|

|

|

|

|

|

Net investment (loss)/income

|

(1,975,419)

|

|

3,943,848

|

|

|

|

|

|

|

Interest income on notes receivable from participants

|

-

|

|

1,161

|

|

|

|

|

|

|

Total additions, net

|

(931,787)

|

|

5,305,468

|

|

|

|

|

|

|

DEDUCTIONS:

|

|

|

|

|

Benefits paid to participants

|

2,991,756

|

|

1,652,216

|

|

Administrative expenses

|

16,179

|

|

34,026

|

|

|

|

|

|

|

Total deductions

|

3,007,935

|

|

1,686,242

|

|

|

|

|

|

|

NET (DECREASE)/INCREASE IN NET ASSETS

|

(3,939,722)

|

|

3,619,226

|

|

|

|

|

|

|

NET ASSETS AVAILABLE FOR BENEFITS:

|

|

|

|

|

Beginning of year

|

37,507,579

|

|

33,888,353

|

|

|

|

|

|

|

End of year

|

$ 33,567,857

|

|

$ 37,507,579

|

|

|

|

|

|

|

|

|

|

|

|

See notes to financial statements.

|

|

|

|

|

|

|

|

|

THE PROCTER & GAMBLE COMMERCIAL COMPANY

EMPLOYEES' SAVINGS PLAN

NOTES TO FINANCIAL STATEMENTS

AS OF AND FOR THE YEARS ENDED DECEMBER 31, 2015 AND 2014

|

1.

|

DESCRIPTION OF THE PLAN

|

The following description of The Procter & Gamble Commercial Company Employees' Savings Plan (the "Plan") provides only general information. Participants should refer to the Plan document for a more complete description of the Plan's provisions.

General

— The Plan is a defined contribution plan covering all eligible employees of Procter & Gamble Commercial, LLC (the "Plan Sponsor") and Olay LLC, (collectively, the "Companies"), subsidiaries of The Procter & Gamble Company (P&G). In order to be eligible to participate in the Plan, employees must be residents of Puerto Rico and have completed one year of service. The Procter & Gamble U.S. Business Services Company controls and manages the operation and administration of the Plan. Banco Popular de Puerto Rico serves as the trustee of the Plan. The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974 (ERISA).

In May 2015, P&G announced the closure of the Cayey manufacturing facility, affecting 200-250 employees. This action is expected to reduce the participation in this Plan in the future.

Effective August 28, 2015, a new custodian and recordkeeper were appointed. Plan assets transferred to the new custodian, Northern Trust, were transferred into funds comparable to those offered by the previous custodian, J.P. Morgan Chase Bank. The conversion initiated a blackout period beginning August 28, 2015, and continuing through September 9, 2015. During the blackout period, funds could not be applied to employee-selected funds with the new custodian or withdrawn from the Plan until the custodian had time to accurately complete the conversion. During the period, employee contributions continue to be made through payroll deductions, and the contributions were deposited and held in the income fund until the completion of the blackout period. At the end of the blackout period, these funds were transferred to the investment options requested by each participant.

Contributions

— Each year, participants may contribute up to 10% of their pretax annual compensation, as defined in the Plan, not exceeding the maximum deferral amount specified by Puerto Rico law. Participants may also contribute amounts representing distributions from other qualified defined benefit or defined contribution plans. The Companies contribute 40% of the first 5% of eligible compensation that a participant contributes to the Plan. Contributions are subject to certain limitations.

Participant Accounts

— Individual accounts are maintained for each Plan participant. Each participant's account is credited with the participant's contribution, allocations of the Companies' contributions and Plan earnings, and charged with withdrawals and an allocation of Plan losses and administrative expenses. Allocations are based on participant earnings or account balances, as defined. The benefit to which a participant is entitled is the benefit that can be provided from the participant's vested account.

Investments

— Participants direct the investment of their contributions and account balances into various investment options offered by the Plan. The Companies' contributions are automatically invested in The Procter & Gamble Company common stock ("P&G common stock"). The Plan currently offers seven mutual funds (including a money market mutual fund) as investment options for participants.

Vesting

— Participants are vested immediately in their contributions, plus actual earnings thereon. The Companies' contributions plus actual earnings thereon are 100% vested upon the occurrence of any of the following events: completion of three years of credited service; attaining age 65; total disability or death while employed by the Companies.

Payment of Benefits

— On termination of service, a participant may receive the value of the vested interest in his or her account as a lump-sum distribution.

Notes Receivable from Participants

— New loans to participants are not permitted under the Plan. Participant loans included in the accompanying statement of net assets available for benefits represent outstanding loans granted to participants of The Gillette Company Employees' Savings Plan prior to its merger with the Plan on September 4, 2009.

Forfeited Accounts

— At December 31, 2015 and 2014, forfeited nonvested accounts totaled $4,285 and $4,494, respectively. These accounts can be used to reduce future employer contributions. There were no employer contributions reduced for the years ended December 31, 2015 and 2014.

|

2.

|

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

|

Basis of Accounting

— The accompanying financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (GAAP).

Use of Estimates

— The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, and changes therein and disclosure of contingent assets and liabilities. Actual results could differ from those estimates.

Risks and Uncertainties

— The Plan utilizes various investment instruments, including common stock and mutual funds. Investment securities, in general, are exposed to various risks, such as interest rate risk, credit risk, and overall market volatility. Due to the level of risk associated with certain investment securities, it is reasonably possible that changes in the values of investment securities could occur in the near term and that such changes could materially affect the amounts reported in the financial statements.

Investment Valuation and Income Recognition

— The Plan's investments are stated at fair value. Fair value of a financial instrument is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Quoted market prices are used to value investments.

Purchases and sales of securities are recorded on a trade-date basis. Interest income is recorded on the accrual basis. Dividends are recorded on the ex-dividend date. Net (depreciation)/appreciation includes the Plan's gains and losses on investments bought and sold as well as held throughout the year.

Management fees and operating expenses charged to the Plan for investments in mutual funds are deducted from income earned on a daily basis and are not separately reflected. Consequently, management fees and operating expenses are reflected as a reduction of investment return for such investments.

Notes Receivable from Participants

— Notes receivable from participants are measured at their unpaid principal balance plus any accrued but unpaid interest. Delinquent terminated participant loans are recorded as distributions based on the terms of the Plan document.

Excess Contributions Payable

— The Plan is required to return contributions received during the Plan year in excess of the Puerto Rican Internal Revenue Code (the "PRIRC") limits. As of December 31, 2015, the Plan had no excess contributions payable to participants. As of December 31, 2014, the Plan had excess contributions payable to participants of $3,344.

Payment of Benefits

— Benefit payments to participants are recorded upon distribution. Amounts allocated to accounts of persons who have elected to withdraw from the Plan, but have not yet been paid, were $0 at December 31, 2015 and 2014, respectively.

Administrative Expenses

— Investment management expenses are paid by the Plan and are netted against investment income. Recordkeeping fees of the Plan are paid by participants through a reduction in their investment balances.

New Accounting Standard

ASU 2015-12 -

In July 2015, the FASB issued ASU 2015-12,

Plan Accounting: Defined Benefit Pension Plans (Topic 960), Defined Contribution Pension Plans (Topic 962), Health and Welfare Benefit Plans (Topic 965): (Part I) Fully Benefit-Responsive Investment Contracts, (Part II) Plan Investment Disclosures, (Part III) Measurement Date Practical Expedient

. Part I eliminates the requirements to measure the fair value of fully benefit-responsive investment contracts but will continue to provide certain disclosures that help users understand the nature and risks of fully benefit-responsive investment contracts. Upon adoption, contract value will be the only required measure for fully benefit-responsive investment contracts. Part II eliminates the requirements to disclose individual investments that represent 5 percent or more of net assets available for benefits and the net appreciation or depreciation in fair value of investments by general type. Part II also simplifies the level of disaggregation of investments that are measured using fair value. Plans will continue to disaggregate investments that are measured using fair value by general type; however, plans are no longer required to also disaggregate investments by nature, characteristics and risks. Further, the disclosure of information about fair value measurements shall be provided by general type of plan asset. Part III provides a practical expedient to permit plans to measure investments and investment-related accounts as of a month-end date that is closest to the plan's fiscal year-end, when the fiscal period does not coincide with month-end. The ASU is effective for fiscal years beginning after December 15, 2015, with early adoption permitted. Parts I and III are not applicable to the Plan. During the year ended December 31, 2015, management has early adopted Part II of ASU 2015-12 and its application was applied retrospectively.

|

3.

|

FAIR VALUE MEASUREMENTS

|

ASC 820,

Fair Value Measurements and Disclosures

, provides a framework for measuring fair value. That framework provides a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value, as follows: Level 1, which refers to securities valued using unadjusted quoted prices from active markets for identical assets; Level 2, which refers to securities not traded on an active market but for which observable market inputs are readily available; and Level 3, which refers to securities valued based on significant unobservable inputs. Assets are classified in their entirety based on the lowest level of input that is significant to the fair value measurement.

Asset Valuation Methodologies

— Valuation methodologies maximize the use of relevant observable inputs and minimize the use of unobservable inputs. The following is a description of the valuation methodologies used for assets measured at fair value. There have been no changes in the methodologies used at December 31, 2015 and 2014.

Common Stocks

— Valued at the closing price reported on the active market on which the individual securities are traded.

Mutual Funds

— Valued at the daily closing price as reported by the fund. Mutual funds held by the Plan are open-ended mutual funds that are registered with the Securities and Exchange Commission. These funds are required to publish their daily net asset value and to transact at that price. The mutual funds held by the Plan are actively traded.

Cash

— Held primarily in short-duration, highly liquid securities, which are valued at cost plus accrued interest.

Transfers between Levels

— The availability of observable market data is monitored to assess the appropriate classification of financial instruments within the fair value hierarchy. Changes in economic conditions or model-based valuation techniques may require the transfer of financial instruments from one fair value level to another. The Plan's policy is to recognize transfers between levels at the actual date of the event or change in circumstances that caused the transfer. For the years ended, December 31, 2015 and 2014, there were no transfers between levels.

We evaluate the significance of transfers between levels based upon the nature of the financial instrument and size of the transfer relative to the total net assets available for benefits.

The following tables set forth by level within the fair value hierarchy a summary of the Plan's investments measured at fair value on a recurring basis at December 31, 2015 and 2014.

|

|

Assets Measured at Fair Value at December 31, 2015

|

|

|

|

Quoted Prices in

|

|

Significant Other

|

|

Significant

|

|

|

|

|

|

Active Markets for

|

|

Observable

|

|

Unobservable

|

|

|

|

|

|

Identical Assets

|

|

Inputs

|

|

Inputs

|

|

|

|

|

|

(Level 1)

|

|

(Level 2)

|

|

(Level 3)

|

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

|

Cash

|

|

$ 33,330

|

|

$ -

|

|

$ -

|

|

$ 33,330

|

|

Mutual funds:

|

|

|

|

|

|

|

|

|

|

Money market

|

|

2,039,945

|

|

$ -

|

|

$ -

|

|

2,039,945

|

|

Equity

|

|

9,700,975

|

|

$ -

|

|

$ -

|

|

9,700,975

|

|

Fixed income

|

|

1,720,527

|

|

$ -

|

|

$ -

|

|

1,720,527

|

|

Balanced

|

|

3,571,739

|

|

$ -

|

|

$ -

|

|

3,571,739

|

|

Common stock

|

|

16,484,102

|

|

$ -

|

|

$ -

|

|

16,484,102

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

$ 33,550,618

|

|

$ -

|

|

$ -

|

|

$ 33,550,618

|

|

|

Assets Measured at Fair Value at December 31, 2014

|

|

|

|

Quoted Prices in

|

|

Significant Other

|

|

Significant

|

|

|

|

|

|

Active Markets for

|

|

Observable

|

|

Unobservable

|

|

|

|

|

|

Identical Assets

|

|

Inputs

|

|

Inputs

|

|

|

|

|

|

(Level 1)

|

|

(Level 2)

|

|

(Level 3)

|

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

|

Cash

|

|

$ 2,706

|

|

$ -

|

|

$ -

|

|

$ 2,706

|

|

Mutual funds:

|

|

|

|

|

|

|

|

|

|

Money market

|

|

2,325,808

|

|

$ -

|

|

$ -

|

|

2,325,808

|

|

Equity

|

|

10,067,473

|

|

$ -

|

|

$ -

|

|

10,067,473

|

|

Fixed income

|

|

1,707,021

|

|

$ -

|

|

$ -

|

|

1,707,021

|

|

Balanced

|

|

3,936,920

|

|

$ -

|

|

$ -

|

|

3,936,920

|

|

Common stock

|

|

19,452,007

|

|

$ -

|

|

$ -

|

|

19,452,007

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

$ 37,491,935

|

|

$ -

|

|

$ -

|

|

$ 37,491,935

|

|

4.

|

NONPARTICIPANT-DIRECTED INVESTMENT

|

Information about the net assets and the significant components of the changes in net assets relating to the nonparticipant-directed investment (P&G common stock) as of December 31, 2015 and 2014, and for the years then ended, is as follows:

|

|

2015

|

|

2014

|

|

|

|

|

|

|

Changes in net assets:

|

|

|

|

|

Contributions

|

$ 535,202

|

|

$ 742,134

|

|

Net (depreciation)/appreciation in fair value of investments

|

(2,500,565)

|

|

2,107,100

|

|

Dividends

|

552,889

|

|

551,378

|

|

Benefits paid to participants

|

(1,169,746)

|

|

(845,416)

|

|

Net transfers to participant-directed investments

|

(387,067)

|

|

(567,156)

|

|

Management fees

|

(6,507)

|

|

(9,294)

|

|

Other receipts/disbursements

|

-

|

|

149

|

|

|

|

|

|

|

Net change

|

(2,975,794)

|

|

1,978,895

|

|

|

|

|

|

|

|

|

|

|

|

The Procter & Gamble Company common stock — beginning of year

|

19,388,729

|

|

17,409,834

|

|

|

|

|

|

|

|

|

|

|

|

The Procter & Gamble Company common stock — end of year

|

$ 16,412,935

|

|

$ 19,388,729

|

|

5.

|

EXEMPT PARTY-IN-INTEREST TRANSACTIONS

|

Certain Plan investments were managed by J.P. Morgan Investment Advisors thru August 28, 2015. J.P. Morgan Investment Advisors is an affiliate of J.P. Morgan Chase Bank. J.P. Morgan Chase Bank was the custodian thru August 28, 2015, at which point, Northern Trust assumed this responsibility, as defined by the Plan. The Plan has a short term investment managed by Northern Trust. In addition, the Plan has an interest bearing deposit with Banco Popular de Puerto Rico, the trustee for the Plan. Therefore, these transactions qualify as party-in-interest transactions. Fees paid for the investment management services were included as a reduction of the return earned on each fund.

At December 31, 2015 and 2014, the Plan held 206,687 and 212,852 shares, respectively, of P&G common stock, with a cost basis of $11,279,628 and $11,135,868, respectively. Related dividend income for the years ended December 31, 2015 and 2014, amounted to $552,889 and $551,378, respectively.

Although they have not expressed any intention to do so, the Companies have the right under the Plan to discontinue their contributions at any time and to terminate the Plan subject to the provisions set forth in ERISA. In the event that the Plan is terminated, participants would become 100% vested in their accounts.

The Plan is exempt from Puerto Rico income taxes under the provisions of the PRIRC enacted on January 31, 2011. The 2011 PRIRC replaced the 1994 PRIRC, as amended. The 2011 PRIRC modified rules concerning contribution limits, coverage requirements, non-discrimination testing, and other matters. The 2011 PRIRC also provided for certain changes applicable to plans sponsored by entities under common control. These changes were effective for periods commencing after December 31, 2010, with certain additional requirements beginning on January 1, 2012. The Plan is not qualified under Section 401(a) of the U.S. Internal Revenue Code, but it is exempt from U.S. taxation under Section 1022 of the Employee Retirement Income Security Act of 1974. The Plan is subject to routine audits by taxing jurisdictions at any time. The Companies and Plan management believe that the Plan is currently designed and operated in compliance with the applicable requirements of the 2011 PRIRC and the Plan and the related trust continue to be tax-exempt. Therefore, no provision for income taxes has been reflected in the Plan's financial statements.

|

8.

|

RECONCILIATION OF FINANCIAL STATEMENTS TO THE FORM 5500

|

Reconciliation of net assets available for benefits as shown in the financial statements to those in the Form 5500 as filed by the Plan as of December 31, 2015 and December 31, 2014, is as follows:

|

|

|

2015

|

|

|

2014

|

|

|

|

|

|

|

Net assets available for benefits per the financial statements

|

$ 33,567,857

|

|

$ 37,507,579

|

|

Certain deemed distributions of participant loans

|

(13,891)

|

|

(18,988)

|

|

|

|

|

|

|

Net assets available for benefits per Form 5500

|

$ 33,553,966

|

|

$ 37,488,591

|

For the year ended December 31, 2015, the following is a reconciliation of distributions to participants per the financial statements to the Form 5500:

|

Total benefits paid to participants per the financial statements

|

$ 2,991,756

|

|

Less previously deemed distributions of participant loans

|

(5,097)

|

|

|

|

|

Total distributions to participants per the Form 5500

|

$ 2,986,659

|

SUPPLEMENTAL SCHEDULES

|

THE PROCTER & GAMBLE COMMERCIAL COMPANY

|

|

|

|

EMPLOYEES' SAVINGS PLAN

|

|

|

|

|

|

|

|

|

|

|

FORM 5500, SCHEDULE H, PART IV, LINE 4i — SCHEDULE OF ASSETS (HELD AT END OF YEAR)

|

|

AS OF DECEMBER 31, 2015

|

|

|

|

|

EIN: 66-0676831

|

|

|

|

|

PLAN: 002

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Description of

|

|

|

|

|

Identity of Issue

|

Investment

|

Cost

|

|

Fair Value

|

|

|

|

|

|

|

|

*

|

The Procter & Gamble Company

|

Common stock

|

$ 11,279,628

|

$ 16,412,935

|

|

|

|

|

|

|

|

|

The J.M. Smucker Company

|

Common stock

|

**

|

71,167

|

|

|

|

|

|

|

|

|

Vanguard FTSE All-World EX US Index Fund

|

Mutual fund

|

**

|

1,320,346

|

|

|

|

|

|

|

|

|

Vanguard Balanced Index Fund

|

Mutual fund

|

**

|

3,571,739

|

|

|

|

|

|

|

|

|

Vanguard Small Cap Index Fund

|

Mutual fund

|

**

|

2,600,437

|

|

|

|

|

|

|

|

|

Vanguard Inflation Protected Securities Fund

|

Mutual fund

|

**

|

372,920

|

|

|

|

|

|

|

|

|

Vanguard Total Bond Market Index Fund

|

Mutual fund

|

**

|

1,347,607

|

|

|

|

|

|

|

|

|

Vanguard Prime Money Market-Inst Fund

|

Mutual fund

|

**

|

2,039,945

|

|

|

|

|

|

|

|

|

Vanguard Institutional Index Fund

|

Mutual fund

|

**

|

5,780,192

|

|

|

|

|

|

|

|

*

|

Northern Trust Short Term Investment Fund

|

Cash Equivalent

|

**

|

30,592

|

|

|

|

|

|

|

|

*

|

Banco Popular de P.R. (Time Deposit)

|

Time deposit open account

|

**

|

2,738

|

|

|

|

bearing interest at a variable rate

|

|

|

|

|

|

(.10% at December 31, 2015)

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

$ 33,550,618

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

Party-in-interest.

|

|

|

|

|

**

|

Cost information is not required for participant-directed investments and therefore is not included.

|

|

|

THE PROCTER & GAMBLE COMMERCIAL COMPANY

|

|

|

|

|

|

EMPLOYEES' SAVINGS PLAN

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FORM 5500, SCHEDULE H, PART IV, LINE 4j — SCHEDULE OF REPORTABLE TRANSACTIONS

|

|

|

|

FOR THE YEAR ENDED DECEMBER 31, 2015

|

|

|

|

|

|

|

EIN: 66-0676831

|

|

|

|

|

|

|

PLAN: 002

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SINGLE TRANSACTIONS — None.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SERIES OF TRANSACTIONS

|

|

|

|

|

|

|

|

|

|

|

Current

|

|

|

|

|

|

|

Value of

|

|

|

|

|

|

|

Asset on

|

Net

|

|

|

Purchase

|

Sales

|

Cost of

|

Transaction

|

Loss

|

|

Description of Asset

|

Amount

|

Amount

|

Asset

|

Date

|

on Sale

|

|

|

|

|

|

|

|

|

The Procter & Gamble Company common stock *

|

1,521,971

|

-

|

1,521,971

|

1,521,971

|

|

|

The Procter & Gamble Company common stock *

|

-

|

860,796

|

1,378,211

|

860,796

|

517,415

|

|

|

|

|

|

|

|

|

* Party-in-interest.

|

|

|

|

|

|

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Mar 2024 to Apr 2024

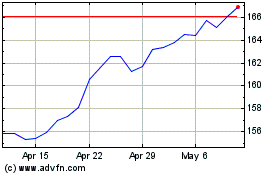

Procter and Gamble (NYSE:PG)

Historical Stock Chart

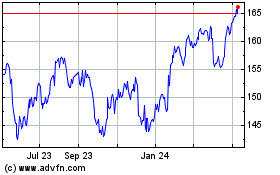

From Apr 2023 to Apr 2024