Today's Top Supply Chain and Logistics News From WSJ

June 16 2016 - 6:53AM

Dow Jones News

By Paul Page

Sign up: With one click, get this newsletter delivered to your

inbox.

Wal-Mart Stores Inc. and Procter & Gamble Co. have shown

that close collaboration between retailers and suppliers can

produce strong results. More recently, the ties appear to be

fraying as the big changes in the retail landscape put the

companies on different, sometimes conflicting paths. The world's

largest retailer and the world's biggest consumer-goods company are

increasingly butting heads, the WSJ's Sarah Nassauer and Sharon

Terlep write, as they navigate a market being roiled by online

competition and changing consumer tastes. Wal-Mart is bulking up

its e-commerce profile, closing stores, shrinking inventory and

pressing suppliers, including P&G, for concessions. P&G,

which once invested with Wal-Mart in a series of big distribution

centers to get goods to stores faster, is pushing Wal-Mart to

preserve higher prices on some items and provide more shelf space.

The outsized role the companies have in the shifting retail market

means that their ability to solve today's market strains may say a

lot about retail-supplier relationships in the future.

What a difference a year makes at U.S. West Coast ports. After

scrambling last spring to recover from deep labor strife,

California gateways are providing glimmers of an ocean-borne

rebound as companies gear up for the peak shipping season. The Port

of Los Angeles reported a 15% jump in its container imports last

month, WSJ Logistics Report's Erica E. Phillips writes, giving the

nation's biggest port the busiest May in its history. Long Beach

and Oakland also reported that imports expanded in May, and that

volume reached the highest level since last August. That's a

relatively typical seasonal turn but welcome growth at ports that

were coping with backlogs last year. Big questions still remain

over the trans-Pacific shipping market, including worries that

retailers aren't yet convinced that there's enough demand to speed

up the flow of goods later this year.

The head of Alibaba Group Holding Ltd. stepped into a firestorm

over fakes , but Jack Ma also highlighted a little-discussed

problem in supply chains. Mr. Ma, who has drawn criticism over

counterfeit goods on Alibaba's marketplaces, said this week that

fake goods "are of better quality and better price than the real

names." The comments raise important questions about the

outsourcing that observers say is behind the spread of many fakes

in China, the WSJ's Eva Dou writes. Experts believe a key flaw of

contract manufacturing is that it can leave factories producing

both brand-name goods and the knockoffs, and leaves intellectual

property moving through a supply chain that firms can't fully

control. For now, the concern over the spread of fakes is focused

mostly on China. But with Alibaba targeting global growth,

retailers worry that supply chains will spin even farther out of

their control.

SUPPLY CHAIN STRATEGIES

Airbus Group SE is facing new supply chain woes in its aircraft

production line . The aircraft manufacturer is pushing back

delivery of its new A350-1000 long-range planes to the second half

of next year, the WSJ's Robert Wall reports, amid supplier problems

similar to the backlogs that have bedeviled deliveries of its

A320neo single-aisle plane. Delays in aircraft deliveries aren't

uncommon but the concerns over fundamentals such as supplier

deliveries underscore the growing complexity of jet manufacturing

supply chains, where complicated and costly components are sourced

from around the world on a tight schedule. For the A350, French

supplier Zodiac Aerospace says it is still struggling to meet

commitments for lavatories. Tighter controls have improved the

quality of the items -- but it's also slowed shipments.

QUOTABLE

IN OTHER NEWS

The Federal Reserve held its benchmark lending rate steady as

officials signaled a gloomier economic outlook for the coming year.

(WSJ)

Starbucks Corp. named Hans Melotte, former chief procurement

office at Johnson & Johnson, as its executive vice president

for global supply chain. (WSJ)

U.S. industrial output fell 0.4% last month as manufacturing

production declined. (WSJ)

The producer-price index for final demand increased 0.4% in May,

largely because of rising energy prices. (WSJ)

More chief executives say their firms intend to step up capital

expenditures this year, hinting at a rebound for slumping business

investment. (WSJ)

Siemens AG and Gamesa Corporacion Tecnologica SA are preparing

to combine their wind-power activities and create the world's

largest wind turbine maker. (WSJ)

Online subscription-box startup Birchbox Inc. suspended plans to

open physical stores as it scales back operations and growth plans.

(WSJ)

Midwest regional less-than-truckload carrier Moran

Transportation Corp. acquired Minnesota-based Mats Trucking.

(Transport Topics)

The U.S. Surface Transportation Board outlined the measures it

plans to use to expedite handling of shipper freight rail pricing

complaints. (Railway Age)

The Port of Singapore reported its first year-over-year gain in

container volume in 15 months in May. (Straits Times)

Scorpio Bulkers Inc. will sell 20 million shares in a public

offering to raise $61 million. (Lloyd's List)

Russian Railways plans to offer new freight services along the

developing China-Europe rail route. (European Railway Review)

Logistics companies are warning that days-long delays are

hitting Bangladesh's Port of Chittagong, a key apparel export

gateway. (Sourcing Journal)

Japan's Nippon Express Co. Ltd. is in talks to buy a minority

stake in India's TVS Logistics Services Ltd. (Live Mint)

Several Japanese logistics operators are boosting investments in

Southeast Asia, including new operations in Vietnam. (Nikkei Asian

Review)

Suez Canal authorities recently detained an unidentified ship

for using a drone without authority as it moved through the canal.

(Splash 24/7)

ABOUT US

Paul Page is deputy editor of WSJ Logistics Report. Follow him

at @PaulPage, and follow the entire WSJ Logistics Report team:

@brianjbaskin, @lorettachao, @RWhelanWSJ and @EEPhillips_WSJ, and

follow the WSJ Logistics Report on Twitter at @WSJLogistics.

Subscribe to this email newsletter by clicking here:

http://on.wsj.com/Logisticsnewsletter .

(END) Dow Jones Newswires

June 16, 2016 06:38 ET (10:38 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

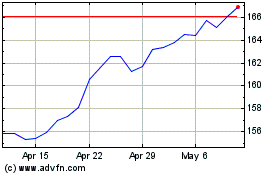

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Mar 2024 to Apr 2024

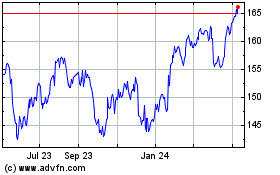

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Apr 2023 to Apr 2024