Current Report Filing (8-k)

March 17 2017 - 2:52PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): March 17, 2017

PFIZER INC.

(Exact name

of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

1-3619

|

|

13-5315170

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

|

|

235 East 42nd Street

New York, New York

|

|

10017

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (212)

733-2323

Not Applicable

(Former Name or Former Address, if changed since last report)

Check the appropriate box below if the Form

8-K

filing is intended to simultaneously satisfy the obligation of the

registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2

(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Item 8.01 Other Events

On March 17, 2017, Pfizer Inc. (the “Company”) completed the previously announced public offering of $1,065,000,000 aggregate principal amount

of 4.20% Notes due 2047 (the “Notes”), pursuant to the subscription agreement dated February 24, 2017 among the Company, BNP Paribas, Taipei Branch and Deutsche Bank AG, Taipei Branch, as managers.

The offering of the Notes was made pursuant to the Company’s shelf registration statement on Form

S-3

(Registration

No. 333-202430)

filed with the Securities and Exchange Commission on March 2, 2015.

The

Notes were issued pursuant to an indenture, dated as of January 30, 2001, between the Company and The Bank of New York Mellon (formerly known as The Bank of New York), as successor to JPMorgan Chase Bank (formerly known as The Chase Manhattan

Bank), as trustee, as supplemented by the eighth supplemental indenture, dated as of March 17, 2017, among the Company and The Bank of New York Mellon, as trustee and The Bank of New York Mellon, London Branch, as paying agent (the “Eighth

Supplemental Indenture”).

The Eighth Supplemental Indenture is filed herewith as Exhibit 4.2 to this Form

8-K

and is incorporated herein by reference.

In addition, in connection with the offering of the Notes, the

Company is filing a legal opinion regarding the validity of the Notes, filed herewith as Exhibit 5.1 to this Form

8-K

and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

|

|

|

|

|

Exhibit No.

|

|

Exhibit Description

|

|

|

|

|

4.1

|

|

Indenture, dated as of January 30, 2001, between Pfizer Inc. and The Bank of New York Mellon (formerly known as The Bank of New York), as successor to JPMorgan Chase Bank (formerly known as The Chase Manhattan Bank), as trustee

(incorporated by reference from the Company’s Current Report on Form

8-K

filed on January 30, 2001)

|

|

|

|

|

4.2

|

|

Eighth Supplemental Indenture, dated as of March 17, 2017, among Pfizer Inc., The Bank of New York Mellon, as trustee and The Bank of New York Mellon, London Branch, as paying agent

|

|

|

|

|

4.3

|

|

Form of 4.20% Notes due 2047 (included in Exhibit 4.2)

|

|

|

|

|

|

Exhibit No.

|

|

Exhibit Description

|

|

|

|

|

5.1

|

|

Opinion of Margaret M. Madden, Senior Vice President and Corporate Secretary, Chief Governance Counsel of the Company

|

|

|

|

|

23.1

|

|

Consent of Margaret M. Madden, Senior Vice President and Corporate Secretary, Chief Governance Counsel of the Company (included in Exhibit 5.1)

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

|

|

PFIZER INC.

|

|

|

|

|

|

|

|

By:

|

|

/s/ Margaret M. Madden

|

|

|

|

|

|

Margaret M. Madden

|

|

|

|

|

|

Senior Vice President and Corporate Secretary

|

|

|

|

|

|

Chief Governance Counsel

|

|

Dated: March 17, 2017

|

|

|

|

|

EXHIBIT INDEX

|

|

|

|

|

Exhibit No.

|

|

Exhibit Description

|

|

|

|

|

4.1

|

|

Indenture, dated as of January 30, 2001, between Pfizer Inc. and The Bank of New York Mellon (formerly known as The Bank of New York), as successor to JPMorgan Chase Bank (formerly known as The Chase Manhattan Bank), as trustee

(incorporated by reference from the Company’s Current Report on Form

8-K

filed on January 30, 2001)

|

|

|

|

|

4.2

|

|

Eighth Supplemental Indenture, dated as of March 17, 2017, among Pfizer Inc., The Bank of New York Mellon, as trustee and The Bank of New York Mellon, London Branch, as paying agent

|

|

|

|

|

4.3

|

|

Form of 4.20% Notes due 2047 (included in Exhibit 4.2)

|

|

|

|

|

5.1

|

|

Opinion of Margaret M. Madden, Senior Vice President and Corporate Secretary, Chief Governance Counsel of the Company

|

|

|

|

|

23.1

|

|

Consent of Margaret M. Madden, Senior Vice President and Corporate Secretary, Chief Governance Counsel of the Company (included in Exhibit 5.1)

|

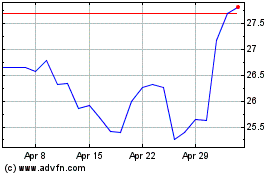

Pfizer (NYSE:PFE)

Historical Stock Chart

From Mar 2024 to Apr 2024

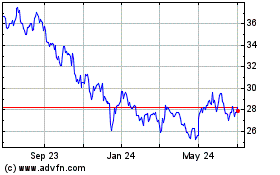

Pfizer (NYSE:PFE)

Historical Stock Chart

From Apr 2023 to Apr 2024