Pfizer Fined $107 Million for Overcharging U.K. for Epilepsy Drug

December 07 2016 - 8:50AM

Dow Jones News

LONDON—Pfizer Inc. has become the latest drugmaker taken to task

for high prices after U.K. authorities slapped the company with a

record £ 84.2 million ($107 million) fine over the price of an

anti-epilepsy drug.

The Competition and Markets Authority said Wednesday that Pfizer

and drug-distribution company Flynn Pharma broke competition law by

charging unfair prices in the U.K. for phenytoin sodium capsules,

an anti-epilepsy drug used by around 48,000 patients in the

country.

The CMA said the Pfizer fine was the highest it had ever

imposed. The regulator also fined Flynn Pharma £ 5.2 million and

has ordered both companies to reduce their prices.

Spokespeople for Pfizer and Flynn Pharma said the companies

rejected the CMA's findings and would appeal all aspects of the

decision.

Drug prices have become a hot political issue in the U.S., where

companies are free to set the price and increase it at any time.

The issue is less incendiary in the U.K., where the price of drugs

typically is well-controlled.

The CMA said Pfizer and Flynn Pharma took advantage of a

peculiarity of the U.K. system. The price of branded drugs is

determined by negotiations between the government and

pharmaceutical companies. Unbranded, or generic, drugs may be

freely priced, but competition between suppliers typically drives

the cost down.

The regulator said Pfizer and Flynn Pharma "deliberately

debranded" the drug in 2012 to raise the price and were able to do

so because there were no competing suppliers.

The CMA said the price of a 100-milligram pack of phenytoin

sodium shot up—to £ 67.50 from £ 2.83—after Pfizer sold the rights

to sell the drug to Flynn Pharma in September 2012. It said the

price decreased to £ 54 in May 2014. Before the agreement, Pfizer

had sold phenytoin sodium capsules directly to U.K. wholesalers and

pharmacies under the brand name Epanutin.

The price increase was partly because Pfizer, which continued to

manufacture phenytoin sodium, sold the drug to Flynn Pharma at up

to 17 times the price than it charged wholesalers and pharmacies

previously, the regulator said. Flynn Pharma hiked the price

further still.

The case has echoes of the scandal that gained U.S.

pharmaceutical executive Martin Shkreli widespread notoriety over

the past year and a half. His company, Turing Pharmaceuticals,

bought the rights to Daraprim, a half-century-old drug that treats

a parasitic infection, and raised the price more than 50-fold.

A spokeswoman for Pfizer said the company "approached this

divestment with integrity and believes it fully complies with

established competition law."

She said phenytoin capsules were unprofitable for Pfizer before

the deal with Flynn Pharma and the transaction secured ongoing

supply of the medicine. The spokeswoman added that the price

charged by Flynn Pharma was 25% to 40% lower than that for an

equivalent, branded epilepsy medicine whose price was

regulated.

Philip Marsden, the chairman of the case decision group for the

CMA investigation, said the companies "deliberately exploited the

opportunity offered by debranding to hike up the price of a drug

which is relied upon by many thousands of patients."

Although Pfizer said the drug was unprofitable before

debranding, the losses would have been recovered within two months

of the price rises, Mr. Marsden said.

"There is no justification for such rises when phenytoin sodium

capsules are a very old drug for which there has been no recent

innovation or significant investment," he said.

A spokesman for Flynn Pharma said the CMA's judgment used "an

entirely novel theory as to the level of margin that can be made by

a generic company [that] has never been discussed, let alone

agreed, with the pharmaceutical industry."

Warwick Smith, director-general of the British Generic

Manufacturers Association, an industry body, said Pfizer and Flynn

Pharma's behavior "broke the virtuous cycle" between innovator and

generic companies in which drugs that lose patent protection

sharply fall in price, allowing the health system to afford the

higher prices for new medicines.

"We would never support activity designed purely to artificially

increase prices," he said.

Write to Denise Roland at Denise.Roland@wsj.com

(END) Dow Jones Newswires

December 07, 2016 08:35 ET (13:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

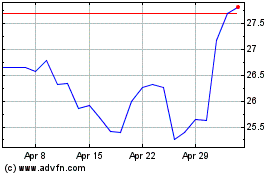

Pfizer (NYSE:PFE)

Historical Stock Chart

From Mar 2024 to Apr 2024

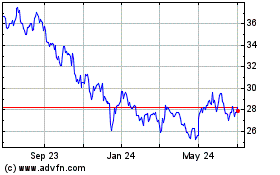

Pfizer (NYSE:PFE)

Historical Stock Chart

From Apr 2023 to Apr 2024